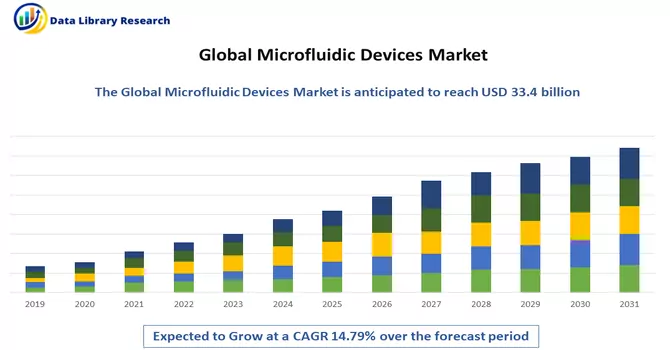

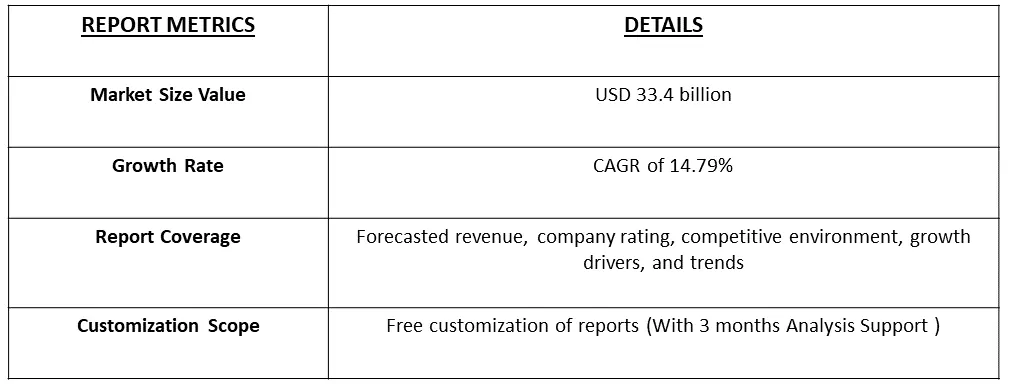

The Microfluidics Market size is estimated at USD 33.4 billion in 2023 and is expected to have a CAGR of 14.79% during the forecast period (2024-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

Microfluidic Devices are small-scale systems designed to manipulate and control tiny amounts of fluids, typically in the microliter to nanoliter range, within channels or chambers with dimensions on the order of micrometres. These devices leverage the principles of microfluidics to perform various tasks such as mixing, pumping, valving, and analyzing fluids at a miniature scale. The key components of microfluidic devices include microchannels, which are small channels or pathways through which fluids flow, and microstructures that enable specific functionalities. Microfluidic technology finds applications in various fields, including chemistry, biology, medicine, and engineering. Some common applications include point-of-care diagnostics, lab-on-a-chip systems, drug delivery, and chemical synthesis.

The microfluidic devices market is experiencing robust growth driven by multiple factors. The demand for precise and rapid point-of-care diagnostics is rising, leading to increased adoption of microfluidic devices that enable efficient on-site testing. Advances in microfabrication technologies, such as soft lithography and 3D printing, are enhancing manufacturing capabilities, resulting in cost-effective production and the creation of more complex devices. Microfluidics find extensive applications in life sciences, particularly in genomics, proteomics, and cell studies, aligning with the growing emphasis on personalized medicine. Additionally, microfluidic devices contribute to environmental monitoring, addressing the need for efficient water quality assessment and pollutant detection. The adoption of lab-on-a-chip platforms and the growing micro total analysis systems (μTAS) market highlight the diverse and expanding applications of microfluidic devices across industries.

