Adaptive LED Headlight for Automobile Market Overview and Analysis:

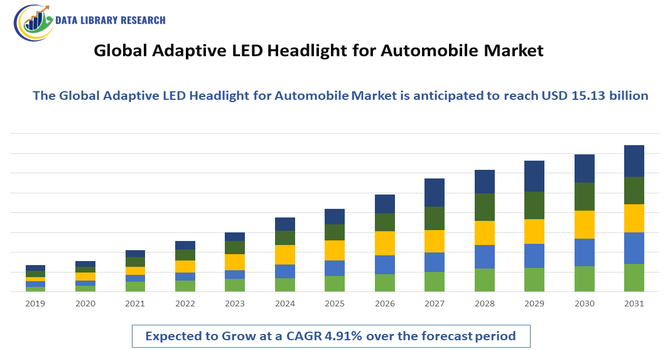

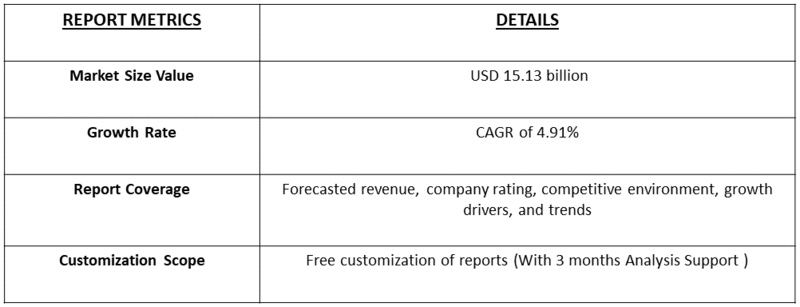

- The Global Adaptive LED Headlight for Automobile Market is expected to reach USD 15.13 billion in 2025, from USD 22.76 billion in 2032, growing at a CAGR of 4.91% from 2025 to 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The growth of the Global Adaptive LED Headlight for Automobile Market is primarily driven by the increasing demand for advanced lighting technologies that enhance road safety, visibility, and driving comfort. Adaptive LED headlights offer dynamic beam adjustment, improved illumination, and energy efficiency compared to conventional halogen and standard LED headlights. Additionally, technological advancements in smart lighting systems and sensor integration for adaptive headlamps are further accelerating the adoption of these headlights globally.

Adaptive LED Headlight for the Automobile Market: Latest Trends

The Global Adaptive LED Headlight for Automobile Market is witnessing several key trends driven by technological innovation and evolving consumer preferences. There is a growing adoption of matrix LED and laser-based adaptive headlights that automatically adjust beam intensity and direction according to traffic conditions, road curvature, and weather. Integration with advanced driver-assistance systems (ADAS) and smart sensors is enhancing safety and reducing glare for oncoming vehicles. Additionally, manufacturers are focusing on lightweight, energy-efficient designs to improve vehicle performance and reduce power consumption. The rising trend of connected and autonomous vehicles is further boosting the adoption of adaptive LED headlight technology.

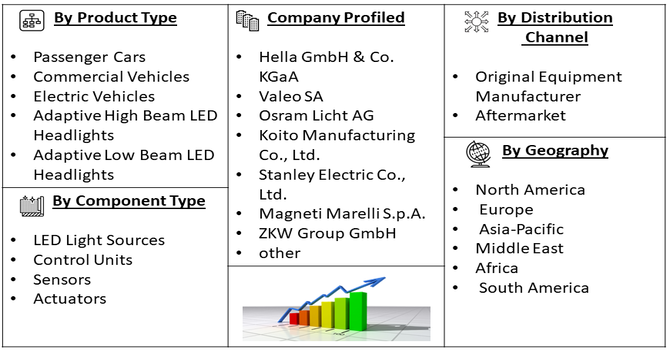

Segmentation: Global Adaptive LED Headlight for Automobile Market is segmented By Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles), Headlight Type (Adaptive High Beam LED Headlights, Adaptive Low Beam LED Headlights), Component Type (LED Light Sources, Control Units, Sensors and Actuators), Distribution Channel (Original Equipment Manufacturer, Aftermarket), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Increasing Focus on Vehicle Safety and Regulatory Compliance

One of the primary drivers is the growing emphasis on road safety and stringent automotive lighting regulations worldwide. Adaptive LED headlights significantly enhance nighttime visibility by automatically adjusting the beam pattern according to traffic conditions, road curvature, and vehicle speed, reducing glare for oncoming drivers. Governments and regulatory authorities in regions like Europe, North America, and Asia-Pacific are enforcing stricter safety standards for vehicles, which encourages automakers to adopt advanced headlight technologies, thereby driving the demand for adaptive LED solutions in both passenger and commercial vehicles.

