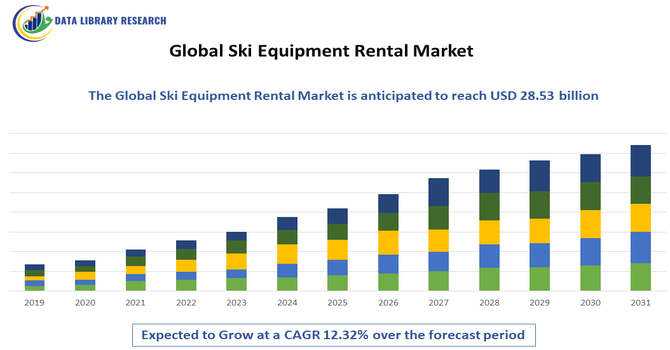

Ski Equipment Rental Market Overview and Analysis

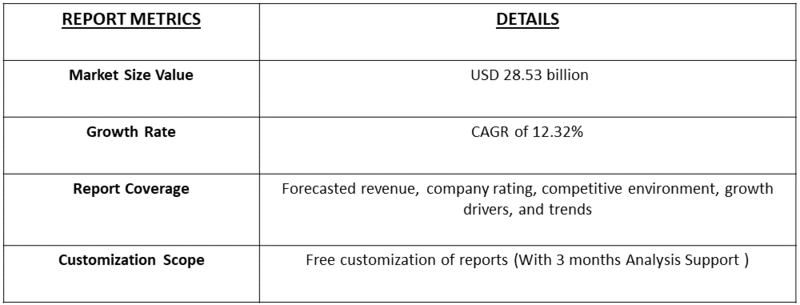

- The Global Ski Equipment Rental Market size is valued at USD 17.74 billion in 2025 and is expected to reach around USD 28.53 billion by 2032, growing at a CAGR of 12.32% from 2025 to 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Ski Equipment Rental Market caters to winter sports enthusiasts by providing convenient access to skis, snowboards, and related gear without the need for ownership. Growing interest in skiing and snowboarding, rising tourism in ski destinations, and the high cost of purchasing equipment drive market growth. Rental services offer affordability, flexibility, and convenience, encouraging more participation in winter sports while boosting local economies and supporting sustainable equipment usage across the industry.

Ski Equipment Rental Market Latest Trends

The Global Ski Equipment Rental Market is evolving with a strong shift toward digitalization, including online booking platforms and mobile apps, which enhance customer convenience. Increasing demand for high-quality, latest-model equipment is driving rental providers to regularly update their inventories. Additionally, eco-friendly and sustainable rental practices are gaining traction as consumers become more environmentally conscious. Growth in emerging ski destinations and expanding winter sports participation, especially among millennials and families, further fuel market expansion. Seasonal promotions and package deals combining rentals with lessons or lift passes are becoming popular, attracting more tourists and casual skiers.

Segmentation: The Global Ski Equipment Rental Market is segmented by Product Type (Skis, Snowboards, Boots, Poles, Helmets & Protective Gear and Others), Rental Type (In-Store Rental and Online Reservation), End User (Recreational Skiers, Professional Skiers and Tourists), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Growing Popularity of Winter Sports and Ski Tourism

The increasing global interest in winter sports and ski tourism has been a major driver for the ski equipment rental market. Skiing and snowboarding have evolved from niche activities to mainstream recreational pursuits, attracting tourists and adventure enthusiasts worldwide. Countries with renowned ski destinations, including the U.S., Canada, Switzerland, and Japan, are witnessing rising visitor inflows during winter seasons. Many tourists prefer renting ski equipment rather than purchasing due to cost, convenience, and travel logistics. This trend has led rental businesses to expand their offerings, modernize equipment, and improve service quality, significantly boosting market growth.

- Technological Advancements and Equipment Innovation

Technological innovation in ski and snowboard equipment is fueling the rental market as consumers increasingly seek high-performance and versatile gear without the commitment of purchase. Modern skis, snowboards, and bindings incorporate lightweight materials, ergonomic designs, and smart features to enhance performance, safety, and user experience. For instance, in July 2024, WNDR Alpine expanded into skis, snowboards, and splitboards, integrating biotechnology to enhance performance and sustainability. The comprehensive product line and innovative features attracted a wider outdoor enthusiast audience, increasing participation in winter sports and consequently driving higher demand in the global ski equipment rental market. Equipment customization, online booking platforms, and IoT-enabled gear tracking further improve convenience, promoting rentals over ownership. These advancements expand market adoption, drive repeat rentals, and strengthen customer loyalty across seasonal and regional markets.

