Infrared and Radio Wave Central Locking Market Overview and Analysis:

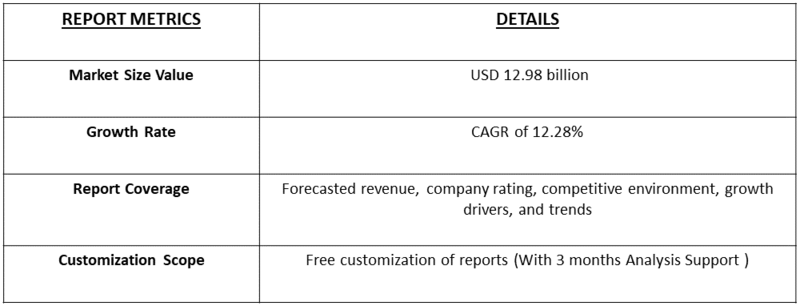

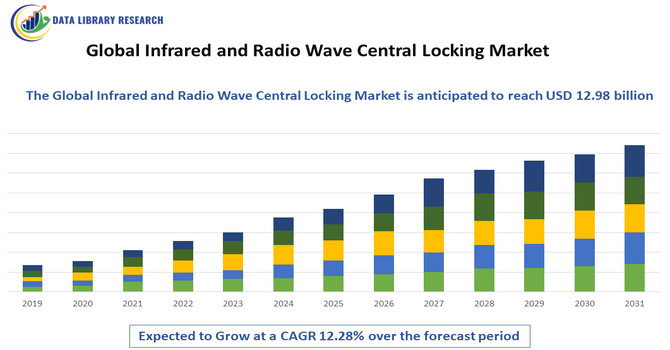

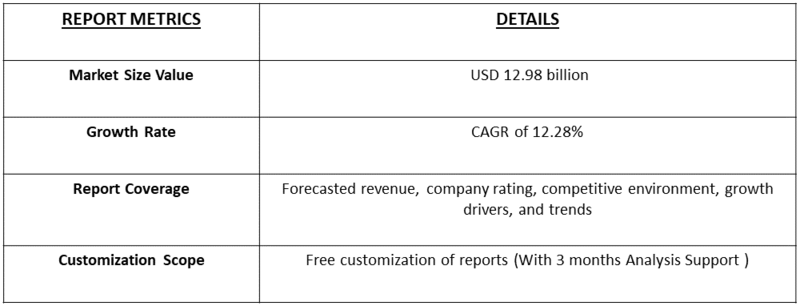

- The Global Infrared Imaging Market size was valued at USD 9.2 billion in 2025 and is projected to reach USD 12.98 billion by 2032, growing with a CAGR of 12.28% from 2025 to 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Infrared and Radio Wave Central Locking Market refers to the industry focused on vehicle locking systems that use infrared or radio wave signals to lock and unlock doors remotely. These technologies enhance vehicle security, convenience, and user experience, and are widely adopted in modern cars worldwide. The growth of the Global Infrared and Radio Wave Central Locking Market has been driven by rising demand for enhanced vehicle security, convenience, and smart features in modern automobiles.

Infrared and Radio Wave Central Locking Market Latest Trends

In the Global Infrared and Radio Wave Central Locking Market, key trends include more cars using smart and connected technologies, like keyless entry and push-button start systems. Companies are also making locks smaller, more energy-efficient, and more reliable, while adding better anti-theft features to meet consumer needs and safety standards.

Another trend in the Global Infrared and Radio Wave Central Locking Market is the growing focus on integration with vehicle mobile apps and IoT devices. Consumers increasingly expect to control and monitor their car locks remotely via smartphones, enhancing convenience and security. This has encouraged manufacturers to innovate and develop more user-friendly, connected locking solutions.

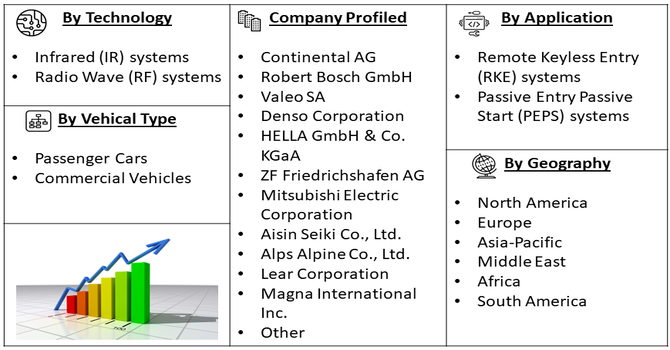

Segmentation: The Global Infrared and Radio Wave Central Locking Market is segmented by Technology Type (Infrared (IR) systems and Radio Wave (RF) systems), Vehicle Type (Passenger Cars and Commercial Vehicles), Application (Remote Keyless Entry (RKE) systems and Passive Entry Passive Start (PEPS) systems) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Demand for Vehicle Security and Safety

The growing awareness among consumers about vehicle safety and security has been a major driver for the Global Infrared and Radio Wave Central Locking Market. Car owners increasingly prefer systems that prevent theft, provide reliable locking mechanisms, and offer remote access capabilities. For instance, in October 2023, NASA’s Deep Space Optical Communications (DSOC) experiment had demonstrated long-range near-infrared laser data transmission, which indirectly influenced the Global Infrared and Radio Wave Central Locking Market. The success showcased advancements in infrared technology, encouraging innovations in vehicle locking systems and boosting adoption of high-performance, secure infrared-based central locking solutions globally.

