Heat Treatment Solution for Wind Industry Market Overview and Analysis

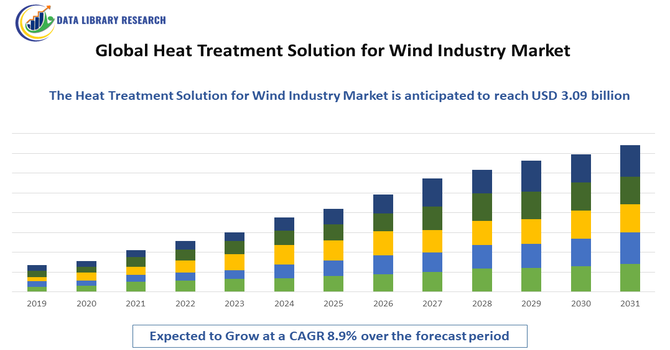

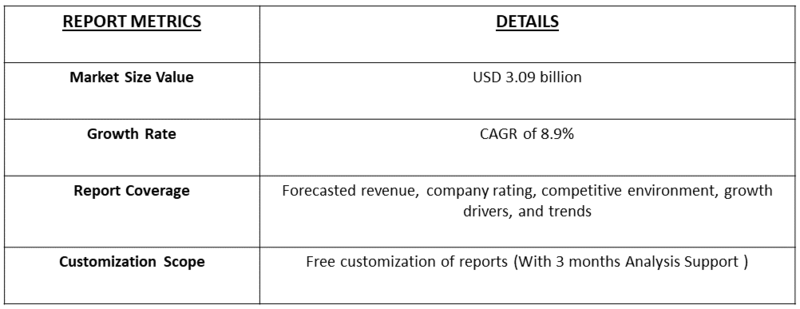

- The Global Heat Treatment Solution for Wind Industry Market size was valued at USD 1.8 billion in 2025 and is projected to reach USD 3.09 billion by 2032, growing with a CAGR of 8.9% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Heat Treatment Solution for Wind Industry Market refers to the specialized thermal processing services and equipment used in producing and maintaining wind turbine components. These solutions—such as quenching, tempering, aging, and annealing—enhance strength, durability and fatigue resistance of materials like gears, shafts, bearings and blades. Widely applied in onshore and offshore wind farms, the market supports the renewable energy sector by ensuring turbine components perform reliably under harsh operational conditions.

Heat Treatment Solution for Wind Industry Market Latest Trends

The global heat-treatment solutions market for the wind industry is seeing increased adoption of advanced processes such as induction hardening, vacuum heat treatment, and laser-based solutions to enhance the lifespan and reliability of turbine components. Automation and IoT-enabled heat-treatment systems are being widely implemented for real-time monitoring and predictive maintenance. With the expansion of offshore wind farms, suppliers are developing specialized solutions to withstand harsh marine environments, driving growth in both onshore and offshore applications.

Segmentation: The Global Heat Treatment Solutions Market Is Segmented by Thermal Processing Equipment (Induction Heating Systems, Furnaces, Heat Treatment Ovens, and Quenching Equipment), Application (Solutions Target Wind Turbine Components, Gearboxes, Bearings, and Blades), Material Type (Steel, Aluminium, Composite Materials, and Nickel Alloys), Technology Type (Span Traditional Heat Treatment, Vacuum Heat Treatment, Continuous Heat Treatment, and Integrative Systems) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Increasing Global Wind Energy Investments

The Global Heat Treatment Solutions market for the wind industry is primarily driven by the rising investments in wind energy infrastructure worldwide. As nations pursue renewable energy targets and decarbonization agendas, the demand for durable, high-performance wind turbines is increasing. Heat treatment solutions, such as induction hardening and vacuum processing, enhance the strength, fatigue resistance, and lifespan of critical components like gears, shafts, and bearings. This ensures reliable operation under harsh environmental conditions, including offshore installations. Additionally, growing adoption of larger turbines and offshore wind farms requires advanced thermal processing technologies to maintain component integrity, driving significant market growth and encouraging manufacturers to invest in innovative heat-treatment systems.

- Need for Component Durability and Operational Efficiency

The demand for long-lasting, maintenance-efficient turbine components is accelerating the adoption of heat treatment solutions. Wind turbine gears, shafts, and bearings are subjected to continuous mechanical stress and extreme weather, making high-strength, fatigue-resistant components essential. Heat treatment processes improve material properties, reduce failure rates, and extend component lifespan, minimizing operational downtime and maintenance costs for wind-farm operators. Furthermore, technological advancements like automated, IoT-enabled, and vacuum-based heat-treatment systems enable precise control over thermal cycles, ensuring consistent quality and reliability.

Market Restraint

- High Capital Investment and Technical Complexity

A major restraint for the global heat treatment solutions market in the wind industry is the high initial cost and technical complexity of implementation. Advanced heat-treatment systems, such as induction furnaces, vacuum chambers, and laser-based equipment, require significant capital expenditure, limiting adoption among small and medium-sized manufacturers. Additionally, these systems demand specialized technical expertise for installation, operation, and maintenance, increasing operational costs. Integration with existing manufacturing lines can also pose challenges, while continuous process monitoring and software updates are necessary for consistent quality.