Market Restraints:

- High Equipment Maintenance Costs and Operational Challenges

The key restraint in the global ski equipment rental market is the high cost of maintaining and managing rental fleets. Ski and snowboard equipment undergo significant wear and tear, requiring regular servicing, replacement, and storage infrastructure. Smaller operators may face operational inefficiencies, increased labor costs, and logistical challenges in managing inventory across multiple locations. Additionally, seasonal demand fluctuations result in underutilized equipment during off-peak periods, affecting profitability. Such operational and maintenance burdens discourage new entrants and limit expansion potential, creating barriers to market growth despite rising consumer demand for ski equipment rentals worldwide.

Socioeconomic Impact on Ski Equipment Rental Market

The ski equipment rental market significantly boosts local economies by creating jobs and supporting tourism-dependent communities in mountainous regions worldwide. It lowers barriers to entry for skiing by making equipment more affordable and accessible, particularly benefiting young and low-income enthusiasts. This accessibility encourages healthier lifestyles through outdoor physical activity, promoting social inclusion. Furthermore, rental services reduce the need for personal ownership, minimizing waste and resource consumption, aligning with sustainable development goals. The market’s growth helps sustain small businesses and rental shops, fostering economic diversification in often seasonal tourism regions.

Segmental Analysis:

- Snowboards segment is expected to witness highest growth over the forecast period

The snowboards segment is expected to witness the highest growth over the forecast period, driven by increasing popularity among younger winter sports enthusiasts and the rising number of snowboard-focused events and resorts globally. Advancements in snowboard design, including lightweight materials, enhanced flexibility, and durability, have improved user experience and safety, encouraging adoption. Rental providers are expanding their snowboard offerings to meet growing demand from recreational and professional riders. Additionally, social media influence and snowboarding competitions have contributed to higher interest, further boosting rentals. This trend positions snowboards as a key revenue driver in the global ski equipment rental market.

- Online Reservation segment is expected to witness highest growth over the forecast period

The online reservation segment is projected to experience the highest growth due to increasing consumer preference for convenience, time efficiency, and contactless services. Skiers and snowboarders increasingly use digital platforms to compare prices, check availability, and book equipment in advance, reducing wait times at rental outlets. Integration with mobile apps, loyalty programs, and secure payment systems has enhanced user experience and accessibility. Additionally, the COVID-19 pandemic accelerated digital adoption, driving permanent shifts toward online booking. Rental companies leveraging technology and e-commerce platforms are well-positioned to capture this growing demand, making online reservations a significant growth driver in the ski equipment rental market.

- Recreational Skiers segment is expected to witness highest growth over the forecast period

The recreational skiers segment is expected to witness the highest growth as skiing and snowboarding become more accessible to leisure enthusiasts worldwide. Increasing disposable income, growing winter tourism, and expanding ski resort infrastructure have contributed to a surge in recreational participation. Rental services cater to these skiers who prefer cost-effective, flexible access to high-quality equipment without the burden of ownership. Marketing campaigns, seasonal promotions, and beginner-friendly rental packages have further incentivized this segment. The trend toward experiential travel and outdoor recreational activities strengthens demand, making recreational skiers the dominant end-user group driving revenue growth in the global ski equipment rental market.

- North American Region segment is expected to witness highest growth over the forecast period

The North American region is expected to witness the highest growth over the forecast period, supported by well-established ski resorts, high winter tourism, and strong consumer spending power. Countries like the U.S. and Canada offer extensive winter sports infrastructure, attracting both domestic and international visitors. For instance, in March 2025, J.Crew partnered with U.S. Ski & Snowboard for three years as the official lifestyle-apparel sponsor. This collaboration enhanced brand visibility, promoted winter sports culture, and attracted a broader consumer base, indirectly driving demand for ski equipment rentals through increased interest in skiing and snowboarding activities.

Similarly, in February 2025, Bcomp teamed up with Jones Snowboards to incorporate natural fiber composites into snowboard designs. This partnership advanced sustainable, high-performance manufacturing, boosted eco-conscious consumer interest, and supported growth in ski and snowboard rentals as environmentally aware customers sought to experience the latest innovative equipment.

Advanced rental services, including online bookings, home delivery, and premium equipment options, enhance accessibility and convenience. Moreover, the region benefits from strong brand presence of major ski equipment rental companies and technological adoption in rental management. These factors collectively contribute to North America’s leadership and growth potential in the global ski equipment rental market.