Infrared and radio wave locking systems enhance convenience while ensuring robust security, reducing risks of break-ins and unauthorized access. As modern vehicles adopt advanced electronics and smart features, manufacturers are incorporating these systems more widely, further boosting market demand and fostering innovation in reliable, user-friendly locking technologies globally.

- Adoption of Smart and Connected Vehicles

The rapid growth of smart and connected vehicles has driven demand for infrared and radio wave central locking systems. Keyless entry, push-button start, and remote monitoring features have become standard expectations among consumers. Integration with mobile apps and IoT platforms allows users to control vehicle access from anywhere, enhancing convenience and security. Automakers are increasingly equipping vehicles with these advanced locking technologies to meet consumer expectations and differentiate their offerings. The trend toward connected cars and smart mobility solutions has significantly contributed to the expansion of the central locking market across both developed and emerging regions.

Market Restraints

- High Cost and Integration Complexity

The high cost and complexity of integrating infrared and radio wave central locking systems have restrained market growth. Advanced locking modules require sophisticated electronics, programming, and precise installation, which can increase production and maintenance costs. Smaller automakers and budget vehicle segments may find these systems less feasible due to higher upfront expenses. Additionally, integrating these systems with existing vehicle electronics, mobile apps, and security protocols can be technically challenging, limiting adoption. These factors have slowed market penetration in price-sensitive regions, posing a challenge for manufacturers aiming to expand the Global Infrared and Radio Wave Central Locking Market.

Socio Economic Impact on Infrared and Radio Wave Central Locking Market

The Global Infrared and Radio Wave Central Locking Market had a notable socioeconomic impact by enhancing vehicle security, convenience, and safety, which directly benefited consumers and communities. Its growth supported employment in manufacturing, electronics, and automotive sectors, while encouraging technological innovation. Widespread adoption reduced theft-related losses, lowering insurance costs and promoting economic stability. Additionally, advanced locking systems improved overall mobility experience, making transportation more reliable and accessible. This market also stimulated investments in connected vehicle technologies and smart infrastructure, contributing to industrial growth, skill development, and the expansion of high-tech automotive solutions globally, positively influencing both economies and societal well-being.

Segmental Analysis:

- Radio Wave (RF) systems segment is expected to witness highest growth over the forecast period

The Radio Wave (RF) systems segment of the Global Infrared and Radio Wave Central Locking Market was expected to witness the highest growth over the forecast period. RF systems offered longer range, higher reliability, and better penetration through obstacles compared with traditional infrared systems, making them ideal for modern vehicles. Growing adoption of keyless entry and smart vehicle technologies further accelerated their demand. Automakers increasingly preferred RF systems for enhanced security, convenience, and integration with mobile apps or IoT platforms. The trend toward connected cars, advanced anti-theft solutions, and consumer preference for remote operation had collectively driven strong market growth for RF-based central locking systems worldwide.

- Commercial Vehicles segment is expected to witness highest growth over the forecast period

The Commercial Vehicles segment was expected to witness the highest growth in the Global Infrared and Radio Wave Central Locking Market over the forecast period. Increased use of trucks, buses, and logistics vehicles in urban and long-distance transport created a demand for secure and efficient locking systems. Infrared and RF central locking solutions provided fleet operators with convenience, enhanced security, and reduced theft risks. Integration with telematics and remote monitoring tools made these systems highly attractive for commercial vehicle operators. Rising investments in logistics, public transportation, and delivery services across emerging and developed markets further fueled the adoption of advanced locking technologies in commercial vehicles, driving segment growth.

- Remote Keyless Entry (RKE) systems segment is expected to witness highest growth over the forecast period

The Remote Keyless Entry (RKE) systems segment was projected to witness the highest growth over the forecast period in the Global Infrared and Radio Wave Central Locking Market. RKE systems allowed drivers to lock and unlock doors remotely, enhancing convenience, safety, and vehicle accessibility. Growing consumer preference for smart and connected car features, combined with increasing vehicle production, supported the adoption of RKE solutions. Automakers integrated these systems into a wide range of passenger and commercial vehicles to meet evolving security and convenience expectations. Continuous innovation in signal range, battery life, and anti-theft functionality further propelled the segment, making RKE systems a key driver of market expansion.

- North America Region segment is expected to witness highest growth over the forecast period

The North America region was expected to witness the highest growth in the Global Infrared and Radio Wave Central Locking Market over the forecast period. High consumer demand for advanced safety and convenience features, widespread adoption of keyless entry systems, and a strong automotive industry drove this growth. Stringent government regulations regarding vehicle security and anti-theft measures encouraged automakers to implement infrared and RF central locking technologies.

