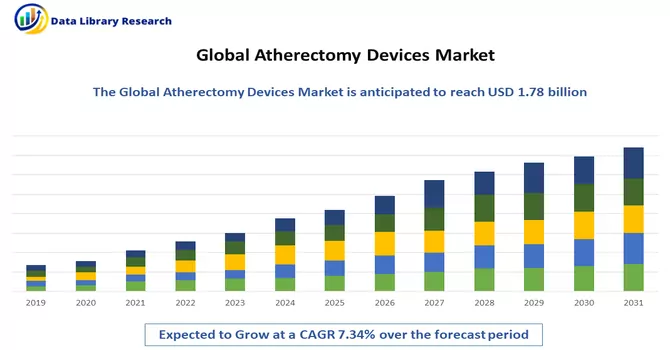

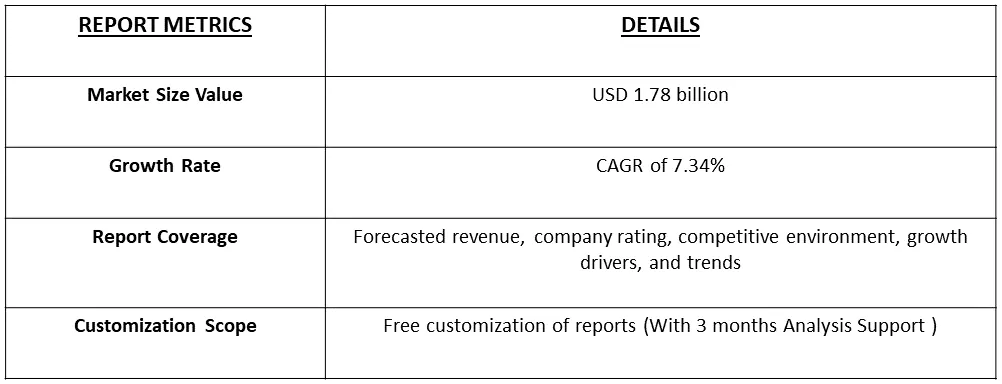

The global atherectomy devices market size in 2023 was USD 1.78 billion and estimated to register a CAGR of 7.34%, over the forecast period 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Atherectomy devices are medical instruments specifically designed for the removal or modification of atherosclerotic plaque, which is the buildup of fatty deposits within arteries. These devices are employed in the field of interventional cardiology and vascular surgery to treat conditions such as peripheral arterial disease (PAD) and coronary artery disease (CAD). Atherectomy procedures involve the precise removal of plaque from blood vessels, improving blood flow and reducing the risk of complications associated with arterial blockages. These devices often use various techniques, including cutting, grinding, or vaporizing the plaque, to restore normal blood flow and maintain vascular health. Atherectomy plays a crucial role in the management of atherosclerosis and is considered an alternative or complementary approach to other interventions such as angioplasty and stenting.

The growth of Atherectomy Devices is fueled by multiple factors, with the increasing prevalence of atherosclerosis-related conditions such as peripheral arterial disease and coronary artery disease serving as a primary driver. Technological advancements, including improved cutting mechanisms and enhanced navigation systems, contribute significantly to the expanding adoption of these devices. The aging global population, coupled with growing awareness about the benefits of minimally invasive treatments, further propels the demand for atherectomy procedures. Additionally, the emphasis on reducing healthcare costs and the shift towards outpatient care settings align with the advantages offered by atherectomy devices, promoting their widespread adoption in the medical field.

The atherectomy devices market is witnessing notable trends that reflect the industry's evolution and response to emerging healthcare needs. A key trend involves continuous technological advancements, with a focus on enhancing precision, safety, and efficacy in atherectomy procedures. Innovations such as improved cutting mechanisms, advanced navigation systems, and the integration of imaging technologies are driving the market forward. Additionally, there is a growing emphasis on the development of versatile devices that can address a broader range of atherosclerotic conditions. Minimally invasive procedures, shorter recovery times, and reduced hospital stays are becoming increasingly important, aligning with the broader healthcare trend towards patient-centric and cost-effective interventions. The market is also shaped by rising awareness among healthcare professionals and patients about the benefits of atherectomy procedures, contributing to the broader adoption of these devices globally.

