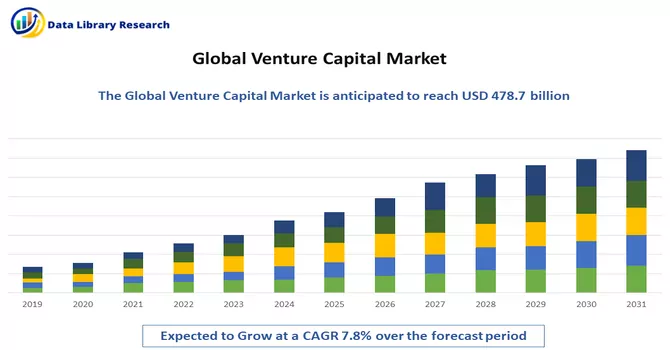

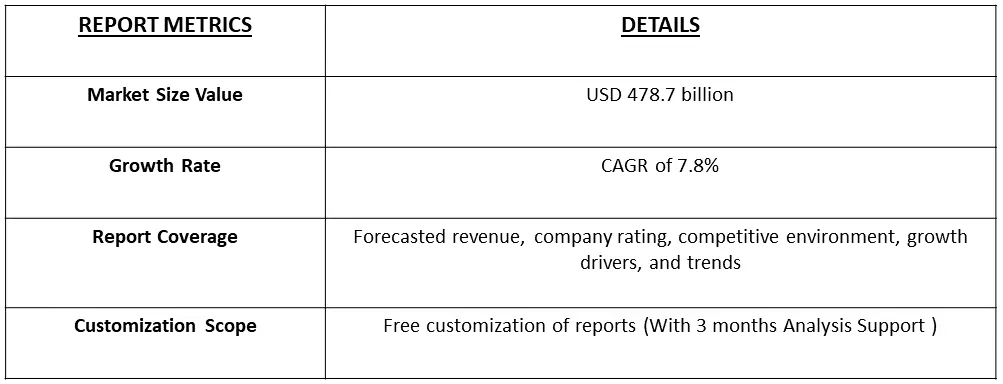

The Venture Capital market worldwide is projected to reach a market volume of USD 478.7 billion in 2023 and is expected to register a CAGR of 7.8% over the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Venture capital, a pivotal component of the financial ecosystem, plays a crucial role in fostering innovation and driving economic growth. This form of private equity investment involves financial backing provided to early-stage, high-potential, and often technology-driven companies with promising growth prospects. Venture capitalists, typically firms or individuals seeking substantial returns, invest in startups and emerging businesses in exchange for equity ownership. Beyond funding, venture capitalists actively contribute strategic guidance, mentorship, and industry expertise to help nurture the growth and success of the invested companies.

The venture capital market is dynamic, marked by risk-taking and a focus on disruptive technologies, and it serves as a catalyst for entrepreneurial endeavours across various industries. As a driving force behind the development of groundbreaking ideas and the transformation of industries, venture capital continues to shape the landscape of innovation and entrepreneurship worldwide. The growth of the venture capital market is fueled by several key factors, with the most prominent being the increasing appetite for innovation and technological disruption. As the global economy evolves towards a digital and knowledge-based landscape, there is a growing recognition of the pivotal role played by startups and early-stage companies in driving transformative change. Venture capital provides crucial financial support to these innovative ventures, enabling them to develop and scale their groundbreaking ideas. Additionally, the surge in entrepreneurial activity and a vibrant startup ecosystem contribute to the expansion of the venture capital market. The pursuit of high returns on investment, coupled with the potential for discovering the next big success story, motivates venture capitalists to actively seek and fund ventures with disruptive potential. The ever-growing demand for cutting-edge solutions and novel business models ensures a robust and dynamic venture capital landscape, making it a driving force behind the continuous evolution of industries and economies.

Market segmentation: Global Venture Capital Market Size & Industry Overview and it is Segmented By Type (Local Investors, and International Investor), Industry (Real Estate, Financial Services, Food & Beverages, Healthcare, Transport & Logistics, IT & ITeS, Education and Other Industries) and By Geography (North America, Latin America, Europe, Asia-Pacific, Middle East and Africa).

