Cellar Equipment & Accessories Market Overview and Analysis

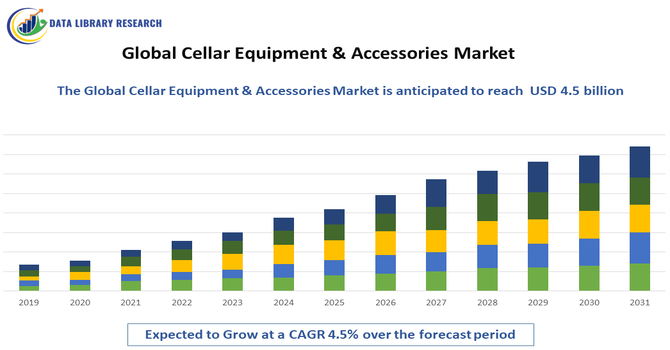

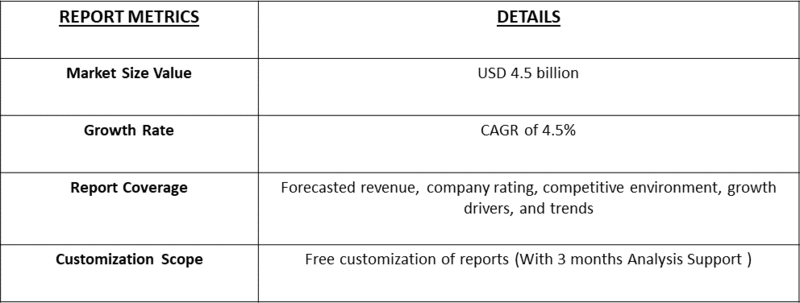

- The Cellar Equipment & Accessories Market was valued at USD 1.2 billion in 2026 and is projected to reach USD 4.5 billion by 2033, registering a CAGR of 4.5% from 2026-2033.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Cellar Equipment & Accessories Market refers to the industry supplying tools, systems, and accessories used in beverage cellars, particularly in breweries, wineries, and beverage storage facilities. This includes fermentation tanks, cooling systems, piping, valves, kegs, fittings, and monitoring accessories that support production, storage, and quality control. Growing demand for craft beer, wine, and premium beverages is driving market growth. Modern cellar equipment emphasizes hygiene, temperature control, efficiency, and automation to ensure product consistency and safety.

Cellar Equipment & Accessories Market Latest Trends

The Global Cellar Equipment & Accessories Market is growing with increasing demand for specialty beverages such as craft beer, wine, cider, and premium spirits. Producers are investing in advanced temperature control systems, automated fermentation tanks, and hygienic fittings to enhance quality and efficiency. IoT connectivity and real-time monitoring are becoming standard, enabling remote control of cooling, pressure, and sanitation.

Segmentation: The Global Cellar Equipment & Accessories Market is segmented by Product Type (Fermentation & Storage Tanks, Cooling & Temperature Control Systems, Piping, Valves & Fittings, Kegs & Dispensing Equipment, Monitoring & Control Accessories and Cleaning & Sanitation Equipment), Application (Breweries, Wineries, Distilleries and Cideries & Other Beverage Producers), End User (Commercial Beverage Producers, Craft & Small-Scale Producers and Hospitality & On-Premise Facilities), Technology (Manual Systems, Semi-Automated Systems and Fully Automated Systems), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Demand for Craft and Premium Beverages

The growing global consumption of craft beer, premium wine, and specialty spirits is a major driver for the cellar equipment and accessories market. Consumers increasingly prefer high-quality, locally produced, and differentiated beverages, encouraging breweries and wineries to invest in advanced cellar infrastructure. Modern fermentation tanks, cooling systems, and monitoring accessories help producers maintain consistency, flavor control, and product safety. The expansion of microbreweries and boutique wineries, has further increased demand. As beverage producers focus on innovation and quality differentiation, investments in reliable and efficient cellar equipment continue to rise globally.