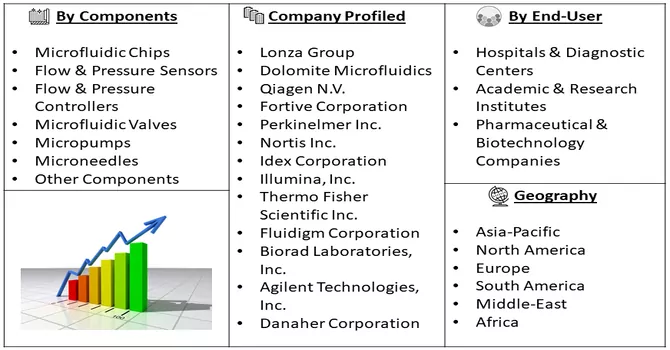

Market Segmentation: The Global Microfluidic Manufacturing Companies and the market is segmented by Product Type (Microfluidic-based devices, Microfluidic Components (Microfluidic Chips, Micro Pumps, Microneedles, and Other Product Types), Application (Drug Delivery, Point-of-Care Diagnostics, Pharmaceutical, and Biotechnology Research (High-throughput Screening, Proteomics, Genomics, Cell-based Assay, Capillary Electrophoresis, and Other Pharmaceutical and Biotechnology Research), Clinical Diagnostics, and Other Applications), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The market size and forecasts are provided in terms of value (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The Organ-on-chip technology, utilizing microfluidic devices to mimic the physiological conditions of organs, continues to advance. This trend is driven by the need for more accurate and efficient in vitro models for drug testing, disease modelling, and personalized medicine. For instance, in 2024, CN Bio, a prominent company specializing in Organ-on-a-Chip (OOC) technology, known for designing and manufacturing both single- and multi-organ microphysiological systems (MPS), has entered into a strategic partnership with LifeNet Health LifeSciences. LifeNet Health, a non-profit organization recognized globally for its all-human research solutions, will collaborate with CN Bio to supply validated primary human cells. The partnership is likely to stimulate the adoption of microfluidic-based Organ-on-a-Chip systems, such as CN Bio's PhysioMimix OOC range. The use of microfluidic devices in these systems is integral to creating accurate and controlled microenvironments that mimic human organs, enhancing the relevance of in vitro models. Also, by collaborating with LifeNet Health, a reputable organization specializing in all-human research solutions, CN Bio can ensure a high standard of quality and reliability in the use of microfluidic devices within their OOC systems, thereby contributing studied market’s growth.

Market Drivers:

Rising Demand for POC Diagnostics

The growing demand for rapid and on-site diagnostic solutions is driving the market for microfluidic devices, given their suitability for point-of-care testing owing to portability and swift analysis capabilities. In March 2023, Altratech, an Irish startup, aims to revolutionize molecular diagnostics by introducing microfluidic tests utilizing peptide nucleic acid (PNA) technology, aiming to replace traditional PCR methods. The UbiHealth system, employing capacitance for the identification of molecular targets on beads, introduces a unique "molecular detection by proxy" approach. Headquartered in Cork, Altratech initially focuses on respiratory and fever assays, with plans to expand into monitoring tests for chronic diseases. This innovative vision challenges the conventions of PCR in molecular diagnostics. The incorporation of capacitance to distinguish bead types and quantities facilitates multiplex testing in microfluidic devices, enabling simultaneous analysis of multiple targets and thereby enhancing diagnostic efficiency. These advancements are poised to significantly contribute to the continued growth of the microfluidic devices market.

Advancement in Healthcare & Life Sciences

The relentless progress in healthcare and life sciences research is fueling the demand for cutting-edge tools, with microfluidic devices playing a crucial role across diverse fields such as genomics, proteomics, and drug discovery, contributing substantially to market expansion. In October 2021, National Tsing Hua University (NTHU) and the Japanese chemical company DAICEL embarked on a transformative five-year joint project. This initiative aims to implement an innovative microfluidic system developed by the eminent scholar Kitamori Takehiko into the chemical manufacturing industry. With a substantial investment of 450 million Japanese yen, the project seeks to revolutionize sustainability in the chemical sector by reducing energy consumption and minimizing carbon production and waste. Prof. Kitamori, a global pioneer in microfluidic and nanofluidic technology, has engineered a groundbreaking system allowing traditionally large-scale mixing and extracting operations to be performed using a business card-sized glass chip. This pioneering advancement facilitates the establishment of a "desktop chemical plant," representing a significant stride toward sustainable and efficient practices in chemical manufacturing.