Socio Economic Impact on Heat Treatment Solution for Wind Industry Market

Heat-treatment solutions for the wind industry support renewable energy expansion, generating jobs in manufacturing, installation, and maintenance of turbines. By improving durability of components like shafts, gears, and bearings, these solutions reduce maintenance costs, minimize downtime, and lower the levelized cost of energy. Enhanced turbine reliability also decreases waste and extends operational lifespans, contributing to sustainability goals. Collectively, these benefits strengthen energy security, foster industrial growth, and create positive socioeconomic effects across regional supply chains.

Segmental Analysis:

- Quenching Equipment Segment is Expected to Witness Significant Growth Over the Forecast Period

The quenching equipment segment is expected to witness substantial growth over the forecast period due to increasing demand for high-strength and fatigue-resistant wind turbine components. Quenching processes enhance material hardness and durability, which is critical for gearboxes, shafts, and bearings operating under continuous mechanical stress. Advances in automated quenching systems and temperature-controlled solutions are improving efficiency, precision, and consistency of treated components. Additionally, the growing adoption of large-scale onshore and offshore wind projects worldwide is driving demand for advanced thermal processing equipment, positioning quenching systems as essential tools to meet industry requirements for reliability, longevity, and maintenance reduction in turbine operations.

- Gearboxes Segment is Expected to Witness Significant Growth Over the Forecast Period

The gearbox segment is anticipated to witness significant growth due to its critical role in wind turbine operation, converting low-speed rotor motion into high-speed generator output. Gearboxes experience extreme mechanical stress, necessitating advanced heat treatment solutions such as induction hardening, tempering, and quenching to improve component strength and durability. Increasing global investments in onshore and offshore wind energy, coupled with the trend of larger, high-capacity turbines, is driving demand for robust gearboxes. Manufacturers are increasingly adopting precision thermal processing technologies to ensure long operational lifespans, reduce maintenance frequency, and enhance overall efficiency of turbine systems, bolstering growth in this segment.

- Steel Segment is Expected to Witness Significant Growth Over the Forecast Period

The steel segment is projected to witness notable growth over the forecast period as steel remains the primary material for wind turbine components, including shafts, bearings, and structural parts. Its high tensile strength, machinability, and compatibility with thermal treatments make it ideal for heat treatment processes such as quenching, annealing, and surface hardening. Rising demand for durable and high-performance components in both onshore and offshore wind farms is fueling the adoption of steel-based solutions. Advanced heat treatment techniques are enhancing steel properties, enabling turbines to withstand mechanical stress and harsh environmental conditions, thus driving market growth in this segment.

- Vacuum Heat Treatment Segment is Expected to Witness Significant Growth Over the Forecast Period

The vacuum heat treatment segment is expected to grow significantly due to its ability to provide high-precision thermal processing without oxidation, scaling, or contamination. This technology is especially beneficial for critical wind turbine components such as gearboxes, bearings, and shafts, where material integrity and surface quality are essential. Vacuum heat treatment ensures uniform hardness, improved fatigue resistance, and extended component life. The increasing demand for offshore and high-capacity turbines, where reliability is paramount, is accelerating adoption. Manufacturers are investing in vacuum systems to achieve consistent quality, reduce rework, and meet stringent performance standards, driving growth of this segment.

- Asia-Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

The Asia-Pacific region is expected to witness the highest growth in the heat treatment solutions market for the wind industry due to rapid expansion of wind energy infrastructure. Countries such as China, India, and Japan are heavily investing in both onshore and offshore wind farms to meet renewable energy targets and reduce carbon emissions. The rising number of turbine installations, coupled with increasing manufacturing capabilities in the region, is driving demand for thermal processing equipment and services. Additionally, the adoption of advanced technologies, government incentives, and the presence of regional heat treatment solution providers are supporting market expansion in Asia-Pacific over the forecast period.

To Learn More About This Report - Request a Free Sample Copy

Heat Treatment Solution for Wind Industry Market Competitive Analysis

The market features a mix of global and regional players offering specialized heat-treatment solutions for wind turbines. Leading companies are investing in high-capacity furnaces, vacuum systems, and automation technologies to meet increasing demand, especially from offshore wind projects. Regional manufacturers are gaining traction by offering cost-effective and customized solutions, intensifying competition. Companies differentiate through technological innovation, service quality, and capacity expansion, while collaborations and strategic partnerships help strengthen market presence and address evolving industry requirements.

The major players for above market are:

- SECO/WARWICK S.A.

- Ipsen International Holding GmbH

- Aichelin Group

- Bodycote plc

- Shanghai Heatking Induction Technology Co., Ltd.

- SAET Group S.p.A.

- EFD Induction A/S

- Inductoheat, Inc.

- Thermal Technologies, Inc.

