Electronic Fuel Injection Motorcycle Market Overview and Analysis:

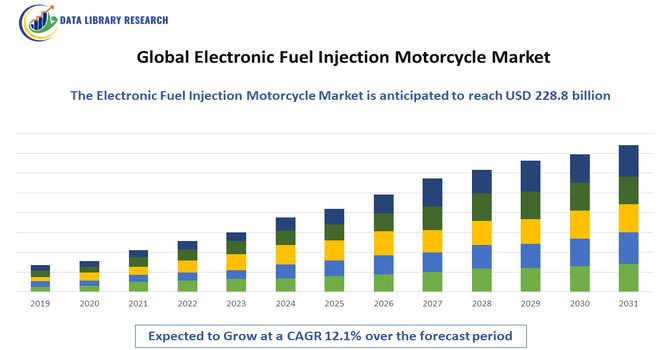

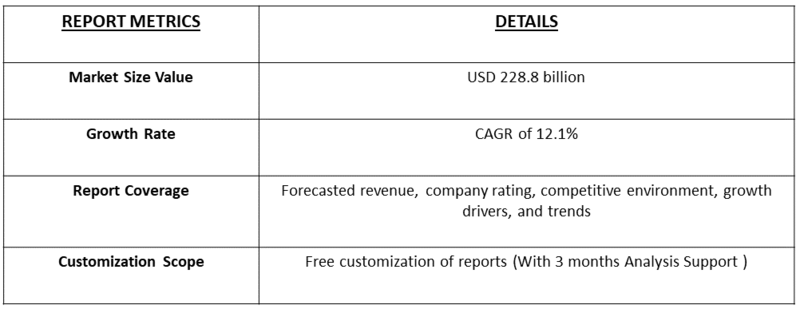

- The Global Electronic Fuel Injection (EFI) Motorcycle Market size was estimated at USD 198.1 billion in 2025 and is expected to grow at a CAGR of 12.1% between 2025 and 2032, reaching USD 228.8 billion in the year 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The growth of the Global Electronic Fuel Injection (EFI) Motorcycle Market is primarily driven by the increasing demand for fuel-efficient, low-emission, and high-performance two-wheelers worldwide. As governments tighten emission regulations such as Euro 5 and BS-VI standards, motorcycle manufacturers are rapidly adopting EFI systems to ensure optimal air-fuel mixture control, improved combustion efficiency, and reduced exhaust pollutants. Rising consumer awareness of vehicle performance, fuel economy, and smoother throttle response has further accelerated the transition from carbureted to fuel-injected motorcycles.

Additionally, the growing adoption of premium and mid-segment motorcycles, coupled with technological advancements in electronic control units (ECUs) and sensors, is enhancing EFI integration across both commuter and performance bike categories. Expanding motorcycle production in emerging economies and the rising trend of electric and hybrid motorcycles featuring advanced fuel management systems also contribute to sustained market growth over the forecast period.

Electronic Fuel Injection Motorcycle Market Latest Trends

The global electronic fuel‐injection (EFI) motorcycle market is undergoing several key trends that are reshaping how two-wheelers are engineered, marketed and used. One prominent trend is the advancement and integration of smart, adaptive EFI systems modern motorcycles are increasingly equipped with ECUs, sensors and data-analytics modules that adjust fuel injection in real time, aligning with varying ride conditions, altitude and load for improved fuel efficiency and ride performance. Another significant trend is the widening adoption of EFI across motorcycle segments and markets, driven by stricter emissions regulations (like Euro 5, BS-VI) and rising consumer demand for cleaner, more fuel-efficient vehicles. What was once primarily a premium feature is now becoming standard even in commuter and emerging-market motorcycles, as OEMs transition away from carbureted systems.

