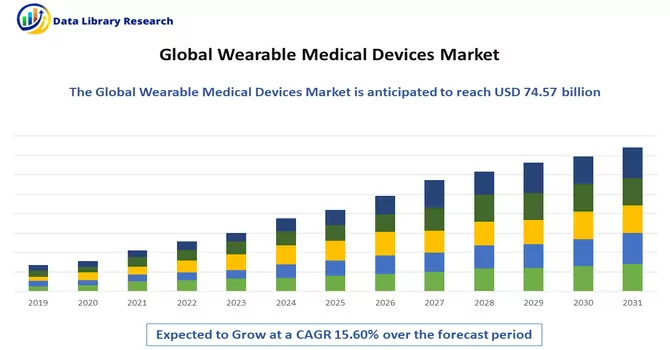

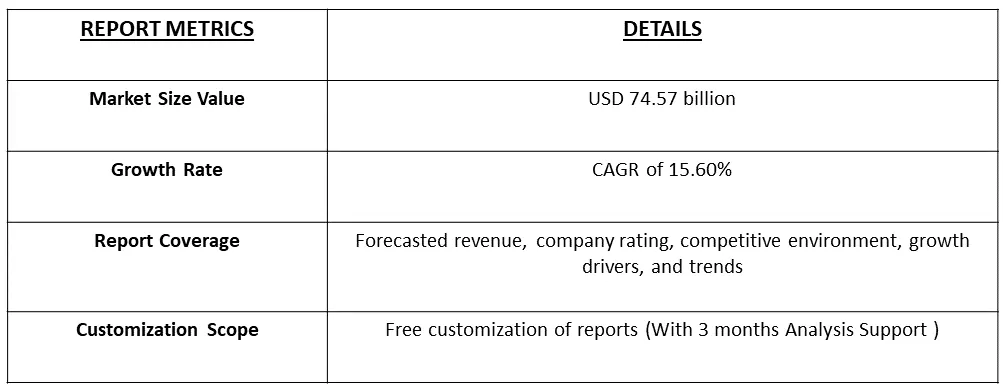

The Wearable Medical Devices Market size is expected to grow from USD 36.12 billion in 2023 to USD 74.57 billion by 2030, at a CAGR of 15.60% during the forecast period (2023-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

Wearable medical devices are electronic devices or sensors designed to be worn on the body, often as accessories or incorporated into clothing, and are equipped with health-related monitoring or tracking capabilities. These devices are intended to collect, monitor, and transmit health and medical data, providing real-time information about various physiological parameters and activities. Common examples of wearable medical devices include fitness trackers, smartwatches with health monitoring features, continuous glucose monitoring systems, wearable ECG monitors, and smart clothing embedded with sensors for various health measurements. These devices play a crucial role in promoting proactive health management, early detection of medical conditions, and supporting personalized healthcare approaches.

The rise in chronic diseases, such as diabetes, cardiovascular conditions, and respiratory disorders, has increased the demand for continuous monitoring. Wearable medical devices help individuals manage these conditions by providing continuous data, allowing for early detection of anomalies and better disease management. Moreover, wearable medical devices offer individuals the ability to monitor their health and fitness in real-time. From tracking steps and physical activity to monitoring heart rate, sleep patterns, and other vital signs, these devices provide valuable insights into overall well-being.

Wearable medical devices are increasingly integrated with telehealth and remote monitoring platforms. This trend supports the growing demand for virtual healthcare services, enabling healthcare providers to monitor patients in real time and deliver more personalized care. Moreover, ongoing advancements in sensor technologies, including biosensors, accelerometers, and optical sensors, contribute to the development of more accurate and sophisticated wearable devices. Improved sensor capabilities enhance the reliability of health data collected by wearables. These trends collectively indicate the dynamic evolution of wearable medical devices, driven by technological innovations, changing consumer preferences, and a growing awareness of the importance of proactive health monitoring.

