Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Digital Assistants in Healthcare Market encompasses AI-driven virtual assistants and chatbots that support healthcare professionals and patients by streamlining administrative tasks, improving patient engagement, enabling personalized care, and enhancing operational efficiency across healthcare systems worldwide.

The Global Digital Assistants in Healthcare Market is experiencing robust growth driven by the rapid adoption of AI-powered virtual health tools, rising demand for remote patient monitoring, and increasing focus on improving patient engagement and hospital workflow efficiency. Healthcare providers are leveraging digital assistants such as chatbots, voice-based AI, and smart medical assistants to streamline administrative tasks, enhance triage support, provide medication reminders, and deliver personalized care guidance, reducing operational burden and improving clinical outcomes.

The Global Digital Assistants in Healthcare Market is witnessing rapid evolution as AI-powered tools transition from basic chatbots to advanced clinical co-pilots capable of supporting diagnostic triage, clinical documentation, and workflow automation. A major trend is the integration of generative AI and large-language-model–based assistants that enable natural, context-aware communication and streamline tasks like medical transcription, appointment scheduling, patient follow-ups, and EHR interaction. Voice-enabled healthcare assistants and multimodal interfaces are gaining adoption to improve clinician efficiency and enhance patient accessibility, particularly for elderly and visually impaired users.

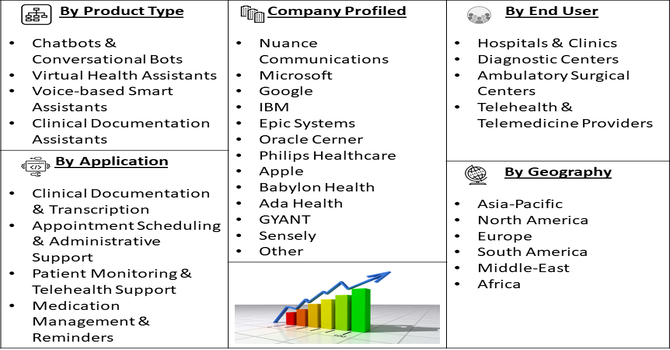

Segmentation: Global Digital Assistants in Healthcare Market is segmented By Technology (Artificial Intelligence, Machine Learning, Natural Language Processing), Product Type (Chatbots & Conversational Bots, Virtual Health Assistants, Voice-based Smart Assistants, Clinical Documentation Assistants), Application (Clinical Documentation & Transcription, Appointment Scheduling & Administrative Support, Patient Monitoring & Telehealth Support, Medication Management & Reminders), End User (Hospitals & Clinics, Diagnostic Centers, Ambulatory Surgical Centers, Telehealth & Telemedicine Providers), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

The increasing adoption of telemedicine, remote patient monitoring, and home-based care is a major driver for digital assistants in healthcare. As healthcare systems shift toward virtual and hybrid care models, AI assistants help manage patient interactions, offer symptom guidance, provide medication reminders, and support chronic disease management, improving accessibility and reducing clinical workload.

Healthcare providers are investing heavily in digital transformation to streamline workflows, reduce administrative burdens, and enhance patient experience. Digital assistants equipped with AI, NLP, and voice-recognition technologies automate tasks such as appointment scheduling, medical documentation, and billing queries, enabling healthcare organizations to cut costs, boost staff productivity, and deliver more efficient, coordinated, and patient-centric care.

In April 2025, Shezlong’s launch of the region’s first AI-powered therapy assistant reflects the broader surge in healthcare digitalization and growing emphasis on operational efficiency. By integrating advanced AI tools into mental health services, Shezlong streamlined therapeutic workflows, enhanced real-time patient engagement, and optimized therapists’ productivity. This innovation aligns with the global trend of leveraging digital technologies to deliver scalable, efficient, and personalized care, reinforcing how AI-driven digital assistants are becoming essential in improving healthcare outcomes and resource management across the industry.

Market Restraints

The Global Digital Assistants in Healthcare Market faces key restraints including stringent regulatory requirements and data privacy concerns, as healthcare organizations handle highly sensitive patient information. Ensuring compliance with standards such as HIPAA, GDPR, and other regional healthcare regulations creates complexity and slows adoption. Additionally, integration challenges with legacy hospital information systems and electronic health records (EHRs) hinder seamless deployment, often requiring significant time, cost, and IT expertise. Limited AI training data quality and concerns over accuracy and reliability in clinical decision-support scenarios also restrict full-scale implementation. Furthermore, resistance from clinicians due to fear of technology replacement, lack of digital literacy among aging populations, and high initial investment costs in AI infrastructure and interoperability solutions pose notable barriers, particularly for small and mid-sized healthcare providers.

The rise of digital assistants is poised to significantly impact global healthcare's socioeconomic landscape by addressing key challenges like rising costs and limited access. Economically, they streamline administrative tasks, such as scheduling and billing, and support remote monitoring, potentially leading to billions in annual savings for health systems by reducing labor costs and unnecessary hospital visits. Societally, these assistants improve health equity by offering 24/7, multi-lingual support and care navigation, breaking down geographical barriers and reaching underserved populations. However, this shift raises concerns about a 'digital divide,' where individuals with lower digital literacy or income may be excluded, and potential job displacement in administrative roles, requiring proactive policies to ensure inclusive adoption and workforce retraining.

Segmental Analysis

The Artificial Intelligence segment leads the market as AI-enabled healthcare assistants deliver advanced automation, real-time patient interaction, and context-aware clinical support. AI technologies enhance decision-making, streamline documentation, enable predictive assistance, and improve patient triaging and monitoring. The growing shift toward AI-driven virtual care, voice-enabled support, and self-learning healthcare bots continues to accelerate adoption across hospitals and telehealth platforms.

