Circular Saw Sharpening Service Market Overview and Analysis:

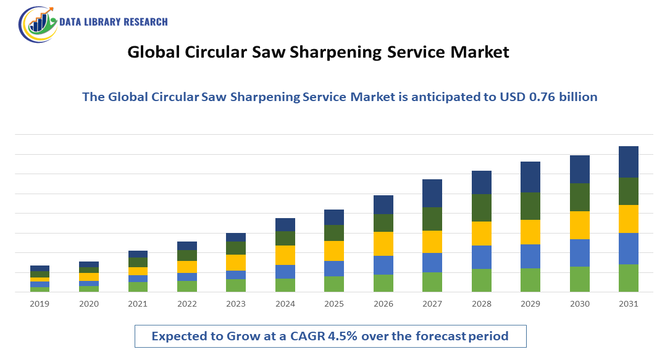

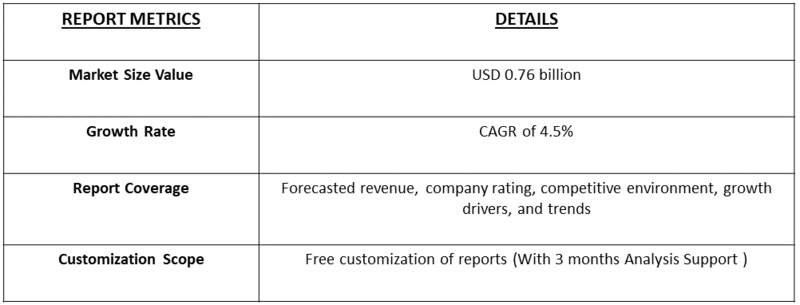

- The Circular Saw Sharpening Service market is projected to reach around USD 0.76 billion in 2025 and 2.5 billion by 2032. The market is forecast to grow steadily, with a CAGR of approximately 4.5% over the forecast period (2025–2032).

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

Key growth drivers include rising throughput demands in timber and panel processing, greater emphasis on product quality and precision in metal fabrication, and cost-control pressures among small- and medium-sized manufacturers that favor service-based blade refurbishment over capex for new tooling. Advances in CNC grind equipment and automated sharpening fixtures have boosted service consistency and turnaround times, enabling providers to offer tighter tolerances, repeatable tooth geometries, and more sophisticated edge treatments (micro-bevels, chip splitters, and anti-resin coatings) that meet modern production requirements.

Circular Saw Sharpening Service Market Latest Trends:

The Global Circular Saw Sharpening Service Market is witnessing notable trends driven by increasing automation in sharpening processes, greater demand for precision tooling, and rising sustainability awareness across industrial sectors. One of the key trends is the growing adoption of CNC-based sharpening systems that offer high accuracy and consistent cutting performance, particularly for carbide and specialty saw blades used in metalworking, construction, and woodworking applications. Additionally, mobile and on-site sharpening services are becoming increasingly popular as manufacturers seek to minimize equipment downtime and avoid logistical costs associated with shipping blades to off-site facilities.

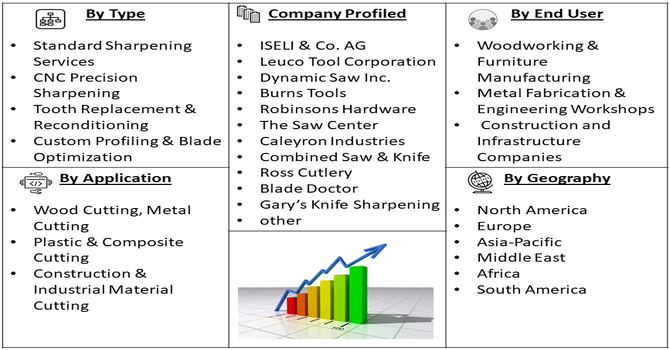

Segmentation: Global Circular Saw Sharpening Service Market is segmented By Service Type (Standard Sharpening Services, CNC Precision Sharpening, Tooth Replacement & Reconditioning, Custom Profiling & Blade Optimization), Blade Type (Carbide-Tipped Circular Blades, High-Speed Steel (HSS) Blades, Diamond-Coated Blades, Tungsten Carbide and Specialty Blades), Application (Wood Cutting, Metal Cutting, Plastic & Composite Cutting, Construction & Industrial Material Cutting), End User (Woodworking & Furniture Manufacturing, Metal Fabrication & Engineering Workshops, Construction and Infrastructure Companies), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Demand for Cost-Effective Tool Maintenance and Productivity Optimization

One of the primary drivers for the Global Circular Saw Sharpening Service Market is the increasing focus on cost efficiency and extending the service life of cutting tools across industries such as woodworking, metal fabrication, construction, and manufacturing. @@@@ Replacing worn or dull circular saw blades can be significantly more expensive than resharpening and reconditioning them, especially high-performance carbide and diamond-tipped blades. Sharpening services help maintain cutting precision, reduce machine strain, and improve operational productivity by minimizing tool downtime. As businesses seek to optimize operating expenses while maintaining high-quality output, the demand for professional sharpening services continues to grow.