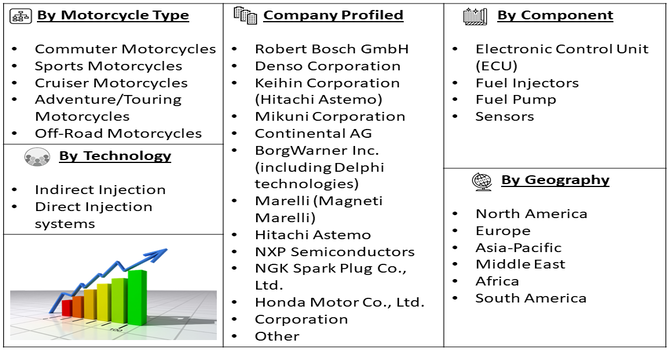

Segmentation: Global Electronic Fuel Injection Motorcycle Market is segmented by Component Type (Electronic Control Unit (ECU), Fuel Injectors, Fuel Pump, Sensors), Engine Type (Single Cylinder, Twin Cylinder, and Multi-Cylinder motorcycles), Technology (Indirect Injection, Direct Injection systems), By Motorcycle Type (Commuter Motorcycles, Sports Motorcycles, Cruiser Motorcycles, Adventure/Touring Motorcycles, and Off-Road Motorcycles), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Stringent Emission Regulations and Shift Toward Fuel Efficiency

One of the primary drivers of the Global Electronic Fuel Injection (EFI) Motorcycle Market is the increasing enforcement of stringent emission standards across major markets. Regulations such as Euro 5 in Europe, BS-VI in India, and similar emission norms in other regions have compelled manufacturers to transition from traditional carbureted systems to advanced fuel injection technologies. EFI systems precisely control the air-fuel ratio, ensuring cleaner combustion and significantly reducing harmful emissions such as hydrocarbons and carbon monoxide. Moreover, growing global awareness of environmental sustainability and rising fuel prices are pushing consumers toward motorcycles that offer higher fuel efficiency and lower operational costs. This regulatory pressure, combined with consumer demand for eco-friendly and cost-effective mobility solutions, is a key factor accelerating the widespread adoption of EFI systems in motorcycles across all segments.

- Technological Advancements and Enhanced Engine Performance

Rapid technological innovation in engine management systems and sensor integration is another major driver of market growth. Modern EFI systems feature advanced electronic control units (ECUs), high-precision sensors, and real-time data analytics that optimize fuel delivery based on engine load, temperature, and riding conditions. These enhancements result in smoother throttle response, improved acceleration, and superior overall performance compared to carbureted motorcycles. Additionally, the growing popularity of premium and performance-oriented motorcycles has intensified demand for EFI technology that can deliver both power and efficiency. Manufacturers are increasingly focusing on developing compact and cost-effective EFI systems for small-displacement motorcycles, making the technology more accessible in emerging markets. Collectively, these advancements in EFI design and functionality are driving the next generation of intelligent, high-performance motorcycles worldwide.

Market Restraints:

- High Initial Cost and System Complexity

One of the primary challenges is the high initial cost and system complexity associated with EFI technology compared to conventional carburetors. The integration of electronic components such as ECUs, sensors, and fuel pumps increases the overall production and maintenance costs of motorcycles, making them less affordable for price-sensitive consumers—especially in emerging economies where low-cost two-wheelers dominate the market. Additionally, EFI systems require specialized diagnostic tools and skilled technicians for servicing and calibration, posing challenges for small workshops and rural areas with limited technical expertise.

Socio Economic Impact on Electronic Fuel Injection Motorcycle Market

The global electronic fuel injection (EFI) motorcycle market is significantly influenced by socioeconomic factors, shaping both demand and innovation. Rising disposable incomes in emerging economies enable consumers to afford technologically advanced motorcycles with EFI systems, which offer better fuel efficiency and lower emissions. Urbanization and changing commuting patterns increase the need for reliable and eco-friendly motorcycles, further boosting market growth. Conversely, economic downturns or fluctuations in fuel prices can dampen consumer spending, slowing sales. Government policies promoting clean energy and stringent emission norms also interact with socioeconomic conditions to drive adoption. Overall, income levels, urban development, environmental awareness, and regulatory frameworks collectively determine the trajectory of the global EFI motorcycle market.

Segmental Analysis:

- Electronic Control Unit segment is expected to witness highest growth over the forecast period

The Electronic Control Unit segment dominates the market, as it serves as the brain of the EFI system, managing real-time fuel delivery, ignition timing, and air-fuel mixture based on sensor inputs. The increasing integration of advanced ECUs with microprocessor technology enhances engine efficiency, reduces emissions, and improves throttle response, driving their widespread adoption in both premium and commuter motorcycles.

