Large Displacement Motorcycle Market Overview and Analysis

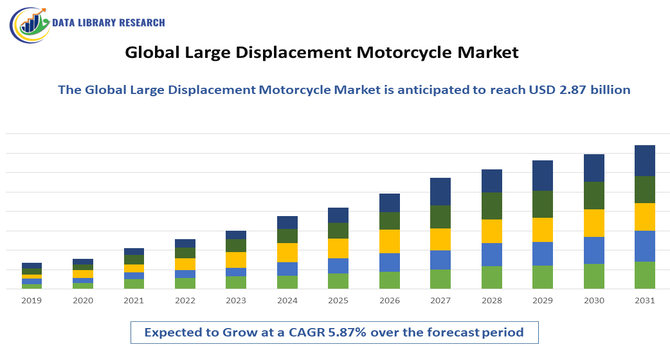

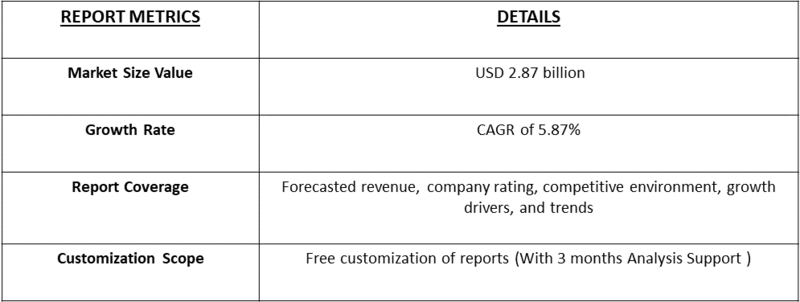

- The Global Large Displacement Motorcycle Market size was estimated at USD 852.3 million in 2026 and is projected to reach USD 2.87 billion by 2034. Growing with a CAGR of 5.87% from 2026-2033.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Large Displacement Motorcycle Market refers to the worldwide industry for motorcycles with engine capacities typically above 500cc, designed for high performance, long-distance touring, and premium recreational riding. This market encompasses sport bikes, cruisers, touring motorcycles, and adventure bikes, catering to enthusiasts seeking speed, power, and advanced features. Growth is driven by rising disposable incomes, increased interest in luxury and lifestyle vehicles, and the expansion of motorcycle tourism and sports.

Large Displacement Motorcycle Market Latest Trends

The global large displacement motorcycle market has been witnessing growth driven by increasing demand for high-performance, premium motorcycles. Enthusiasts are increasingly seeking motorcycles with larger engine capacities for touring, adventure, and sports riding. Technological advancements, including ABS, traction control, fuel injection, and electronic riding aids, are enhancing safety and performance, attracting new customers. There is also a trend toward adventure and cruiser bikes due to lifestyle and recreational riding preferences.

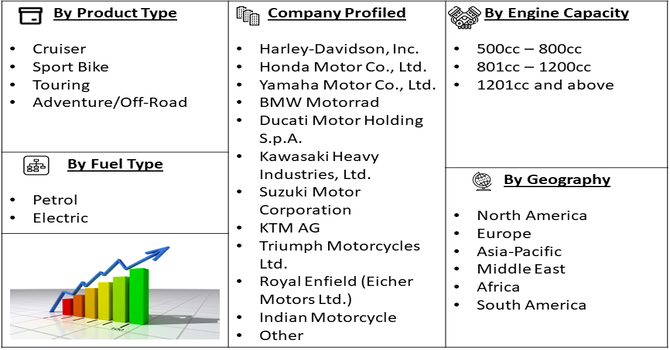

Segmentation: The Global Large Displacement Motorcycle Market is segmented by Type (Cruiser, Sport Bike, Touring and Adventure/Off-Road), Engine Capacity (500cc – 800cc, 801cc – 1200cc and 1201cc and above), Fuel Type (Petrol and Electric), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Demand for Marine Infrastructure and Water-Based Recreation

