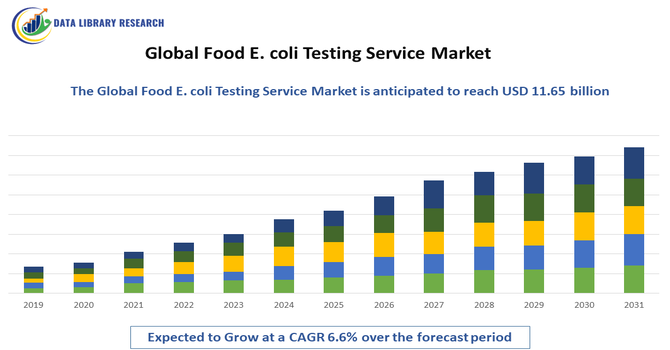

Food E. coli Testing Service Market Overview and Analysis

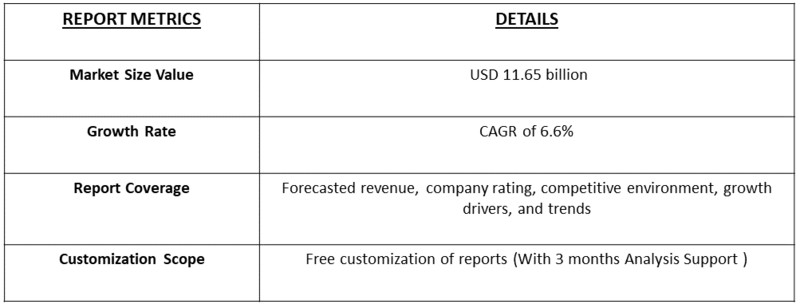

- The Global Food E. coli Testing Service Market is currently valued at around USD 2.1 billion in 2025 and is projected to reach 11.65 billion in 2032, growing with a Compound Annual Growth Rate (CAGR) of approximately 6.6%, from 2025 to 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Food E. coli Testing Service Market is primarily driven by the rising incidence of foodborne illnesses, which has increased the urgency for rigorous microbial testing across the food supply chain. Stricter food safety regulations, mandatory pathogen testing protocols, and heightened surveillance by international food safety authorities are further accelerating demand. Growing consumer awareness of contamination risks and the expansion of processed and packaged food industries are intensifying the need for routine E. coli screening.

Food E. coli Testing Service Market Latest Trends

The Global Food E. coli Testing Service Market is increasingly shaped by rapid and portable testing technologies, with PCR-based and biosensor methods enabling faster and more on-site detection of E. coli in food products, significantly cutting turnaround times and improving responsiveness in food processing environments. There is also a strong trend toward laboratory automation and high-throughput platforms that enhance efficiency and reduce human error in pathogen screening. Additionally, point-of-care and mobile testing solutions are gaining traction, allowing food manufacturers to conduct real-time testing at critical control points along the supply chain, aligning with stricter food safety regulations and rising consumer demand for contamination-free food products.

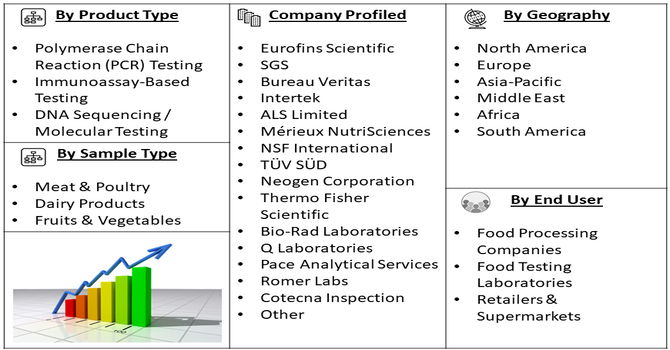

Segmentation: Global Food E.coli Testing Service Market is segmented By Test Type (Polymerase Chain Reaction (PCR) Testing, Immunoassay-Based Testing, DNA Sequencing / Molecular Testing), Sample Type (Meat & Poultry, Dairy Products, Fruits & Vegetables), End-User (Food Processing Companies, Food Testing Laboratories, Retailers & Supermarkets), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Incidence of Foodborne Illnesses and Outbreaks

The increasing number of global foodborne disease outbreaks linked to E. coli contamination is a major driver accelerating the demand for testing services. Contaminated meat, dairy, fresh produce, and ready-to-eat foods frequently contribute to large-scale public health risks, prompting both manufacturers and regulators to enforce strict microbial monitoring. As consumers become more aware of contamination hazards, food companies are under growing pressure to implement routine E. coli testing to avoid product recalls, economic losses, and brand damage. This heightened focus on preventing contamination across the supply chain significantly boosts market growth.

