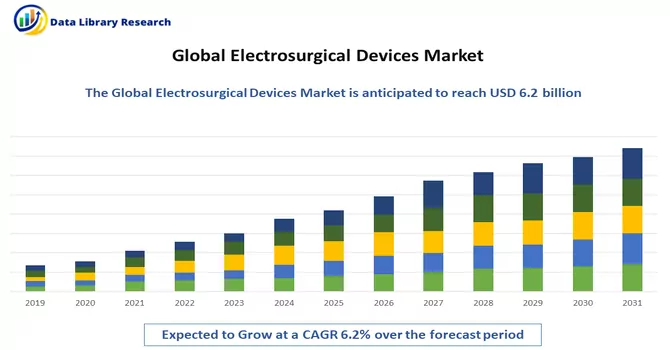

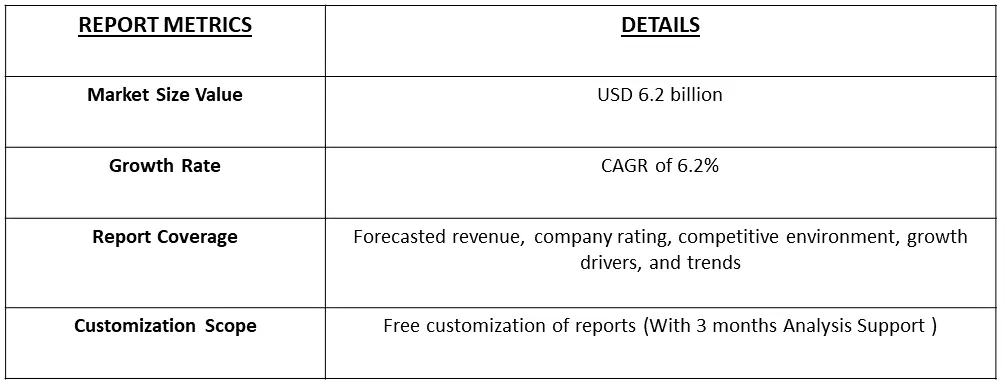

In 2022, the global electrosurgery market, measured by revenue, was estimated at USD 6.2 billion, with an anticipated Compound Annual Growth Rate (CAGR) of 6.2% forecasted over the ensuing period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Electrosurgical devices, integral to medical practices, utilize electrical energy for tasks such as cutting, coagulating, or modifying biological tissues during surgical procedures. These instruments find widespread application across diverse surgical specialities, encompassing general surgery, gynaecology, dermatology, and orthopaedics. Electrosurgical procedures entail the application of high-frequency electrical currents to generate heat, a crucial element in achieving the desired surgical outcomes. Several factors contribute to the growth of the electrosurgery market. The increasing prevalence of various medical conditions, coupled with a globally ageing population, has led to a surge in surgical procedures.

Electrosurgical devices play a pivotal role in both traditional and minimally invasive surgeries, driving the expansion of the market. The market's growth is further propelled by continuous technological advancements in electrosurgical devices. Innovations encompass enhanced precision, safety features, and seamless integration with other surgical technologies. These advancements not only meet the evolving demands of the healthcare industry but also contribute to the heightened demand for electrosurgical devices in medical practices globally. The amalgamation of technological progress with the rising need for surgical interventions establishes a promising trajectory for the electrosurgery market in the coming years.

A discernible trend in the electrosurgery industry is the move towards the development of compact and more portable devices. This shift towards miniaturization offers heightened manoeuvrability during surgical procedures, particularly in the context of minimally invasive interventions. Surgeons and healthcare practitioners are increasingly prioritizing devices that offer enhanced flexibility and ease of use, aligning with the evolving landscape of surgical practices. Moreover, the industry is experiencing a noteworthy trend characterized by the integration of advanced energy sources into electrosurgical devices. This involves the assimilation of technologies such as radiofrequency, ultrasonics, or lasers, aiming to elevate cutting precision and coagulation capabilities. The overarching objective is to enhance the overall performance of these devices, providing surgeons with a broader spectrum of options tailored to specific applications. This strategic integration of advanced technologies not only aligns with the industry's pursuit of innovation but also responds to the increasing demand for sophisticated and versatile electrosurgical solutions in medical settings.

