Bomb Disposal Oversuits Market Overview and Analysis

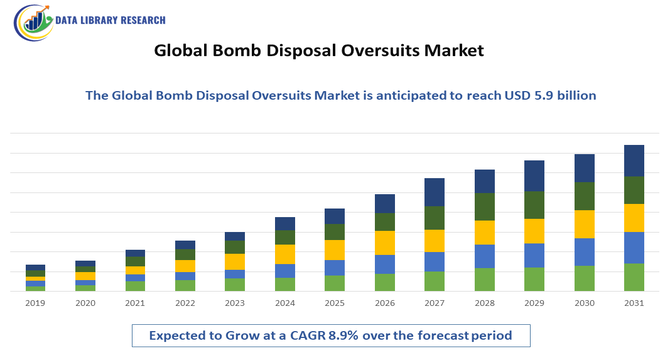

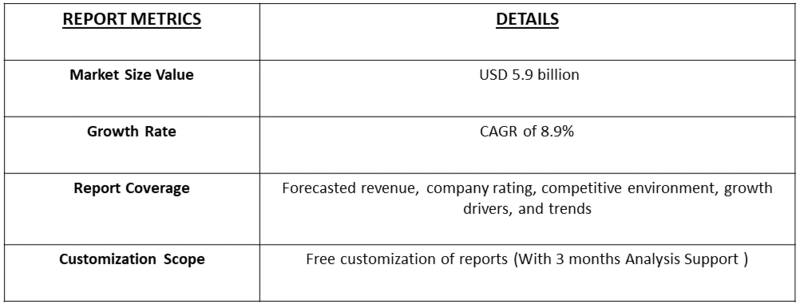

- Industry estimates put the market at roughly USD 1.87 billion in 2025, and project it to reach approximately USD 5.9 billion by 2032, growing with a CAGR of 8.9% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The global Bomb Disposal Oversuits (EOD suits) market is being driven primarily by rising geopolitical tensions and a steady increase in terrorist incidents and asymmetric threats that force governments and law-enforcement agencies to upgrade EOD capabilities; growing defense, homeland-security and public-safety budgets that prioritize procurement and modernization of protective gear; continuous technological and materials innovations (lighter composite armors, improved blast-attenuation systems, integrated cooling and communications, and modular designs) that expand operational use and appeal; greater adoption across military, police, and emergency-response units for counter-IED, mine-clearance and urban EOD missions; and tightening safety standards and training programs that institutionalize replacement cycles and procurement of advanced oversuits—together these factors sustain steady, multi-percent annual growth and broaden demand geographically (notably rising in Asia-Pacific alongside traditional demand in North America and Europe).

Bomb Disposal Oversuits Market Latest Trends

The Global Bomb Disposal Oversuits market is witnessing notable trends centered on performance enhancement, operator comfort, and digital integration. Manufacturers are increasingly adopting advanced lightweight composites and ergonomic suit architectures to improve blast resistance while reducing weight and enhancing mobility for longer mission endurance. There is strong momentum toward technology-integrated suits, featuring built-in communication systems, cooling and ventilation modules, health-monitoring sensors, and compatibility with robotic EOD platforms, reflecting the shift toward smart protective equipment. Growing modular and customizable configurations allow forces to tailor protection levels to specific threats, environments, and mobility needs. Rising defense and homeland-security modernization programs, particularly across Asia-Pacific, Middle East, and Eastern Europe, are fueling adoption of next-gen EOD suits with improved blast-attenuation systems.

