Car Camera Cleaning System Market Overview and Analysis

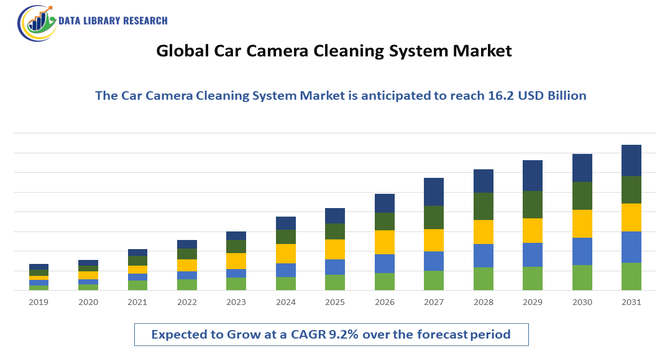

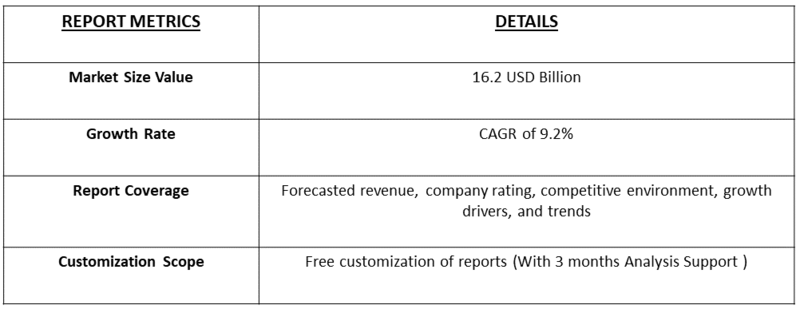

- The Global Automotive Camera Cleaning System Market is projected to grow significantly from 4.05 USD Billion in 2024 to 16.2 USD Billion by 2035.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Car Camera Cleaning System Market refers to the worldwide industry focused on technologies and products that clean vehicle cameras, ensuring clear vision for driver-assistance and autonomous systems. It includes camera washing nozzles, sensors, and fluid systems used in cars. Market growth is driven by rising demand for safety, automation, and advanced vehicle technologies.

The growth of the Global Car Camera Cleaning System Market is driven by the increasing adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles, which require consistently clear camera vision for safe operation. Rising consumer demand for enhanced vehicle safety, stricter government regulations on driver safety, and growing production of electric and premium vehicles further boost market expansion. Additionally, technological advancements in sensor cleaning mechanisms and integration with smart vehicle systems enhance reliability and performance, encouraging widespread adoption across automotive manufacturers worldwide.

Car Camera Cleaning System Market Latest Trends

The market for car-camera cleaning systems is evolving rapidly, with growing adoption of self-cleaning modules integrated into the broader ADAS (Advanced Driver Assistance Systems) and autonomous-vehicle ecosystems. Drivers include the proliferation of rear-view and surround-view camera setups—in some markets over 70% of new vehicles—and technological innovations like AI-activated dirt detection, heated nozzles for harsh climates, and hydrophobic lens coatings.

Segmentation: The Car Camera Cleaning System Market is segmented by System Type (Static and Dynamic Camera Cleaning Systems), Application (Exterior and Interior Camera Cleaning), Vehicle Type (Passenger Cars, and Medium & Heavy Commercial Vehicles), Camera Type (Surround View, Rear View, and Front View Cameras) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Adoption of ADAS and Autonomous Vehicles

The growing integration of Advanced Driver Assistance Systems (ADAS) and autonomous driving technologies is a major driver for the Automotive Camera Cleaning System Market. These systems rely heavily on cameras to provide a clear, accurate view of the vehicle’s surroundings. Any obstruction, such as dirt, dust, or water, can compromise the performance of safety features like lane departure warning, automatic braking, and parking assistance. As automakers enhance vehicle automation, maintaining clear camera vision has become essential, driving the demand for efficient cleaning solutions. Furthermore, the increasing production of electric and premium vehicles, often equipped with multiple cameras, amplifies the need for reliable camera cleaning systems across both passenger and commercial vehicle segments.

