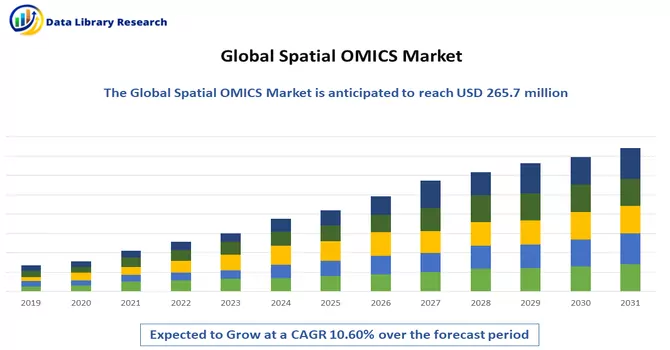

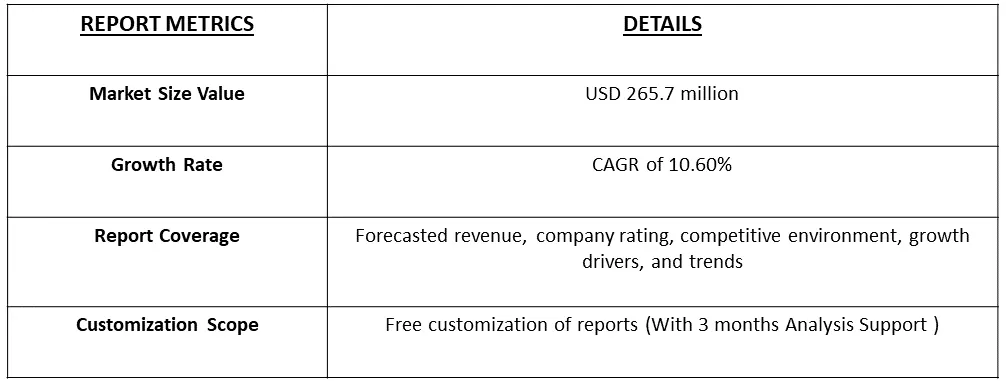

The global spatial OMICS market, valued at USD 265.7 million in 2022 and this growth trajectory reflects a robust compound annual growth rate (CAGR) of 10.60% throughout the forecast period from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Spatial OMICS refers to a suite of technologies that integrate high-throughput molecular profiling with spatial information, providing a means to analyze biological samples within their spatial context. Several key factors contribute to the upward trend in the spatial OMICS market. Firstly, there is a noticeable increase in the prevalence of various genetic disorders, driving the demand for advanced technologies that can provide insights into the molecular landscape of biological samples.

Secondly, global advancements in sequencing technologies have significantly enhanced the capabilities of spatial OMICS, making it a powerful tool for researchers and clinicians. Lastly, the market is buoyed by augmented funding for spatial OMICS research, reflecting the growing recognition of its potential in advancing our understanding of complex biological systems. Thus, the spatial OMICS market is poised for substantial expansion, driven by the confluence of increased prevalence of genetic disorders, technological advancements, and robust financial support for research initiatives in this field.

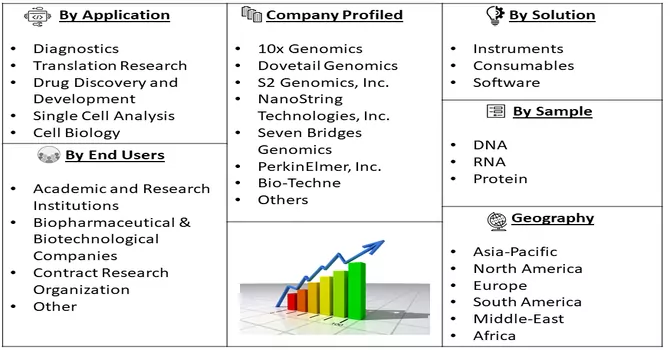

Market Segmentation: The Spatial Omics Market by Application (Diagnostics, Translation Research, Drug Discovery and Development, Single Cell Analysis, and Cell Biology), Solution Type (Instruments, Consumables, and Software), Sample (DNA, RNA, and Protein) End Users (Academic and Research Institutions, Biopharmaceutical & Biotechnological Companies, Contract Research Organization, and Other) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The continuous advancements in spatial OMICS technologies, including imaging modalities and data analysis tools, are a prominent trend. These innovations enhance the resolution, accuracy, and efficiency of spatial profiling, allowing for more comprehensive and detailed analyses of biological samples. There is a growing trend toward integrating spatial OMICS data with other omics datasets, such as genomics, transcriptomics, and proteomics. This holistic approach provides a more comprehensive understanding of the complex interactions within biological systems, enabling researchers to unravel intricate molecular mechanisms.

