Digestive Health Complex Granules Market Overview and Analysis:

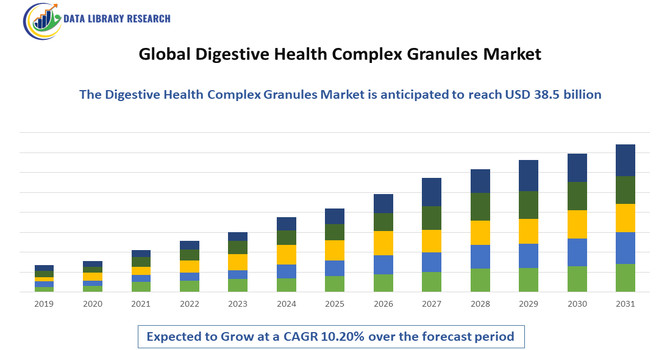

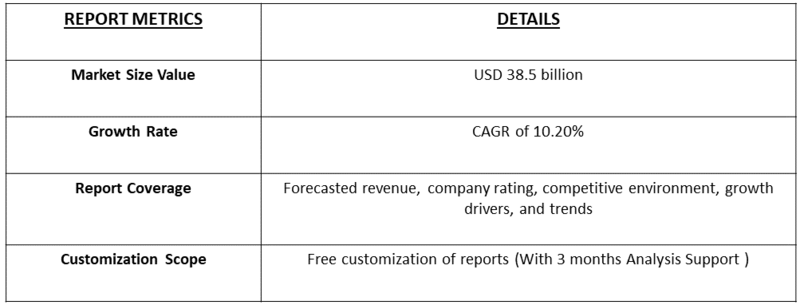

- The Global Digestive Health Complex Granules market is expected to grow from USD 22.3 billion in 2025 to USD 38.5 billion by 2035, reflecting a CAGR of 10.20% during 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

Rising global demand for digestive-health solutions is being driven primarily by growing consumer awareness of gut health and the proven benefits of probiotics, prebiotics and digestive enzymes; this health-conscious shift paired with increasing prevalence of gastrointestinal disorders and an aging population has expanded the addressable market for concentrated, easy-to-use formats like complex granules.

Rapid product innovation (new probiotic strains, enzyme blends and synbiotic formulations), wider availability through e-commerce and modern retail channels, and the appeal of convenient dosage forms that fit busy lifestyles are accelerating adoption, while rising disposable incomes and urbanization especially in Asia-Pacific are creating the fastest-growing regional demand. Finally, strong investment in R&D, marketing by established nutraceutical players, and favorable industry forecasts (robust CAGRs reported across multiple market studies) are encouraging new product launches and distribution expansion, further compounding market growth for digestive health complex granules.

Digestive Health Complex Granules Market Latest Trends:

The Global Digestive Health Complex Granules market is witnessing notable trends driven by evolving consumer preferences and technological innovation. There is a strong shift toward natural, organic, and clean-label formulations, with consumers seeking products made from plant-based ingredients and minimal artificial additives. The growing focus on gut microbiome health has encouraged manufacturers to incorporate probiotics, prebiotics, and synbiotic blends into granule formulations that promote long-term digestive balance rather than short-term relief. Advancements in formulation and delivery technologies, such as microencapsulation, improved solubility, and single-serve packaging, are enhancing product stability and convenience. Moreover, personalized nutrition is emerging as a key trend, with tailored digestive granules designed for specific age groups, dietary needs, and health conditions.

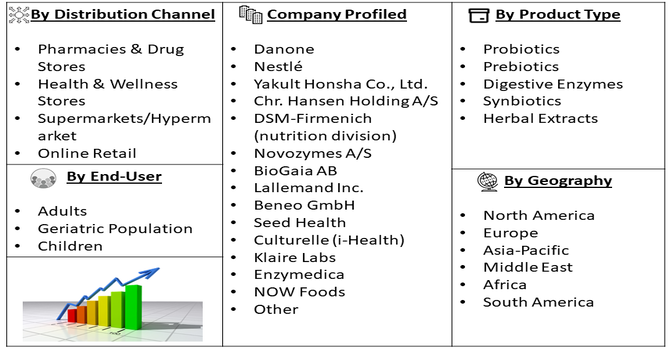

Segmentation: Global Digestive Health Complex Granules Market is segmented By Ingredient Type (Probiotics, Prebiotics, Digestive Enzymes, Synbiotics, Herbal Extracts), Function (Gut Health Maintenance, Constipation Relief, Bloating and Indigestion Relief, Immunity Support), End User (Adults, Geriatric Population, and Children), Distribution Channel (Pharmacies & Drug Stores, Health & Wellness Stores, Supermarkets/Hypermarkets, and Online Retail), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Awareness of Gut Health and Preventive Wellness

