Medical iOS Application Market Overview and Analysis:

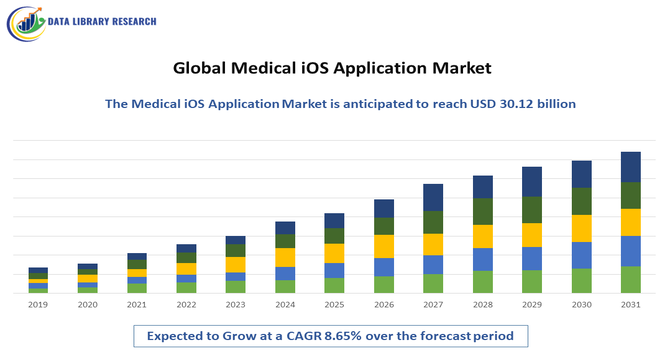

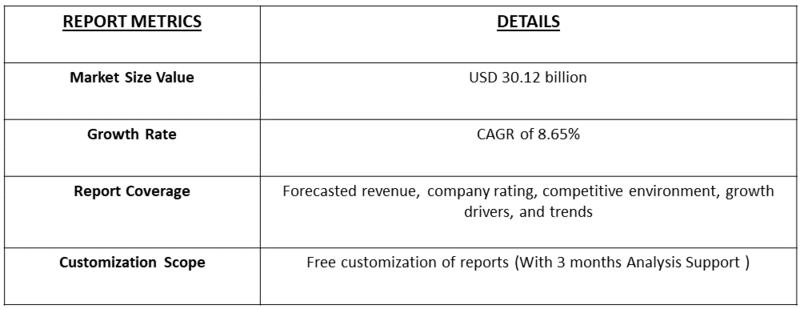

- The Global Medical iOS Application Market is substantial and expanding rapidly, with an estimated market size of approximately USD 4.05 billion in 2025, and projected to reach USD 30.12 billion by 2033, growing with a CAGR of 8.65% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Medical iOS Application Market is experiencing strong growth, driven primarily by the rapid adoption of smartphones among healthcare professionals and patients, the increasing shift toward digital health management, and rising demand for remote monitoring, telemedicine, and clinical decision-support tools available on iOS platforms. The growth is further supported by the high security standards of Apple’s ecosystem, the expanding integration of AI-enabled health analytics, and the surge in chronic disease management apps that empower personalized care and continuous health tracking, making iOS-based medical applications a key component of modern healthcare delivery.

Medical iOS Application Market Latest Trends

The Global Medical iOS Application Market is being reshaped by several powerful trends: AI-powered diagnostic and predictive health tools are becoming more common, using on-device machine learning to assess symptoms, analyze imaging, and provide personalized health insights. Telemedicine continues to expand, with iOS apps increasingly offering virtual consultations, integrated triage, and real-time data sharing with providers. Another major trend is enhanced remote patient monitoring (RPM), where iOS apps sync with wearables and medical devices to continuously track vitals like heart rate, blood pressure, glucose, and oxygen levels. There’s also rising use of big data and predictive analytics in these apps — by analyzing longitudinal patient data, the apps can flag health risks, optimize treatment, and support preventive care.

Segmentation: Global Medical iOS Application Market is segmented By Application Type (Telemedicine and Virtual Care Apps, Remote Patient Monitoring (RPM) Apps, Chronic Disease Management Apps, Diagnostic and Clinical Decision Support Apps, Mental Health and Wellness Apps, Medical Reference and Education Apps), End User (Healthcare Professionals, Hospitals and Clinics, Patients and General Users, Medical Students and Researchers), Deployment Model (Cloud-Based Applications, On-Premise Integrated Apps, Hybrid Deployment), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Demand for Remote Patient Monitoring (RPM) and Telemedicine Solutions