For Detailed Market Segmentation - Download Free Sample PDF

Current trends in the venture capital market underscore its dynamic and evolving nature. One prominent trend is the increasing diversification of investment sectors, with a notable focus on emerging technologies such as artificial intelligence, biotech, and clean energy. Additionally, there is a growing emphasis on impact and sustainability, with venture capitalists actively seeking investments that align with environmental, social, and governance (ESG) criteria. Another notable trend is the geographic expansion of venture capital activity, with a rise in investments in regions beyond traditional hubs, reflecting a more inclusive approach to supporting innovation globally. The prevalence of mega-rounds and larger deal sizes further characterizes the market, indicating a willingness to make substantial investments in high-potential startups. As technology continues to shape industries and redefine business models, venture capital trends reflect a keen interest in transformative ideas, diverse investment strategies, and a global outlook that collectively contribute to the ongoing evolution of the entrepreneurial ecosystem.

Market Drivers:

The accelerating pace of digital innovation and technological disruption fuels a demand for venture capital investments

The venture capital market is strongly propelled by the accelerating pace of digital innovation and technological disruption, creating a robust demand for strategic investments. As industries undergo profound transformations through digitization, startups and early-stage companies are at the forefront of pioneering groundbreaking technologies and solutions. The dynamic landscape of emerging technologies, including artificial intelligence, blockchain, and advanced analytics, requires substantial capital for research, development, and market expansion. Venture capitalists play a pivotal role in meeting this demand, providing crucial funding to fuel the growth of innovative ventures. The inherent agility and risk-taking nature of the venture capital ecosystem make it an ideal driver for supporting ventures that are poised to reshape industries, contributing to the ongoing evolution of the global business landscape.

The strength and dynamism of the global entrepreneurial ecosystem serve as a key driver

The strength and dynamism of the global entrepreneurial ecosystem stand as fundamental drivers for the venture capital market. The proliferation of innovative startups, fueled by a culture of entrepreneurship and a constant pursuit of disruptive ideas, creates a fertile ground for venture capital investments. Across diverse industries and sectors, ambitious entrepreneurs are leveraging emerging opportunities, driving the need for financial backing to propel their ventures to new heights. The interconnected nature of the global entrepreneurial ecosystem ensures a continuous influx of innovative ventures seeking support, providing venture capitalists with a rich and diverse pool of investment opportunities. This dynamic ecosystem, characterized by resilience, adaptability, and a spirit of innovation, serves as a catalyst for venture capital, contributing to the discovery and growth of the next generation of transformative businesses worldwide.

Market Restraints:

The venture capital market faces several constraints that impact its operations and growth potential. Firstly, the inherent risk associated with early-stage investments poses a significant challenge. Many startups, despite their innovative ideas, may face market uncertainties, making it challenging for venture capitalists to predict their success accurately. This risk factor contributes to a considerable number of ventures not achieving the anticipated returns, leading to financial losses for investors.Secondly, the exit strategy for venture capitalists, often reliant on initial public offerings (IPOs) or acquisitions, can be unpredictable. Market conditions, regulatory hurdles, or economic downturns may hinder the successful exit of investments, affecting the overall return on investment for venture capitalists. Additionally, the intense competition for promising investment opportunities can lead to inflated valuations, reducing the potential for favourable returns. As more capital flows into the venture capital space, the challenge of identifying high-potential ventures at reasonable valuations becomes increasingly complex. Moreover, economic downturns and market uncertainties, as witnessed during global crises, can tighten the availability of capital and increase the level of risk aversion among investors, leading to a reduction in overall venture capital activity. Addressing these constraints requires a combination of risk management strategies, thorough due diligence, and adaptation to the evolving economic landscape to ensure the sustained growth and resilience of the venture capital market.

The COVID-19 pandemic has significantly impacted the venture capital market, introducing a complex interplay of challenges and opportunities. Initially, the heightened economic uncertainty led to a cautious approach among venture capitalists, resulting in a slowdown in funding activities, especially for early-stage startups. The focus shifted towards portfolio management, with many investors prioritizing the financial health of existing investments over new ventures. However, as the pandemic unfolded, certain sectors experienced accelerated growth, such as health tech, edtech, and e-commerce, reflecting the adaptability of the venture capital landscape. The crisis highlighted the importance of digital transformation, spurring investments in technology-driven solutions. Remote work trends, coupled with increased reliance on digital services, contributed to the resilience of certain industries. While the fundraising environment faced challenges, there was also a surge in interest in pandemic-resilient sectors, creating opportunities for ventures addressing immediate societal needs. The venture capital market demonstrated adaptability, with an increased emphasis on sustainability, health, and innovative solutions. As economies recover, the venture capital landscape is poised for further evolution, navigating the ongoing impacts of the pandemic and capitalizing on emerging trends reshaping the business and technology sectors.