- Growing Focus on Road Safety and Regulations

Rising global emphasis on road safety and stringent government regulations mandating advanced safety features in vehicles are propelling the Automotive Camera Cleaning System Market. Camera-based systems play a crucial role in improving driver visibility, reducing blind spots, and preventing collisions. Regulatory bodies in regions such as Europe and North America are increasingly requiring manufacturers to integrate safety-enhancing technologies, including cameras and sensors, into vehicles. This, in turn, necessitates the inclusion of cleaning systems to ensure optimal functionality under various environmental conditions. The growing consumer preference for vehicles with enhanced safety and convenience features further boosts the adoption of camera cleaning systems, making them a standard component in modern vehicles.

Market Restraint:

- High System Cost and Integration Challenges

Despite strong growth prospects, the Automotive Camera Cleaning System Market faces challenges due to the high cost and complexity of integrating these systems into vehicles. Advanced camera cleaning mechanisms, particularly dynamic systems with automated sensors, require additional hardware, control modules, and fluid lines, which increase overall vehicle manufacturing costs. For mass-market and budget vehicles, this cost factor can limit adoption. Moreover, the system’s design and integration must accommodate limited space around cameras and ensure compatibility with vehicle electronics and ADAS software.

Socio Economic Impact on Car Camera Cleaning System Market

These cleaning systems contribute to vehicle safety by helping ensure camera clarity and thereby reliable functioning of safety features such as blind-spot warnings, automatic braking and parking assistance. Their wider adoption can reduce accident risk and thus lower associated economic costs (repair, medical, insurance). Additionally, as these systems become more affordable, they can spread to mid-range vehicles, improving overall traffic safety regardless of vehicle class.

Segmental Analysis

- Dynamic Camera Cleaning Systems Segment is Expected to Witness Significant Growth Over the Forecast Period

The dynamic camera cleaning systems segment is anticipated to experience substantial growth due to its superior efficiency and adaptability in maintaining clear camera vision under varying environmental conditions. Unlike static systems, dynamic systems actively detect dirt, dust, or water on camera lenses and automatically trigger cleaning mechanisms using high-pressure air or fluid jets. The increasing integration of advanced driver-assistance systems (ADAS) and autonomous vehicle technologies is further accelerating adoption, as these vehicles require consistent and precise visual data for safe operation. Automakers are increasingly favoring dynamic solutions to enhance camera reliability and performance, particularly in harsh weather conditions. As a result, demand for intelligent, self-activating cleaning systems is expected to surge across both passenger and commercial vehicle categories.

- Interior Camera Cleaning Segment is Expected to Witness Significant Growth Over the Forecast Period

The interior camera cleaning segment is projected to grow significantly as automakers introduce more in-cabin monitoring systems to enhance driver and passenger safety. Interior cameras are increasingly used for driver fatigue detection, occupant monitoring, and gesture recognition, making lens clarity crucial for system accuracy. With growing adoption of safety mandates such as driver monitoring systems in Europe and other regions, maintaining clean and unobstructed camera vision inside the cabin has become essential. Technologies using air jets, miniature wipers, or hydrophobic coatings are being developed for interior cleaning without disturbing passengers. The rise of shared mobility, premium vehicles, and autonomous cars—where interior monitoring is vital—will further propel demand for reliable, maintenance-free interior camera cleaning systems over the coming years.

- Medium & Heavy Commercial Vehicles Segment is Expected to Witness Significant Growth Over the Forecast Period

The medium and heavy commercial vehicles segment is expected to record robust growth in the automotive camera cleaning system market due to increasing integration of safety and monitoring technologies in logistics and transportation fleets. These vehicles often operate in challenging environments such as construction sites, mining zones, and long-haul routes where dust, mud, and adverse weather conditions frequently obstruct cameras. Regulatory initiatives promoting road safety and the need for fleet operators to minimize downtime and accidents are encouraging adoption of camera cleaning systems. Furthermore, the growing use of ADAS, rear and surround view cameras for maneuvering, and blind-spot detection in large vehicles supports market expansion. Enhanced operational safety, reduced maintenance costs, and compliance with safety norms are key factors driving this segment’s growth.

