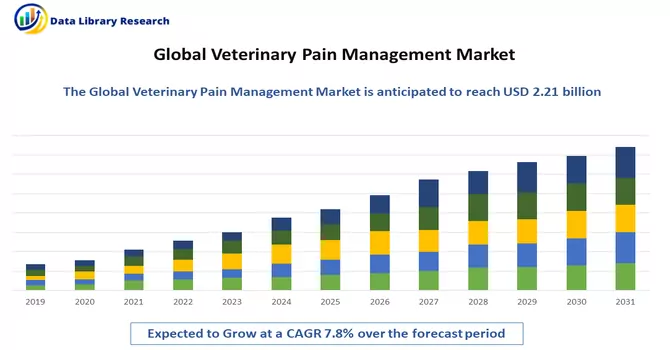

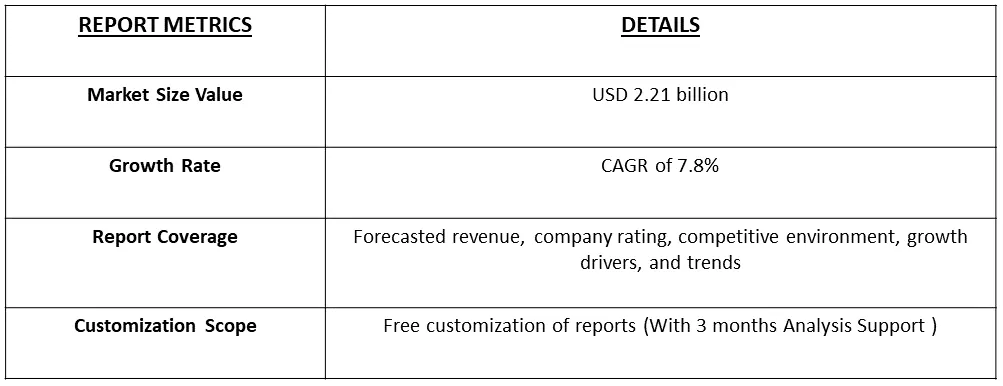

The global veterinary pain management market size was USD 2.21 billion in 2022, and is predicted to register a CAGR of 7.8% during the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Veterinary pain management refers to the practice of alleviating or minimizing pain and discomfort in animals. Animals, like humans, can experience pain due to various reasons such as injury, surgery, illness, or chronic conditions. Effective pain management in veterinary medicine is essential not only for ethical reasons but also for promoting the overall well-being and recovery of the animal.

The rising trend of pet ownership and the increasing number of companion animals globally contribute to a growing demand for veterinary services, including pain management. The prevalence of chronic conditions in animals, such as arthritis and cancer, necessitates long-term pain management strategies, boosting the demand for related products and services. Moreover, ongoing advancements in veterinary medicine, including the development of new and improved pain management techniques, medications, and technologies, drive the market forward.

There is a growing emphasis on preventive healthcare for animals, including early detection and management of pain. This trend encourages the use of pain management strategies as part of routine veterinary care. The exploration of cannabis-derived compounds, such as CBD (cannabidiol), for their potential therapeutic effects in managing pain and inflammation in pets is a notable trend. Regulatory changes in some regions have facilitated the development and use of such products. These trends reflect the dynamic nature of the veterinary pain management market, driven by a combination of technological advancements, changing consumer preferences, and a growing understanding of the importance of pain management in ensuring the health and quality of life of animals.

Market Segmentation: The Global Veterinary Pain Management Market Size and is Segmented by Product (Drugs and Devices), Application (Osteoarthritis and Joint Pain, Postoperative Pain, Cancer, and Other Applications), Animal Type (Companion and Livestock), End User (Hospitals and Clinics, Retail Outlets, and Other End Users), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers :

Growing Number of Companion Animals

The escalating population of companion animals across the globe, accompanied by the growing inclination toward pet humanization, has resulted in a heightened demand for veterinary services. This surge in demand encompasses various aspects of pet care, particularly emphasizing the need for effective pain management solutions. This trend is significantly influencing the dynamics of the Global Veterinary Pain Management Market. As pet owners increasingly consider their animals as integral family members, the awareness of providing comprehensive healthcare, including specialized pain management, has surged. This paradigm shift in attitude is contributing to the expansion of the veterinary pain management market on a global scale.

