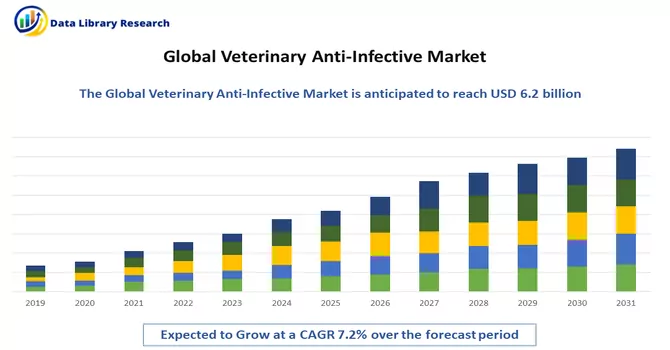

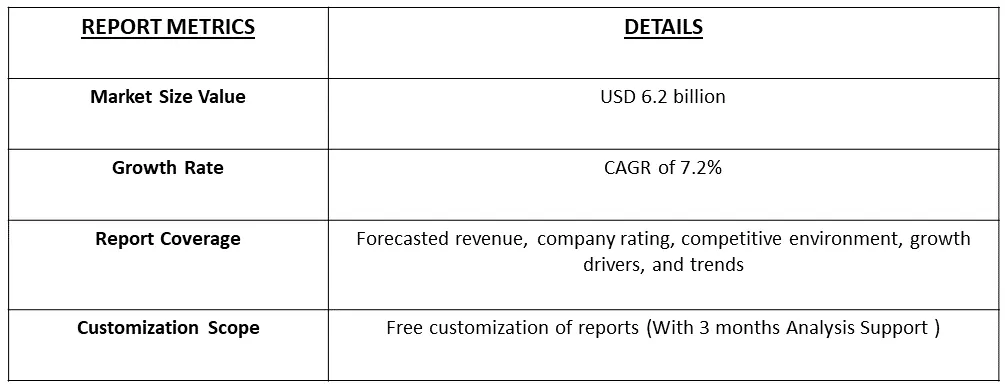

In 2022, the market size of veterinary anti-infectives reached USD 6.2 billion globally, with a projected Compound Annual Growth Rate (CAGR) of 7.2% expected during the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Veterinary anti-infectives refer to a class of pharmaceuticals specifically designed to prevent, treat, or control infections in animals. These infectious diseases may affect various species, including livestock, poultry, companion animals, and wildlife. Veterinary anti-infectives include antibiotics, antivirals, antifungals, and other agents aimed at combating microbial pathogens that can cause diseases in animals.

The goal is to maintain animal health, ensure food safety, and prevent the spread of infectious diseases within both animal populations and, in some cases, to humans. The primary driver for veterinary anti-infectives is the need to prevent and treat infections in animals. Diseases can spread rapidly in animal populations, leading to economic losses in agriculture and affecting the well-being of companion animals. Ensuring the health and well-being of animals is a key factor. Veterinary anti-infectives play a vital role in preventing and treating diseases that can cause suffering and distress in animals.

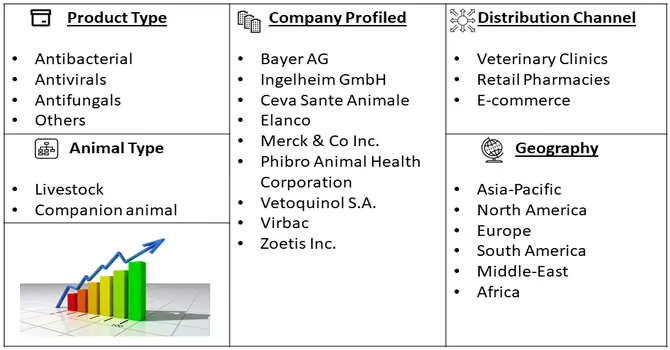

Market Segmentation: The market is segmented by Animal Type, Product Type (Antibacterial, Antivirals, Antifungals, and Others), and by Geography (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa). The report offers market size and values in (USD million) during the forecasted years for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The anticipated expansion is attributed to the growing awareness surrounding enhanced animal health, which is poised to be a key driver of market growth.The increasing trend of pet ownership, coupled with the humanization of pets, is driving the demand for veterinary anti-infectives. Pet owners are more inclined to invest in healthcare products, including anti-infectives, to ensure the well-being of their companion animals. There is a growing emphasis on preventive healthcare and wellness in veterinary medicine. This trend is reflected in the use of veterinary anti-infectives not only for treating diseases but also for preventive measures, including vaccinations and routine health maintenance.

Market Drivers:

Prevention and Treatment of Infections

One primary driving factor for the use of veterinary anti-infectives is the compelling need to prevent and treat infections in animals. In agricultural settings, livestock and poultry are susceptible to various infectious diseases that can spread rapidly within herds or flocks. The administration of veterinary anti-infectives helps mitigate the impact of these diseases, preventing economic losses for farmers and ensuring the health and well-being of the animals. For instance, survey conducted by the Centers for Disease Control and Prevention (CDC), an estimated 48 million individuals in the United States contract foodborne diseases annually, leading to 128,000 hospitalizations and 3,000 fatalities. This underscores a pressing need for efficacious treatments to mitigate these outbreaks, thereby driving significant market growth. The escalating demand for dairy products, fresh meat, dietary nutrition, and animal vaccines places increased responsibility on livestock owners to uphold veterinary health standards, further fueling the swift adoption of veterinary anti-infectives in the near future. Thus, such factors are contributing to the studied market growth.