The growing demand for superior modular floating dock systems is primarily driven by increasing investments in marine infrastructure, waterfront development, and recreational boating. Harbors, marinas, resorts, and waterfront residential complexes require durable, flexible, and easy-to-install dock solutions to accommodate varying water levels and vessel sizes. Modular floating docks offer adaptability, rapid deployment, and cost-efficiency compared to traditional fixed docks. The rising popularity of water-based recreational activities, such as boating, fishing, and tourism, further fuels demand. Government initiatives to enhance coastal infrastructure and private investment in leisure and tourism sectors contribute significantly, positioning modular floating dock systems as a preferred solution globally.

- Technological Advancements and Sustainable Materials

Technological innovations and the adoption of sustainable, high-performance materials are key drivers of growth in the modular floating dock systems market. Modern docks are now made from corrosion-resistant, UV-stabilized polymers, reinforced plastics, and lightweight metals, ensuring long lifespan, low maintenance, and environmental compatibility. Advanced interlocking systems and modular designs allow flexibility in configuration, expansion, and relocation, meeting diverse user requirements. The integration of eco-friendly materials also aligns with environmental regulations and increasing consumer preference for sustainable infrastructure. These advancements enhance safety, durability, and ease of installation, encouraging widespread adoption across commercial, recreational, and industrial waterfront applications worldwide.

Market Restraints:

- High Investment & Maintenance Cost

The high initial investment and ongoing maintenance costs act as a restraint for the global superior modular floating dock systems market. High-quality materials, advanced modular designs, and corrosion-resistant components often come at a premium, which can deter small businesses, marinas, or residential customers. Maintenance, including cleaning, inspections, and periodic replacements of wear-prone components, adds to operational expenses. Additionally, installation in rough or fluctuating water conditions may require specialized labor and equipment, further increasing costs. These financial considerations can limit adoption in price-sensitive regions or smaller-scale projects. As a result, cost barriers remain a key challenge to market expansion.

Socioeconomic Impact on Large Displacement Motorcycle Market

Large displacement motorcycles contribute significantly to the economy by driving sales in manufacturing, aftermarket accessories, and tourism. They create high-value employment opportunities in design, production, sales, and maintenance. Motorcycling promotes tourism, particularly in adventure and long-distance riding segments, benefiting local businesses and hospitality industries. The market also encourages technological innovation in engines, safety systems, and fuel efficiency, indirectly benefiting related sectors. While higher purchase and maintenance costs may limit accessibility, the market supports premium consumer segments and enhances economic growth through luxury vehicle consumption and associated industries.

Segmental Analysis:

- Adventure/Off-Road segment is expected to witness highest growth over the forecast period

The adventure/off-road segment is expected to witness the highest growth over the forecast period due to rising consumer interest in versatile motorcycles capable of both on- and off-road riding. These bikes appeal to riders seeking long-distance touring, adventure travel, and outdoor recreational experiences. Manufacturers are introducing models with advanced suspension systems, high ground clearance, and durable frames to enhance performance and comfort on rugged terrains. Growing motorcycle tourism, off-road racing events, and social media influence on adventure lifestyles are driving demand. As riders increasingly prioritize versatility and exploration, adventure/off-road motorcycles are becoming one of the fastest-growing segments globally.

- 800 CC Engine Type segment is expected to witness highest growth over the forecast period

The 800cc engine type segment is expected to witness the highest growth over the forecast period due to its balance of power, performance, and accessibility. Motorcycles in this range offer sufficient engine output for touring, sport, and adventure riding without the extreme costs or complexity of larger-displacement models. Rising demand from enthusiasts seeking high-performance yet manageable motorcycles, especially in emerging markets, is boosting adoption. Manufacturers are also innovating with mid-range engines featuring fuel efficiency, advanced electronics, and safety features like ABS and traction control. The 800cc category increasingly appeals to both experienced riders and aspirational buyers, driving market expansion.