- Luoyang Shining Induction Heating Co., Ltd.

- Hind High Vacuum Co., Ltd.

- Mitsubishi Electric Corporation

- Siemens AG

- GE Renewable Energy

- Rexnord Corporation

- SMS Group GmbH

- Tesa SE

- Baker Hughes Company

- Gauss MR Co., Ltd.

- AFC Holcroft, Inc.

Recent Development

- In January 2025, SLB and geothermal developer Star Energy Geothermal finalized a collaboration agreement to accelerate advanced technologies for geothermal asset development. The partnership combined Star Energy's extensive field knowledge with SLB's technology expertise, aiming to deploy solutions that successfully shifted the economics of conventional projects and improved asset recovery rates globally. The initiative, focused purely on subsurface heat extraction, exerted negligible direct effect on the distinct Global Heat Treatment Solution for Wind Industry Market, which remained driven by wind turbine manufacturing demands.

- In March 2022, SKF developed a new high-durability roller bearing for wind turbine gearboxes, offering industry-leading bearing rating life and reducing downtime and maintenance. The bearing utilized a tailored combination of steel and an advanced thermochemical heat treatment process to enhance fatigue resistance, surface integrity, and subsurface robustness. This innovation highlighted the critical role of specialized heat treatment in improving component reliability, driving demand for advanced thermal processing solutions and positively impacting the global heat treatment solutions market for the wind industry.

Frequently Asked Questions (FAQ) :

Q1. What the main growth driving factors for this market?

The market is primarily driven by the massive global expansion of the wind energy sector, both onshore and, increasingly, offshore. Favorable government policies, renewable energy targets, and the necessity to reduce carbon emissions are fueling wind farm development. Since wind turbine components—especially large parts like gearboxes, main shafts, and bearings—must withstand extreme fatigue and harsh weather for decades, there is a non-negotiable demand for high-quality heat treatment processes (like hardening and tempering). This ensures the material strength, durability, and operational lifespan of critical components.

Q2. What are the main restraining factors for this market?

One key restraining factor is the high capital investment and operational cost associated with advanced heat treatment equipment, such as large, specialized vacuum or controlled-atmosphere furnaces required for massive wind components. Additionally, the volatility of energy costs significantly impacts operational expenses, as heat treatment is an energy-intensive process. There is also a challenge in maintaining the fragmented global supply chain and adhering to increasingly strict quality and environmental regulations regarding furnace emissions and process control, which can slow down market expansion.

Q3. Which segment is expected to witness high growth?

The Offshore Wind Component Heat Treatment segment is expected to witness high growth. Offshore turbines are significantly larger and operate in much harsher, corrosive environments, demanding components with superior fatigue resistance and material integrity. This translates to an urgent need for the most advanced and precise heat treatment processes, such as vacuum carburizing and specialized nitriding, to meet extremely high quality specifications. Massive investment in new, deep-sea offshore projects globally is fueling this segment's demand for high-performance thermal processing.

Q4. Who are the top major players for this market?

The market is led by major industrial furnace and thermal processing service providers. Top players include Bodycote plc (a global leader in heat treatment services), SECO/WARWICK S.A., and Ipsen International GmbH (known for their advanced furnace equipment). These companies offer specialized solutions like vacuum and atmosphere furnaces crucial for large wind components. Their competitiveness is based on meeting the stringent quality standards of wind turbine manufacturers like Vestas and Siemens Gamesa and integrating Industry 4.0 automation for precise process control.

Q5. Which country is the largest player?

The Asia-Pacific (APAC) region, with China as its core driver, is the largest market player in terms of volume and installed wind capacity. China's massive, state-backed investment in domestic wind turbine manufacturing (like Goldwind and Mingyang) and rapid power grid expansion drives huge demand for heat-treated components. However, Europe (led by Germany and Spain) remains highly significant in terms of advanced technology and high-value components, as it hosts major global wind industry leaders and has pioneered stringent quality standards for both onshore and offshore projects.

List of Figures

Figure 1: Global Heat Treatment Solution for Wind Industry Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Heat Treatment Solution for Wind Industry Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Heat Treatment Solution for Wind Industry Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Heat Treatment Solution for Wind Industry Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Heat Treatment Solution for Wind Industry Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Heat Treatment Solution for Wind Industry Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Heat Treatment Solution for Wind Industry Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Heat Treatment Solution for Wind Industry Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Heat Treatment Solution for Wind Industry Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Heat Treatment Solution for Wind Industry Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Heat Treatment Solution for Wind Industry Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Heat Treatment Solution for Wind Industry Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Heat Treatment Solution for Wind Industry Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Heat Treatment Solution for Wind Industry Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Heat Treatment Solution for Wind Industry Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Heat Treatment Solution for Wind Industry Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Heat Treatment Solution for Wind Industry Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Heat Treatment Solution for Wind Industry Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Heat Treatment Solution for Wind Industry Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Heat Treatment Solution for Wind Industry Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Heat Treatment Solution for Wind Industry Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Heat Treatment Solution for Wind Industry Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model