- Surround View Segment is Expected to Witness Significant Growth Over the Forecast Period

The surround view camera segment is set to witness substantial growth as modern vehicles increasingly incorporate 360-degree vision systems to improve parking assistance, lane change monitoring, and obstacle detection. These multi-camera systems require clear, synchronized visuals from multiple angles, making effective cleaning solutions essential. Even minor obstructions like dirt or rain can distort the composite image, compromising driver awareness and system performance. Growing consumer preference for vehicles with advanced safety and comfort features, particularly in premium and electric models, further boosts demand. Automakers are investing in automated cleaning systems integrated with ADAS to ensure uninterrupted functionality. The expansion of autonomous and semi-autonomous vehicles will further accelerate the adoption of surround view camera cleaning technologies globally.

- Asia-Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

The Asia-Pacific region is expected to register the fastest growth in the automotive camera cleaning system market, driven by rising vehicle production, rapid adoption of advanced safety technologies, and increasing government regulations promoting road safety. Countries like China, Japan, South Korea, and India are witnessing strong demand for connected and autonomous vehicles equipped with ADAS features, creating significant opportunities for camera cleaning solutions. Additionally, the growing presence of major automotive OEMs and technological advancements in sensor cleaning systems contribute to regional expansion. The shift toward electric and smart vehicles, coupled with improving consumer awareness of safety and comfort, is further propelling market growth. Infrastructure development, rising disposable incomes, and urbanization will also enhance adoption across both passenger and commercial vehicles.

To Learn More About This Report - Request a Free Sample Copy

Car Camera Cleaning System Market Competitive Analysis

The competitive environment is characterized by major automotive-supplier players such as Continental AG, Valeo SA, and Denso Corporation, who are investing heavily in R&D and partnering with OEMs to integrate camera-cleaning modules at source. At the same time, the market remains somewhat fragmented with numerous regional and niche suppliers competing on cost or retro-fit solutions. Differentiation is increasingly driven by performance, integration capability, and novel cleaning technologies rather than price alone.

The major players for above market are:

- Continental AG

- Valeo SA

- Denso Corporation

- Magna International Inc.

- Robert Bosch GmbH

- Ficosa International SA

- Hella GmbH & Co. KGaA

- Kautex Textron GmbH & Co. KG

- Gentex Corporation

- Panasonic Corporation

- Hyundai Mobis

- Mitsubishi Electric Corporation

- Sony Corporation

- OmniVision Technologies, Inc.

- Mobileye N.V.

- Autoliv Inc.

- Kyocera Corporation

- MS Foster & Associates, Inc.

- DlhBOWLES Inc.

- Shenzhen Mingshang Industrial Co., Ltd.

Recent Development

- In August 2025, Tensor, a pioneering agentic AI company, has revolutionized the automotive industry with the launch of Tensor Robocar, the world’s first personally owned autonomous vehicle. By advancing embodied AI, agent-driven control, and privacy-focused safety, Tensor redefines personal mobility and autonomy. This innovation is expected to significantly boost the Global Car Camera Cleaning System Market, as autonomous vehicles require consistently clear, high-performance cameras for reliable navigation and safety assurance.

- In February 2025, Stellantis N.V. has introduced STLA AutoDrive 1.0, its first fully in-house automated driving system, offering Hands-Free and Eyes-Off (SAE Level 3) capabilities. As part of Stellantis’ technology ecosystem, including STLA Brain and STLA Smart Cockpit, the system enhances vehicle intelligence, automation, and user experience. This advancement is poised to drive growth in the Global Car Camera Cleaning System Market, as high-precision cameras must remain clean and fully functional for reliable autonomous operation.

