Hydropower Stew Pot Market Overview and Analysis:

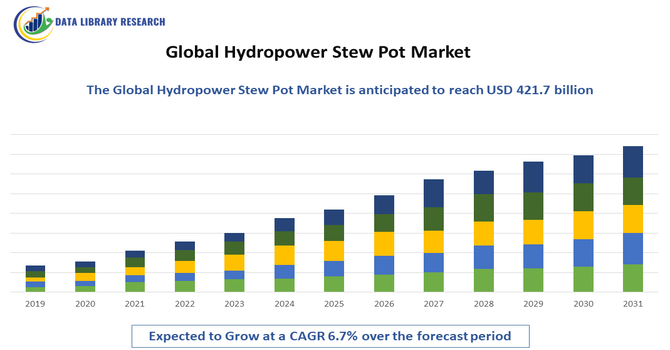

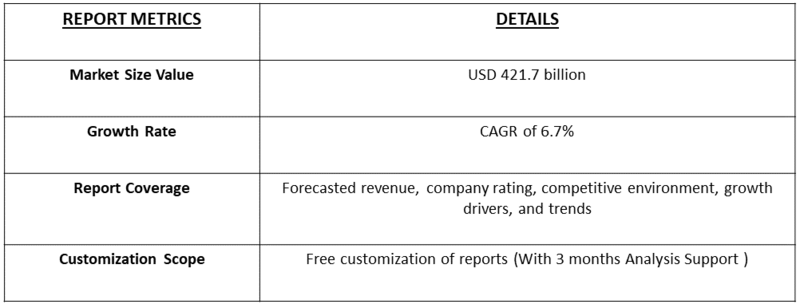

- The Global Hydropower Market was valued at approximately USD 265 billion in 2025 and is projected to reach over USD 421.7 billion by 2035. This market is forecasted to grow at a Compound Annual Growth Rate (CAGR) generally estimated to be between 6.7%, 2025-2032 driven by increasing global demand for clean energy.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Hydropower Market is being driven by a sustained increase in global electricity demand, especially as populations grow and economies expand — hydropower remains a stable, large scale source of renewable energy that helps meet rising power needs while enhancing energy security. Additionally, renewed focus on environmental sustainability and reduction of carbon emissions is pushing many countries to shift away from fossil fuel based generation and invest heavily in hydropower infrastructure.

Hydropower Stew Pot Market Latest Trends:

The global hydropower market is experiencing a surge in both conventional and pumped-storage hydropower capacity, with significant additions in recent years enhancing energy generation and storage capabilities. There is increasing integration of hydropower with solar and wind energy, leveraging pumped-storage systems to balance intermittent renewable generation and provide grid flexibility. Digitalization is another key trend, with utilities adopting IoT-enabled monitoring, real-time sensors, and AI-driven predictive maintenance to optimize turbine performance and forecast water availability. Additionally, small-scale and decentralized hydropower projects are gaining attention, particularly for rural electrification and enhancing local energy resilience.

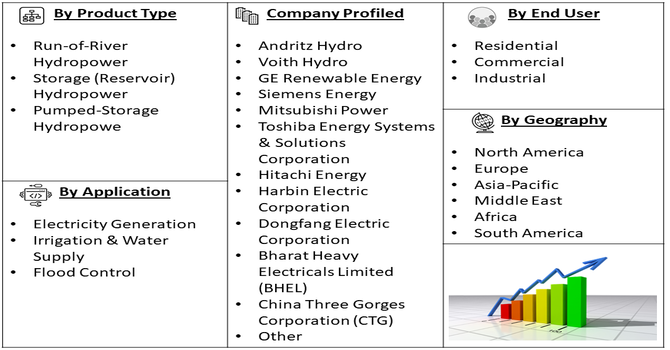

Segmentation: Global Hydropower Stew Pot Market is segmented By Type (Run-of-River Hydropower, Storage (Reservoir) Hydropower, Pumped-Storage Hydropower), Capacity (Small-Scale Hydropower, Medium-Scale Hydropower, Large-Scale Hydropower), Application (Electricity Generation, Irrigation & Water Supply, Flood Control), End-Use Industry (Residential, Commercial, Industrial), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Growing Global Demand for Renewable and Reliable Energy

A primary driver of the Global Hydropower Market is the increasing worldwide demand for electricity, especially from renewable and sustainable sources. As populations grow, urbanization accelerates, and industrialization expands, energy consumption rises significantly. Hydropower provides a stable, large-scale, and renewable source of electricity, capable of meeting base-load requirements while reducing reliance on fossil fuels. Its ability to generate consistent power with low greenhouse gas emissions makes it a preferred choice for governments and utilities aiming to achieve energy security, support economic growth, and meet international climate and sustainability targets.