- Rising Adoption of Electric Vehicles (EVs) and Premium Vehicles

The increasing production and adoption of electric vehicles (EVs) and luxury/premium vehicles are fueling the growth of adaptive LED headlights. EVs benefit from energy-efficient lighting solutions, and adaptive LED headlights consume less power compared to conventional halogen or standard LED units, contributing to overall vehicle efficiency. For instance, in July 2023, Marelli, in collaboration with ams OSRAM, launched the h-Digi microLED, a high-resolution digital front-lighting module now in series production. This compact, efficient, and affordable system features around 20,000 pixels per lamp and provides adaptive, dynamic headlight operation, including glare-free high beams, dynamic curve lights, and road projections. The system is designed for a wider range of vehicles and offers enhanced safety, energy efficiency, and adaptability, marking a major advancement in automotive lighting.

Market Restraints:

- Technical Complexity and Maintenance Challenges

Adaptive LED headlights are technologically complex, involving precise calibration of sensors, control units, and lighting modules to function correctly. Any misalignment or malfunction in sensors or software can impair performance, reducing beam accuracy and overall safety. Additionally, repair and replacement of these advanced systems are more expensive and technically demanding than traditional headlights, creating a restraint for fleet operators and individual consumers. The complexity of integration with vehicle electronics and ADAS systems further limits adoption, especially in markets with less advanced automotive service infrastructure.

Socioeconomic Impact on Adaptive LED Headlight for the Automobile Market

The global adaptive LED headlight market for automobiles has significantly impacted socioeconomic development by enhancing road safety and reducing accidents through improved visibility and intelligent lighting systems. These headlights support energy efficiency and lower carbon emissions, aligning with environmental sustainability goals. The market’s growth has generated jobs in manufacturing, research, and automotive design, boosting economic activity worldwide. Improved vehicle safety features have reduced healthcare costs related to traffic injuries while fostering consumer confidence in advanced automotive technologies. Additionally, the adoption of adaptive LED headlights has accelerated innovation in the automotive sector, contributing to smarter, safer transportation and supporting overall societal well-being.

Segmental Analysis:

- Electric Vehicles (EVs) segment is expected to witness the highest growth over the forecast period

The adoption of adaptive LED headlights is rising significantly in electric vehicles (EVs) due to the need for energy-efficient, long-lasting, and high-performance lighting systems. Adaptive LED technology consumes less power than traditional halogen or standard LED headlights, helping maximize EV battery efficiency. Furthermore, EVs often target premium and tech-savvy consumers who demand advanced lighting features, including dynamic beam adjustment and matrix LED functionality for enhanced safety and driving comfort.

- Adaptive High Beam LED Headlights segment is expected to witness the highest growth over the forecast period

Adaptive high beam LED headlights are designed to automatically adjust the intensity and direction of the light beam according to traffic conditions, road curves, and vehicle speed. This ensures optimal visibility for the driver without blinding oncoming traffic, improving safety during nighttime driving. These headlights are increasingly integrated into modern vehicles, luxury cars, and SUVs, driven by regulatory requirements and consumer preference for advanced safety features.

- Sensors and Actuators segment is expected to witness the highest growth over the forecast period

Sensors and actuators are critical components of adaptive LED headlight systems, enabling real-time detection of surrounding traffic, road conditions, and vehicle movement. These components control beam adjustment, ensuring that the headlights dynamically respond to changing driving scenarios. High precision and reliability of sensors and actuators are essential for ADAS integration, automated beam switching, and overall system performance, making them a key driver for market adoption.

- Original Equipment Manufacturer (OEM) segment is expected to witness the highest growth over the forecast period

OEMs dominate the adaptive LED headlight market as manufacturers integrate these systems directly into vehicles during production. This approach ensures optimal performance, seamless integration with vehicle electronics, and adherence to safety regulations. OEM distribution also enables manufacturers to bundle adaptive lighting with premium and safety packages, driving higher adoption among end-users, particularly in luxury and electric vehicle segments.

- North America segment is expected to witness the highest growth over the forecast period

North America is expected to witness significant growth due to the high adoption of advanced automotive technologies, stringent vehicle safety regulations, and strong demand for electric and premium vehicles.

The region benefits from well-established automotive manufacturing infrastructure, technological innovation, and increasing awareness of road safety, which encourages the integration of adaptive LED headlight systems across passenger and commercial vehicles. For instance, In April 2024, ams OSRAM partnered with DOMINANT Opto Technologies to integrate its Open System Protocol (OSP) into DOMINANT’s next-generation intelligent RGB LEDs for automotive ambient lighting. This collaboration introduced a universal communication standard, enabling cross-manufacturer compatibility, which enhanced flexibility and spurred innovation in automotive lighting systems. This partnership boosted North America’s adaptive LED headlight market by promoting interoperability and accelerating development of customizable, intelligent lighting solutions, meeting growing consumer demand for advanced and flexible automotive lighting technologies.

Investments in ADAS and connected vehicle technologies further reinforce North America’s leading position in this market. For instance, In July 2023, HELLA, part of FORVIA, and Porsche unveiled the world’s first high-resolution SSL | HD matrix headlamp featuring over 32,000 LED pixels. This cutting-edge headlamp delivers superior visibility and safety and became an optional feature on the new Porsche Cayenne, representing a major advancement in automotive lighting technology. The launch advanced North America’s adaptive LED headlight market by setting new standards in lighting precision and safety, driving consumer interest and encouraging wider adoption of high-resolution matrix lighting in premium vehicles.