One of the primary drivers fueling the growth of the global digestive health complex granules market is the increasing consumer awareness regarding the importance of gut health in overall well-being. Scientific studies and public health campaigns have emphasized the role of the gut microbiome in immunity, metabolism, and mental health, leading consumers to adopt digestive supplements proactively rather than reactively. This shift toward preventive healthcare has significantly increased the demand for convenient and effective digestive solutions such as complex granules, which combine multiple active ingredients like probiotics, prebiotics, and digestive enzymes in a single formulation. Additionally, the growing prevalence of digestive disorders such as irritable bowel syndrome (IBS), acid reflux, and constipation—exacerbated by modern dietary habits, stress, and sedentary lifestyles—has further accelerated product uptake. As a result, nutraceutical and pharmaceutical manufacturers are investing heavily in R&D to create targeted formulations that support microbiome balance and long-term digestive wellness.

- Innovation in Formulation and Product Delivery

The growing demand for natural, clean-label, and non-GMO ingredients has also influenced product design, with brands focusing on transparency and sustainability to gain consumer trust. Together, these innovations not only improve product performance and user convenience but also expand market reach by catering to evolving consumer preferences across global markets. For instance, in April 2025, Ashwagandha (Withania somnifera), a widely used herb in traditional medicine systems, including Indian practices, has garnered significant global scientific attention. Research on its medicinal properties has surged, with PubMed listing 95 studies in 2019 and 201 studies in 2024, marking a 111.58% increase. This trend reflects growing recognition of Ashwagandha’s therapeutic potential and its expanding role in clinical research and health-focused applications worldwide. The rising scientific validation of Ashwagandha supports its integration into digestive health complex granules, appealing to consumers seeking natural, herbal solutions for gut wellness. Its adaptogenic and digestive-supporting properties enhance the functional value of granules, driving product innovation.

Market Restraints:

- High Cost of Product Development and Formulation

The Global Digestive Health Complex Granules Market faces several restraints that may limit its expansion. One of the primary challenges is the high cost of product development and formulation. Producing stable and effective digestive health granules often requires advanced technologies such as microencapsulation and the use of heat-sensitive probiotic strains, which significantly increase production costs. Additionally, maintaining product efficacy during storage and distribution poses technical challenges, particularly in regions with varying climatic conditions. These cost and stability issues can limit affordability for consumers and reduce the competitiveness of smaller manufacturers.

Socio-Economic Impact on Digestive Health Complex Granules Market

The global digestive health complex granules market is significantly shaped by socioeconomic factors that influence consumer awareness, purchasing power, and lifestyle choices. Rising incomes and urbanization in developing regions have increased demand for convenient, health-focused nutritional supplements, while busy lifestyles and dietary imbalances drive adoption in both emerging and developed markets. Education and awareness about digestive health, fueled by digital platforms and wellness campaigns, further encourage preventive healthcare spending. Conversely, economic downturns or high product costs can restrict access in lower-income populations. Government regulations and healthcare policies promoting dietary supplements also play a critical role, collectively steering the growth and accessibility of the global market.

Segmental Analysis:

- Probiotics segment is expected to witness the highest growth over the forecast period

Among the ingredient types, the Probiotics segment holds a major share and is expected to continue dominating the market during the forecast period. The growing awareness of the role of probiotics in maintaining gut microbiome balance and improving digestive health has significantly boosted demand. Probiotic-based granules help enhance nutrient absorption, support immunity, and alleviate digestive issues such as bloating and constipation. Continuous research on new probiotic strains and their health benefits, coupled with product innovations offering better shelf stability and efficacy, are driving strong growth in this category.

- Gut Health Maintenance segment is expected to witness the highest growth over the forecast period

Within the function segment, Gut Health Maintenance accounts for the largest share owing to increasing consumer emphasis on preventive health and overall wellness. As poor dietary habits, stress, and sedentary lifestyles contribute to digestive imbalances, consumers are turning toward daily supplements that promote digestive harmony and long-term gut function. The integration of probiotic and enzyme blends in granule form provides comprehensive digestive support, driving strong uptake across all age groups.

