Infant and Baby Cold Medicine Market Overview and Analysis:

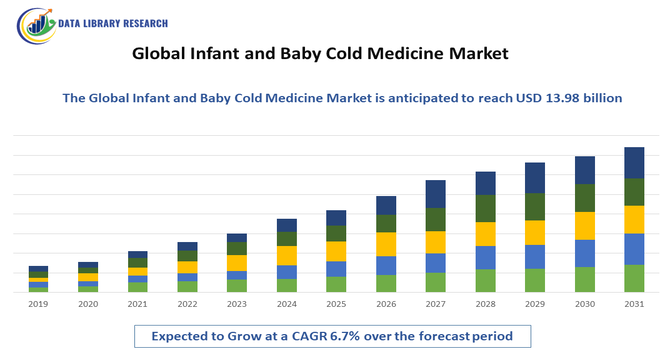

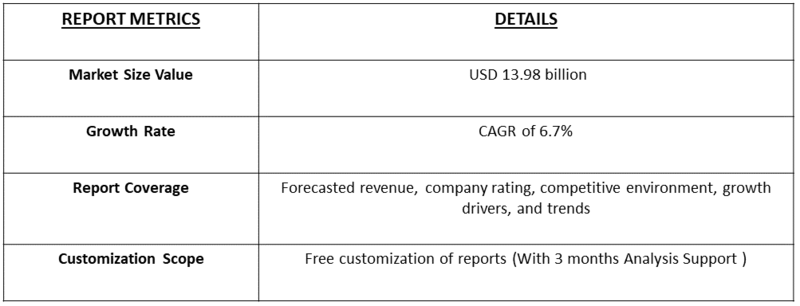

- The Global Infant and Baby Cold Medicine Market will expand from USD 13.98 billion in 2025 to USD 22.5B by 2032, with a CAGR of 6.7% from 2025 to 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Infant and Baby Cold Medicine Market has exhibited steady growth and is shaped by evolving parental preferences, regulatory dynamics, and the prevalence of respiratory ailments among infants and young children. Demand for infant-safe cold remedies is driven by increasing parental awareness of the importance of early symptom management and rising incidence of common cold and related respiratory infections in children with developing immune systems. As caregivers seek effective, safe, and age-appropriate treatments, the market has expanded across both developed and emerging regions, supported by broader healthcare access and comprehensive paediatric healthcare initiatives.

Infant and Baby Cold Medicine Market Latest Trends:

The Global Infant and Baby Cold Medicine Market is currently shaped by several significant and evolving trends that reflect changes in consumer behaviour, technology adoption, and product innovation. One of the most prominent trends is the shift toward natural, gentle, and cleaner formulations. Parents today increasingly prefer products that are sugar-free, alcohol-free, preservative-free, and infused with natural ingredients such as herbal extracts (e.g., elderberry, chamomile) that are perceived as safer and more suitable for infants’ delicate systems — with over 30 % of new product launches in 2024 featuring such ingredients. This movement toward “clean” OTC medicines aligns with broader parental health consciousness and demand for minimal-side-effect remedies.

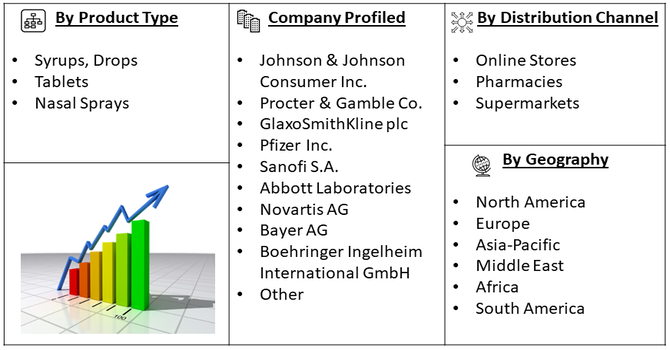

Segmentation: Global Infant and Baby Cold Medicine Market is segmented By Product Type (Syrups, Drops, Tablets, Nasal Sprays), Age Group (0–6 Months, 6–12 Months, 1–2 Years), By Distribution Channel (Online Stores, Pharmacies, Supermarkets), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Incidence of Respiratory Infections Among Infants and Babies

Infants and young children are highly susceptible to common colds, coughs, and mild respiratory infections due to their underdeveloped immune systems. Seasonal changes, increasing air pollution, urban overcrowding, and greater exposure in daycare and early childcare environments have significantly contributed to the rising frequency of such illnesses. This has led to consistent demand for safe, effective, and age-appropriate cold medicines specifically formulated for infants and babies. Parents and caregivers increasingly seek timely symptom relief solutions—such as fever reduction, nasal congestion relief, and cough suppression—to prevent complications and ensure child comfort, thereby driving sustained market growth.