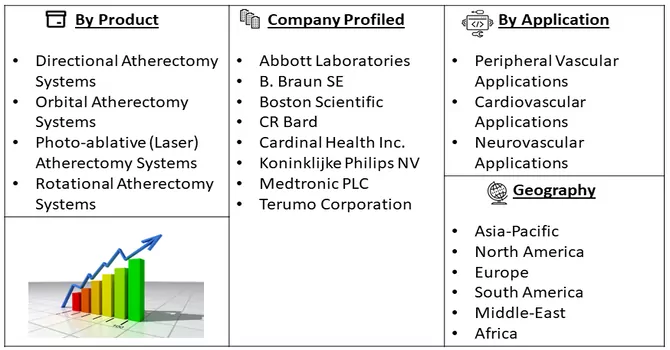

Market Segmentation: The Global Atherectomy Devices Market Growth is Segmented by Product (Directional Atherectomy Systems, Orbital Atherectomy Systems, Photo-ablative (Laser) Atherectomy Systems, and Rotational Atherectomy Systems), Application (Peripheral Vascular Applications, Cardiovascular Applications, and Neurovascular Applications), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Continuous Product Development and Commercialization

Continuous product development and commercialization play pivotal roles in the evolution and growth of the medical device industry, including the atherectomy devices market. This dynamic process involves the iterative creation, enhancement, and introduction of innovative products to meet the evolving needs of healthcare professionals and patients. Atherectomy device manufacturers engage in continuous product development to improve the safety, efficacy, and precision of their devices. Advancements in technologies such as catheter designs, cutting mechanisms, and imaging integration contribute to refining atherectomy procedures, ultimately enhancing patient outcomes. Ongoing research and development efforts also focus on addressing specific challenges, expanding the range of treatable conditions, and adapting devices for use in various vascular territories. Commercialization is the crucial phase where developed products are introduced to the market, and their benefits are made accessible to healthcare practitioners. Strategic commercialization involves understanding market dynamics, creating effective marketing strategies, and navigating regulatory pathways to gain approvals and clearances. Successful commercialization ensures that atherectomy devices are readily available to healthcare providers, facilitating broader adoption and integration into clinical practice. Continuous product development and commercialization are interconnected processes that drive innovation in the atherectomy devices market. The introduction of novel devices not only enhances treatment options for patients but also fosters competition and technological advancement within the industry. Additionally, ongoing product development ensures that atherectomy systems remain aligned with emerging healthcare trends, such as the increasing demand for minimally invasive procedures and personalized medicine. Companies engaged in the atherectomy devices market must maintain agility and responsiveness to market needs, employing a customer-centric approach to product development. Collaborations between industry stakeholders, including manufacturers, healthcare professionals, and regulatory bodies, are essential to streamline processes, address challenges, and promote the successful development and commercialization of advanced atherectomy technologies. Ultimately, this dynamic cycle drives progress, elevates standards of care, and contributes to the overall growth and advancement of the atherectomy devices market.

Favourable Medical Reimbursement Scenario in Mature Markets

A favourable medical reimbursement scenario in mature markets is a significant catalyst for the growth and adoption of medical technologies, including atherectomy devices. In mature healthcare markets, established reimbursement systems often contribute to increased accessibility and utilization of advanced medical procedures and devices. Atherectomy procedures, designed to address conditions such as peripheral arterial disease (PAD) and coronary artery disease (CAD), benefit substantially from a supportive reimbursement environment. Reimbursement mechanisms in mature markets, such as those in North America and Europe, play a crucial role in facilitating patient access to atherectomy treatments. Favorable reimbursement policies reduce financial barriers for both healthcare providers and patients, encouraging the incorporation of atherectomy procedures into standard care protocols. This, in turn, promotes the widespread adoption of atherectomy devices, as healthcare professionals are more inclined to offer these interventions when reimbursement is assured. The presence of comprehensive reimbursement frameworks ensures that the costs associated with atherectomy procedures, including device expenses, are adequately covered. This not only encourages hospitals and healthcare facilities to invest in these technologies but also supports the sustainability of atherectomy device manufacturers by creating a reliable market demand. Moreover, a favorable reimbursement scenario fosters innovation in the atherectomy devices market. Manufacturers are more incentivized to invest in research and development, introducing advanced technologies that align with the stringent requirements of reimbursement policies. As a result, the continuous improvement and evolution of atherectomy devices become integral to maintaining and enhancing their reimbursement eligibility. In mature markets with robust reimbursement systems, collaborations between healthcare providers, insurers, and manufacturers are crucial for optimizing patient care and driving advancements in medical technologies. The assurance of reimbursement not only promotes the adoption of atherectomy devices but also contributes to the overall growth and sustainability of the market by fostering an environment conducive to innovation and improved patient outcomes.