- Growth in Woodworking, Construction, and Manufacturing Activities Worldwide

The expansion of industries that rely heavily on cutting and machining tools—particularly woodworking, furniture production, sawmills, and building construction—is driving strong demand for circular saw sharpening services globally. The increasing use of automated cutting machinery and high-speed production lines requires consistently sharp and reliable blades to maintain efficiency, accuracy, and safety.

Additionally, rapid industrialization in emerging markets such as India, China, and Southeast Asia, along with the resurgence of manufacturing activities in North America and Europe, is further boosting service demand. As industrial output increases, the recurring need for blade maintenance strengthens the role of sharpening services in operational workflows.

Market Restraints:

- Increasing Availability of Low-Cost Replacement Blades

The major challenges is the increasing availability of low-cost replacement blades, particularly from mass-produced overseas manufacturers, which makes purchasing new blades more economical for some end users compared to investing in repeated sharpening services.

Additionally, the lack of standardized blade designs, tooth geometries, and materials poses operational challenges for service providers, as highly specialized or coated blades require advanced equipment and expertise, increasing service costs and limiting scalability. Another restraint is the limited awareness and adoption of sharpening services among small workshops and DIY users, who may perceive sharpening as unnecessary or time-consuming.

Socio-Economic Impact on Circular Saw Sharpening Service Market

The global circular saw sharpening service market has a notable socioeconomic impact by supporting industries that rely on cutting and machining operations, including construction, manufacturing, and woodworking. By providing efficient sharpening services, the market helps reduce tool downtime, extend equipment life, and lower operational costs, boosting productivity and profitability. It also creates employment opportunities for skilled technicians, fosters technological adoption, and promotes safer and more sustainable industrial practices, contributing to economic growth and industrial efficiency worldwide.

Segmental Analysis:

- CNC Precision Sharpening segment is expected to witness the highest growth over the forecast period

Within the service type category, CNC precision sharpening is expected to be the most prominent segment due to its ability to deliver consistent, repeatable, and highly accurate sharpening results for advanced blade materials and complex tooth geometries. As industries increasingly rely on automated cutting systems with tight tolerances, the demand for CNC-based sharpening continues to grow, especially for carbide and diamond-tipped blades used in high-speed production environments.

- Tipped Circular Blades segment is expected to witness the highest growth over the forecast period

Among blade types, carbide-tipped circular blades hold a major share of the market owing to their widespread use in woodworking, furniture production, and industrial manufacturing. These blades are costlier to replace, making sharpening services more economical and necessary to extend their operational lifespan. Their durability and precision cutting capabilities drive recurring sharpening service demand, especially in high-volume production setups.

- Wood Cutting segment is expected to witness the highest growth over the forecast period

Wood cutting remains the leading application segment due to the extensive use of circular saws in lumber processing, cabinet manufacturing, and general woodworking. These industries require frequent blade maintenance because continuous use dulls cutting edges quickly. The growth of modular furniture, high-speed sawmills, and automation in woodworking facilities further boosts sharpening demand.

- Woodworking & Furniture Manufacturing segment is expected to witness the highest growth over the forecast period

Woodworking and furniture manufacturing represent the dominant end-user segment, driven by increasing production output, customization demands, and precision cutting requirements. With rising global furniture demand and increased use of advanced cutting solutions, this sector relies heavily on sharpening services to maintain production efficiency and ensure consistent product quality.

- North America segment is expected to witness the highest growth over the forecast period

North America is expected to lead the regional market due to mature woodworking industries, strong construction demand, and a well-established manufacturing base.

The region also benefits from a higher adoption rate of CNC sharpening technologies and a growing preference for subscription-based or on-site maintenance services, supporting continued market expansion. For instance, in May 2024, M.K. Morse revamped its recast saw blade product lineup, shifting from name-based to application-based families. This change introduced Heavy Duty (HD), Professional (PRO), Professional Carbide (PRO-CT), and Specialty (SP) categories. The redesign significantly influenced North America’s Global Circular Saw Sharpening Service Market by streamlining service offerings, enhancing customer targeting, and boosting demand for sharpening services aligned with specific blade applications.

Similarly, in a strategic move, in September 2025, Armstrong World Industries, Inc. acquired Geometrik Manufacturing Inc., a prominent Canadian producer of wood acoustical ceiling and wall systems, in Kelowna, British Columbia. This acquisition strengthened Canada’s Global Circular Saw Sharpening Service Market by increasing demand for sharpening services, driven by the need to maintain the precision cutting of diverse wood species like Western Hemlock used in Geometrik’s products.

Thus, all such factors are driving the growth of the above market in this region.