- Growing Parental Awareness and Emphasis on Child Healthcare Safety

Increasing awareness among parents regarding early childhood health management has strongly influenced purchasing behavior in the infant and baby cold medicine market. Caregivers are more informed about pediatric health recommendations and actively seek products that are clinically tested, clearly labeled, and compliant with regulatory standards. This has driven demand for medicines that are free from harmful ingredients such as alcohol, artificial colors, and strong decongestants. Additionally, the rising focus on preventive care, coupled with improved access to pediatric healthcare advice through digital platforms, has encouraged parents to proactively manage mild cold symptoms using trusted OTC and prescription cold medicines, further accelerating market expansion.

Market Restraints:

- Stringent Regulatory Compliance and Safety Concerns

The major restraints in the infant and baby cold medicine market are the complex and strict regulatory environment designed to ensure safety for this vulnerable age group. Regulatory bodies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and other national health authorities impose rigorous standards on product formulation, labeling, and marketing for paediatric use. These regulations often restrict certain active ingredients (e.g., decongestants and antihistamines) for young children due to safety concerns, limiting the range of products that can be approved. Manufacturers must invest substantial time and resources into compliance, including costly safety evaluations, age-appropriate dosage studies, and often lengthy approval cycles, which increase development costs and delay product launches. Additionally, discrepancies in regulatory requirements across regions make it even more challenging for global companies to standardize products, requiring multiple reformulations to meet local safety criteria.

Socioeconomic Impact on Infant and Baby Cold Medicine Market

The Global Infant and Baby Cold Medicine Market has a significant socioeconomic impact by improving child health and reducing the burden of respiratory illnesses among infants. Effective cold medicines help decrease hospital visits and parental work absences, contributing to better family productivity and economic stability. Access to safe and age-appropriate medications enhances the quality of life for infants and the peace of mind for caregivers. Moreover, the market stimulates economic growth through job creation in pharmaceutical manufacturing, distribution, and retail sectors. However, affordability and awareness remain challenges in low-income regions, highlighting the need for equitable healthcare access to maximize positive socioeconomic outcomes worldwide.

Segmental Analysis:

- Syrups segment is expected to witness the highest growth over the forecast period

The syrups segment represents one of the most widely used product forms in the infant and baby cold medicine market due to its ease of administration, palatability, and accurate dosing for young children. Liquid syrups are particularly preferred by caregivers for infants and toddlers who cannot swallow solid dosage forms, making them a staple offering in pediatric cold relief products globally. Syrups often incorporate child-friendly flavours and gentler active ingredients tailored for the sensitive needs of infants.

- 0–6 Months segment is expected to witness the highest growth over the forecast period

The 0–6 months age group constitutes a critical segment within the market as newborns are especially vulnerable to respiratory infections due to immature immune systems. Medicines in this category are formulated with extra caution, often as mild syrups or drops with minimal active ingredients and suitable for the very young. This segment’s importance is underscored by parental preference for clinically tested, safe solutions that align with stringent medical guidelines for newborn care.

- Online Stores segment is expected to witness the highest growth over the forecast period

Online stores are a rapidly growing distribution channel in the infant and baby cold medicine market, offering convenience, home delivery, and greater product variety. The rise of e-commerce has enabled tech-savvy parents to research products, compare brands, read reviews, and purchase age-appropriate cold medicines without visiting physical stores. This channel is particularly influential in urban regions where internet penetration and digital literacy are high, contributing significantly to market expansion.

- North America segment is expected to witness the highest growth over the forecast period

North America stands as a leading regional market for infant and baby cold medicine, driven by high parental awareness of child health, well-established healthcare infrastructure, and accessibility of both OTC and prescription pediatric medicines.

The United States, in particular, commands a large share of the market with widespread retail pharmacies, strong online sales growth, and emphasis on regulated, age-specific formulations that meet rigorous safety standards. For instance, in 2025, ByHeart launched its innovative Anywhere Pack, a compact, pre-portioned, mess-free solution for feeding babies on-the-go. This convenience-focused product enhanced parental flexibility and accessibility to infant nutrition, reflecting the growing demand for portable, user-friendly baby care solutions. The launch highlighted the market’s shift toward practical, high-quality products that improve infant well-being and support busy caregivers, positively influencing growth and consumer adoption in the global infant and baby medicine and nutrition market.

In conclusion, North America’s robust healthcare system, strong parental focus on child health, and widespread availability of both prescription and over-the-counter pediatric medicines position the region as a key driver of growth in the global infant and baby cold medicine market, reflecting sustained demand and ongoing innovation in pediatric care.

To Learn More About This Report - Request a Free Sample Copy

Infant and Baby Cold Medicine Market Competitive Landscape:

The Global Infant and Baby Cold Medicine Market is characterized by intense competition among major pharmaceutical and consumer healthcare companies, along with smaller specialised pediatric brands. Leading global players leverage extensive distribution networks, strong R&D capabilities, and established brand equity to compete effectively across regions. Emphasis on product safety, regulatory compliance, and development of gentle, age-appropriate formulations tailored for infants and young children is central to competitive strategies. Market participants are also focusing on expanding their presence through strategic partnerships, geographic expansion, and innovation in formulations and delivery systems to meet evolving caregiver preferences.