Virtual Health Assistants (VHAs) are experiencing strong growth due to their ability to interact naturally with patients, manage health queries, provide medication reminders, and support symptom assessment and chronic-disease management. These assistants improve patient engagement and reduce burden on healthcare professionals, especially in remote-care environments. Their integration with telehealth systems, mobile apps, and EHR platforms is boosting usage across outpatient and home-care settings.

The Clinical Documentation & Transcription segment is gaining momentum as AI-driven voice assistants and ambient clinical intelligence systems are increasingly used to automate real-time note-taking and medical transcription. This reduces physician workload, prevents burnout, enhances accuracy, and saves significant time in electronic health record (EHR) updates. The demand for automated documentation solutions is growing rapidly in hospitals, specialty clinics, and telemedicine consultations.

Hospitals & Clinics form the largest end-user segment, adopting digital assistants to streamline patient communication, automate administrative tasks, improve care coordination, and support clinical workflows. These systems help manage scheduling, triage, documentation, and AI-enabled virtual nursing support. Rising focus on digital transformation, operational efficiency, and improved patient outcomes is pushing adoption across large hospitals and multispecialty networks.

North America dominates the market due to widespread digital-health adoption, advanced healthcare IT infrastructure, high investment in AI-based health innovations, and supportive regulatory frameworks. The region also has strong telehealth penetration, growing clinical automation strategies, and major tech companies driving AI integration in healthcare.

The United States leads with significant deployments across hospitals, payers, and home-care systems. For instance, in January 2025, Accenture and Meiji Yasuda Life Insurance Company entered a multi-year partnership, running through March 2030, to drive a comprehensive corporate transformation using artificial intelligence (AI). The collaboration focuses on enhancing workforce efficiency and innovation by integrating AI-powered digital assistants and other digital technologies into daily operations. This initiative positively influenced the Global Digital Assistants in Healthcare Market, highlighting the growing cross-industry adoption of AI-driven assistants that boost productivity, streamline workflows, and inspire similar advancements in healthcare ecosystems worldwide.

Similarly, February 2025, Drive Health, a Phoenix-based digital health startup, announced the launch of its groundbreaking AI nurse in collaboration with Google Public Sector, marking a major milestone in expanding healthcare accessibility and addressing the U.S. healthcare workforce shortage. The AI nurse aims to enhance patient outcomes and streamline clinical support nationwide. This innovation significantly boosted the Global Digital Assistants in Healthcare Market, showcasing the U.S. leadership in AI-driven care delivery, operational efficiency, and scalable digital solutions for modern healthcare systems. Thus, all such factors are driving the growth of above market in this region.

To Learn More About This Report - Request a Free Sample Copy

The competitive landscape for the Global Digital Assistants in Healthcare Market is dynamic and crowded, featuring large tech incumbents, established healthcare IT vendors, and agile startups competing on AI capabilities, EHR interoperability, voice and ambient-listening features, regulatory compliance, and vertical specialization (telehealth, clinical documentation, patient engagement). Market leaders leverage scale, existing customer relationships, and deep pockets to integrate assistants into broad healthcare platforms, while smaller specialists differentiate through niche clinical workflows, superior NLP models, or quicker deployment and customization. Strategic partnerships, M&A, and regulatory-compliant productization are common tactics as players race to embed digital assistants across hospitals, telemedicine providers, and home-care ecosystems.

Key Players

Recent Development

Q1. What the main growth driving factors for this market?

The main drivers are the rising demand for efficient healthcare, especially for chronic disease management and home-based monitoring. Rapid advancements in Artificial Intelligence (AI) and the growing use of smartphones and digital health tools also play a key role. These assistants help automate tasks like appointment scheduling and symptom checking, easing the burden on healthcare staff and providing faster patient support. The shift towards value-based care also encourages their adoption for better patient outcomes.

Q2. What are the main restraining factors for this market?

The primary concern is the security and privacy of sensitive patient data, requiring strict adherence to regulations like HIPAA, which can be complex. Other major obstacles include the high initial costs of implementation, challenges integrating new digital assistant systems with older, existing hospital technologies, and the need for standardized regulatory clarity around AI-driven clinical decisions. These factors slow down the wider adoption among providers.

Q3. Which segment is expected to witness high growth?

The Automatic Speech Recognition (ASR) and AI-powered chatbot segments are projected to see the highest growth. ASR is driven by the demand for hands-free documentation and efficient communication in clinical settings. Chatbots are expanding rapidly as they offer immediate, 24/7 patient responses for basic inquiries, appointment booking, and triage, greatly enhancing patient engagement and streamlining hospital workflows using sophisticated AI.

Q4. Who are the top major players for this market?

The market is led by major technology companies leveraging their core AI and cloud capabilities. Key players include Microsoft (which acquired Nuance Communications), known for clinical documentation solutions, Amazon (with Alexa Health), focused on patient engagement and home monitoring, and Google LLC. Other significant companies specializing in the sector are Sensely Inc., eGain Corporation, and Babylon Healthcare Services Limited.

Q5. Which country is the largest player?

The North American region, particularly the United States, is the largest market player by revenue share. This dominance is due to the rapid and high adoption rate of advanced AI and digital health technologies, a strong IT infrastructure, and the high demand for virtual care and efficient patient management systems. However, the Asia Pacific region is expected to grow the fastest, driven by increasing investments in digital healthcare.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model