Frequently Asked Questions (FAQ) :

Q1. What the main growth driving factors for this market?

The primary growth factor is the widespread integration of Advanced Driver-Assistance Systems (ADAS) and the shift toward autonomous driving technologies. ADAS features like lane assist and adaptive cruise control rely heavily on clear camera vision for safety and operation. Furthermore, stringent government safety regulations, particularly those mandating features like rear-view cameras in new vehicles, compel automakers to install reliable cleaning systems. The rising sales of electric and premium vehicles, which often feature multiple cameras, also fuel market expansion.

Q2. What are the main restraining factors for this market?

The main restraining factors are generally related to the cost and complexity of integrating these systems. High initial investment and installation costs can be a deterrent for both automakers, especially for entry-level vehicles, and consumers. Additionally, there is a lack of widespread consumer awareness regarding the necessity of these specialized cleaning systems for maintaining ADAS function. Concerns over the long-term reliability of cleaning systems in harsh weather and the environmental impact of cleaning fluids also pose minor hurdles.

Q3. Which segment is expected to witness high growth?

The aftermarket segment is projected to witness the fastest high growth, driven by the increasing number of vehicles already on the road that need retrofitting with camera cleaning solutions. Among vehicle types, the Light Commercial Vehicle (LCV) segment, which includes urban delivery and electric commercial fleets, is also anticipated to grow substantially as ADAS adoption increases in this sector. By technology, IoT-Enabled Systems are emerging as a fast-growing segment due to the push for connected and smart vehicles.

Q4. Who are the top major players for this market?

The market features several established automotive component suppliers and technology companies. The top major players include Continental AG, a prominent German company, along with others like Denso Corporation (Japan) and Valeo S.A. (France). Other significant entities are ZF Friedrichshafen AG, Ficosa Internacional SA, and Magna Electronics Inc. These companies are continually innovating through R&D and strategic collaborations with Original Equipment Manufacturers (OEMs) to dominate the market share.

Q5. Which country is the largest player?

Asia Pacific region is anticipated to hold the largest market share in the global car camera cleaning system market over the forecast period. This dominance is due to the rapid growth of the automotive industry in countries like China, Japan, and India, coupled with increasing vehicle production and consumer demand for advanced safety features.

List of Figures

Figure 1: Global Car Camera Cleaning System Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Car Camera Cleaning System Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Car Camera Cleaning System Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Car Camera Cleaning System Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Car Camera Cleaning System Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Car Camera Cleaning System Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Car Camera Cleaning System Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Car Camera Cleaning System Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Car Camera Cleaning System Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Car Camera Cleaning System Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Car Camera Cleaning System Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Car Camera Cleaning System Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Car Camera Cleaning System Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Car Camera Cleaning System Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Car Camera Cleaning System Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Car Camera Cleaning System Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Car Camera Cleaning System Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Car Camera Cleaning System Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Car Camera Cleaning System Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Car Camera Cleaning System Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Car Camera Cleaning System Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Car Camera Cleaning System Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Car Camera Cleaning System Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Car Camera Cleaning System Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Car Camera Cleaning System Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Car Camera Cleaning System Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Car Camera Cleaning System Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Car Camera Cleaning System Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Car Camera Cleaning System Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Car Camera Cleaning System Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Car Camera Cleaning System Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Car Camera Cleaning System Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Car Camera Cleaning System Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Car Camera Cleaning System Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Car Camera Cleaning System Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Car Camera Cleaning System Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Car Camera Cleaning System Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Car Camera Cleaning System Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Car Camera Cleaning System Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Car Camera Cleaning System Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Car Camera Cleaning System Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Car Camera Cleaning System Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Car Camera Cleaning System Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Car Camera Cleaning System Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Car Camera Cleaning System Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Car Camera Cleaning System Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Car Camera Cleaning System Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Car Camera Cleaning System Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Car Camera Cleaning System Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Car Camera Cleaning System Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Car Camera Cleaning System Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Car Camera Cleaning System Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Car Camera Cleaning System Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Car Camera Cleaning System Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Car Camera Cleaning System Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model