Key Players:

- Johnson & Johnson Consumer Inc.

- Procter & Gamble Co.

- GlaxoSmithKline plc

- Pfizer Inc.

- Sanofi S.A.

- Abbott Laboratories

- Novartis AG

- Bayer AG

- Boehringer Ingelheim International GmbH

- Church & Dwight Co., Inc.

- Prestige Consumer Healthcare Inc.

- Hyland’s Inc.

- Zarbee’s Naturals

- Little Remedies

- Similasan Corporation

- Maty’s Healthy Products LLC

- Genexa Inc.

- The Himalaya Drug Company

- Dabur India Ltd.

- Reckitt Benckiser Group plc

Recent Development

- In July 2025, Swissmedic approved Coartem (artemether-lumefantrine) Baby, the first malaria treatment for newborns and young infants, developed by MMV and Novartis. Participation from eight African countries accelerated regional approvals. By offering this infant-friendly medicine largely on a not-for-profit basis, access to life-saving treatments in endemic regions improved, highlighting the growing emphasis on safe, effective pediatric formulations and supporting expansion in the global infant and baby medicine market.

- In September 2022, ByHeart, a next-generation baby nutrition company, launched its innovative infant formula in the US, developed over five years with expert breast milk research. It featured a patented protein blend closest to breast milk, organic grass-fed whole milk, and clinically proven easy digestibility, without corn syrup, soy, maltodextrin, or palm oil.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is growing because parents are becoming more proactive about treating their children's seasonal flu and respiratory infections early. Increased air pollution and changing weather patterns have led to a higher frequency of common colds in infants. Additionally, the availability of flavored, easy-to-swallow syrups makes it simpler for parents to give medicine to fussy babies.

Q2. What are the main restraining factors for this market?

Growth is limited by strict safety warnings from health authorities like the FDA, which advise against giving certain cold medicines to very young children due to potential side effects. Many parents also fear the chemicals in synthetic drugs, leading them to choose natural home remedies or organic alternatives instead of traditional over-the-counter medicines.

Q3. Which segment is expected to witness high growth?

The Online Stores segment is expected to witness the highest growth over the forecast period due to increasing internet penetration and consumer preference for convenient, contactless shopping. Easy access to a wide range of infant and baby cold medicines, competitive pricing, and home delivery options are driving this rapid market expansion.

Q4. Who are the top major players for this market?

The market is led by well-known healthcare giants and specialized pediatric brands. Major players include Johnson & Johnson (Tylenol/Motrin), Reckitt Benckiser (Mucinex), and Perrigo. Specialized brands like Hyland’s and Zarbee’s Naturals are also very popular because they focus specifically on gentle, natural ingredients for infants and toddlers.

Q5. Which country is the largest player?

The United States is the largest market for infant and baby cold medicine. This is due to high healthcare spending, a strong culture of using over-the-counter (OTC) products, and clear pediatric guidelines. American parents have easy access to these medicines through large retail chains and online stores, which keeps the demand consistently high.

List of Figures

Figure 1: Global Infant and Baby Cold Medicine Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Infant and Baby Cold Medicine Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Infant and Baby Cold Medicine Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Infant and Baby Cold Medicine Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Infant and Baby Cold Medicine Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Infant and Baby Cold Medicine Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Infant and Baby Cold Medicine Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Infant and Baby Cold Medicine Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Infant and Baby Cold Medicine Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Infant and Baby Cold Medicine Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Infant and Baby Cold Medicine Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Infant and Baby Cold Medicine Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Infant and Baby Cold Medicine Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Infant and Baby Cold Medicine Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Infant and Baby Cold Medicine Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Infant and Baby Cold Medicine Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Infant and Baby Cold Medicine Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Infant and Baby Cold Medicine Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Infant and Baby Cold Medicine Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Infant and Baby Cold Medicine Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Infant and Baby Cold Medicine Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Infant and Baby Cold Medicine Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Infant and Baby Cold Medicine Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Infant and Baby Cold Medicine Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Infant and Baby Cold Medicine Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Infant and Baby Cold Medicine Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Infant and Baby Cold Medicine Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Infant and Baby Cold Medicine Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Infant and Baby Cold Medicine Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Infant and Baby Cold Medicine Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Infant and Baby Cold Medicine Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Infant and Baby Cold Medicine Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Infant and Baby Cold Medicine Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Infant and Baby Cold Medicine Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Infant and Baby Cold Medicine Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Infant and Baby Cold Medicine Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Infant and Baby Cold Medicine Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Infant and Baby Cold Medicine Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Infant and Baby Cold Medicine Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Infant and Baby Cold Medicine Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Infant and Baby Cold Medicine Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Infant and Baby Cold Medicine Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Infant and Baby Cold Medicine Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Infant and Baby Cold Medicine Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Infant and Baby Cold Medicine Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Infant and Baby Cold Medicine Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Infant and Baby Cold Medicine Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Infant and Baby Cold Medicine Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model