- Electric Bikes segment is expected to witness highest growth over the forecast period

The electric bikes segment is expected to witness the highest growth over the forecast period as sustainability and environmental awareness drive consumer preference. Increasing government incentives, stricter emission regulations, and rising fuel costs are motivating manufacturers and consumers to adopt electric motorcycles. Advances in battery technology, motor efficiency, and charging infrastructure are enhancing performance, range, and convenience. Electric adventure and sport motorcycles are gaining popularity, combining power with eco-friendly operation. Rising urbanization and demand for low-maintenance, quiet, and emission-free motorcycles further support market growth. The segment is expected to grow rapidly as more riders shift toward electrification globally.

- North America Region is expected to witness highest growth over the forecast period

North America is expected to witness the highest growth in the global large displacement motorcycle market over the forecast period due to strong demand for premium motorcycles and a well-established motorcycle culture. Riders increasingly prefer adventure, touring, and cruiser motorcycles, supported by expanding road networks and motorcycle tourism. High disposable incomes, brand loyalty, and interest in lifestyle and recreational riding fuel adoption.

Manufacturers are launching region-specific models, limited editions, and high-performance motorcycles to meet local preferences. For instance, in November 2025, Thirty years after Bosch launched its first production-ready motorcycle ABS system, the company had significantly advanced rider safety with technologies like Motorcycle Stability Control and intelligent assistance systems. These innovations enhanced safety and performance in large-displacement motorcycles, positively impacting North America’s market by increasing consumer confidence, encouraging adoption of high-capacity bikes, and driving demand for technologically advanced, safer motorcycles.

Additionally, the increasing availability of electric large-displacement motorcycles and smart riding technologies attracted a new segment of environmentally conscious and tech-savvy customers. Integration of features like connected dashboards, adaptive cruise control, and ride modes enhanced the appeal of premium motorcycles. Combined with North America’s strong recreational riding culture, these innovations further reinforced the region’s position as a key growth hub for large-displacement motorcycles.

To Learn More About This Report - Request a Free Sample Copy

Large Displacement Motorcycle Market Competitive Landscape

The global large displacement motorcycle market is highly competitive, dominated by established players such as Harley-Davidson, Honda, BMW Motorrad, Yamaha, Ducati, Kawasaki, KTM, Suzuki, Triumph, and Royal Enfield. Competition revolves around engine performance, design, safety features, brand reputation, and customization options. Companies are investing heavily in R&D to introduce innovative technologies like electronic suspension, ride modes, and connectivity features. Limited editions and lifestyle-focused models help differentiate brands in a crowded market. Strategic collaborations, sponsorships in racing events, and expanding dealership networks further strengthen competitive positions. Price, after-sales service, and regional availability also influence market dynamics and consumer choice.

The major players for this market are:

- Harley-Davidson, Inc.

- Honda Motor Co., Ltd.

- Yamaha Motor Co., Ltd.

- BMW Motorrad

- Ducati Motor Holding S.p.A.

- Kawasaki Heavy Industries, Ltd.

- Suzuki Motor Corporation

- KTM AG

- Triumph Motorcycles Ltd.

- Royal Enfield (Eicher Motors Ltd.)

- Indian Motorcycle (Polaris Industries)

- Aprilia (Piaggio Group)

- MV Agusta Motor S.p.A.

- Hero MotoCorp Ltd.

- Bajaj Auto Ltd.

- Honda Racing Corporation (HRC)

- Norton Motorcycles Ltd.

- Benelli (Qianjiang Group)

- Moto Guzzi (Piaggio Group)

- CF Moto

Recent Development

- In May 2025, Honda’s cumulative global production of 500 million motorcycles, reached 76 years after starting mass production with the Dream D-Type, underscored its longstanding impact on the industry. This achievement strengthened consumer confidence in high-performance, reliable motorcycles and bolstered the global large displacement motorcycle market by promoting brand loyalty, driving technological advancements, and supporting growth in premium and high-capacity motorcycle segments worldwide.