- Technological Advancements and Automation in Beverage Production

Advancements in automation, digital monitoring, and temperature control technologies are driving adoption of modern cellar equipment. IoT-enabled sensors, automated fermentation control, and energy-efficient cooling systems improve operational efficiency and reduce manual intervention. These technologies allow producers to monitor critical parameters in real time, minimize product loss, and ensure compliance with hygiene standards. Automation also supports scalability, enabling producers to expand production without compromising quality. As labor costs rise and production processes become more complex, beverage manufacturers increasingly invest in technologically advanced cellar solutions to enhance productivity, reduce operational risks, and maintain competitive advantage in the global beverage industry.

Market Restraints

- High Capital Investment and Installation Costs

High upfront investment and installation costs pose a significant restraint for the cellar equipment and accessories market. Advanced fermentation tanks, automated cooling systems, and integrated monitoring solutions require substantial capital expenditure, which can be challenging for small and emerging producers. In addition to equipment costs, installation, customization, and maintenance add to overall expenses.

Socioeconomic Impact on Cellar Equipment & Accessories Market

Cellar equipment and accessories contribute significantly to economic activity in beverage production, supporting job creation in manufacturing, installation, maintenance, and technical services. High-quality equipment improves product consistency and safety, helping wineries and breweries meet regulatory standards and consumer expectations. Enhanced production capabilities allow small and medium producers to scale operations, fostering entrepreneurship and regional economic development. Investments in energy-efficient and automated systems also reduce operational costs and environmental impact. Improved beverage quality can boost tourism and cultural branding for regions known for wine and craft beer. Thus, the market supports economic growth, technological adoption, and higher standards in the global beverage industry.

Segmental Analysis:

- Fermentation & Storage Tanks segment is expected to witness highest growth over the forecast period

The fermentation and storage tanks segment is expected to witness the highest growth over the forecast period due to rising beverage production and quality-focused brewing practices. Breweries, wineries, and cider producers increasingly invest in stainless steel tanks that offer durability, hygiene, and precise temperature control. Growing demand for scalable and modular tank systems supports both small craft producers and large commercial facilities. Technological improvements, such as pressure control and automated cleaning features, further enhance efficiency and product consistency. As beverage producers expand capacity and diversify product portfolios, demand for advanced fermentation and storage tanks continues to grow globally.

- Cideries & Other Beverage Producers segment is expected to witness highest growth over the forecast period

The fermentation and storage tanks segment is expected to witness the highest growth over the forecast period due to rising beverage production and quality-focused brewing practices. Breweries, wineries, and cider producers increasingly invest in stainless steel tanks that offer durability, hygiene, and precise temperature control. Growing demand for scalable and modular tank systems supports both small craft producers and large commercial facilities. Technological improvements, such as pressure control and automated cleaning features, further enhance efficiency and product consistency. As beverage producers expand capacity and diversify product portfolios, demand for advanced fermentation and storage tanks continues to grow globally.

- Hospitality & On-Premise Facilities segment is expected to witness highest growth over the forecast period

The hospitality and on-premise facilities segment is expected to witness the highest growth driven by rising demand for fresh, locally produced beverages in restaurants, hotels, brewpubs, and tasting rooms. On-site brewing and cellar installations enhance customer experience and brand differentiation. Compact fermentation tanks, dispensing systems, and automated monitoring solutions are increasingly adopted to support small-batch production and consistent quality. Growth in experiential dining, tourism, and premium hospitality offerings is further boosting demand. As establishments seek to diversify revenue streams and improve customer engagement, investment in efficient and space-optimized cellar equipment is accelerating across the hospitality sector.