To Learn More About This Report - Request a Free Sample Copy

Ski Equipment Rental Market Competitive Landscape

The competitive landscape of the Global Ski Equipment Rental Market is diverse, featuring international rental chains, local specialty shops, and growing online rental platforms. Major players compete on factors like equipment quality, pricing, location convenience, and digital booking ease. Innovation in customer service, such as personalized fittings and multi-language support, differentiates leading companies. Partnerships with ski resorts and tourism agencies strengthen market positioning. Additionally, some players focus on sustainable rental options to attract eco-conscious consumers. Market consolidation through mergers and acquisitions is increasing, as firms seek to expand regional footprints and improve operational efficiencies in a highly seasonal, competitive market.

The major players for this market are:

- INTERSPORT Rent

- Christy Sports

- Black Tie Ski Rentals

- Ski Butlers

- SkiSet

- RentSkis

- Skis.com

- Epic Mountain Gear

- Elevation Ski Rentals

- Alpine Ski Rentals

- Mountain Sports Rental

- Powderhouse Ski Rentals

- Ski Rental Outlet

- Sunday River Rental

- Ober Gatlinburg

- Big White Ski Resort Rentals

- Alyeska Resort Rentals

- Copper Mountain Rentals

- Purgatory Rentals

- Stratton Rental

Recent Development

- In June 2024, Salomon launched the Salomon Shift, an innovative ski binding that merges the advantages of both alpine and touring systems, delivering enhanced versatility for all skiers. This breakthrough caters to the rising interest in backcountry skiing, allowing users to effortlessly switch between resort slopes and off-piste terrain.

- In August 2024, Fischer Skis unveiled the Fischer Ranger ski line, featuring advanced materials and precision engineering to meet the needs of performance-driven skiers. The Ranger series delivers versatile options suitable for diverse terrain, appealing to both all-mountain and freeride skiing enthusiasts.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is growing because more people are traveling for ski vacations and prefer renting over carrying heavy gear on airplanes. High-quality equipment is expensive to buy, so beginners and casual skiers find renting much more affordable. Additionally, resorts now offer online booking and premium "demo" rentals, allowing skiers to try the latest technology.

Q2. What are the main restraining factors for this market?

Growth is primarily threatened by climate change, as shorter winters and less snowfall reduce the number of days people can ski. High rental prices at popular resorts can also discourage families on a budget. Furthermore, some frequent skiers prefer the perfect fit and familiarity of owning their own custom boots and skis.

Q3. Which segment is expected to witness high growth?

The Online Pre-booking segment is expected to see the highest growth. Travelers want to skip long lines at the rental shop and ensure their size is available before they arrive. Digital platforms and mobile apps make it easy to reserve gear, often at a discount, providing a much smoother experience for modern tourists.

Q4. Who are the top major players for this market?

The market is led by large resort operators and specialized rental chains. Key players include Vail Resorts, Skiset, Intersport Rent, Sport 2000, and Rentskis.com. These companies dominate by having prime locations right at the base of the mountains and offering loyalty programs that work across different international ski destinations.

Q5. Which country is the largest player?

France is a leading player in the ski equipment rental market, home to some of the world's largest and most visited ski areas in the Alps. The country has a very mature rental infrastructure with massive chains like Skiset. The high volume of international tourists visiting French resorts every winter keeps the rental demand consistently high.

List of Figures

Figure 1: Global Ski Equipment Rental Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Ski Equipment Rental Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Ski Equipment Rental Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Ski Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Ski Equipment Rental Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Ski Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Ski Equipment Rental Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Ski Equipment Rental Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Ski Equipment Rental Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Ski Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Ski Equipment Rental Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Ski Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Ski Equipment Rental Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Ski Equipment Rental Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Ski Equipment Rental Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Ski Equipment Rental Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Ski Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Ski Equipment Rental Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Ski Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Ski Equipment Rental Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Ski Equipment Rental Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Ski Equipment Rental Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Ski Equipment Rental Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Ski Equipment Rental Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Ski Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Ski Equipment Rental Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Ski Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Ski Equipment Rental Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Ski Equipment Rental Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Ski Equipment Rental Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Ski Equipment Rental Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Ski Equipment Rental Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Ski Equipment Rental Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Ski Equipment Rental Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Ski Equipment Rental Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Ski Equipment Rental Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Ski Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Ski Equipment Rental Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Ski Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Ski Equipment Rental Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Ski Equipment Rental Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Ski Equipment Rental Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Ski Equipment Rental Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Ski Equipment Rental Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Ski Equipment Rental Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Ski Equipment Rental Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Ski Equipment Rental Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Ski Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Ski Equipment Rental Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Ski Equipment Rental Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Ski Equipment Rental Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Ski Equipment Rental Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Ski Equipment Rental Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Ski Equipment Rental Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Ski Equipment Rental Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model