Growth in the Prevalence of Painful and Inflammatory Diseases in Animals

The surge in the occurrence of painful and inflammatory diseases in animals, coupled with an increasing demand for accessible and cost-effective treatment options, and a growing awareness of animal health and welfare, stands out as the primary drivers propelling the market forward. To illustrate, a March 2021 article from the Morris Animal Foundation highlighted that approximately 14.0 million adult dogs in the United States are affected by osteoarthritis each year, consistently ranking it as a top health concern among pets, according to owners. Additionally, an April 2021 article by the American Animal Health Association reported that around 6.0 million dogs are diagnosed with cancer annually, with approximately one in four dogs developing cancer at some point, and nearly 50.0% of dogs older than ten experiencing some form of cancer.

According to a September 2021 report from the CDC, Bovine Spongiform Encephalopathy (BSE) is one of the most prevalent chronic diseases among cattle in Canada. The report revealed that the true prevalence of Bovine Spongiform Encephalopathy (BSE) in Canada is approximately 90.0%, significantly higher than the prevalence in the United States (3.0 to 8.0 cases per million in Canada compared to around 0.167 cases per million in the United States). This high prevalence of diseases is expected to drive the demand for veterinary pain management drugs, thereby fostering substantial growth in the market. Thus, such factors are contributing to the growth of the studied market over the forecast period.

Market Restraints:

Side Effects Associated With Treatment and High Cost of Certain Products

The growth of the veterinary pain management market faces challenges attributed to side effects associated with treatments and the high cost of certain products. While veterinary pain management is essential for the well-being of animals, these impediments pose considerations for both practitioners and pet owners. The slow growth in the veterinary pain management market is also linked to the level of education and awareness among pet owners and veterinary professionals. Limited understanding of the importance of pain management or the availability of newer, more effective, and safer options can hinder market growth. Thus, these market trends are expected to slow down the growth of the studied market over the studied period.

The global COVID-19 pandemic had a notable impact on the veterinary pain management market by disrupting the supply chain of veterinary products. A case in point is the Food and Agriculture Organization's publication of a new policy in April 2020 addressing livestock production and the supply chain of livestock products during the pandemic, leading to a slowdown in the supply of veterinary products. Despite these challenges, the market experienced a surge in demand due to the high adoption rate of pet animals during lockdowns. As an illustration, in June 2021, the PDSA PAW report revealed a significant uptick in pet adoptions in the United Kingdom, with 2.0 million people adopting pets between March 2020 and May 2021. This surge in pet ownership during the lockdown period contributed to an increased demand for veterinary pain management drugs. Consequently, the market has started to regain momentum, and there is an expectation that this upward trend will persist throughout the forecast period.

Segmental Analysis:

Anesthetic Segment is Expected to Witness Significant Growth Over the Forecast Period

The use of anesthetics plays a crucial role in veterinary pain management, providing a means to alleviate or eliminate pain during various medical procedures and surgeries for animals. Anesthetics are substances that induce a reversible loss of sensation or consciousness, allowing veterinarians to perform interventions without causing pain or distress to the animal. Anesthetics are commonly employed during surgical procedures to ensure that animals do not experience pain or discomfort. This is essential for routine surgeries, such as spaying or neutering, as well as more complex procedures. Moreover, anesthetics serve not only to prevent pain during a procedure but also contribute to postoperative pain management. By inducing a state of unconsciousness or sedation, anesthetics help ensure a smoother recovery for the animal. Thus, owing to such advatnges, the segment is expected to witness significant growth over the forecast period.

Osteoarthritis and joint pain Segment is Expected to Witness Significant Growth Over the Forecast Period

Osteoarthritis and joint pain are prevalent conditions in the veterinary world, affecting a wide range of animals, particularly aging pets. In response to these conditions, veterinary pain management becomes a critical aspect of care. Diagnosing osteoarthritis in animals can be challenging, as they may not always exhibit overt signs of pain. Veterinary professionals often rely on a combination of physical examinations, imaging studies, and a detailed history from pet owners to make an accurate diagnosis. Medications such as nonsteroidal anti-inflammatory drugs (NSAIDs), analgesics, and joint supplements are commonly prescribed for managing pain associated with osteoarthritis. These drugs help control inflammation and provide relief from pain. Thus, owing to such advatnges, the segment is expected to witness significant growth over the forecast period.