- Adults segment is expected to witness the highest growth over the forecast period

The Adult segment represents the largest consumer base for digestive health complex granules. Rising awareness about gut-brain connection, busy work lifestyles, and increasing cases of digestive discomfort among working adults are fueling product adoption. Moreover, adults are more inclined toward preventive healthcare and functional foods, making them the most responsive demographic to digestive health innovations. Manufacturers are also targeting this group with tailored formulations focused on stress-related digestive issues and immunity enhancement.

- Online Retail segment is expected to witness highest growth over the forecast period

The Online Retail segment is witnessing the fastest growth across distribution channels. The expansion of e-commerce platforms, increasing internet penetration, and consumer preference for convenient, doorstep delivery options are driving this trend. Online retail also enables consumers to compare brands, access product information, and read reviews, enhancing purchasing confidence. Additionally, direct-to-consumer (DTC) nutraceutical brands and subscription-based health supplement services are further accelerating online sales growth.

- North America region is expected to witness highest growth over the forecast period

The North America region is expected to witness the highest growth over the forecast period, driven by increasing consumer focus on digestive wellness, preventive healthcare, and balanced nutrition. Rising awareness of the gut microbiome’s influence on immunity, metabolism, and overall health has fueled demand for functional digestive supplements such as complex granules.

The region benefits from a well-established nutraceutical industry, advanced product innovation, and a high rate of probiotic and enzyme supplement adoption. Moreover, the growing prevalence of lifestyle-related digestive disorders, coupled with a surge in health-conscious consumers seeking clean-label and clinically validated products, is accelerating market expansion. The widespread availability of these products across pharmacies, wellness stores, and online retail platforms further enhances accessibility. Additionally, ongoing R&D initiatives by key manufacturers in the U.S. and Canada, combined with strong regulatory support for dietary supplements, are expected to solidify North America’s position as the fastest-growing region in the global digestive health complex granules market.

To Learn More About This Report - Request a Free Sample Copy

Digestive Health Complex Granules Market Competitive Landscape:

The competitive landscape of the Global Digestive Health Complex Granules market is characterized by a mix of large multinational nutraceutical and food companies, specialized probiotic and enzyme manufacturers, contract manufacturers/CMOs, and nimble DTC startups.

Key Players:

- Danone

- Nestlé

- Yakult Honsha Co., Ltd.

- Chr. Hansen Holding A/S

- DSM-Firmenich (nutrition division)

- Novozymes A/S

- BioGaia AB

- Lallemand Inc.

- Beneo GmbH

- Seed Health

- Culturelle (i-Health)

- Klaire Labs

- Enzymedica

- NOW Foods

- Garden of Life (Nestlé/attendant brands)

- Amway (Nutrilite)

- Glanbia Nutritionals

- Abbott Laboratories

- Himalaya Wellness Company

- Haleon plc

Recent Development

- In September 2025, Glac Biotech, a Taiwan-based developer of probiotics and postbiotics, announced that its flagship probiotic strain, CP-9 (Bifidobacterium lactis CCTCC M 2014588), received Generally Recognized as Safe (GRAS) status from the U.S. Food and Drug Administration (FDA). This approval validates the strain’s safety for use in food and dietary supplements, paving the way for broader commercialization in global health and wellness products. The FDA GRAS approval of CP-9 strengthens confidence in probiotic-based digestive supplements, encouraging manufacturers to incorporate scientifically validated strains into complex granules. This enhances product credibility, supporting market expansion, especially in North America.

- In January 2025, Mitsubishi Chemical Group, in collaboration with the Graduate School of Agriculture at Kindai University, demonstrated that the spore-forming lactic acid bacteria probiotic Heyndrickxia coagulans SANK70258 increased goblet cell numbers, strengthening the mucosal barrier in red sea bream and reducing mortality. The study reinforces the effectiveness of probiotics like H. coagulans in promoting gut health, boosting consumer confidence in digestive health supplements. This can drive innovation in digestive health complex granules, encouraging manufacturers to integrate spore-forming probiotics for improved gut barrier function and immunity. Growing awareness of scientifically validated probiotics is likely to expand global demand, particularly in functional foods and supplements aimed at digestive wellness and preventive health.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary driver is the rising global prevalence of digestive disorders such as Irritable Bowel Syndrome (IBS), chronic constipation, and acid reflux, which are often linked to modern, poor diets and high-stress lifestyles. Consumers are actively seeking effective, non-prescription, and natural solutions for maintaining gut wellness. The granule formulations themselves are highly convenient, as they are easy to mix into beverages and are often seen as having superior efficacy compared to pills due to better absorption. Growing trends in preventative healthcare and high consumer awareness through digital information sources also fuel market expansion.