- Technological Advancements and Grid Integration

Technological innovations are significantly driving hydropower adoption. Modern turbine designs, improved control systems, and smart grid integration have enhanced efficiency, flexibility, and operational performance of hydropower plants. Pumped-storage hydropower (PSH) in particular is gaining importance as a tool for grid stabilization, providing long-duration energy storage to balance intermittent generation from solar and wind sources. The integration of IoT-based monitoring, AI-driven predictive maintenance, and real-time water management systems further optimizes plant performance, reduces downtime, and minimizes operational costs, boosting investor confidence and facilitating new hydropower projects globally.

Market Restraints

- High Initial Capital Investment

A significant restraint for the Global Hydropower Market is the high upfront cost required for the construction and development of hydropower plants. Building dams, reservoirs, and associated infrastructure demands substantial financial investment, which can be a barrier, particularly in developing countries or regions with limited funding. Additionally, long project timelines and the need for extensive feasibility studies, land acquisition, and regulatory approvals can delay returns on investment. These high capital requirements often make hydropower projects less attractive compared to other renewable energy sources such as solar or wind, which typically have lower installation costs and shorter payback periods.

Socioeconomic Impact on Hydropower Stew Pot Market

The global hydropower market drives significant socioeconomic benefits by providing reliable, renewable electricity, particularly in rural and underserved regions, enabling schools, healthcare facilities, and businesses to function efficiently. It reduces dependence on fossil fuels, lowers energy costs, and promotes sustainable economic growth. Hydropower projects create employment during construction, operation, and maintenance phases while improving infrastructure such as roads, water management, and local services. By stimulating local economies, enhancing energy security, and supporting environmental sustainability, hydropower contributes to higher living standards, long-term community development, and national progress, making it a critical component of clean energy transitions worldwide.

Segmental Analysis:

- Pumped-Storage Hydropower segment is expected to witness the highest growth over the forecast period

Pumped-storage hydropower (PSH) is increasingly important for grid stabilization and energy storage, allowing electricity to be stored during low-demand periods and dispatched during peak demand. This technology is vital for integrating intermittent renewable sources like solar and wind, providing long-duration energy storage and ensuring reliable electricity supply. PSH plants are being prioritized in modern energy strategies due to their flexibility, scalability, and ability to balance grid fluctuations efficiently.

- Large-Scale Hydropower (>100 MW) segment is expected to witness the highest growth over the forecast period

Large-scale hydropower plants contribute the majority of hydropower generation globally due to their ability to produce massive amounts of electricity to meet base-load demands. These projects, often involving extensive dams and reservoirs, are key for national energy security and industrial power supply. Large-scale installations benefit from economies of scale and are attractive for governments seeking sustainable, long-term energy solutions.

- Electricity Generation segment is expected to witness the highest growth over the forecast period

Electricity generation remains the primary application for hydropower, providing renewable, low-emission power to residential, commercial, and industrial consumers. Hydropower supports energy grids with stable base-load power while complementing intermittent renewables, making it essential for meeting increasing electricity demand sustainably.

- Industrial segment is expected to witness the highest growth over the forecast period

The industrial sector heavily relies on hydropower for large-scale operations due to its ability to provide stable and continuous electricity. Industries such as manufacturing, mining, and chemical processing benefit from hydropower’s cost-effectiveness, reliability, and lower environmental impact compared to fossil-fuel energy sources.

Moreover, hydropower supports the industrial sector by enabling energy-intensive operations to run efficiently and without interruption. Its scalability allows industries to adjust power supply according to demand, reducing operational costs and enhancing productivity. The sustainable nature of hydropower also helps companies meet environmental regulations and corporate sustainability goals, fostering greener industrial practices. By providing a consistent and clean energy source, hydropower strengthens competitiveness, encourages investment in industrial expansion, and promotes long-term economic stability, while simultaneously contributing to national energy security and reducing dependence on non-renewable resources.

- Asia-Pacific region is expected to witness the highest growth over the forecast period

The Asia-Pacific region is expected to witness the highest growth in the global hydropower market over the forecast period due to rapid industrialization, increasing energy demand, and substantial investments in renewable energy infrastructure. Countries such as China, India, and Southeast Asian nations are actively expanding hydropower capacity to meet growing electricity needs, reduce carbon emissions, and achieve sustainable development goals.

Government incentives, supportive policies, and large-scale projects are accelerating adoption, while technological advancements in turbine efficiency and grid integration enhance project feasibility. Additionally, rural electrification programs and rising industrial and commercial power consumption are driving demand. The region’s abundant water resources, coupled with strong economic growth, position Asia-Pacific as the fastest-growing hydropower market globally.