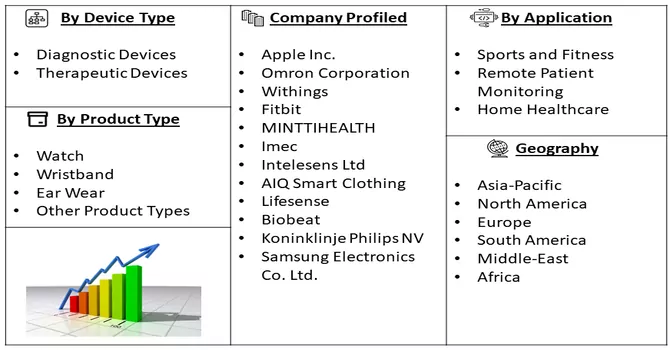

Market Segmentation: The Global Wearable Healthcare Devices Market is Segmented by Device Type (Diagnostic Devices and Therapeutic Devices), Application (Sports and Fitness, Remote Patient Monitoring, and Home Healthcare), Product Type (Watch, Wristband, Ear Wear, and Other Product Types), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The value is provided in (USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers :

Increasing Technological Advancements and Innovations

Ongoing technological advancements in the field of wearable medical devices have facilitated the miniaturization of components, resulting in the creation of smaller and more discreet devices. This evolution in form factors not only enhances user comfort but also encourages continuous and unobtrusive monitoring of health parameters. Breakthroughs in sensor technologies, including biosensors, accelerometers, and gyroscopes, have significantly contributed to the precision and comprehensiveness of health data collection by wearable devices. These innovations empower devices to monitor a broader range of physiological parameters with heightened accuracy. The market is witnessing a surge in the launch of wearable devices by key industry players, and this trend is expected to drive market growth. For instance, in August 2022, GOQii introduced Smart Vital Ultra and GOQii Stream devices, specifically designed for young adults and the youth demographic. These innovative products offer consumers a convenient means to monitor vital health indicators. This reflects the industry's commitment to providing advanced solutions that cater to diverse consumer needs, fostering the widespread adoption of wearable medical devices for proactive health monitoring.

Increasing Per-capita Income in Developing Countries

The increasing per-capita income in developing countries has contributed significantly to the growing adoption and use of wearable medical devices. As individuals in these regions experience improvements in economic conditions, there is a corresponding rise in awareness and investment in personal healthcare. With rising incomes, individuals in developing countries have greater financial capacity to invest in health and wellness. Wearable medical devices, once considered luxury items, become more affordable and accessible to a broader segment of the population. For instance, in March 2023, India’s per capita net national income (at current prices) for 2022-23 stands at INR 172,000, according to estimates from the National Statistical Office (NSO). This marks an almost 100 percent increase from the per capita income in 2014-15 – INR 86,647 – when the Narendra Modi government first came to power. Thus, increase in per capital income is expected to contribute to the studied market growth over the forecast period.

Market Restraints :

High Cost of Wearable Devices and Unfavourable Reimbursement

The high cost of wearable devices and unfavourable reimbursement scenarios are anticipated to act as impediments, potentially slowing down the growth of the wearable medical device market. The cost of advanced wearable medical devices, often equipped with cutting-edge technologies and features, can be prohibitive for a significant portion of the population. Affordability concerns limit the widespread adoption of these devices, particularly in regions where healthcare expenses are not fully covered by insurance or reimbursement programs. In low-income settings or regions with limited access to healthcare resources, the high cost of wearable medical devices becomes a significant barrier. Individuals in these areas may struggle to afford such devices, leading to disparities in access to advanced healthcare technologies. Thus, such factors are expected to slow down the growth of the studied market over the forecast period.

Segmental Analysis:

Sleep Monitoring Devices Segment is Expected to Witness Significant Growth Over the Forecast Period

Sleep monitoring devices are innovative technological tools designed to track and analyze various aspects of an individual's sleep patterns and quality. These devices utilize advanced sensors and technologies to provide valuable insights into sleep duration, sleep cycles, disturbances, and overall sleep health. Sleep monitoring devices often come with user-friendly interfaces, presenting sleep data through dashboards and detailed reports. This allows users to easily interpret their sleep metrics and identify trends over time. Sleep monitoring devices play a crucial role in promoting better sleep habits and overall well-being by empowering individuals with actionable insights into their sleep patterns. As technology continues to advance, these devices are becoming increasingly sophisticated, contributing to a more holistic approach to sleep health.