- Fully Automated Systems segment is expected to witness highest growth over the forecast period

The fully automated systems segment is projected to witness the highest growth as beverage producers prioritize efficiency, consistency, and operational control. Automated fermentation, temperature regulation, cleaning, and monitoring reduce human error and labor dependency while improving product quality. Integration of IoT and digital control platforms enables real-time tracking and predictive maintenance. These systems are particularly attractive to producers scaling operations or managing multiple facilities. Rising labor costs and the need for standardized production processes are accelerating adoption. As technology becomes more accessible, fully automated cellar systems are expected to play a central role in modern beverage production globally.

- Europe Region is expected to witness highest growth over the forecast period

Europe is expected to witness the highest growth in the cellar equipment and accessories market over the forecast period due to its strong brewing and winemaking heritage. Countries such as Germany, France, Italy, Spain, and the UK are home to a large number of breweries, wineries, and cider producers investing in modern cellar infrastructure. For instance, in August 2025, Lesaffre invested in a state-of-the-art yeast production and packaging facility at its Algist Bruggeman plant in Ghent, Belgium. Strengthening its industrial capabilities, the investment enabled Fermentis, Lesaffre’s business unit for fermented beverages, to better serve brewers worldwide. This expansion reinforced Lesaffre’s longstanding expertise in fermentation and microorganisms since 1853, enhancing production efficiency and global supply capacity. Lesaffre’s investment enhanced Europe’s fermented beverage production capabilities, improving supply efficiency and quality for brewers. It strengthened the region’s position in advanced yeast production and industrial fermentation technologies.

Similarly, in 2023, French animal nutrition company STI Biotechnologie inaugurated a 2,000 m² extension of its Maen Roch factory. Following its 2020 acquisition by IDENA Group, the EUR 2.3 million investment expanded production and storage capacity for probiotics, prebiotics, and postbiotics from 3,000 to 10,000 tonnes. The factory expansion increased demand for advanced storage, handling, and processing equipment, indirectly boosting Europe’s cellar equipment market by supporting larger-scale production and enhanced operational efficiency in beverage and fermentation-related facilities.

Moreover, the increasing demand for premium and craft beverages, combined with strict quality and hygiene regulations, is driving adoption of advanced equipment. Additionally, technological innovation, sustainability initiatives, and rising exports of European beverages are supporting market expansion, positioning Europe as a key growth region.

To Learn More About This Report - Request a Free Sample Copy

Cellar Equipment & Accessories Market Competitive Landscape

The competitive landscape of the cellar equipment and accessories market includes specialized manufacturers, industrial equipment providers, and regional suppliers. Companies compete on product quality, technological innovation, customization, and after-sales support. Leading players offer integrated solutions including fermentation tanks, cooling and glycol systems, automated control units, and hygienic fittings. Competition is driven by the ability to deliver modular, scalable, and energy-efficient systems tailored to diverse production scales. Strategic partnerships with craft breweries and wineries help companies secure long-term contracts.

The major players for above market are:

- Alfa Laval

- GEA Group

- TEMA Process

- Della Toffola Group

- Specific Mechanical Systems (SMS)

- Meheen Manufacturing Corporation

- Bright Tanks

- KEGWERKS

- Micro Matic

- Perlick Corporation

- John Guest (JG Speedfit)

- Encore Stainless, Inc.

- Stainless Depot

- Blichmann Engineering

- J.J. Berto Equipment

- American Stainless Equipment Co. (ASECO)

- S.S. Brewtech

- BSG Craftbrewing

- FermTech (a Division of BGM)

- BrewBuilt

Recent Development

- In May 2025, Cider and Craft Beverage Tap House opened at 113 Hiester Street, replacing The Deli, in time for the Central Pennsylvania Festival of the Arts. Founded by Penn State alumni, the team combined expertise in fermentation, agriculture, and science to create a space celebrating craft beverages, conversation, and community.