Food Safety and Security:

Another crucial driving factor is the role of veterinary anti-infectives in maintaining food safety and security. In the livestock industry, where animals are raised for meat, milk, and other products, preventing the spread of infections is paramount. The use of veterinary anti-infectives ensures that animals are healthy, reducing the risk of transmitting diseases to humans through the consumption of animal products. This factor underscores the importance of veterinary anti-infectives in supporting a safe and secure global food supply chain. Moreover, According to report from the Michigan Department of Agriculture and Rural Development, a total of 115 cases were documented. Additionally, pets are vulnerable to bacterial diseases, including but not limited to plague, brucellosis, and Lyme disease. According to a qualitative report by the CDC in 2018, cats exhibit a higher susceptibility to plague compared to dogs, and they can transmit the infection to humans as well. Thus, such factors are contributing to the studied market growth.

Market Restraint:

Antimicrobial Resistance (AMR) and Regulatory Scrutiny and Compliance

One of the significant market restraints is the growing concern and challenge of antimicrobial resistance (AMR) in veterinary anti-infectives. Prolonged and indiscriminate use of antibiotics in animals can contribute to the development of resistant strains of bacteria. This not only compromises the effectiveness of existing treatments but also poses a serious threat to both animal and human health. Regulatory pressures and increasing awareness of the impact of AMR are limiting the widespread use of certain veterinary anti-infectives. Furthermore, sringent regulatory scrutiny and evolving compliance requirements pose challenges for the veterinary anti-infectives market. Regulatory agencies are increasingly focused on ensuring the responsible use of antibiotics and other anti-infective agents in animals to address concerns related to AMR. This has led to tighter regulations, increased documentation requirements, and a more cautious approach to the approval and usage of certain veterinary anti-infectives. Thus, such factors are slowing down to the studied market growth.

The global supply chains for veterinary anti-infectives experienced significant disruption due to the pandemic, impacting both the production and distribution processes. Restrictions on international trade, border closures, and logistical disruptions created challenges in sourcing raw materials and timely delivering finished products. This, in turn, had profound effects on the availability of veterinary anti-infectives in the market. The changes in consumer behavior and economic uncertainties brought about by the pandemic also influenced the demand dynamics for veterinary anti-infectives. The emphasis on essential needs during lockdowns and economic constraints likely prompted shifts in consumption patterns for animal healthcare products, including anti-infectives. Consumers may have prioritized certain aspects of animal health, leading to fluctuations in the demand for specific veterinary anti-infective products.

Segmental Analysis:

Antivirals Segment is Expected to Witness Significant Growth over the Studied Period

Antiviral medications for veterinary animals play a crucial role in preventing, managing, and treating viral infections that affect a wide range of species. These medications are designed to target specific viruses, inhibiting their replication and spread within the animal's body. Veterinary animals, including livestock, poultry, and companion animals, are susceptible to a variety of viral infections. These can range from respiratory viruses and gastrointestinal viruses to more severe and systemic infections. Some viral infections affecting animals have zoonotic potential, meaning they can be transmitted from animals to humans. The use of antiviral medications in veterinary care not only protects animal health but also contributes to preventing the spread of zoonotic diseases. Thus, owing to such advantges, the segment is expected to witness significant growth over the studied period.

North America Region is Expected to Witness Significant Growth Over the Studied Period

North America region is among the major contributor to livestock and the implementation of animal healthcare benefits across the region. The market is growing rapidly due to the presence of advanced animal healthcare programs coupled with awareness regarding animal health is projected to drive the regional market growth. Overall, rising pet ownership, advances in veterinary medicine, rising demand for specialized services, and expansion of pet insurance coverage, which makes it easier for pet owners to afford veterinary care, are expected to fuel the growth of the North America market.

Moreover, the integration of technology, including telemedicine, has become more prevalent in North American veterinary practices. Telemedicine allows for remote consultations, monitoring, and advice, improving access to veterinary care, particularly in rural areas. Also, Veterinary medicine in North America is subject to regulatory oversight to ensure the safety and efficacy of treatments. Regulatory agencies set standards for the approval of veterinary drugs, including antivirals, to maintain the highest standards of animal care. Thus, such factors are expected to drive the studied market’s growth over the studied period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The global players in the veterinary anti-infectives market are

Recent Development:

1) In January 2023: Norbrook® broadens extensive antibiotic line with addition of Tulieve® (tulathromycin injection). New generic Tulathromycin injectable available in exclusive plastic bottle & four different sizes. Tulieve®, like other tulathromycin injectables, is a semi-synthetic macrolide class of bacteriostatic antimicrobials that disrupts protein synthesis of both Gram-positive and Gram-negative bacteria

2) In November 2022: The Hyderabad based firm has on Monday entered into a partnership with Central Institute of Fisheries Education (CIFE), Mumbai, for the commercial development of a vaccine against common bacterial diseases in freshwater fishes.

Q1. What was the Veterinary Anti-Infective Market size in 2022?

As per Data Library Research the market size of veterinary anti-infectives reached USD 6.2 billion in 2022.

Q2. At what CAGR is the market projected to grow within the forecast period?

Veterinary Anti-Infective Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% during the forecast period.

Q3. Which region has the largest share of the Veterinary Anti-Infective Market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here

Q4. What are the factors driving the Veterinary Anti-Infective Market?

Key factors that are driving the growth include the Prevention and Treatment of Infections and Food Safety and Security.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model