- Stricter Government Regulations and Food Safety Compliance Requirements

Governments and international regulatory bodies, such as the FDA, EFSA, and WHO, have intensified standards focusing on pathogen detection in food production and distribution. Mandatory microbial testing policies, Hazard Analysis and Critical Control Point (HACCP) protocols, and import/export compliance requirements compel food companies to adopt reliable E. coli testing services. These stringent standards are particularly crucial for high-risk food categories such as meat, dairy, and raw vegetables. With regulatory frameworks continuing to tighten globally, food manufacturers increasingly rely on accredited testing laboratories and advanced diagnostic technologies, driving consistent market demand.

Market Restraints:

- High Cost of Advanced Testing Technologies and Services

The adoption of advanced molecular diagnostic tools—such as PCR, DNA sequencing, and rapid biosensor-based methods—requires significant investment in infrastructure, skilled personnel, and maintenance. Smaller food producers, particularly in developing regions, often struggle to afford regular E. coli testing due to high service fees and equipment costs. Additionally, accredited laboratory testing can be time-consuming and expensive for companies managing large sample volumes. These cost-related challenges limit widespread adoption of comprehensive microbial testing programs, thereby restraining market expansion in cost-sensitive sectors.

Socioeconomic Impact on the Food E. coli Testing Service Market

The Global Food E. coli Testing Service Market has significant socioeconomic implications by enhancing public health, reducing foodborne illness outbreaks, and improving consumer confidence in food safety. Early detection and monitoring of E. coli contamination help prevent hospitalizations, lower healthcare costs, and reduce productivity losses associated with foodborne diseases. The market also generates employment opportunities in laboratory testing, quality assurance, and regulatory compliance, particularly in regions with large food processing and export sectors. Furthermore, stringent food safety regulations and testing standards enable producers to access international markets, supporting trade and economic growth. Overall, the expansion of E. coli testing services contributes to safer food supply chains, better public health outcomes, and sustainable economic development globally.

Segmental Analysis:

- Polymerase Chain Reaction (PCR) Testing segment is expected to witness highest growth over the forecast period

PCR testing remains the most preferred method due to its high sensitivity, rapid turnaround time, and ability to detect even low levels of E. coli contamination. Its capability to identify specific pathogenic strains such as E. coli O157:H7 makes it essential for compliance with stringent regulatory requirements. As food manufacturers increasingly adopt rapid and reliable diagnostic tools, PCR testing continues to dominate due to its accuracy and suitability for high-throughput laboratory environments.

- Meat & Poultry segment is expected to witness highest growth over the forecast period

The meat and poultry segment accounts for a major share of testing demand because these products present the highest risk for E. coli contamination during slaughtering, processing, storage, and transportation. Outbreaks linked to undercooked or improperly handled meat have prompted mandatory microbial testing protocols across many countries. This strengthens the need for consistent and robust testing services, particularly for export-oriented meat producers who must meet strict international standards.

- Food Processing Companies segment is expected to witness highest growth over the forecast period

Food processing companies form the largest end-user group, driven by their need to maintain product safety, meet regulatory requirements, prevent costly recalls, and ensure brand protection. These companies conduct frequent testing at multiple points in the supply chain, from raw material inspection to final product validation. Increasing automation in food processing facilities also supports integration with advanced E. coli testing methods.

- North America segment is expected to witness highest growth over the forecast period

North America leads the market due to its well-established food safety infrastructure, stringent regulations enforced by the FDA and USDA, and high awareness among manufacturers and consumers. For instance, in January 2025, The FDA cleared Qiagen’s targeted syndromic multiplex qPCR panel for gastrointestinal infections. The FDA’s clearance of Qiagen’s targeted syndromic multiplex qPCR panel for gastrointestinal infections provided a powerful tool for accurate, rapid E. coli detection. This regulatory approval validated advanced molecular testing technologies, encouraging healthcare and food safety sectors to adopt more sensitive and specific diagnostic methods, significantly propelling the global E. coli testing service market forward.

Similarly, in March 2024, Hygiena’s BAX System Real-Time PCR assay for E. coli O157:H7/NM gained Compendium of Analytical Methods approval. Hygiena’s BAX System Real-Time PCR assay receiving Compendium of Analytical Methods approval for E. coli O157:H7/NM reinforced confidence in real-time PCR testing. This endorsement enhanced market credibility, leading to wider acceptance of Hygiena’s technology and increased adoption of rapid, reliable testing methods, thereby driving expansion and innovation within the global food E. coli testing market.

The region has a dense network of accredited laboratories and widespread adoption of rapid molecular testing technologies. Frequent outbreaks and strong compliance-driven testing requirements further contribute to the region’s dominant market position.

To Learn More About This Report - Request a Free Sample Copy

Food E. coli Testing Service Market Competitive Landscape

The Global Food E. coli Testing Service Market is competitive and evolving, led by large multinational testing & inspection firms, specialized microbiology laboratories, and innovative diagnostics companies. Key players differentiate through accreditation, geographic reach, rapid testing capabilities (PCR, biosensors), on-site testing services, and digital traceability integrations. Strategic moves—such as capacity expansion, partnerships with food processors and retailers, and investments in automated, high-throughput platforms—are common as firms race to shorten turnaround times and meet tightening regulatory standards worldwide.