One of the strongest drivers of the Global Medical iOS Application Market is the escalating demand for remote patient monitoring and telemedicine services. With the rise of chronic diseases such as diabetes, cardiovascular disorders, and respiratory conditions, patients and healthcare providers increasingly rely on iOS-based applications to track vital signs, monitor symptoms, manage medications, and conduct virtual consultations. For instance, in May 2023, an article published by The Lancet Summit, reported that 2019, chronic respiratory diseases (CRDs) were the third leading cause of death, causing 4.0 million deaths and affecting 454.6 million people. COPD accounted for 3.3 million deaths and 212.3 million cases, while asthma had 262.4 million cases. As CRD incidence climbed in low- and middle-income countries, mobile apps became essential for accessible, affordable respiratory care, and other chronic diseases, thereby driving rapid adoption and significant market expansion.

- Growing Adoption of AI and Data Analytics for Personalized Healthcare

Another key driver is the rapid integration of artificial intelligence and advanced analytics into medical iOS applications. AI-powered algorithms enable apps to analyze patient data, predict health risks, support diagnostics, and recommend personalized treatment plans. This capability is increasingly important in preventive care, early disease detection, mental health assessment, and chronic disease management. iOS apps with AI-enhanced features, such as symptom checkers, image-based diagnostics, and personalized health coaching, offer higher accuracy and better user engagement.

Market Restraints:

- Strict Healthcare Regulations and Compliance

The Global Medical iOS Application Market faces several restraints that could slow its growth, primarily due to regulatory, technical, and cost-related challenges. Strict healthcare regulations and compliance requirements such as HIPAA, GDPR, and regional data protection laws make it difficult for developers to launch and update medical apps without significant investment in security and documentation. Additionally, concerns over data privacy and cybersecurity risks remain major barriers, as medical apps handle sensitive patient information that must be protected against breaches and unauthorized access.

Socio Economic Impact on Medical iOS Application Market

The Global Medical iOS Application Market has a notable socioeconomic impact by improving access to healthcare, reducing costs, and empowering patients with better control over their health. These apps make medical services more accessible to people in remote or underserved areas, helping bridge healthcare gaps. They also support early diagnosis, reduce hospital visits, and improve treatment adherence, ultimately lowering the overall burden on healthcare systems. Additionally, the market creates new job opportunities in app development, digital health services, and telemedicine, contributing to economic growth while enhancing public health outcomes.

Segmental Analysis:

- Telemedicine and Virtual Care Apps segment is expected to witness highest growth over the forecast period

Telemedicine and virtual care apps represent one of the fastest-growing segments due to rising demand for remote consultations, virtual diagnostics, and real-time communication between patients and healthcare providers. iOS-based telemedicine platforms offer secure video calls, AI-assisted triage, digital prescriptions, and seamless integration with Apple HealthKit, making care more accessible and efficient. For instance, in November 2025, TruDoc Healthcare, the Middle East’s largest telehealth provider, launched its Super Health App in India and the GCC, marking a major shift toward accessible, digital-first healthcare. The platform leveraged advanced digital technologies to deliver smarter, simpler, and more connected care, supporting India’s transition to modern virtual healthcare services. This launch accelerated adoption of mobile-based telehealth solutions, increased patient engagement, expanded app-based virtual consultations, and strengthened demand for high-quality medical iOS applications.

- Hospitals and Clinics segment is expected to witness highest growth over the forecast period

Hospitals and clinics are major adopters of medical iOS applications as they increasingly integrate digital tools for patient management, clinical decision support, appointment scheduling, and EHR accessibility. iOS apps help streamline workflows, enhance communication among care teams, reduce administrative burden, and improve diagnostics through AI-enabled features. The reliability, security, and interoperability of iOS systems make them preferred choices for clinical environments aiming to modernize healthcare delivery.