Market Segmentation: The Electrosurgical Devices Market is Segmented by Product (Electrosurgical Generators, Active Electrodes, Electrosurgical Instruments and Accessories), Application (Neurosurgery, Gynecology Surgery, Cardiovascular Surgery, Cosmetic Surgery, General Surgery, Orthopedic Surgery, and Other Applications), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value (in USD) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Increasing Surgical Procedures

The electrosurgical devices industry is propelled by a substantial increase in the volume of surgical procedures conducted worldwide. With the expansion of healthcare accessibility and a rising prevalence of medical conditions, there is an escalating demand for surgical interventions. Electrosurgical devices assume a pivotal role across diverse surgical specialities, spanning general surgery, gynaecology, and orthopaedics. Their versatility in facilitating procedures, both in conventional and minimally invasive surgical approaches, establishes them as indispensable instruments in the contemporary surgical arena. For instance, an article published by the Euripean Center for Disease Control and Prevention in May 2023, reported that between 2018 and 2020, nearly 20 000 surgical site infections (SSIs) were reported from a total of over 1.2 million surgical procedures in 13 EU/EEA countries participating in ECDC-coordinated SSI surveillance. Over 2,500 hospitals are part of this surveillance network. Thus, such incidence is expected to increase in the volume of surgical procedures over the forecast period.

Advancements in Technology

The ongoing advancements in technology are a key driver for the electrosurgical devices market. Innovations in device design, energy delivery systems, and safety features contribute to improved precision and efficacy in surgical procedures. The integration of electrosurgical devices with other advanced surgical technologies further enhances their capabilities. Surgeons and healthcare facilities are increasingly adopting the latest technologies to improve patient outcomes, reduce complications, and enhance the overall efficiency of surgical interventions. As a result, the demand for state-of-the-art electrosurgical devices remains high. Moreover, the anticipated growth of the market is expected to be further fueled by the introduction of new products by key industry players. For example, in June 2021, Ethicon, a division of the Johnson & Johnson Medical Devices Companies, unveiled the ENSEAL X1 Curved Jaw Tissue Sealer. This innovative device is designed to enhance procedural efficiency and tissue sealing, catering to a range of surgical applications including colorectal, gynaecological, bariatric surgery, and thoracic procedures. These developments have significantly contributed to the establishment of North America as the leading market for electrosurgical devices.

Market Restraints:

Stringent Regulatory Compliance and High Initial Costs and Capital Expenditure:

The electrosurgical devices industry encounters challenges linked to rigorous regulatory compliance. The process of meeting regulatory standards and securing approvals for new devices is often time-consuming and entails substantial costs. Conforming to evolving regulatory requirements introduces intricacies into the development and marketing of electrosurgical products. The initial financial outlay associated with the procurement of electrosurgical devices and the necessary capital expenditure for healthcare facilities can act as a noteworthy constraint. The expenses encompassing the acquisition, installation, and upkeep of advanced electrosurgical equipment may present financial hurdles for certain healthcare providers, particularly in settings with limited resources. These financial considerations underscore the complexities and potential barriers that healthcare institutions may face in adopting and integrating sophisticated electrosurgical technologies, emphasizing the need for strategic financial planning and resource allocation in the industry.

The global pandemic induced disruptions in the functioning of supply chains worldwide, exerting an impact on the manufacturing and distribution of electrosurgical devices. Measures such as lockdowns, travel restrictions, and workforce shortages significantly affected the production and transportation of essential components, resulting in delays and the potential risk of shortages within the supply chain. The healthcare landscape witnessed a profound shift in priorities during the pandemic, marked by an intensified focus on managing and treating COVID-19 cases. Consequently, non-urgent elective surgeries and procedures, wherein electrosurgical devices are commonly employed, were frequently postponed or canceled. This trend led to a notable reduction in the demand for these devices, reflecting the broader impact of the pandemic on the utilization and procurement patterns within the healthcare sector.