Additionally, the increasing production of smart, connected vehicles integrated with mobile apps and IoT platforms further accelerated market expansion. Investments in innovation, consumer awareness, and high disposable incomes collectively made North America a leading region for central locking system adoption and technological advancement.

To Learn More About This Report - Request a Free Sample Copy

Infrared and Radio Wave Central Locking Market Competitive Landscape

The competitive landscape of the Global Infrared & Radio Wave Central Locking Market was dominated by established automotive electronics firms like Continental AG, Denso Corporation, HELLA GmbH, Valeo SA, ZF Friedrichshafen, Alps Alpine, Mitsubishi Electric, Lear Corporation, and Bosch. These players focused on R&D to improve security, energy efficiency, and integration with digital key and vehicle-access systems. Strategies such as mergers, partnerships, and modular product development helped them maintain strong OEM ties, gain market share, and respond to evolving smart vehicle demands.

The 20 major players for above market are:

- Continental AG

- Robert Bosch GmbH

- Valeo SA

- Denso Corporation

- HELLA GmbH & Co. KGaA

- ZF Friedrichshafen AG

- Mitsubishi Electric Corporation

- Aisin Seiki Co., Ltd.

- Alps Alpine Co., Ltd.

- Lear Corporation

- Magna International Inc.

- Johnson Electric Holdings Ltd.

- NXP Semiconductors N.V.

- Aptiv PLC

- BorgWarner Inc.

- Gentex Corporation

- Visteon Corporation

- Hyundai Mobis Co., Ltd.

- Mando Corporation

- Tokai Rika Co., Ltd.

Recent Development

- In October 2025, OSI System’s USD 37 million order for advanced RF-based communication and surveillance systems had positively impacted the Global Infrared and Radio Wave Central Locking Market. The deal highlighted growing demand for radio frequency technologies, encouraging innovation and adoption of RF-based locking solutions in vehicles, enhancing security, convenience, and market growth globally.

- In January 2025, The Dutch National Growth Fund’s Polaris project, launched with EUR 101.7 million in funding, had strengthened RF technology development. This initiative, involving Philips and a consortium of companies and universities, had indirectly boosted the Global Infrared and Radio Wave Central Locking Market by advancing RF innovations and encouraging adoption in automotive security systems worldwide.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

Market growth is primarily driven by rising global vehicle production and consumer demand for superior safety and convenience features. The integration of central locking with advanced driver-assistance systems (ADAS) is key. Additionally, ongoing technological leaps yield smaller, more reliable, and longer-range systems, accelerating the adoption of both infrared and radio wave technologies in new vehicles.

Q2. What are the main restraining factors for this market?

Key restraints include the persistent security risk of hacking or signal jamming in wireless systems, necessitating heavy R&D investment. Another factor is the high initial cost for manufacturers to implement and integrate these advanced locking systems. This high investment can slow down the speed of adoption, particularly within more affordable, budget-sensitive vehicle segments.

Q3. Which segment is expected to witness high growth?

The Radio Wave (RF) segment is poised for the highest growth. This is due to its critical role in advanced Remote Keyless Entry (RKE) and Passive Entry Passive Start (PEPS) systems. The industry's shift toward smart cars requiring constant, long-range wireless connectivity for apps and security makes RF the favored and fastest-expanding technology over shorter-range infrared systems.

Q4. Who are the top major players for this market?

Major automotive component suppliers and technology specialists dominate this market. Top players include global industry leaders like Continental AG, known for vehicle access control, alongside prominent firms such as Valeo and Hella GmbH & Co. KGaA. These competitors focus on integrating advanced microelectronics and software to ensure strong digital security and key fob reliability.

Q5. Which country is the largest player?

North America holds the largest market share in advanced automotive technology, largely due to the United States' high adoption rate of sophisticated locking systems. Crucially, the Asia-Pacific region is currently showing the fastest growth. This rapid expansion is fueled by massive vehicle production in countries like China and India, driven by growing consumer wealth.

List of Figures

Figure 1: Global Infrared and Radio Wave Central Locking Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Infrared and Radio Wave Central Locking Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Infrared and Radio Wave Central Locking Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Infrared and Radio Wave Central Locking Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Infrared and Radio Wave Central Locking Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Infrared and Radio Wave Central Locking Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Infrared and Radio Wave Central Locking Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Infrared and Radio Wave Central Locking Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Infrared and Radio Wave Central Locking Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Infrared and Radio Wave Central Locking Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Infrared and Radio Wave Central Locking Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Infrared and Radio Wave Central Locking Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Infrared and Radio Wave Central Locking Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Infrared and Radio Wave Central Locking Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Infrared and Radio Wave Central Locking Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Infrared and Radio Wave Central Locking Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Infrared and Radio Wave Central Locking Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Infrared and Radio Wave Central Locking Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Infrared and Radio Wave Central Locking Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Infrared and Radio Wave Central Locking Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Infrared and Radio Wave Central Locking Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Infrared and Radio Wave Central Locking Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model