- Cloud-Based Applications segment is expected to witness highest growth over the forecast period

Cloud-based medical iOS applications dominate the market due to their scalability, ease of integration, and ability to store and process large volumes of patient data securely. These applications support real-time data exchange, remote accessibility for both patients and physicians, and rapid deployment of updates and analytics. Cloud deployment also reduces infrastructure costs for healthcare institutions, enabling broad adoption across small clinics, hospitals, and telehealth service providers.

- North America segment is expected to witness highest growth over the forecast period

North America leads the market owing to its advanced healthcare infrastructure, high level of digital health adoption, widespread use of Apple devices, and significant investments in medical app development. Strict regulatory standards and strong focus on data security further boost adoption of certified medical iOS applications. For instance, in 2024, DIGITAL, Canada’s Global Innovation Cluster, advanced AI-driven healthcare by supporting USD 26 million in new projects to improve patient outcomes and expand access. This boosted the North America Medical iOS Application Market by accelerating AI-enabled health app adoption and strengthening the region’s already robust digital healthcare infrastructure.

Moreover, the region’s growing emphasis on telemedicine, remote patient monitoring, and AI-driven healthcare tools drives continuous growth in demand for iOS-based solutions. For instance, in October 2022, GE Healthcare and AMC Health formed a collaboration enabling clinicians to deliver Remote Patient Monitoring (RPM) as a virtual care extension from hospital to home. By integrating GE Healthcare’s in-hospital monitoring expertise with AMC Health’s FDA-cleared RPM platform and analytics, the partnership improved continuity of care after discharge. This development strengthened the North America Medical iOS Application Market by accelerating adoption of mobile-based RPM apps, boosting hospital demand for integrated digital health tools, and enhancing remote patient engagement.

Thus, such factors together are fuelling the market growth in the region.

To Learn More About This Report - Request a Free Sample Copy

Medical iOS Application Market Competitive Landscape

The competitive landscape of the Global Medical iOS Application Market is diverse and fast-evolving, featuring a mix of large telehealth platforms, traditional healthcare IT vendors extending into mobile, specialist digital-health startups, and bespoke app-development firms. Competitors differentiate through clinical integration (EHR/EMR connectivity), regulatory and data-security compliance (HIPAA/GDPR), AI/analytics and remote-monitoring capabilities, native Apple ecosystem features (HealthKit, Apple Watch integration), and value-added services such as virtual care, RPM, and chronic-care programs. Consolidation through acquisitions, partnerships with healthcare systems and payers, and investments in on-device privacy and clinical validation are common strategies as firms race to scale user bases and embed into clinical workflows.

Key Players:

- Teladoc Health

- Amwell

- Doctor on Demand

- MDLive

- Babylon Health

- Doximity

- GoodRx

- Epic Systems (MyChart)

- Oracle Cerner

- Philips Healthcare

- GE Healthcare

- ResMed

- Medtronic

- Abbott

- Dexcom

- Omada Health

- One Medical (1Life)

- Ada Health

- UpToDate (Wolters Kluwer)

- Epocrates (Athenahealth)

Recent Development

- In November 2025, Owlet, Inc. partnered with Locus Health to enhance infant health management by integrating data from Owlet’s FDA-cleared BabySat® device into Locus Health’s remote monitoring platform. This allowed clinicians secure, continuous access to vital infant data after discharge. The collaboration positively impacted the Global Medical iOS Application Market by strengthening wearable–app integration, improving remote monitoring capabilities, and increasing demand for clinically connected mobile health solutions.