Market Restraints:

Complex Manufacturing Process

The production of microfluidic devices is a nuanced process, characterized by intricate fabrication techniques. This intricacy introduces challenges when attempting to scale up production, potentially impacting the overall cost-effectiveness of these devices. The complexity inherent in the manufacturing of microfluidic devices may necessitate careful consideration and optimization of production methods to ensure efficient scaling while maintaining affordability. The intricacies involved in fabrication techniques highlight the importance of addressing scalability challenges to unlock the full potential of these devices in various applications. Thus, such factors are slowing down the growth of the studied market over the forecast period.

The healthcare market felt the impact of the COVID-19 pandemic, particularly in the initial phase when companies focused on developing sensor devices and equipment for wearables and mobile devices to enable remote monitoring of chronically ill patients. The surge in COVID-19 cases created a heightened demand for point-of-care diagnostics, leading to the accelerated development of various microfluidic technologies. For example, a Life Journal article in May 2022 highlighted techniques like the microfluidic DA-D4 and sandwich/competitive immune sensors for detecting SARS-CoV-2 antibodies, offering efficient testing capabilities. A semi-automated microfluidic platform utilizing the classic multilayer soft-lithography technique was also noted for its ability to detect antibodies against multiple SARS-CoV-2 antigens while processing a significant number of samples in a single device. This trend presents substantial opportunities for point-of-care diagnostic test manufacturers and the rapid adoption of miniaturized microfluidic technologies, anticipated to drive market growth in the foreseeable future.

Segmental Analysis:

Microfluidic Chips Segment to Hold a Significant Market Share Over the Forecast Period

Microfluidic chips and devices, integral components of the burgeoning field of microfluidics, represent a transformative approach to fluid handling on a microscale. These miniaturized systems, often referred to as lab-on-a-chip devices, feature intricate channels, chambers, and valves on small substrates, enabling precise control over fluid flow and reactions. Widely applied across diverse industries, microfluidic devices have revolutionized healthcare with applications in point-of-care diagnostics, DNA analysis, and drug discovery. Their compact size and ability to operate with minimal sample volumes make them invaluable in genomics, proteomics, and environmental monitoring. Notably, microfluidic chips have redefined fundamental techniques like polymerase chain reaction (PCR), allowing for rapid DNA amplification with reduced reagent consumption, particularly beneficial in resource-limited settings. The market, initially dominated by major players, is witnessing increased dynamism with mid-size and smaller companies introducing innovative solutions, propelling the field toward new frontiers in personalized medicine, tissue engineering, and drug delivery. As technology advances, the integration of microfluidic chips and devices is poised to reshape fluid handling approaches, fostering a paradigm shift in scientific and industrial applications. Thus, the segment is expected to witness significant growth over the forecast period.

High-throughput Screening Segment to Hold a Significant Market Share Over the Forecast Period

The convergence of high-throughput screening (HTS) and microfluidic devices has profoundly impacted drug discovery and biological research. High-throughput screening involves the swift evaluation of numerous compounds against specific biological targets for potential drug development. Microfluidic devices, operating at the microscale, allow precise fluid manipulation within miniature channels, enabling parallelization of assays and automation of fluid-handling tasks. This symbiotic relationship enhances experimental throughput by enabling simultaneous execution of thousands of experiments with minimal reagents and sample volumes. Microfluidics not only accelerates screening processes but also offers advantages such as cost-effectiveness, environmental friendliness, and the ability to create well-defined microenvironments for cellular assays. The integration of microfluidic technology into HTS workflows streamlines drug discovery, providing researchers with unprecedented speed, efficiency, and control in large-scale screenings. This collaboration between HTS and microfluidics is poised to shape the future of drug discovery, advancing personalized medicine and our understanding of complex biological systems.