To Learn More About This Report - Request a Free Sample Copy

Hydropower Stew Pot Market Competitive Landscape

The global hydropower market is highly competitive and vertically integrated, comprising heavy-equipment OEMs, EPC contractors, utility developers, and specialist service providers. Competition centers on turbine and generator technology, turnkey project delivery, plant modernization and refurbishment, pumped-storage expertise, and long-term O&M/service contracts. Key strategies include technological innovation (higher-efficiency turbines, digitalization/IoT, predictive maintenance), strategic partnerships or acquisitions to secure regional pipeline access, and financing solutions to address large capital requirements. As markets mature, vendors increasingly compete on lifecycle value — offering retrofit, hybridization with other renewables, and grid-integration services to capture more stable, long-term revenue streams.

The major players for above market are:

- Andritz Hydro

- Voith Hydro

- GE Renewable Energy

- Siemens Energy

- Mitsubishi Power

- Toshiba Energy Systems & Solutions Corporation

- Hitachi Energy

- Harbin Electric Corporation

- Dongfang Electric Corporation

- Bharat Heavy Electricals Limited (BHEL)

- China Three Gorges Corporation (CTG)

- Hydro-Québec

- Statkraft

- EDF Renewables

- Iberdrola

- Acciona Energía

- Kawasaki Heavy Industries

- KSB SE & Co. KGaA

Sembcorp Industries

- Wärtsilä Corporation

Recent Development

- In November 2025, India’s hydropower sector revived, becoming a key component of its clean-energy framework by supporting peak demand and long-duration storage amid growing solar and wind capacity. By FY2025-26, ~50 GW of large hydro existed, with Parbati-II (800 MW) fully operational and Lower Subansiri (2,000 MW) entering wet commissioning.

- In June 2025, GE Vernova Inc. commissioned the first of four 250 MW variable-speed units at THDC India’s Tehri Pumped Storage Hydropower Plant. With this 1 GW expansion, the complex reached 2.4 GW, becoming India’s largest hydropower facility, while its reservoir provided irrigation and drinking water support in Uttarakhand during non-monsoon periods.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The growth is fueled by the global push for clean, reliable renewable energy to replace fossil fuels. Hydropower's key strength is its flexibility, especially pumped storage, which supports inconsistent solar and wind power. Government mandates and funding for sustainable infrastructure heavily drive investment and market expansion.

Q2. What are the main restraining factors for this market?

The primary hurdle is the massive initial capital investment required for new hydropower projects, coupled with long construction times. Additionally, strict environmental regulations and social concerns about the impact on ecosystems and local communities often delay or completely halt developments.

Q3. Which segment is expected to witness high growth?

The Electricity Generation segment is expected to see the highest growth, driven by massive global energy demand and the push for grid modernization. This expansion includes not just new dam construction, but also retrofitting existing plants for flexible operation, especially pumped storage, which is essential for stabilizing power grids integrating intermittent solar and wind sources.

Q4. Who are the top major players for this market?

Major players are global industrial and engineering firms involved in complex energy infrastructure. Key companies include Voith, ANDRITZ, and General Electric (GE), which specialize in manufacturing the turbines, generators, and control systems crucial for hydro facilities.

Q5. Which country is the largest player?

China is overwhelmingly the largest player globally, both in terms of existing installed capacity and new construction. Their aggressive investment in massive projects, particularly large-scale pumped storage facilities, dominates the worldwide hydropower market share.

List of Figures

Figure 1: Global Hydropower Stew Pot Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Hydropower Stew Pot Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Hydropower Stew Pot Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Hydropower Stew Pot Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Hydropower Stew Pot Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Hydropower Stew Pot Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Hydropower Stew Pot Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Hydropower Stew Pot Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Hydropower Stew Pot Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Hydropower Stew Pot Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Hydropower Stew Pot Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Hydropower Stew Pot Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Hydropower Stew Pot Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Hydropower Stew Pot Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Hydropower Stew Pot Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Hydropower Stew Pot Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Hydropower Stew Pot Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Hydropower Stew Pot Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Hydropower Stew Pot Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Hydropower Stew Pot Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Hydropower Stew Pot Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Hydropower Stew Pot Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Hydropower Stew Pot Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Hydropower Stew Pot Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Hydropower Stew Pot Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Hydropower Stew Pot Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Hydropower Stew Pot Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Hydropower Stew Pot Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Hydropower Stew Pot Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Hydropower Stew Pot Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Hydropower Stew Pot Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Hydropower Stew Pot Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Hydropower Stew Pot Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Hydropower Stew Pot Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Hydropower Stew Pot Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Hydropower Stew Pot Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Hydropower Stew Pot Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Hydropower Stew Pot Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Hydropower Stew Pot Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Hydropower Stew Pot Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Hydropower Stew Pot Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Hydropower Stew Pot Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Hydropower Stew Pot Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Hydropower Stew Pot Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Hydropower Stew Pot Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Hydropower Stew Pot Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Hydropower Stew Pot Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Hydropower Stew Pot Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Hydropower Stew Pot Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Hydropower Stew Pot Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Hydropower Stew Pot Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Hydropower Stew Pot Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Hydropower Stew Pot Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Hydropower Stew Pot Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Hydropower Stew Pot Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model