- In May 2024, Kawasaki and Yamaha models became available through OK Mobility via a partnership with Mundimoto, Europe’s leading online motorbike sales and leasing platform. This collaboration, including OK Group’s investment in Mundimoto, expanded access to large-displacement motorcycles for rentals and sales. It strengthened the global large displacement motorcycle market by increasing visibility, consumer accessibility, and adoption of premium high-capacity motorcycles.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

Growth is primarily driven by rising disposable incomes and a shifting consumer perception of motorcycles from basic transport to lifestyle symbols. The expansion of "mototourism" and adventure riding has spurred demand for high-performance bikes. Additionally, rapid advancements in electronic rider aids, such as cornering ABS and traction control, attract safety-conscious enthusiasts.

Q2. What are the main restraining factors for this market?

The market faces headwinds from stringent environmental regulations and tightening emission standards like Euro 5+, which increase manufacturing costs. High purchase prices and expensive maintenance also limit the consumer base. Furthermore, the rising popularity of electric alternatives and a declining interest in traditional motorcycling among younger urban demographics pose long-term challenges.

Q3. Which segment is expected to witness high growth?

The Adventure Touring segment is expected to see the highest growth. These versatile "on-off road" motorcycles appeal to riders seeking both long-distance comfort and rugged capability. As infrastructure improves in emerging markets and the trend for outdoor exploration continues, manufacturers are heavily investing in this category to capture enthusiast interest.

Q4. Who are the top major players for this market?

The competitive landscape is dominated by legendary brands including Harley-Davidson, BMW Motorrad, and Ducati. Japanese giants Honda, Yamaha, Kawasaki, and Suzuki maintain massive market shares through diverse lineups. Meanwhile, European manufacturers like Triumph and KTM have solidified their positions by focusing on premium performance and high-tech engine configurations.

Q5. Which country is the largest player?

The United States remains the largest player in the large displacement market. A deep-rooted culture of heavyweight cruisers and long-distance touring, combined with a vast highway network, sustains high demand for engines over 600cc. While Europe is a close second, the American consumer's preference for high-torque, large-capacity machines remains unparalleled.

List of Figures

Figure 1: Global Large Displacement Motorcycle Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Large Displacement Motorcycle Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Large Displacement Motorcycle Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Large Displacement Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Large Displacement Motorcycle Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Large Displacement Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Large Displacement Motorcycle Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Large Displacement Motorcycle Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Large Displacement Motorcycle Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Large Displacement Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Large Displacement Motorcycle Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Large Displacement Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Large Displacement Motorcycle Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Large Displacement Motorcycle Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Large Displacement Motorcycle Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Large Displacement Motorcycle Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Large Displacement Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Large Displacement Motorcycle Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Large Displacement Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Large Displacement Motorcycle Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Large Displacement Motorcycle Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Large Displacement Motorcycle Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Large Displacement Motorcycle Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Large Displacement Motorcycle Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Large Displacement Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Large Displacement Motorcycle Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Large Displacement Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Large Displacement Motorcycle Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Large Displacement Motorcycle Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Large Displacement Motorcycle Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Large Displacement Motorcycle Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Large Displacement Motorcycle Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Large Displacement Motorcycle Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Large Displacement Motorcycle Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Large Displacement Motorcycle Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Large Displacement Motorcycle Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Large Displacement Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Large Displacement Motorcycle Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Large Displacement Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Large Displacement Motorcycle Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Large Displacement Motorcycle Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Large Displacement Motorcycle Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Large Displacement Motorcycle Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Large Displacement Motorcycle Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Large Displacement Motorcycle Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Large Displacement Motorcycle Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Large Displacement Motorcycle Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Large Displacement Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Large Displacement Motorcycle Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Large Displacement Motorcycle Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Large Displacement Motorcycle Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Large Displacement Motorcycle Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Large Displacement Motorcycle Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Large Displacement Motorcycle Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Large Displacement Motorcycle Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model