North America Region to Hold a Significant Market Share Over the Forecast Period

North America emerges as the dominant force in the microfluidics market, poised to maintain a significant share throughout the forecast period. This dominance can be attributed to well-established healthcare systems and the widespread adoption of novel therapeutics among the populace. The region witnesses a growing focus on microfluidics, with substantial R&D budgets allocated to this field. Notably, data from the Pharmaceutical Research and Manufacturers of America (PhRMA) reveals substantial investments, with member companies dedicating over USD 1.1 trillion to the pursuit of new treatments and cures, including a substantial USD 102.3 billion in 2021. This robust financial commitment is anticipated to fuel the growth of the microfluidics segment. The region's emphasis on point-of-care diagnostics, utilizing microfluidic technology for applications like molecular diagnostics and disease detection, further propels market expansion. A noteworthy development in August 2020 saw researchers from the University of Illinois at Urbana-Champaign unveiling a prototype for a rapid COVID-19 molecular test and a portable instrument for result interpretation using smartphones, eliminating the need for lab sample processing. The market's growth is further spurred by key players launching innovative products. For example, LexaGene's MiQLab system received emergency use authorization (EUA) in the United States for detecting the SARS-CoV-2 virus, and LumiraDx's submission of the LumiraDx SARS-CoV-2 & Flu A/B Test to the FDA for Emergency Use Authorization (EUA) showcases the region's dynamic landscape and commitment to advancing microfluidics technology in healthcare.

Get Complete Analysis Of The Report - Download Free Sample PDF

While the microfluidics market is currently characterized by the dominance of a few major players in terms of market share, it is also marked by notable competitiveness. The landscape is evolving with technological advancements and product innovations, allowing mid-size to smaller companies to enhance their market presence. These companies are strategically positioning themselves by introducing novel technologies that offer affordability without compromising on performance. As a result, the market is witnessing increased dynamism, with a broader range of players contributing to the overall growth and diversification of microfluidic technologies. This trend underscores the industry's capacity for innovation and the potential for a more balanced market share distribution in the future. The key market players are:

Recent Development:

1) In October 2023, 3EO Health, a diagnostics company with a focus on "Point of Life" solutions, announced the acquisition of emergency use authorization (EUA) for its molecular test designed to detect SARS-CoV-2. This test, developed for both point-of-care and at-home testing, represents a milestone in the company's commitment to delivering cost-effective, high-performance molecular diagnostics. Microfluidic devices excel in enabling point-of-care testing due to their small size, portability, and rapid analysis capabilities. With the EUA for the SARS-CoV-2 molecular test, microfluidic devices can be instrumental in bringing efficient and quick COVID-19 testing directly to healthcare settings, reducing turnaround times for results. Thus, providing significant market opportunities to flourish over the forecast period.

2) In January 2022, uFluidix initiated a solicitation for manufacturing projects seeking financial support. Demonstrating substantial growth, the uFluidix team has successfully doubled its manufacturing capacity in the preceding 12 months. Presently, the focus is on refining operations to accommodate new process variables specifically within the realm of thermoplastic microfluidic chip production. This strategic expansion aims to enhance the company's capabilities and responsiveness to diverse manufacturing requirements in the microfluidics sector.

Q1. What was the Microfluidic Devices Market size in 2023?

As per Data Library Research the Microfluidics Market size is estimated at USD 33.4 billion in 2023.

Q2. At what CAGR is the Microfluidics market projected to grow within the forecast period?

Microfluidics Market is expected to have a CAGR of 14.79% during the forecast period.

Q3. What are the factors driving the Microfluidics market?

Key factors that are driving the growth include the Rising Demand for POC Diagnostics and Advancement in Healthcare & Life Sciences.

Q4. Which region has the largest share of the Microfluidics market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model