Segmentation: Global Bomb Disposal Oversuits Market is segmented By Product Type (Water-Cooling Systems, Air-Cooling Systems), Protection Level (Lightweight / Mobility-Optimised Suits, Heavyweight / Maximum-Protection Suits), Application (Military, Law Enforcement / Security & Homeland Security), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Escalating security threats and the persistent IED/terrorism risk (demand shock)

Across regions, increased incidence of terrorism, insurgency, and asymmetric warfare—plus more frequent reported IEDs and suspicious-device incidents in both conflict and urban settings—directly drives demand for bomb-disposal oversuits. When EOD teams face higher operational tempo or newly identified threat vectors (e.g., shaped charges, heavy fragmentation, mixed-hazard devices), agencies accelerate procurement of advanced oversuits or expand inventories to cover more teams and shifts. This driver is tightly linked to operational readiness requirements: governments and major municipal police forces budget for replacement cycles, spares and multiple suit types (mobility-optimised vs. max-protection) so units can respond to more simultaneous incidents without degrading capability.

- Rising defense/homeland-security budgets and modernization programs

Sustained increases in defense and public-safety spending—including targeted modernization programs for military EOD units, national police bomb squads, and critical-infrastructure operators—create the financing backbone that turns operational need into orders. Larger procurement budgets let buyers prioritize higher-performance features (advanced composites, integrated comms/telemetry, active cooling) and accept higher unit costs, while planned modernization cycles shorten replacement timelines and boost aftermarket sales (spares, cooling packs, helmet upgrades). In addition, multinational aid, grants, and cooperative procurement (especially in regions building EOD capacity) funnel funds toward standardized, certified suits, further enlarging addressable market size and smoothing demand volatility.

Market Restraints:

- High Acquisition and Maintenance Costs

The growth of the Global Bomb Disposal Oversuits market is constrained by high acquisition and maintenance costs, as these suits are engineered with advanced composite materials, blast-resistant plating, modular cooling systems, and integrated communication technologies, making them significantly expensive for procurement and lifecycle upkeep. This imposes budget pressure, especially in developing countries and smaller law-enforcement agencies, where financial limitations often delay modernization programs and replacement cycles. Additionally, mobility and ergonomic challenges act as a notable restraint; despite ongoing material innovations, premium protective capability still results in heavy suit weight, restricted movement, and heat stress during extended operations, impacting operator endurance and mission performance. These limitations create a continued trade-off between maximum protection and operational flexibility, reducing adoption among units requiring high-mobility tactical response in complex environments.

Segmental Analysis:

- Water-Cooling Systems segment is expected to witness the highest growth over the forecast period

The Water-Cooling Systems segment leads due to its superior heat-regulation performance, offering EOD personnel sustained comfort during long and high-intensity operations. These systems circulate chilled water through integrated tubes within the suit, significantly reducing heat stress, increasing operational endurance, and enhancing concentration in hot climates or high-risk missions. Demand is growing as modern EOD missions require longer wear time and high-mobility operations, especially in regions with extreme temperatures and defense forces prioritizing advanced thermal-management solutions.

- Heavyweight / Maximum-Protection Suits segment is expected to witness the highest growth over the forecast period

The Heavyweight / Maximum-Protection Suits segment holds a significant share as they are designed to withstand the highest levels of blast pressure, fragmentation, and shockwave impact in critical explosive-ordnance-disposal missions. These suits incorporate thick ballistic plates, reinforced helmets, and multilayer blast-resistant fabric, prioritized for combat zones and high-threat environments. Despite being heavier, their unmatched safety standards make them essential for military and anti-terror squads performing frontline EOD tasks, ensuring maximum survivability during high-risk operations.

- Military segment is expected to witness the highest growth over the forecast period

The Military segment dominates due to increasing global defense modernization initiatives, rising battlefield IED threats, and greater adoption of advanced protective gear in armed forces worldwide. Military EOD units require highly specialized suits with superior blast resistance, integrated communication modules, CBRN compatibility, and cooling systems for extended operations. Growing investments in soldier survivability and counter-IED programs, combined with rapid equipment upgrades in conflict-prone regions, strengthen this segment’s demand over the forecast period.