Moreover, the rising consumer demand for fuel-efficient and environmentally friendly motorcycles is accelerating the growth of the EFI system market. Manufacturers are increasingly focusing on developing compact, lightweight, and cost-effective EFI solutions that cater to diverse motorcycle segments. Technological advancements, such as adaptive mapping and diagnostic capabilities within ECUs, enable better performance under varying riding conditions, further appealing to end-users.

- Single-Cylinder segment is expected to witness highest growth over the forecast period

The Single-Cylinder segment holds the largest market share due to its prevalence in commuter and entry-level motorcycles, especially across Asia-Pacific markets. Single-cylinder engines are cost-effective, fuel-efficient, and easier to maintain, making them ideal for urban mobility. The implementation of EFI in these engines significantly enhances performance while complying with stringent emission norms.

- Indirect Injection segment is expected to witness highest growth over the forecast period

The Indirect Injection segment accounts for a major portion of the market. This technology is more cost-effective and easier to integrate compared to direct injection, making it the preferred choice for mid-range and commuter motorcycles. Indirect injection systems deliver a balanced combination of performance, fuel economy, and emission control, catering to the growing demand for affordable yet efficient motorcycles.

- Commuter Motorcycle segment is expected to witness highest growth over the forecast period

The Commuter Motorcycle segment leads the market, driven by rising urbanization, increasing fuel prices, and strong demand in developing economies such as India, Indonesia, and Vietnam. EFI systems in commuter motorcycles enhance mileage and reliability while supporting compliance with regulatory emission standards.

- Asia Pacific region is expected to witness highest growth over the forecast period

The Asia-Pacific (APAC) region is overwhelmingly projected to lead global market growth, driven by a powerful confluence of regulatory changes and consumer dynamics. Countries like India, China, and Southeast Asian nations represent the world's largest consumer base for two-wheelers, where motorcycles are the primary mode of transportation. The recent and mandatory implementation of strict emission standards (such as BS-VI in India and similar regulations across ASEAN countries) is forcing a complete and rapid technological conversion from carburetors to more efficient EFI systems across millions of vehicles annually. This regulatory shift, combined with rising disposable incomes enabling consumers to afford marginally more expensive, better-performing, and fuel-efficient EFI models, establishes APAC as the epicentre of market expansion over the forecast period.

To Learn More About This Report - Request a Free Sample Copy

Electronic Fuel Injection Motorcycle Market Competitive Landscape:

The Global Electronic Fuel Injection Motorcycle Market is moderately consolidated, with key players such as Robert Bosch GmbH, Denso Corporation, Keihin Corporation, Mikuni Corporation, and Continental AG leading through technological innovation and strong OEM partnerships. Major motorcycle manufacturers like Honda, Yamaha, Suzuki, and BMW Motorrad are increasingly adopting EFI systems to meet emission standards and enhance performance. Continuous R&D, product upgrades, and strategic collaborations remain central strategies as companies compete to deliver efficient, high-performance, and eco-friendly motorcycle technologies.

Key Players:

- Robert Bosch GmbH

- Denso Corporation

- Keihin Corporation (Hitachi Astemo)

- Mikuni Corporation

- Continental AG

- BorgWarner Inc. (including Delphi technologies)

- Marelli (Magneti Marelli)

- Hitachi Astemo

- NXP Semiconductors

- NGK Spark Plug Co., Ltd.

- Honda Motor Co., Ltd.

- Yamaha Motor Co., Ltd.

- Suzuki Motor Corporation

- Kawasaki Heavy Industries (Motorcycles)

- Harley-Davidson, Inc.

- BMW Motorrad (BMW Group)

- KTM AG

- Triumph Motorcycles Ltd.

- Royal Enfield (Eicher Motors Ltd.)

- Ducati Motor Holding S.p.A.