Market Drivers :

Precision Medicine Advancements and Disease Understanding

The advancements in precision medicine are significantly contributing to our understanding of diseases, and this progress is intricately linked with the growth of the spatial OMICS market. Precision medicine involves tailoring medical treatment and interventions to individual characteristics, considering genetic, environmental, and lifestyle factors. Spatial OMICS allows for the detailed analysis of the spatial distribution of biomolecules within tissues. This spatial context is crucial for understanding the heterogeneity of diseases at the molecular level. In precision medicine, this granular information aids in developing personalized treatment strategies that are tailored to the specific characteristics of an individual's disease. Precision medicine often involves integrating information from various omics disciplines. Spatial OMICS seamlessly integrates with genomics, transcriptomics, and other omics datasets. This comprehensive approach ensures a holistic understanding of diseases, allowing for more informed and targeted precision medicine interventions. Biotechnology Advancements

The integration of spatial OMICS into clinical diagnostics is gaining momentum. The technology's potential to provide spatial context to molecular information is particularly valuable in identifying and characterizing disease-related biomarkers. This technology is likely to lead to advancements in precision medicine and personalized treatment strategies. The introduction of new instruments plays a pivotal role in the evolution of consumables, thereby influencing both the instruments and consumables segments. A noteworthy instance occurred in December 2020 when NanoString unveiled its latest innovation, a spatial molecular imager (SMI). This advanced spatial OMICS platform is designed for multiplexed protein and RNA analysis in single cells within formalin-fixed paraffin-embedded (FFPE) tissue samples. The development of such cutting-edge instruments not only propels instrument sales but also spurs the demand for associated consumables.

Similarly, in 2023, Bio-Techne and Lunaphore are forming a strategic alliance to develop a fully automated spatial multiomics solution. This partnership aims to create a method for the simultaneous identification of protein and RNA biomarkers on a single slide, offering panel design flexibility and facilitating comprehensive disease research. Thus, such developments are experts are expected to witness significant growth over the forecast period.

Market Restraints:

Data Handling Challenges and Standardization Issues

Spatial OMICS technologies generate vast amounts of complex data, including spatially resolved molecular information. Handling and processing such extensive and intricate datasets pose significant challenges, requiring robust computational infrastructure and advanced analytics tools. The sheer volume and complexity of spatial data can lead to difficulties in data management and analysis. The handling of spatial data also brings forth ethical and legal considerations, particularly regarding patient privacy and data sharing. Standardizing ethical guidelines and legal frameworks for spatial OMICS data usage and sharing is essential to navigate potential challenges related to data security and compliance. Thus, these data-handling challenges and standardization issues require collaborative efforts from researchers, technology developers, and regulatory bodies.

The pandemic led to a pronounced shift in research priorities, with a heightened emphasis on understanding infectious diseases, particularly COVID-19. Spatial OMICS technologies played a crucial role in studying the spatial distribution of cells and biomolecules in tissues affected by the SARS-CoV-2 virus, providing valuable insights into disease pathology. The implementation of lockdowns, travel restrictions, and disruptions in laboratory operations during the pandemic posed challenges to ongoing research activities. Many spatial OMICS research projects experienced delays or interruptions, affecting timelines for data generation, analysis, and publication. The pandemic underscored the importance of spatial technologies in studying tissue architecture, immune responses, and disease progression. The recognition of these technologies in the context of the pandemic response may lead to sustained interest and investment in spatial OMICS for broader applications.

Drug Discovery and Development Segment is Expected to Witness Significant Growth Over the Forecast Period

Spatial OMICS enables the identification and validation of spatially defined biomarkers associated with various diseases. By studying the spatial distribution of molecules within tissues, researchers can pinpoint specific biomarkers indicative of disease states. This information is crucial for developing targeted therapies and diagnostic tools. Understanding the spatial context of gene expression and protein localization provides a more comprehensive view of potential drug targets. Spatial OMICS helps in identifying relevant cellular subtypes, confirming the expression of target molecules in specific regions, and validating their role in disease pathology. This accelerates the target validation process, reducing the risk of pursuing ineffective targets. Thus, spatial OMICS has revolutionized drug discovery and development by providing spatially resolved molecular information, guiding target identification, optimizing drug delivery, and contributing to the development of precision medicine.

Software Segment is Expected to Witness Significant Growth Over the Forecast Period

The integration of advanced software solutions is a critical component in harnessing the full potential of spatial OMICS technologies. Software plays a pivotal role in data analysis, visualization, interpretation, and the extraction of meaningful insights from the complex spatially resolved molecular datasets generated by spatial OMICS techniques. Spatial OMICS techniques generate high-dimensional imaging datasets that require sophisticated image processing algorithms. Specialized software aids in the segmentation and analysis of cellular and molecular structures within tissues. Software solutions often include centralized data repositories that ensure secure storage, retrieval, and sharing of spatial OMICS datasets, promoting data accessibility and reproducibility. Thus, sophisticated software solutions are indispensable for unlocking the full potential of spatial OMICS technologies. By facilitating data analysis, visualization, integration with multi-omics data, and enabling collaborative workflows, software plays a crucial role in advancing spatial OMICS research and its applications across diverse scientific disciplines.

