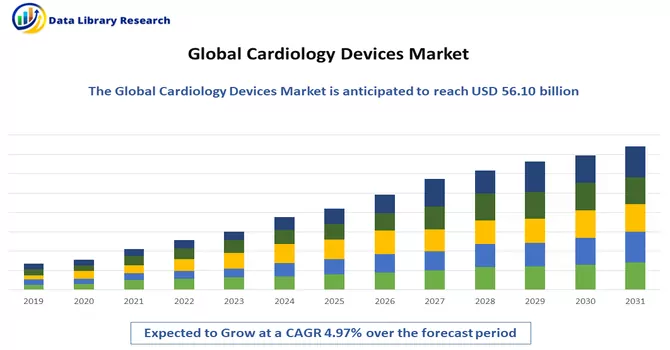

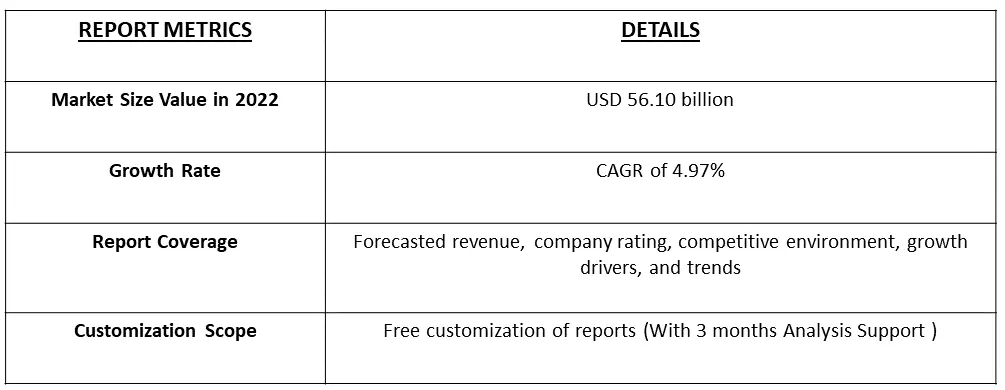

The Cardiovascular Devices Market size is expected to grow from USD 56.10 billion in 2022, registering a CAGR of 4.97% over the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Cardiovascular devices represent a cornerstone of modern cardiology and healthcare. Their diagnostic, therapeutic, and monitoring capabilities have revolutionized the treatment of heart-related conditions, significantly improving the prognosis and quality of life for countless patients. As technology continues to advance, the role of cardiovascular devices in preventing, diagnosing, and treating cardiovascular diseases remains essential in the ongoing pursuit of heart health.

The major factors driving the market are rapid technological advancements, the rising global burden of various cardiovascular diseases, and increased preference for minimally invasive procedures. Heart-related mortality is caused by the rising prevalence of heart disorders such as cardiomyopathy and stroke. The most common diseases in the world are those related to the cardiovascular system.

Cardiovascular devices are increasingly being used for preventive purposes. Wearable fitness and health tracking devices can monitor heart health and detect early warning signs. With the coming of advanced imaging techniques like 4D cardiac MRI and intravascular ultrasound (IVUS) are providing more detailed and precise insights into cardiovascular anatomy and function. Furthermore, evolving regulatory standards and reimbursement policies are influencing the development and adoption of cardiovascular devices, thus these trends are providing opportunity to the studied market to grow.

Segmentation:

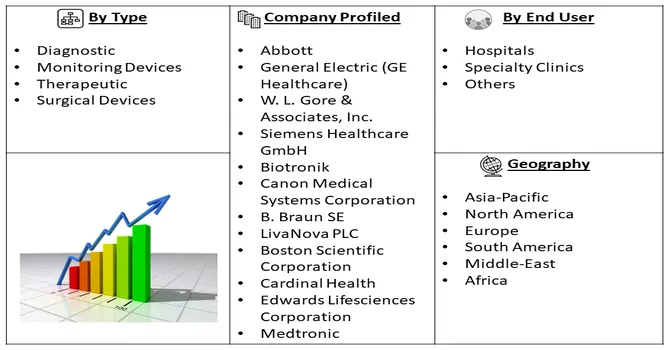

The Global Cardiovascular Devices Market is Segmented

By Device Type :

Geography

The report offers the value (in USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers :

Increasing Cases of CVDs

According to the report published by the Heart and Stroke Foundation of Canada in February 2022, there are 750,000 patients diagnosed with heart failure and this is increasing every year. Hence for proper diagnosis and treatment of heart-related diseases cardiovascular devices play an important role that drives the market growth over the study period.

Technologies used in the development of cardiology devices have improved significantly over the past decade, and indications for these devices have expanded

This has led to an increasing number of patients being managed with cardiology devices, resulting in exponential therapeutical and monitoring outcomes. Artificial intelligence is one such advancement that has a significant positive impact on cardiology with improved capabilities for monitoring certain heart conditions. For instance, in July 2021, Medtronic received United States FDA clearance for two AccuRhythm AI algorithms for use with the LINQ II insertable cardiac monitor (ICM). AccuRhythm AI applies artificial intelligence (AI) to heart rhythm event data collected by LINQ II, improving the accuracy of information physicians receive so they can better diagnose and treat abnormal heart rhythms.