- In March 2025, Blake’s Beverage Co. launched several innovative new ciders, combining the expertise of Blake’s Hard Cider, Austin Eastciders, and AVID Cider Co. The company redefined the cider category with imaginative, fruit-forward flavors and variety packs, targeting adventurous consumers and shaping next-generation beverage trends.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The global rise in wine consumption and the growing culture of premium home wine collections are major drivers. Advancements in climate-control technology and smart-cellar integration attract tech-savvy enthusiasts. Additionally, the expansion of the hospitality sector and the trend toward specialized wine-tasting rooms in luxury residences fuel consistent market demand.

Q2. What are the main restraining factors for this market?

High initial installation costs for professional-grade refrigeration and insulation systems act as a significant barrier for entry-level collectors. Economic fluctuations can also impact discretionary spending on luxury accessories. Furthermore, strict regulations regarding energy consumption for cooling systems and the physical space requirements for dedicated cellars limit market penetration in urban areas.

Q3. Which segment is expected to witness high growth?

The fermentation and storage tanks segment is expected to grow fastest due to rising demand for high-quality craft beer, wine, and specialty beverages. Advanced tanks ensure precise temperature control, hygiene, and scalability, supporting both small and large producers in enhancing efficiency, product consistency, and overall beverage quality.

Q4. Who are the top major players for this market?

Prominent leaders in this specialized industry include EuroCave, Vinotemp, WhisperKOOL, Wine Enthusiast, and Sub-Zero. These companies dominate by offering a range of products from modular racks to professional cooling units. They maintain competitive advantages through aesthetic design, brand prestige, and the integration of IoT-enabled sensors for cellar management.

Q5. Which country is the largest player?

France remains the largest and most influential player in the cellar equipment market. Its deep-rooted viticulture heritage and high density of commercial wineries drive immense domestic demand. Furthermore, French manufacturers are renowned for high-end craftsmanship, exporting premium cellar solutions globally to cater to the growing international community of wine connoisseurs.

List of Figures

Figure 1: Global Cellar Equipment & Accessories Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Cellar Equipment & Accessories Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Cellar Equipment & Accessories Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Cellar Equipment & Accessories Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Cellar Equipment & Accessories Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Cellar Equipment & Accessories Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Cellar Equipment & Accessories Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Cellar Equipment & Accessories Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Cellar Equipment & Accessories Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Cellar Equipment & Accessories Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Cellar Equipment & Accessories Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Cellar Equipment & Accessories Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Cellar Equipment & Accessories Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Cellar Equipment & Accessories Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Cellar Equipment & Accessories Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Cellar Equipment & Accessories Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Cellar Equipment & Accessories Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Cellar Equipment & Accessories Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Cellar Equipment & Accessories Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Cellar Equipment & Accessories Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Cellar Equipment & Accessories Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Cellar Equipment & Accessories Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Cellar Equipment & Accessories Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Cellar Equipment & Accessories Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Cellar Equipment & Accessories Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Cellar Equipment & Accessories Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Cellar Equipment & Accessories Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Cellar Equipment & Accessories Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Cellar Equipment & Accessories Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Cellar Equipment & Accessories Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Cellar Equipment & Accessories Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Cellar Equipment & Accessories Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Cellar Equipment & Accessories Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Cellar Equipment & Accessories Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Cellar Equipment & Accessories Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Cellar Equipment & Accessories Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Cellar Equipment & Accessories Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Cellar Equipment & Accessories Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Cellar Equipment & Accessories Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Cellar Equipment & Accessories Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Cellar Equipment & Accessories Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Cellar Equipment & Accessories Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Cellar Equipment & Accessories Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Cellar Equipment & Accessories Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Cellar Equipment & Accessories Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Cellar Equipment & Accessories Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Cellar Equipment & Accessories Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Cellar Equipment & Accessories Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Cellar Equipment & Accessories Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Cellar Equipment & Accessories Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Cellar Equipment & Accessories Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Cellar Equipment & Accessories Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Cellar Equipment & Accessories Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Cellar Equipment & Accessories Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Cellar Equipment & Accessories Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model