Market Restraints:

Stringent Regulatory Scenario

The atherectomy devices market may encounter challenges in its growth trajectory due to a stringent regulatory scenario. Stringent regulations imposed by health authorities and regulatory bodies are designed to ensure the safety and efficacy of medical devices, including atherectomy systems. While these regulations are crucial for safeguarding patient well-being, they can also pose hurdles for manufacturers seeking approval and market clearance for new or updated devices. The regulatory process involves rigorous scrutiny of atherectomy devices, assessing their safety profiles, performance, and adherence to quality standards. Meeting these stringent requirements can lead to prolonged approval timelines and increased development costs for manufacturers. Additionally, the evolving nature of regulations and the need for constant compliance with changing standards can create a dynamic environment that requires ongoing adjustments by industry players. Moreover, the regulatory landscape varies across regions, adding complexity for companies aiming for global market penetration. Harmonizing regulatory requirements and navigating through different approval processes in various countries contribute to the challenges faced by atherectomy device manufacturers. While regulatory scrutiny ensures patient safety and device effectiveness, it can potentially slow down the introduction of new technologies and innovations to the market. Striking a balance between robust regulatory oversight and fostering innovation is crucial to address the evolving needs of patients and healthcare providers. Industry stakeholders, including regulatory bodies and manufacturers, must collaborate to streamline regulatory processes and ensure that atherectomy devices can reach the market efficiently without compromising safety standards. Finding this balance is pivotal for sustaining growth and advancing technologies in the atherectomy devices market.

The global cardiac surgery market encountered significant setbacks during the COVID-19 pandemic, marked by a substantial reduction in cardiovascular procedures and elective surgeries. A research study published in the Annals of Thoracic Surgery in March 2022 revealed a notable decline, with a 52.7% reduction in adult cardiac surgery volume and a 65.5% reduction in elective cases. Regions such as the Mid-Atlantic, heavily impacted during the initial COVID-19 surge, experienced a 69.7% reduction in overall case volume and an 80.0% reduction in elective cases, contributing to an observed-to-expected mortality increase in certain regions. The gradual easing of COVID-19 restrictions globally has signaled a resurgence in the cardiac surgery market, though the recovery to pre-pandemic levels is anticipated to be gradual. The persistent impact on cardiac surgery patients and atherectomy procedures necessitates a cautious approach towards a full market rebound.

Segmental Analysis:

Atherectomy Systems Segment is Expected to Witness Significant Growth Over the Forecast Period

Atherectomy systems are pivotal medical devices designed for minimally invasive removal of atherosclerotic plaque from blood vessels, particularly in the context of peripheral arterial disease (PAD) and coronary artery disease (CAD). These systems utilize various mechanisms, including cutting, grinding, shaving, or vaporizing, to address plaque buildup within arteries, aiming to enhance blood flow and restore vascular health. Recognized for their effectiveness in treating complex lesions, atherectomy systems are often employed alongside other interventional procedures. Ongoing technological advancements, such as improved catheter designs and the incorporation of imaging technologies, continue to refine the precision and safety of these systems. The market for atherectomy systems is fueled by factors like the increasing prevalence of atherosclerotic diseases and a growing preference for minimally invasive cardiovascular interventions, positioning them as essential tools in the modern landscape of vascular care.