Thus, such factors are driving the growth of this market in this region.

To Learn More About This Report - Request a Free Sample Copy

Adaptive LED Headlight for the Automobile Market Competitive Landscape

The competitive landscape of the Global Adaptive LED Headlight for Automobile Market is characterized by the presence of leading automotive lighting manufacturers and technology solution providers focusing on innovation, performance, and energy efficiency. Companies compete on headlight brightness, adaptive features, integration with ADAS, and durability while also investing in R&D, strategic partnerships, and expansion into electric and premium vehicle segments. The market is moderately consolidated, with major players leveraging technological advancements, global distribution networks, and strong OEM relationships to maintain competitiveness. Rising demand for smart and safe lighting systems is intensifying competition globally.

Key Players:

- Hella GmbH & Co. KGaA

- Valeo SA

- Osram Licht AG

- Koito Manufacturing Co., Ltd.

- Stanley Electric Co., Ltd.

- Magneti Marelli S.p.A.

- ZKW Group GmbH

- Depo Auto Industrial Co., Ltd.

- Automotive Lighting Group

- Lumileds Holding B.V.

- Continental AG

- Morimoto Lighting, Inc.

- PIAA Corporation

- Ficosa International SA

- TYC Brother Industrial Co., Ltd.

- Bosch Automotive Lighting

- Seiko Electric Co., Ltd.

- Automotive Lighting India Pvt. Ltd.

- Visteon Corporation

- Xingyu Automotive Lighting Systems

Recent News

- In April 2025, Valeo and Appotronics formed a strategic partnership to develop a next-generation front lighting system featuring laser video projection technology. The collaboration focused on enhancing adaptive lighting (ADB) capabilities, improving road safety, and offering drivers more comfortable lighting options alongside integrated entertainment features.

- In November 2024, ams OSRAM launched the OSIRE E3731i intelligent RGB LED designed for dynamic automotive interior lighting. Equipped with Open System Protocol (OSP), it enabled control of up to 1,000 LEDs through a single microcontroller, simplifying design, reducing wiring and costs, and allowing customizable lighting effects with high optical consistency.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is significantly driven by increasing consumer awareness regarding road safety and the demand for advanced driver-assistance systems (ADAS). Stricter government regulations worldwide, such as the legalization of Adaptive Driving Beam (ADB) technology, also mandate improved vehicle lighting for enhanced nighttime visibility and accident prevention, pushing manufacturers toward adaptive LED adoption.

Q2. What are the main restraining factors for this market?

The high initial cost of Adaptive LED systems remains a major constraint, limiting their widespread adoption primarily to luxury and premium vehicle segments. Additionally, the complexity of managing the heat generated by high-power LED modules, requiring extra cooling equipment, further increases manufacturing costs compared to traditional lighting solutions.

Q3. Which segment is expected to witness high growth?

The OEM segment is projected to experience the highest growth over the forecast period as manufacturers increasingly integrate adaptive LED headlights into new vehicle models. Rising consumer demand for advanced safety features and regulatory mandates are encouraging OEMs to adopt these technologies, boosting market penetration and driving innovation.

Q4. Who are the top major players for this market?

The market is dominated by established automotive lighting specialists and major component suppliers. Key players include Hella, Valeo, Koito Manufacturing, Stanley Electric, and Marelli. These companies continually invest in R&D to integrate adaptive lighting with ADAS sensors and develop more compact and efficient LED and Laser technologies.

Q5. Which country is the largest player?

United States, in North America is expected to witness the highest growth over the forecast period due to its advanced automotive industry, strong demand for smart lighting solutions, and supportive regulations promoting vehicle safety and energy efficiency. High consumer awareness and significant investments in automotive innovation further drive market expansion in this region.

List of Figures

Figure 1: Global Adaptive LED Headlight for Automobile Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Adaptive LED Headlight for Automobile Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Adaptive LED Headlight for Automobile Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Adaptive LED Headlight for Automobile Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Adaptive LED Headlight for Automobile Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Adaptive LED Headlight for Automobile Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Adaptive LED Headlight for Automobile Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Adaptive LED Headlight for Automobile Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Adaptive LED Headlight for Automobile Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Adaptive LED Headlight for Automobile Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Adaptive LED Headlight for Automobile Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Adaptive LED Headlight for Automobile Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Adaptive LED Headlight for Automobile Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Adaptive LED Headlight for Automobile Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Adaptive LED Headlight for Automobile Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Adaptive LED Headlight for Automobile Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Adaptive LED Headlight for Automobile Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Adaptive LED Headlight for Automobile Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Adaptive LED Headlight for Automobile Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Adaptive LED Headlight for Automobile Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Adaptive LED Headlight for Automobile Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Adaptive LED Headlight for Automobile Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model