To Learn More About This Report - Request a Free Sample Copy

Circular Saw Sharpening Service Market Competitive Landscape:

The competitive landscape of the Global Circular Saw Sharpening Service Market is comprised of a diverse mix of specialist sharpening service providers, tooling OEMs offering sharpening as an add-on, and mobile/on-site service operators. Players compete on factors such as turnaround time, on-site capability, CNC precision sharpening, blade life extension services, digital blade tracking, and geographic service coverage.

Key Players:

- ISELI & Co. AG

- Leuco Tool Corporation

- Dynamic Saw Inc.

- Burns Tools

- Robinsons Hardware

- The Saw Center

- Caleyron Industries

- Combined Saw & Knife

- Ross Cutlery

- Blade Doctor

- Gary’s Knife Sharpening

- Anderson Saw

- Prosharp

- New-Form Tools

- Proform Tooling Ltd

- Superior Saws

- Elite Saw

- Dynashape

- Fitch Sharpening & Tools

- Cutters Edge

Recent Development

- In February 2025, DoAll introduced the S-153 micro-benchtop saw, specifically designed for small workshops and portable use. This compact saw features a convenient carry-anywhere design, offers miter cuts up to 60°, and includes adjustable band speed settings.

- In October 2024, M.K. Morse launched the spring-loaded Pen Drive Hole Saw Arbor, aimed at enhancing drilling accuracy and efficiency for professional users.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary growth driver is the continuous expansion of core industries that rely heavily on precise cutting tools, such as construction, woodworking, and manufacturing. As these sectors grow, the demand for sharp, reliable saw blades increases. Furthermore, the push for sustainability encourages businesses to sharpen and reuse blades rather than replacing them, extending the tool lifespan and driving service demand.

Q2. What are the main restraining factors for this market?

A significant restraint is the high initial cost of advanced, automated sharpening equipment, which can be prohibitive for smaller service providers and workshops. This machinery requires large investments and specialized maintenance. Additionally, the market faces challenges from fluctuations in raw material costs, which can increase the overall price of the blades, sometimes making replacement a seemingly simpler option than specialized sharpening.

Q3. Which segment is expected to witness high growth?

The Woodworking & Furniture Manufacturing segment is projected to experience the highest growth in the Global Circular Saw Sharpening Service Market during the forecast period. Increasing demand for precision-cut wood products, rising furniture production, and the need for maintaining saw efficiency are driving segment growth globally.

Q4. Who are the top major players for this market?

The market is quite fragmented, including both international corporations that supply related machinery and local, specialized service shops. Major global players who supply the blades and tools often associated with sharpening include Stanley Black & Decker, Bosch, and Illinois Tool Works. However, many smaller, regional experts provide the actual sharpening service itself.

Q5. Which country is the largest player?

North America, primarily driven by the United States, currently holds the largest share of the global market. This dominance stems from a mature and robust industrial base, including advanced manufacturing and a high-volume construction sector. The strong emphasis on quality control and efficient production across American industries ensures a constant, high demand for precision saw blade maintenance.

List of Figures

Figure 1: Global Circular Saw Sharpening Service Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Circular Saw Sharpening Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Circular Saw Sharpening Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Circular Saw Sharpening Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Circular Saw Sharpening Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Circular Saw Sharpening Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Circular Saw Sharpening Service Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Circular Saw Sharpening Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Circular Saw Sharpening Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Circular Saw Sharpening Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Circular Saw Sharpening Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Circular Saw Sharpening Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Circular Saw Sharpening Service Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Circular Saw Sharpening Service Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Circular Saw Sharpening Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Circular Saw Sharpening Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Circular Saw Sharpening Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Circular Saw Sharpening Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Circular Saw Sharpening Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Circular Saw Sharpening Service Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Circular Saw Sharpening Service Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Circular Saw Sharpening Service Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Circular Saw Sharpening Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Circular Saw Sharpening Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Circular Saw Sharpening Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Circular Saw Sharpening Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Circular Saw Sharpening Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Circular Saw Sharpening Service Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Circular Saw Sharpening Service Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Circular Saw Sharpening Service Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Circular Saw Sharpening Service Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Circular Saw Sharpening Service Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Circular Saw Sharpening Service Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Circular Saw Sharpening Service Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Circular Saw Sharpening Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Circular Saw Sharpening Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Circular Saw Sharpening Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Circular Saw Sharpening Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Circular Saw Sharpening Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Circular Saw Sharpening Service Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Circular Saw Sharpening Service Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Circular Saw Sharpening Service Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Circular Saw Sharpening Service Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Circular Saw Sharpening Service Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Circular Saw Sharpening Service Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Circular Saw Sharpening Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Circular Saw Sharpening Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Circular Saw Sharpening Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Circular Saw Sharpening Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Circular Saw Sharpening Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Circular Saw Sharpening Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Circular Saw Sharpening Service Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Circular Saw Sharpening Service Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Circular Saw Sharpening Service Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Circular Saw Sharpening Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model