Recent Development

- In January 2025, Honda unveiled a new design concept expanding its GX Series engines with the iGX400 and iGX430 models. These engines featured smart fuel-injection (FI) and an integrated Self-Tuning Regulator (STR) governor with ECU-driven drive-by-wire control, enhancing adaptability, productivity, and serviceability for commercial applications. The introduction of such advanced EFI technology reinforced global confidence in electronic fuel injection systems, driving innovation and adoption in the motorcycle market by highlighting efficiency, customization, and performance benefits.

- In January 2025, Suzuki Motor Corporation unveiled three new models, including its first global strategic battery EV for motorcycles, the all-new e-ACCESS, alongside the all-new ACCESS and the bioethanol-fueled GIXXER SF250. Produced by Suzuki Motorcycle India Private Limited, these launches highlighted Suzuki’s commitment to alternative fuels and advanced powertrains, boosting global interest in electronic fuel injection systems by promoting efficiency, emission reduction, and innovation in motorcycle technology.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary driver is the global move towards stricter emission standards (like Euro 6 or Bharat Stage VI), which carbureted engines often fail to meet. EFI systems deliver fuel more precisely, significantly reducing harmful pollutants and increasing fuel efficiency. This technological advantage, combined with growing consumer demand for motorcycles with better performance, easier cold starts, and consistent power delivery across varying altitudes and temperatures, is pushing manufacturers worldwide to adopt EFI technology across their entire product range.

Q2. What are the main restraining factors for this market?

The primary constraint is the higher manufacturing cost of EFI systems compared to traditional, inexpensive carburetor systems. This cost differential makes EFI adoption challenging, especially in the crucial low-end and commuter motorcycle segments of price-sensitive markets like India and Southeast Asia. Additionally, EFI systems rely on complex electronics and sensors, requiring specialized tools and trained technicians for maintenance and repair, which can be scarce or expensive in rural and developing regions.

Q3. Which segment is expected to witness high growth?

The Commuter/Standard Motorcycle Segment (typically 125cc to 250cc) is expected to witness the highest growth. While EFI started in high-end sports bikes, environmental regulations are now forcing its adoption into the mass-market commuter segment. As major Asian manufacturers transition millions of entry-level bikes to EFI to meet emission standards, the sheer volume of sales in this segment will generate the fastest overall growth rate, driven purely by regulatory compliance and expanding middle-class markets.

Q4. Who are the top major players for this market?

The market for EFI motorcycles is dominated by global motorcycle manufacturers, but the core EFI technology suppliers also hold significant power. Top vehicle players include Honda Motor Co., Ltd., Bajaj Auto Ltd., and TVS Motor Company Ltd., which are rapidly converting their mass-market fleets to EFI. Key suppliers of the actual EFI systems are often large automotive parts manufacturers such as Robert Bosch GmbH and Delphi Technologies, which provide the electronic control units and fuel injection components.

Q5. Which country is the largest player?

India, within the Asia-Pacific region, is expected to be the largest market player, primarily in terms of volume and mandatory transition. Although North America and Europe led in initial adoption, India's massive domestic market, combined with the stringent and recent implementation of the Bharat Stage VI (BS-VI) emission norms, forced a rapid, mass-scale shift from carburetors to EFI across millions of new two-wheelers sold annually. This regulatory change ensured India became the single largest driver of EFI adoption volumes.

List of Figures

Figure 1: Global Electronic Fuel Injection Motorcycle Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Electronic Fuel Injection Motorcycle Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Electronic Fuel Injection Motorcycle Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Electronic Fuel Injection Motorcycle Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Electronic Fuel Injection Motorcycle Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Electronic Fuel Injection Motorcycle Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Electronic Fuel Injection Motorcycle Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Electronic Fuel Injection Motorcycle Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Electronic Fuel Injection Motorcycle Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Electronic Fuel Injection Motorcycle Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Electronic Fuel Injection Motorcycle Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Electronic Fuel Injection Motorcycle Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Electronic Fuel Injection Motorcycle Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Electronic Fuel Injection Motorcycle Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Electronic Fuel Injection Motorcycle Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Electronic Fuel Injection Motorcycle Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Electronic Fuel Injection Motorcycle Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Electronic Fuel Injection Motorcycle Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Electronic Fuel Injection Motorcycle Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Electronic Fuel Injection Motorcycle Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Electronic Fuel Injection Motorcycle Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Electronic Fuel Injection Motorcycle Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model