As the COVID-19 pandemic continuing its effect around the world, many defense and aerospace companies are facing its impact during this time around the world. For instance, commercial aviation companies in the U.S., France, Germany, and Canada are facing disruption in the production process and reduced demand as workforces staying at home, passengers stop traveling, and delay in delivery of new aircraft. Analysts expecting a drop from 3,000 to 4,000 aircraft during the pandemic period. On the defense side, contractors operating in the sector are in a better position, hence the impact of the pandemic is likely low in the short to mid-term. However, low demand due to budget constraints affecting the production as in aircraft manufacturing.

Market Overview

Global Military Computers Market is anticipated to witness significant growth during forecast period. The militaries in various countries are upgrading their current systems with the new and advanced ones including military computers. These computers are used in innumerable ways for several tasks. For instance, they provide direct network to allow the multiple lines of the communication between several parties in military. Efficient communication is key aspect in military as it can haste up the processes and allow for the more fluid decision-making, which is anticipated to drive the market growth during forecast period. North America is likely to be prominent region for military computers market due to presence of the major manufacturers, including Curtiss-Wright Corporation and Northrop Grumman Corporation in region. Europe is anticipated to be second-largest market owing to the growing demand for the military computers in the region.

Segment Overview

Rugged computer segment is anticipated to be the larger during forecast period. These computers are designed to function in harsh environments and climatic conditions. These systems provide features such as HD graphics, USB interface, Ethernet connectivity, and Wi-Fi connectivity. These rugged computers permit military personnel to share and view crucial information from the remote areas. Hence, rugged computers segment is likely to register higher CAGR during forecast period.

The militaries are concentrating on deploying more technologically-advanced and portable computers in warzones. The ruggedness of the military devices such as handhelds, laptops, and wearable is necessary to function and survive properly in extreme conditions including extreme cold and heat. Similarly, governments across globe are showing interest in the military wearable as they provide the data regarding soldier’s location and health and are easy to carry for soldiers.

Regional Overview

North America military computers market is anticipated to grow at highest CAGR during forecast period. The growth is owing to high military budget of U.S. and the high level of advancements and sophistication in technology of the U.S. military defense systems. The U.S. Army uses the advanced systems, scope of adoption of the embedded computers is high. Undergoing R&D for military weapons and equipment for U.S. Army would also drive adoption of the military computers.

According to (SIPRI) Stockholm International Peace Research Institute, the U.S. was the largest spender on the military with almost USD 610 billion in the year 2017 as USD 596 billion in the year 2015. The rise in the defense expenditure can be accredited to the rising arms manufacturing and the army modernization programs. For instance, in 2018, U.S. Army signed contract with the Lockheed Martin Corporation for the about USD 356 million for the close-combat tactical training, manned module modernization (M3) systems. Furthermore, growing adoption of the advanced technology by U.S. Army for improved data security and privacy is boosting market growth in region.

Competitor overview

In Sept 2017, company Curtiss-Wright Corporation’s company subsidiary Defense Solutions signed contract with prime contractor to offer rugged airborne processing system technology for the use on defense platform. It includes the COTS modules along with CHAMP-XD2M the digital signal processor module. The original contract was valued at the USD 3 million and potential lifetime value of contract is projected at USD 6 million.

Key Players

- Curtiss-Wright Corporation

- Zebra Technologies Corp.