Remote Patient Monitoring Segment is Expected to Witness Significant Growth Over the Forecast Period

Remote Patient Monitoring (RPM) wearable medical devices represent a transformative aspect of modern healthcare, enabling healthcare providers to remotely track and monitor patients' health parameters in real time. These wearable devices offer continuous monitoring outside traditional healthcare settings, providing valuable data for personalized and timely interventions. RPM devices come in various wearable forms, including smartwatches, fitness trackers, patches, and specialized medical wearables. These devices are designed to be comfortable and unobtrusive, allowing patients to incorporate them seamlessly into their daily lives. Manufacturers of RPM wearables adhere to regulatory standards to ensure the safety, accuracy, and security of the health data collected. Compliance with regulations such as HIPAA (Health Insurance Portability and Accountability Act) is crucial for protecting patient privacy. Remote Patient Monitoring wearable medical devices are at the forefront of healthcare innovation, offering a paradigm shift towards proactive and patient-centric care. As technology advances, these devices continue to evolve, playing a vital role in improving patient outcomes and reducing healthcare costs.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America is poised to dominate the wearable medical devices market, with the United States playing a pivotal role in driving this sector's growth. The U.S., in particular, stands out as a major contributor, boasting the largest market share. This dominance is attributed to the high incidence of cardiovascular and lifestyle-related diseases, coupled with the widespread adoption of wearable medical technology. The region's elevated per capita medical expenditure further fuels the demand for advanced healthcare solutions. Key players such as Garmin Ltd, Fitbit Inc., and Biotelemetry Inc. have established a robust presence in the United States, channeling investments into innovative wearables through substantial research and development efforts. The growth of the market is also bolstered by increasing partnerships for the distribution of wearable medical devices in the U.S. In a notable example, Medtronic plc formed a strategic alliance with BioIntelliSense to secure exclusive distribution rights for the BioButton multi-parameter wearable. This partnership extends to both U.S. hospitals and the post-acute hospital-to-home sector. Moreover, the surge in approvals granted by the U.S. Food and Drug Administration (FDA) for wearable devices is expected to further propel market expansion. An illustrative instance is the FDA's approval of Medicalgorithmics' ECG wearable unit, Qpatch, in June 2022. Qpatch is designed to accurately measure individual ECG signals, enabling precise cardiac arrhythmia diagnoses from monitoring sessions lasting up to 15 days. Thus, these factors, North America is poised for significant growth. The region's trajectory is marked by the escalating adoption of technologically advanced wearable medical devices, increased healthcare expenditure, and proactive initiatives from key market players.

Get Complete Analysis Of The Report - Download Free Sample PDF

The market is propelled by the continuous introduction of innovative products by various players. Companies strive to differentiate themselves by bringing cutting-edge wearable medical devices to market. These innovations often target specific healthcare needs, ensuring a diverse range of solutions for consumers. The entry of new players into the market contributes to its fragmentation. Start-ups and emerging companies bring fresh perspectives, ideas, and technologies, challenging established players and fostering competition. This influx of new entrants stimulates innovation and can lead to the development of niche or specialized wearable devices. Some of the key market players working in this market segment are:

Recent Development:

1) In November 2022, Zepp Health introduced the Amazfit Pop 2, an exclusive smartwatch tailored for the Indian market. This fitness wearable is now accessible for purchase on the popular e-commerce platform Flipkart.

2) In October 2022, OnePlus, a prominent Chinese smartphone manufacturer, unveiled the OnePlus Nord watch, a new wearable device falling under its Nord product category. The OnePlus Nord Watch is designed to sync with the N Health app on smartphones, enabling the measurement and storage of data related to step counts, calories burned, and sleep quality.

Q1. How big is the Wearable Medical Devices Market ?

The Wearable Medical Devices Market size is expected to grow from USD 36.12 billion in 2023 to USD 74.57 billion by 2030.

Q2. At what CAGR is the Wearable Medical Devices Market projected to grow within the forecast period?

Wearable Medical Devices Market is expected to grow at a CAGR of 15.60% during the forecast period.

Q3. What are the factors driving the Wearable Medical Devices Market?

Key factors that are driving the growth include the Increasing Technological Advancements and Innovations and Increasing Per-capita Income in Developing Countries.

Q4. Which region has the largest share of the Wearable Medical Devices market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model