Segmentation Analysis:

Electrosurgical Generators Segment is Expected to Witness Significant growth Over the Forecast Period

Electrosurgical generators play a vital role in medical procedures by providing the necessary high-frequency electrical energy essential for diverse electrosurgical interventions. These generators serve as the power source that transmits energy through electrosurgical instruments, facilitating precise cutting or coagulation of tissues during surgical procedures. The versatility of electrosurgical generators is a key characteristic, as they are designed to support a broad spectrum of surgical applications across different medical specialities. These generators find applications in various medical fields, including general surgery, gynaecology, and orthopaedics, showcasing their adaptability to a diverse range of electrosurgical procedures. Whether in traditional open surgeries or minimally invasive techniques, electrosurgical generators contribute significantly to achieving the desired surgical outcomes by providing surgeons with the necessary energy control and precision. This adaptability and versatility contribute to the widespread use of electrosurgical generators in modern medical practices, underscoring their indispensable role in enhancing the efficiency and efficacy of a multitude of surgical interventions.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America commands a substantial share of the global electrosurgical devices market, propelled by its advanced healthcare infrastructure, robust regulatory framework, and high technological adoption rates. The region stands out for its continuous emphasis on innovation, introducing cutting-edge electrosurgical technologies. Many prominent global players in the electrosurgical devices industry have established a strong presence in North America, often leading in market share and contributing to the region's role as a focal point for research, development, and manufacturing in this sector.

Additionally, numerous key players are actively engaged in strategic initiatives to enhance their product portfolios and expand their presence across various regions, further augmenting market growth. An illustrative example is the October 2021 agreement where Hologic, Inc. entered into a definitive agreement to acquire Bolder Surgical, a U.S.-based company specializing in advanced energy vessel-sealing surgical devices. This strategic move broadened Hologic's surgical portfolio by incorporating Bolder's distinctive advanced vessel sealing and dissection tools used in laparoscopic procedures. The convergence of factors such as the increasing prevalence of chronic diseases, a surge in product launches, and strategic activities by key industry players is anticipated to drive significant growth in the electrosurgical devices market in North America over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The electrosurgical devices market exhibits a moderate level of fragmentation, with a predominant share of devices being manufactured by key global players. Market leaders, equipped with ample resources for research and a robust distribution system, have successfully solidified their positions in the market. Some of the key players in the market are

Recent Developments:

1) Olympus Corporation introduced the ESG-410 Electrosurgical Generator in June 2023, an advanced device designed for the treatment of conditions such as bladder cancer and enlarged prostate. According to Olympus, the ESG-410 enhances treatment options and efficiencies for non-muscle-invasive bladder cancer (NMIBC) and benign prostatic hyperplasia (BPH), also known as an enlarged prostate. The generator offers a range of resection loops, band electrodes, and vaporization buttons and needles.

2) Innoblative Designs, Inc. achieved Breakthrough Device Designation from the United States Food and Drug Administration (FDA) in April 2023 for its SIRA RFA Electrosurgical Device (SIRA). This designation is specifically for the treatment of breast cancer patients undergoing lumpectomy, signifying a significant milestone in advancing innovative solutions for breast cancer treatment.

Q1. What was the Electrosurgical Devices Market size in 2022?

As per Data Library Research the global electrosurgery market was estimated at USD 6.2 billion in 2022.

Q2. What is the Growth Rate of the Electrosurgical Devices Market ?

Electrosurgical Devices Market is anticipated a Compound Annual Growth Rate (CAGR) of 6.2% over the forecast period.

Q3. What are the Growth Drivers of the Electrosurgical Devices Market?

Increasing Surgical Procedures and Advancements in Technology are the Growth Drivers of the Electrosurgical Devices Market.

Q4. Which region has the largest share of the Electrosurgical Devices Market? What are the largest region's market size and growth rate?

North America has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model