Segmental Analysis:

International Investor Segment is Expected to Witness Significant Growth Over the Forecast Period

The international capital market encompasses the network of financial institutions, governments, and investors that trade securities and currencies across borders, facilitating the flow of funds globally. It includes the bond market, equity market, and foreign exchange market, among others, and plays a crucial role in funding businesses, governments, and projects worldwide. Parallel to this, the venture capital market focuses on providing funding to startups and early-stage companies with high growth potential, typically in exchange for equity. Venture capital firms take on risks to invest in innovative ideas and technologies, driving innovation and economic growth. Together, these markets form integral parts of the global financial system, supporting businesses of all sizes and contributing to economic development on a global scale.

Transport & Logistics Segment is Expected to Witness Significant Growth Over the Forecast Period

The transport and logistics sector has been a focal point for venture capital investment, driven by the industry's need for innovative solutions to meet evolving demands. Venture capital firms are increasingly investing in startups and technologies that aim to disrupt traditional transport and logistics models, such as autonomous vehicles, drones for delivery, and digital freight platforms. These investments are driven by the potential for significant returns as well as the opportunity to revolutionize how goods are transported and delivered. Additionally, venture capital in the transport and logistics sector is helping to drive sustainability efforts, with investments in electric vehicles, alternative fuels, and smart infrastructure. Overall, the venture capital market is playing a crucial role in shaping the future of transport and logistics, driving innovation and efficiency in a rapidly evolving industry.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America is a key player in the global venture capital market, characterized by its robust ecosystem supporting innovation and entrepreneurship. The region, particularly the United States, is home to Silicon Valley, which is renowned for its concentration of technology startups and venture capital firms. North America's venture capital market is fueled by a combination of factors, including a strong culture of entrepreneurship, access to capital, and a supportive regulatory environment. The region attracts venture capital investments across various sectors, including technology, healthcare, and consumer goods. Major cities like San Francisco, New York, and Boston are prominent hubs for venture capital activity, offering a diverse range of investment opportunities. Overall, North America's venture capital market continues to drive innovation and economic growth, making it a key player in the global venture capital landscape. Thus, the segment is expected to witness significant growth Over the Forecast Period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company's presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic manoeuvres. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders. Some of the key market players working in this segment are:

Recent Development:

1) In 2022, IDG Capital Vietnam officially affirmed its investment in METAIN, positioning itself as a leader in the emerging trend of NFT-empowered real estate in Vietnam. The investment firm expresses its ambition to spearhead the NFT real estate movement and outlines plans to actively engage with global investors, aiming to attract investments into the Vietnamese real estate market. The adoption of blockchain, smart contracts, and Non-Fungible tokens (NFT) technology is heralding a transformative era in the real estate industry, offering high security, instantaneous settlement, and a transparent, seamless transaction process. These technological advancements are anticipated to shape the real estate landscape in Vietnam and globally, becoming a pivotal trend in the decades to come. Shifting focus to 2020, the venture capital (VC) investment landscape in Europe witnessed a remarkable second consecutive quarterly record, with a substantial USD 14.3 billion raised across 1,192 deals. This marked an increase from the USD 13.8 billion secured across 1,473 deals in the third quarter of the same year. Notably, the Americas accounted for over half of the global VC investment during the fourth quarter of 2020, with a staggering USD 41 billion invested across 2,725 deals. Within this, the United States claimed a significant portion, with USD 38.8 billion invested across 2,526 deals. These statistics underscore the resilience and growth of VC investments, signaling the dynamism and continued strength of the venture capital landscape on both regional and global scales.

Q1. What was the Venture Capital Market size in 2023?

As per Data Library Research the Venture Capital market worldwide is projected to reach a market volume of USD 478.7 billion in 2023.

Q2. What is the Growth Rate of the Venture Capital Market ?

Venture Capital Market is expected to register a CAGR of 7.8% over the forecast period.

Q3. Which region has the largest share of the Venture Capital market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Q4. What segments are covered in the Venture Capital Market Report?

By Type, By Industry and Geography these segments are covered in the Venture Capital Market Report.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model