Key Players:

- Eurofins Scientific

- SGS

- Bureau Veritas

- Intertek

- ALS Limited

- Mérieux NutriSciences

- NSF International

- TÜV SÜD

- Neogen Corporation

- Thermo Fisher Scientific

- Bio-Rad Laboratories

- Q Laboratories

- Pace Analytical Services

- Romer Labs

- Cotecna Inspection

- Element Materials Technology

- Microbac Laboratories

- Campden BRI

- FoodChain ID

- DNV

Recent Development

- In April 2025, E. coli detected in water samples at Anjara Homes, Greater Noida, India, leading to over 400 cases of gastrointestinal illness. The detection of E. coli contamination in water samples at Anjara Homes, Greater Noida, causing over 400 gastrointestinal illness cases, highlighted the urgent need for enhanced testing services. This incident underscored vulnerabilities in water safety, driving increased demand for reliable E. coli testing solutions globally to prevent outbreaks and ensure food and water safety, thereby expanding the market.

- In February 2025, bioMérieux received FDA clearance for the BIOFIRE FILMARRAY Gastrointestinal Panel Mid, delivering 11-target results in about 1 hour. BioMérieux’s FDA clearance of the BIOFIRE FILMARRAY Gastrointestinal Panel Mid, capable of delivering 11-target results in approximately one hour, accelerated the adoption of rapid, multiplex E. coli testing technologies. This breakthrough enhanced diagnostic efficiency, enabling faster outbreak detection and response, thereby boosting demand and growth within the global food E. coli testing service market.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary driver is the rising incidence of foodborne illness outbreaks linked to pathogenic E. coli strains globally. Governments are constantly enacting stricter food safety regulations, such as the U.S. FDA’s rules, which mandate frequent testing across meat, produce, and water supply chains. Technological advances, offering rapid and precise molecular testing, also support market expansion.

Q2. What are the main restraining factors for this market?

The high cost of advanced testing equipment and services poses a significant barrier, especially for small-to-medium food processors in developing economies. Furthermore, the requirement for highly skilled technical personnel to operate sophisticated molecular diagnostic instruments, combined with the lack of standardization across global testing procedures, slows down adoption.

Q3. Which segment is expected to witness high growth?

The Polymerase Chain Reaction (PCR) Testing segment is expected to witness the highest growth over the forecast period due to its high sensitivity and accuracy in detecting pathogens. Rising foodborne illness outbreaks, stringent regulatory requirements, and increasing demand for rapid and reliable seafood safety testing are driving widespread adoption of PCR-based methods.

Q4. Who are the top major players for this market?

The market is dominated by major global diagnostic and testing firms. Key players include Thermo Fisher Scientific Inc., bioMérieux SA, and Bio-Rad Laboratories, Inc. These companies provide comprehensive solutions, ranging from traditional culture media to advanced molecular methods like Polymerase Chain Reaction (PCR) and immunoassay testing kits.

Q5. Which country is the largest player?

North America, led overwhelmingly by the United States, is the largest regional market by revenue. This dominance is due to well-established, stringent federal regulations (FDA mandates), a highly advanced public health surveillance system, and high consumer awareness and demand for tested, safe food products throughout the entire supply chain.

List of Figures

Figure 1: Global Food E. coli Testing Service Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Food E. coli Testing Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Food E. coli Testing Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Food E. coli Testing Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Food E. coli Testing Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Food E. coli Testing Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Food E. coli Testing Service Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Food E. coli Testing Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Food E. coli Testing Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Food E. coli Testing Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Food E. coli Testing Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Food E. coli Testing Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Food E. coli Testing Service Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Food E. coli Testing Service Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Food E. coli Testing Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Food E. coli Testing Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Food E. coli Testing Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Food E. coli Testing Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Food E. coli Testing Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Food E. coli Testing Service Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Food E. coli Testing Service Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Food E. coli Testing Service Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Food E. coli Testing Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Food E. coli Testing Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Food E. coli Testing Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Food E. coli Testing Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Food E. coli Testing Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Food E. coli Testing Service Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Food E. coli Testing Service Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Food E. coli Testing Service Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Food E. coli Testing Service Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Food E. coli Testing Service Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Food E. coli Testing Service Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Food E. coli Testing Service Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Food E. coli Testing Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Food E. coli Testing Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Food E. coli Testing Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Food E. coli Testing Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Food E. coli Testing Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Food E. coli Testing Service Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Food E. coli Testing Service Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Food E. coli Testing Service Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Food E. coli Testing Service Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Food E. coli Testing Service Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Food E. coli Testing Service Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Food E. coli Testing Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Food E. coli Testing Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Food E. coli Testing Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Food E. coli Testing Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Food E. coli Testing Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Food E. coli Testing Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Food E. coli Testing Service Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Food E. coli Testing Service Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Food E. coli Testing Service Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Food E. coli Testing Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model