Q2. What are the main restraining factors for this market?

A significant constraint is the lack of strict regulation and standardized clinical evidence for many over-the-counter health granules, leading to consumer skepticism about their true efficacy. The market features intense competition and is saturated with numerous brands and formulations, making it difficult for consumers to distinguish reliable products and thereby creating trust issues. Furthermore, the high cost of using premium, scientifically-backed ingredients (like patented probiotic strains or specialized enzymes) compared to traditional powders can limit widespread adoption, especially in price-sensitive developing markets.

Q3. Which segment is expected to witness high growth?

The Probiotics and Prebiotics Blend Segment is projected to witness the highest growth rate. This is because consumers are increasingly demanding comprehensive solutions that offer dual benefits: the beneficial live bacteria (probiotics) and the specific dietary fibers that nourish them (prebiotics) in one supplement. Granule formulations are particularly well-suited for housing these sensitive symbiotic blends and ensuring the ingredients remain stable until consumption. This strong preference for holistic gut flora support and the wealth of scientific research backing combined therapies make this segment the fastest-growing area.

Q4. Who are the top major players for this market?

The market is fragmented but includes large, established firms in the pharmaceutical and nutraceutical sectors. Top major global players include Nestlé S.A. (through its health science division), Danone S.A. (via probiotic brands), Bayer AG, and Amway Corporation. These companies focus their competition on investing heavily in scientifically validated ingredient sourcing, building robust distribution channels (including online platforms and pharmacies), and offering convenient, user-friendly packaging that highlights the portability and stability inherent in the granule format.

Q5. Which country is the largest player?

The United States, representing the largest part of the North American market, is the leading country in this sector. This dominant position is due to the nation's high level of health consciousness concerning gut wellness, the enormous consumer spending capacity dedicated to dietary supplements, and an advanced retail infrastructure. These factors ensure widespread availability and marketing. Furthermore, the high reported incidence of digestive issues and a cultural inclination toward proactively seeking preventative health solutions drive strong, consistent demand for premium and convenient granule formulations.

List of Figures

Figure 1: Global Digestive Health Complex Granules Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Digestive Health Complex Granules Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Digestive Health Complex Granules Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Digestive Health Complex Granules Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Digestive Health Complex Granules Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Digestive Health Complex Granules Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Digestive Health Complex Granules Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Digestive Health Complex Granules Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Digestive Health Complex Granules Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Digestive Health Complex Granules Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Digestive Health Complex Granules Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Digestive Health Complex Granules Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Digestive Health Complex Granules Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Digestive Health Complex Granules Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Digestive Health Complex Granules Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Digestive Health Complex Granules Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Digestive Health Complex Granules Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Digestive Health Complex Granules Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Digestive Health Complex Granules Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Digestive Health Complex Granules Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Digestive Health Complex Granules Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Digestive Health Complex Granules Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Digestive Health Complex Granules Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Digestive Health Complex Granules Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Digestive Health Complex Granules Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Digestive Health Complex Granules Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Digestive Health Complex Granules Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Digestive Health Complex Granules Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Digestive Health Complex Granules Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Digestive Health Complex Granules Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Digestive Health Complex Granules Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Digestive Health Complex Granules Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Digestive Health Complex Granules Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Digestive Health Complex Granules Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Digestive Health Complex Granules Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Digestive Health Complex Granules Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Digestive Health Complex Granules Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Digestive Health Complex Granules Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Digestive Health Complex Granules Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Digestive Health Complex Granules Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Digestive Health Complex Granules Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Digestive Health Complex Granules Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Digestive Health Complex Granules Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Digestive Health Complex Granules Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Digestive Health Complex Granules Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Digestive Health Complex Granules Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Digestive Health Complex Granules Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Digestive Health Complex Granules Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Digestive Health Complex Granules Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Digestive Health Complex Granules Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Digestive Health Complex Granules Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Digestive Health Complex Granules Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Digestive Health Complex Granules Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Digestive Health Complex Granules Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Digestive Health Complex Granules Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model