Protein Segment is Expected to Witness Significant Growth Over the Forecast Period

Proteins play a central role in spatial OMICS studies, serving as key molecular markers that provide crucial insights into the spatial organization and functionality of biological systems. Spatial OMICS techniques, which encompass spatially resolved analyses of proteins within tissues, enable researchers to investigate the distribution, interactions, and functions of proteins in their native spatial context. Spatial OMICS techniques, such as immunohistochemistry (IHC), immunofluorescence (IF), and spatially resolved proteomics, allow researchers to map the expression of specific proteins within tissues with spatial precision. High-resolution imaging technologies in spatial OMICS enable the visualization of individual proteins at subcellular levels. Thus, proteins are pivotal entities in spatial OMICS investigations, acting as molecular beacons that illuminate the spatial intricacies of biological systems. The ability to analyze proteins in their native spatial context empowers researchers to decipher complex cellular dynamics, unravel disease mechanisms, and gain a deeper understanding of the functional organization of tissues.

Biopharmaceutical & Biotechnological Companies Segment is Expected to Witness Significant Growth Over the Forecast Period

Biopharmaceutical and biotechnological companies play a pivotal role in driving advancements and applications of spatial OMICS technologies. The synergy between these industries and spatial OMICS contributes to a deeper understanding of biological processes, disease mechanisms, and the development of innovative therapeutics. Biopharmaceutical companies leverage spatial OMICS techniques to identify and validate potential therapeutic targets with spatially resolved information. Biotechnological companies contribute to the expansion of the spatial OMICS market by adopting and commercializing spatial technologies. Thus, the partnership between biopharmaceutical and biotechnological companies and the spatial OMICS market is transformative, accelerating scientific discovery and therapeutic innovation. This collaboration is instrumental in advancing precision medicine, unravelling the complexities of disease biology, and ultimately improving patient outcomes. As spatial OMICS technologies continue to evolve, the close integration with biopharmaceutical research will play a pivotal role in shaping the future landscape of personalized medicine and targeted therapeutics.

North America Segment is Expected to Witness Significant Growth Over the Forecast Period

North America has emerged as the leading region in the spatial omics market, capturing the predominant share. This dominance can be attributed to several factors, including the rising incidence of cancer, a heightened demand for personalized medicine, well-established healthcare infrastructure, and the accessibility of innovative diagnostic methodologies. The escalating rates of morbidity and mortality associated with cancer, as well as other metabolic, autoimmune, and inflammatory conditions, have created a surge in demand for the innovation of novel therapeutic approaches, consequently propelling market growth in this geographic area.

The advancement of software technologies within the country is anticipated to be a key driver for market growth in the region. An illustrative example is the utilization of GLUER (Integrative Analysis of Multi-omics at Single-cell Resolution) by U.S. researchers in January 2021. This tool seamlessly integrated imaging data with single-cell omics data, demonstrating remarkable efficiency in accurately aligning cells across diverse data modalities. Thus, the market is expected to witness significant growth in the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

Leading market participants have embraced strategic initiatives to strengthen their foothold in the market. These companies are concentrating on the implementation of growth strategies, including diversifying their product portfolios, advancing technologies, forming strategic partnerships, and expanding marketing and distribution channels. These efforts are geared towards enhancing product accessibility, fostering innovation, and gaining a competitive edge in the market.

Also, the integration of spatial OMICS into clinical diagnostics is gaining momentum. The technology's potential to provide spatial context to molecular information is particularly valuable in identifying and characterizing disease-related biomarkers. This trend is likely to lead to advancements in precision medicine and personalized treatment strategies. Key Spatial OMICS Companies:

Recent Development:

1) In February 2023, Curio Bioscience announced the introduction of Curio Seeker, the first high-resolution, whole-transcriptome spatial mapping kit, marking the start of the company's commercial activities.

2) In 2023, OMAPiX, a spatial omics services provider, has forged collaborations with Vizgen, Resolve Biosciences, and Ultivue, Inc. They will utilize cutting-edge technologies to deliver standardized, high-quality spatial transcriptomic and proteomic data. These partnerships aim to accelerate drug development and life science research by providing valuable insights to customers.

Q1. What was the Spatial OMICS Market size in 2022?

As per Data Library Research the global spatial OMICS market, valued at USD 265.7 million in 2022.

Q2. At what CAGR is the spatial OMICS market projected to grow within the forecast period?

Spatial OMICS Market is expected to grow at a compound annual growth rate (CAGR) of 10.60% throughout the forecast period.

Q3. What are the factors on which the Spatial OMICS market research is based on?

By Application, By Solution, By Sample, End-User and Geography are the factors on which the Spatial OMICS market research is based.

Q4. Who are the key players in Spatial OMICS Market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model