- In March 2025, Circadian Health formed a strategic partnership with Tenovi to integrate its cellular-connected RPM and RTM devices into Circadian’s nationwide virtual cardiometabolic care model. This collaboration strengthened real-time monitoring, expanded hospital-at-home services, and improved early intervention for chronic conditions. Its impact on the Global Medical iOS Application Market was significant, boosting demand for mobile RPM apps, enhancing integration of medical devices with iOS platforms, and accelerating adoption of app-based chronic disease management worldwide. @@@@@

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is primarily driven by the increasing patient demand for accessible and convenient digital healthcare solutions. Key factors include the high global adoption of Apple's secure iOS ecosystem and the widespread need for remote patient monitoring (RPM). The rising prevalence of chronic diseases, coupled with the expansion of telehealth services, accelerates this growth by enabling patients to easily track their conditions and communicate with healthcare providers from home.

Q2. What are the main restraining factors for this market?

The main hurdles stem from complex issues surrounding patient data. Ensuring strict data privacy and security compliance, particularly with global regulations like HIPAA and GDPR, presents a significant challenge for developers. Furthermore, the market is restrained by the lack of universal clinical validation for some apps, which leads to skepticism among healthcare professionals regarding the reliability and accuracy of the information provided.

Q3. Which segment is expected to witness high growth?

The "Disease Management" and "Remote Patient Monitoring (RPM)" segments are anticipated to exhibit the fastest growth. This surge is directly linked to the global rise in chronic conditions, such as diabetes and cardiovascular disorders, which demand continuous care. These advanced iOS applications use connected wearables and AI to facilitate real-time tracking, medication adherence, and personalized intervention, significantly improving long-term patient outcomes.

Q4. Who are the top major players for this market?

The key players in this market include both large-scale technology providers and specialized medical device manufacturers. Apple Inc. is a dominant indirect player, controlling the operating system and the Health ecosystem. Major medical technology companies like Abbott Laboratories and Medtronic plc are also crucial, integrating their smart medical devices and solutions directly into the iOS platform for remote patient management.

Q5. Which country is the largest player?

The United States (U.S.) currently stands as the largest country player in terms of market revenue for the Medical iOS Application sector. This leadership position is due to the presence of an advanced, well-funded healthcare infrastructure, high expenditures on digital health technologies, and substantial penetration of Apple devices among both consumers and healthcare providers, creating a mature and large revenue base.

List of Figures

Figure 1: Global Medical iOS Application Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Medical iOS Application Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Medical iOS Application Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Medical iOS Application Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Medical iOS Application Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Medical iOS Application Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Medical iOS Application Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Medical iOS Application Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Medical iOS Application Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Medical iOS Application Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Medical iOS Application Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Medical iOS Application Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Medical iOS Application Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Medical iOS Application Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Medical iOS Application Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Medical iOS Application Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Medical iOS Application Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Medical iOS Application Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Medical iOS Application Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Medical iOS Application Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Medical iOS Application Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Medical iOS Application Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Medical iOS Application Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Medical iOS Application Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Medical iOS Application Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Medical iOS Application Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Medical iOS Application Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Medical iOS Application Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Medical iOS Application Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Medical iOS Application Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Medical iOS Application Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Medical iOS Application Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Medical iOS Application Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Medical iOS Application Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Medical iOS Application Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Medical iOS Application Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Medical iOS Application Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Medical iOS Application Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Medical iOS Application Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Medical iOS Application Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Medical iOS Application Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Medical iOS Application Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Medical iOS Application Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Medical iOS Application Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Medical iOS Application Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Medical iOS Application Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Medical iOS Application Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Medical iOS Application Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Medical iOS Application Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Medical iOS Application Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Medical iOS Application Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Medical iOS Application Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Medical iOS Application Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Medical iOS Application Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Medical iOS Application Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Medical iOS Application Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Medical iOS Application Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Medical iOS Application Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Medical iOS Application Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Medical iOS Application Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Medical iOS Application Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Medical iOS Application Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Medical iOS Application Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Medical iOS Application Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Medical iOS Application Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Medical iOS Application Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Medical iOS Application Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Medical iOS Application Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Medical iOS Application Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Medical iOS Application Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Medical iOS Application Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Medical iOS Application Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Medical iOS Application Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Medical iOS Application Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Medical iOS Application Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Medical iOS Application Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Medical iOS Application Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Medical iOS Application Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model