- North America region is expected to witness the highest growth over the forecast period

The North America region is expected to witness the highest growth over the forecast period in the Global Bomb Disposal Oversuits Market. This growth is driven by strong defense and homeland-security budgets, ongoing counter-terror preparedness initiatives, and rapid adoption of advanced EOD technologies across military and law-enforcement agencies in the U.S. and Canada.

Additionally, continuous modernization programs, frequent equipment upgrade cycles, and the presence of leading protective-gear manufacturers further position North America as the fastest-growing and most technologically advanced market for bomb disposal oversuits during the forecast timeline. For instance, in 2025, The 4030 ELITE Suit and Helmet System was developed in collaboration with EOD operators and tested according to NIJ 0117.01 standards. It introduced a new approach to bomb disposal protection by offering superior survivability, enhanced ergonomics, and reduced weight. The system also featured a user-configurable and scalable platform, improving operator comfort and flexibility. Its development influenced the global bomb disposal oversuits market by setting higher performance benchmarks, encouraging innovation, and driving demand for lighter, more adaptable protective solutions worldwide.

To Learn More About This Report - Request a Free Sample Copy

Bomb Disposal Oversuits Market Competitive Landscape

The global bomb disposal oversuits market features a competitive set of specialized protective-gear manufacturers and established defense/survivability firms, all vying to offer lighter weight, enhanced mobility, integrated cooling/communications, and higher blast/fragmentation ratings. Key competition arises from companies holding advanced materials capabilities, rigorous certification credentials, global distribution networks and strong relationships with military, homeland-security and law-enforcement procurement agencies. Strategic factors include product differentiation (e.g., modular cooling systems, multi-threat protection), aftermarket servicing, and regional manufacturing-support for rapidly developing markets.

Key Players:

- Med Eng Systems Inc.

- NP Aerospace Ltd.

- WG Group plc

- Safariland LLC

- D3O Holdings Ltd.

- Kapri Corp

- ELP GmbH European Logistic Partners

- Sheffer Industries

- Garanti Protection

- Mine Safety Appliances Co. (MSA)

- 3DX Ray Inc.

- Westminster Group plc

- Teledyne Technologies Incorporated

- Honeywell International Inc.

- 3M Company

- Digital Armor Systems Inc.

- ArmorWorks Group

- ProGARM Ltd.

- Dunlop Protective Footwear & Clothing

- Para Gear International

Recent Development

- In August 2023, U.S. Army Explosive Ordnance Disposal (EOD) technicians from the 55th Ordnance Company collaborated with the Program Executive Office Soldier and Johns Hopkins University’s Applied Physics Laboratory to develop the Vertical Load Offset System (VLOS) for the Integrated Head Protection System (IHPS) combat helmet. This advancement enhanced head protection for EOD operators during high-risk missions. Their contributions influenced the global bomb disposal oversuits market by driving innovation in protective gear, improving operator safety, and setting new standards for integrated equipment in hazardous environments worldwide.

- In October 2022, Joe English, Lead EOD Engineer at NP Aerospace, and Siti Pareti, former Counter-Explosive Ordnance Adviser, emphasized the critical role of blast trials in bomb disposal suit development. These trials, aligned with standards like NIJ 0117.01, assessed suit protection against blast overpressure, fragmentation, and head injuries. Their work advanced suit design, improving operator visibility, mobility, and safety through integrated cooling and communication systems. This rigorous testing enhanced the global bomb disposal oversuits market by driving innovation, increasing operator survivability, and meeting stringent safety requirements worldwide.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth driving factors for this market?

The primary driver is the escalating global threat of terrorism, insurgencies, and IED (Improvised Explosive Device) incidents worldwide. This compels national governments and law enforcement agencies to significantly boost their counter-terrorism capabilities and invest higher budgets into public safety and defense. Furthermore, continuous advancements in materials science have resulted in lightweight, more ergonomic suits that enhance the operator's mobility, comfort, and operational endurance, driving demand for equipment upgrades.