Neurovascular Applications Segment is Expected to Witness Significant Growth Over the Forecast Period

Neurovascular applications and atherectomy systems represent two distinct yet interrelated domains within the broader field of medical interventions. Neurovascular applications involve the use of various medical devices and procedures to address conditions affecting the blood vessels within the brain and central nervous system. This encompasses treatments for aneurysms, ischemic strokes, and other neurovascular disorders. Atherectomy systems, on the other hand, play a crucial role in the cardiovascular realm, specifically in the removal of atherosclerotic plaque from blood vessels, predominantly in the peripheral arteries and coronary arteries. The synergy between these domains emerges in cases where atherosclerotic plaque buildup affects vessels not only in the cardiovascular system but also in the neurovascular system. In some instances, atherectomy systems may be adapted or utilized to address specific neurovascular conditions where plaque removal is necessary for optimal blood flow and to mitigate the risk of complications. The integration of advanced technologies, such as imaging and catheter-based systems, has enhanced the precision and efficacy of atherectomy procedures in both neurovascular and cardiovascular applications. This intersection reflects the interdisciplinary nature of modern medical interventions, emphasizing the need for comprehensive approaches to address complex health conditions. As research and innovation continue to advance in both neurovascular and cardiovascular fields, the synergy between atherectomy systems and neurovascular applications is likely to contribute to more refined and specialized trea.

North America Region Segment is Expected to Witness Significant Growth Over the Forecast Period

North America is poised to command a substantial share in the atherectomy devices market, driven by several factors contributing to its growth. The region benefits from an increasing availability of reimbursements for atherectomy systems, fostering widespread adoption among medical professionals. The prevalence of peripheral and coronary artery diseases within a large patient population further fuels demand. The surge in clinical trials evaluating the therapeutic efficacy of atherectomy systems in specific disease treatments adds momentum to the market's expansion. The February 2022 update from the CDC underscores the prominence of heart diseases in the United States, with coronary artery disease leading as a common and life-threatening condition. The escalating prevalence of heart diseases is expected to amplify the demand for atherectomy procedures, consequently propelling market growth in the region. North America's dominance is also attributed to a favorable reimbursement landscape and a notable number of FDA-approved devices. Recent clearances, such as BD's Rotarex Atherectomy System and Philips' introduction of new applications, including the IntraSight Mobile system and Nexcimer laser system, further underscore the region's leadership in advancing atherectomy technologies. These factors collectively position North America as a significant growth hub for the atherectomy devices market in the foreseeable future.

Get Complete Analysis Of The Report - Download Free Sample PDF

The atherectomy devices market exhibits a moderate level of competitiveness, characterized by the presence of numerous global players. As reported by Mordor Intelligence, the market landscape is shaped by the active participation of various established companies operating on a global scale. This competitive dynamic fosters innovation and technological advancements within the atherectomy devices sector, as companies strive to distinguish themselves in terms of product offerings, efficiency, and overall market presence. The presence of a diverse range of global players underscores the significance of the market, with each participant contributing to the evolution and growth of atherectomy technologies to address the complex challenges associated with atherosclerotic diseases.

Recent Development:

1) In August 2022, AngioDynamics, Inc. reported a significant development with the Auryon Atherectomy System securing 510(k) clearance for an expanded indication, now encompassing arterial thrombectomy. This regulatory milestone enhances the system's capabilities, allowing for a broader range of applications in vascular interventions.

2) In February 2022, RA Medical Systems disclosed a noteworthy progress update, indicating that the pivotal clinical trial assessing the safety and efficacy of the DABRA excimer laser system as an atherectomy device for treating peripheral arterial disease has reached an enrollment of 95 subjects. This advancement underscores the ongoing commitment to evaluating the system's performance and potential in addressing peripheral arterial disease, marking a substantial step forward in clinical research and development efforts.

Q1. What was the Atherectomy Devices Market size in 2023?

As per Data Library Research the global atherectomy devices market size in 2023 was USD 1.78 billion.

Q2. At what CAGR is the Atherectomy Devices market projected to grow within the forecast period?

Atherectomy Devices Market estimated to register a CAGR of 7.34%, over the forecast period.

Q3. What are the factors driving the Atherectomy Devices Market?

Key factors that are driving the growth include the Continuous Product Development and Commercialization and Favourable Medical Reimbursement Scenario in Mature Markets.

Q4. Which region has the largest share of the Atherectomy Devices market? What are the largest region's market size and growth rate?

North America has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model