Restraints :

The cardiovascular devices market is subject to strict regulatory oversight by health authorities, such as the FDA in the United States and the European Medicines Agency (EMA) in Europe. Regulatory compliance involves extensive testing, clinical trials, and documentation, which can significantly lengthen the time to market for new devices.

The emergence of the COVID-19 pandemic hurt the cardiovascular devices market in the beginning. It had a detrimental effect on the market due to the reduction in the diagnosis of cardiovascular diseases due to healthcare resources being reserved for COVID-19 patients. Many medical device companies have experienced losses in their cardiovascular device businesses due to the pandemic. However, production and healthcare facilities got resumed which is expected to have a positive impact on the market. For instance, as per the 2022 annual report of Medtronic, a technology company having a major share of the revenue from the cardiovascular portfolio has increased revenue due to the global procedure volumes recovering from the decline brought on by the COVID-19 pandemic in the first and second quarters of the fiscal year 2021.

Segmental Analysis :

The Electrocardiogram (ECG) Under Diagnostic and Monitoring Devices Segment is Expected to Hold a Significant Share in the Market

More people are using ECGs for diagnostic and monitoring purposes thanks to the latest generation of lightweight and compact devices, which are especially popular in the home healthcare market. Rising rates of cardiovascular disease (CVD) necessitate continuous ECG monitoring. In addition, the development of wireless ECG has allowed for real-time patient monitoring and diagnosis, which has contributed to the growth of the market. In January 2022, Philips, for instance, began offering a 12-lead electrocardiogram (ECG) solution for use in decentralized clinical trials that could be performed in the comfort of a patient's own home. Among the new technologies in cardiac devices, wearable smart devices equipped with heart-monitoring capabilities, such as bands, watches, and rings, have become the norm for many people globally. In February 2021, VivaLNK launched a wearable ECG monitoring solution designed to wirelessly capture ECG and heart rate during a six-minute walk test (6MWT). Thus the new product launches and approvals increase the scope for the usage of ECG which drives the market segment over the study period. Therefore, due to the aforementioned factors, this market segment is expected to witness significant growth during the forecast period.

North America is Expected to Hold a Significant Share in the Market During the Forecast Period

North America is expected to dominate the cardiovascular devices market due to the high prevalence of cardiovascular diseases, the high adoption rate of minimally invasive procedures, the presence of reimbursements, the rising geriatric population, and the high demand for continuous and home-based monitoring.

According to the CDC’s updated report published in October 2022, a heart attack occurs in the United States every 40 seconds, and about 805,000 Americans experience a heart attack each year. This rising burden of cardiovascular diseases increases the demand for cardiovascular diagnostics and treatment devices. Additionally, some of the key market players in the country are developing novel products and technologies to compete with existing products, while others are acquiring and partnering with other companies trending in the market.

For instance, Abbott received approval from the United States FDA for its Aveir single-chamber (VR) leadless pacemaker for treating patients in the United States with slow heart rhythms in April 2022. This marks a significant advancement in patient care and brings new features to patients and their physicians. Similarly, Abbott received expanded indication approval from the United States FDA for the CardioMEMS HF System to support the care of patients suffering from earlier stages of heart failure in February 2022. These new product approvals increase the scope for using devices that drive the market in the region.

Furthermore, supportive awareness initiatives to create disease awareness are projected to support the market for cardiovascular devices in North America. For instance, Philips is supporting the American Heart Association’s multi-year effort to generate awareness among cross-disciplinary specialties and improve survival rates from cardiovascular implantable electronic device (CIED) infections1.

Get Complete Analysis Of The Report - Download Free Sample PDF

The cardiovascular devices market is moderately consolidated and competitive. The major players have established themselves in specific segments of the market. Furthermore, the companies are competing in emerging regions with global players and with established local players. Key players are developing and launching novel products and technologies to compete with existing products, while others are acquiring and partnering with other companies trending in the market. Some of the major players include:

Recent Development

1) October 2022: Medtronic plc received United States FDA approval for expanded labeling of a cardiac lead that taps into the heart's natural electrical system, giving patients needed therapy while avoiding complications sometimes associated with traditional pacing methods, such as cardiomyopathy.

2) October 2022: Biosense Webster, Inc., part of Johnson & Johnson MedTech launched the HELIOSTAR Balloon Ablation Catheter in Europe. The HELIOSTAR Balloon Ablation Catheter is indicated for use in the catheter-based cardiac electrophysiological mapping (stimulating and recording) of the atria and, when used with a compatible multi-channel RF generator, for cardiac ablation.

Q1. What is the current Cardiology Devices Market size?

The Cardiovascular Devices Market size is expected to grow USD 56.10 billion.

Q2. What is the Growth Rate of the Cardiovascular Devices Market?

Cardiovascular Devices Market is registering a CAGR of 4.97% over the forecast period.

Q3. What are the Growth Drivers of the Cardiovascular Devices Market?

Increasing Cases of CVDs are the Growth Drivers of the Cardiovascular Devices Market.

Q4. Which are the major companies in the Cardiovascular Devices Market?

Abbott, General Electric (GE Healthcare), W. L. Gore & Associates, Inc. and Siemens Healthcare GmbH are some the major companies in the Cardiovascular Devices Market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model