Q2. What are the main restraining factors for this market?

The main constraints are the high manufacturing costs of advanced bomb disposal oversuits, which utilize specialized composite and aramid materials, limiting procurement budgets for smaller organizations and developing countries. Despite technological improvements, the suits can still limit the mobility and dexterity of EOD technicians, especially in confined spaces. The rapid development of robotic bomb disposal technologies also presents an alternative, potentially reducing the need for human-operated disposal in certain high-risk situations.

Q3. Which segment is expected to witness high growth?

The Military Application segment is expected to remain the largest, driven by ongoing modernization programs and continuous high defense spending globally, as militaries require high-performance suits for complex explosive threats. However, the Law Enforcement/Homeland Security segment is projected to witness rapid growth. This is fueled by the rising frequency of domestic terrorism and bomb threats in urban areas, leading law enforcement agencies to rapidly acquire advanced EOD tools for public safety and rapid deployment capabilities.

Q4. Who are the top major players for this market?

The market is competitive, dominated by a few global defense and specialized protection technology firms. Top major players include Med-Eng Holdings ULC (a subsidiary of Cadre Holdings, Inc.), L3Harris Technologies, Inc., and Northrop Grumman Corporation. These companies maintain their leadership through continuous R&D focus on integrating lightweight ballistic materials, superior cooling systems (like water cooling), and advanced communication technologies into their suit designs to meet the stringent safety and performance standards of defense and security agencies.

Q5. Which country is the largest player?

North America, primarily the United States, is the largest market player by revenue share. This is attributed to the U.S. government's high, sustained investment in soldier modernization, counter-terrorism programs, and the continuous procurement of state-of-the-art EOD equipment for both its military and federal/local law enforcement agencies. However, the Asia-Pacific region is simultaneously projected to exhibit the fastest growth rate, fueled by rising geopolitical tensions, increased defense budgets, and growing internal security challenges.

List of Figures

Figure 1: Global Bomb Disposal Oversuits Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Bomb Disposal Oversuits Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Bomb Disposal Oversuits Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Bomb Disposal Oversuits Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Bomb Disposal Oversuits Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Bomb Disposal Oversuits Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Bomb Disposal Oversuits Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Bomb Disposal Oversuits Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Bomb Disposal Oversuits Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Bomb Disposal Oversuits Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Bomb Disposal Oversuits Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Bomb Disposal Oversuits Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Bomb Disposal Oversuits Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Bomb Disposal Oversuits Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Bomb Disposal Oversuits Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Bomb Disposal Oversuits Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Bomb Disposal Oversuits Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Bomb Disposal Oversuits Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Bomb Disposal Oversuits Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Bomb Disposal Oversuits Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Bomb Disposal Oversuits Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Bomb Disposal Oversuits Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Bomb Disposal Oversuits Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Bomb Disposal Oversuits Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Bomb Disposal Oversuits Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Bomb Disposal Oversuits Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Bomb Disposal Oversuits Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Bomb Disposal Oversuits Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Bomb Disposal Oversuits Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Bomb Disposal Oversuits Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Bomb Disposal Oversuits Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Bomb Disposal Oversuits Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Bomb Disposal Oversuits Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Bomb Disposal Oversuits Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Bomb Disposal Oversuits Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Bomb Disposal Oversuits Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Bomb Disposal Oversuits Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Bomb Disposal Oversuits Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Bomb Disposal Oversuits Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Bomb Disposal Oversuits Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Bomb Disposal Oversuits Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Bomb Disposal Oversuits Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Bomb Disposal Oversuits Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Bomb Disposal Oversuits Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Bomb Disposal Oversuits Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Bomb Disposal Oversuits Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Bomb Disposal Oversuits Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Bomb Disposal Oversuits Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Bomb Disposal Oversuits Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Bomb Disposal Oversuits Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Bomb Disposal Oversuits Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Bomb Disposal Oversuits Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Bomb Disposal Oversuits Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Bomb Disposal Oversuits Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Bomb Disposal Oversuits Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model