Companion Animal Segment is Expected to Witness Significant Growth Over the Forecast Period

Companion animals, including dogs, cats, and other household pets, are valued members of many families. Ensuring their well-being is a top priority for pet owners, and this extends to the management of pain when they experience discomfort due to various reasons. Veterinary pain management for companion animals is a crucial aspect of responsible pet care, encompassing a range of strategies to address and alleviate pain effectively. Companion animals can experience pain due to various factors, including injuries, surgeries, dental issues, arthritis, cancer, and age-related conditions. Veterinary pain management aims to address both acute and chronic pain associated with these causes.

Moreover medications play a crucial role in veterinary pain management for companion animals. Nonsteroidal anti-inflammatory drugs (NSAIDs), opioids, and other analgesics may be prescribed to alleviate pain and reduce inflammation. The choice of medication depends on the type and severity of the pain, as well as the overall health of the animal. Thus, owing to such advatnges, the segment is expected to witness significant growth over the forecast period

Veterinary Hospitals and Clinics Segment is Expected to Witness Significant Growth Over the Forecast Period

Veterinary hospitals serve as primary institutions for the diagnosis, treatment, and overall healthcare of animals. They play a vital role in addressing a wide range of medical conditions, including those causing pain and discomfort. Veterinary hospitals incorporate thorough pain assessment as part of their diagnostic and treatment protocols. This includes evaluating an animal's behavior, physiological parameters, and clinical signs to determine the presence and intensity of pain. Thus, the synergy between veterinary hospitals and the veterinary pain management market is integral to the overall well-being of animals. The continuous evolution of pain management practices within these healthcare settings reflects a commitment to providing compassionate and effective care for animal patients.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America is poised to assert dominance in the veterinary pain management market throughout the forecast period, driven by factors such as a surge in pet adoption and an escalating per capita expenditure on animal healthcare in the region. The market's growth is further fueled by an uptick in the prevalence of various animal diseases and injuries.

According to the American Pet Products Association's 2021-2022 National Pet Owners Survey, a substantial number of Americans are pet owners. Approximately 69.0 million Americans own dogs, 45.3 million own cats, 11.8 million own freshwater fish, 9.9 million own birds, 6.2 million own small animals, 5.7 million own reptiles, 3.5 million own horses, and 2.9 million own saltwater fish. The increased ownership of pets and livestock has contributed to a heightened awareness among US citizens regarding the health of these animals. In March 2020, data from the American Veterinary Medical Association revealed that around USD 29.3 billion was spent on veterinary care and services in the country. This increased awareness and expenditure on animal health are expected to drive significant growth in the North American veterinary pain management market over the forecast period.

The United States, in particular, is experiencing growth in the veterinary pain management market due to rising partnerships, agreements, mergers, and acquisitions among companies. Numerous companies are introducing new products to meet the demand. Notably, in 2020, the US FDA granted approval for Cronus Pharma Specialties’ Carprofen Chewable Tablets, a generic version of Rimadyl by Zoetis, designed for dogs. This nonsteroidal anti-inflammatory drug (NSAID) has demonstrated safety and efficacy in alleviating pain and inflammation associated with osteoarthritis. Additionally, it aids in controlling postoperative pain linked to soft tissue and orthopedic surgeries.

Considering these factors, coupled with the increasing prevalence of inflammatory diseases in animals, the veterinary pain management market is anticipated to witness substantial growth over the forecast period in North America.

Get Complete Analysis Of The Report - Download Free Sample PDF

The market for veterinary pain management exhibits moderate competitiveness, featuring the participation of both international and local companies. The competitive landscape involves an examination of several companies, both global and local, that possess market shares. Some of the key market players working in this domain are:

Recent Development:

1) September 2022: Zoetis launched Solensia to manage feline osteoarthritis pain in the United States.

2) April 2022: FDA-approved medetomidine and vatinoxan hydrochlorides injection for use as a sedative and analgesic in dogs while undergoing certain clinical examinations and procedures and minor surgical procedures.

Q1. What was the Veterinary Pain Management Market size in 2022?

As per Data Library Research the global veterinary pain management market size was USD 2.21 billion in 2022.

Q2. At what CAGR is the market projected to grow within the forecast period?

Veterinary Pain Management Market is predicted to register a CAGR of 7.8% during the forecast period.

Q3. What are the Growth Drivers of the Veterinary Pain Management Market ?

Growing Number of Companion Animals and Growth in the Prevalence of Painful and Inflammatory Diseases in Animals are the Growth Drivers of the Veterinary Pain Management Market.

Q4. Which region has the largest share of the Veterinary Pain Management Market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model