- Cobham plc

- Saab

- Rockwell Collins, Inc

- Thales Group

- Northrop Grumman Corporation

- Getac Technology Corporation

- Panasonic Corporation

Market Segmentation

By Type

- Rugged Computers

- Embedded Computers

- Airborne,

- Ground

- Naval

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- UAE

- Rest of LAMEA

1 Executive Summary 13

- 1.1 Market Attractiveness Analysis 14

- 1.1.1 Global Military Computers Market, by Type 14

- 1.1.2 Global Military Computers Market, by Platform 15

- 1.1.3 Global Military Computers Market, by Region 16

2 Market Introduction 17

- 2.1 Definition 17

- 2.2 Scope of the Study 17

- 2.3 Market Structure 17

- 2.4 Key Buying Criteria 18

3 Research Methodology 19

- 3.1 Research Process 19

- 3.2 Primary Research 20

- 3.3 Secondary Research 21

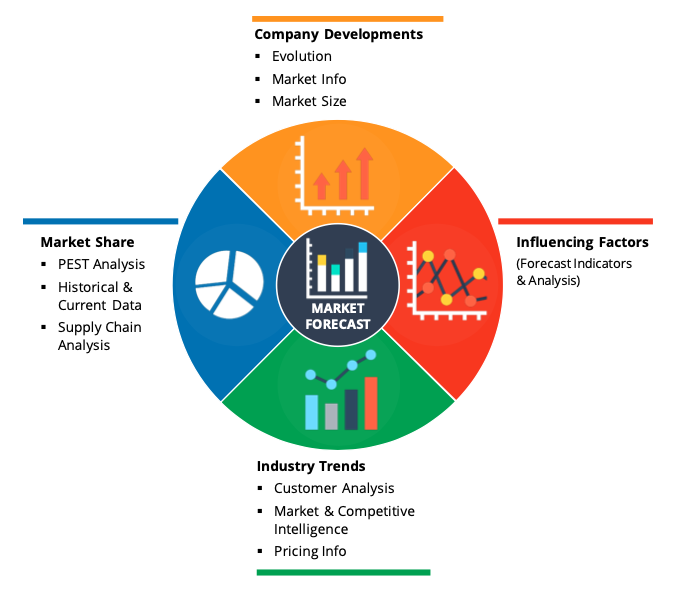

- 3.4 Market Size Estimation 21

- 3.5 Top down & bottom up approach 22

- 3.6 Forecast Model 22

- 3.7 List of Assumptions 23

4 Market Insights 24

5 Market Dynamics 29

- 5.1 Introduction 29

- 5.2 Drivers 30

- 5.2.1 Increase in Military Spending 30

- 5.2.2 Use of Military Computers in the Advanced Military Systems 31

- 5.2.3 Drivers Impact Analysis 31

- 5.3 Restraints 32

- 5.3.1 Vulnerabilities to Cyberattacks 32

- 5.3.2 Restraints Impact Analysis 32

- 5.4 Opportunity 32

- 5.4.1 Cloud Computing-Based Weapons Systems 32

6 Market Factor Analysis 33

- 6.1 Supply Chain Analysis 33

- 6.2 Porter’s Five Forces Model 34

- 6.2.1 Threat of New Entrants 34

- 6.2.2 Bargaining Power of Suppliers 34

- 6.2.3 Bargaining Power of Buyers 35

- 6.2.4 Threat of Substitutes 35

- 6.2.5 Rivalry 35

7 Global Military Computers Market, by Type 36

- 7.1 Overview 36

- 7.1.1 Rugged Computers 36

- 7.1.2 Embedded Computers 36

- 7.2 Global Military Computers Market, by Type, 2018–2024 (USD Million) 37

- 7.2.1 Global Rugged Military Computers Market, by Region, 2018–2024 (USD Million) 37

- 7.2.2 Global Embedded Military Computers Market, by Region, 2018–2024 (USD Million) 38

8 Global Military Computers Market, by Platform 39

- 8.1 Overview 39

- 8.1.1 Ground 39

- 8.1.2 Airborne 39

- 8.1.3 Naval 39

- 8.2 Global Military Computers Market, by Platform, 2018–2024 (USD Million) 40

- 8.2.1 Global Ground Military Computers Market, by Region, 2018–2024 (USD Million) 40

- 8.2.2 Global Airborne Military Computers Market, by Region, 2018–2024 (USD Million) 41

- 8.2.3 Global Naval Military Computers Market, by Region, 2018–2024 (USD Million) 41

9 Global Military Computers Market, by Region 42

- 9.1 Overview 42

- 9.1.1 Global Military Computers Market, by Region, 2018–2024 (USD Million) 42

- 9.2 North America 43

- 9.2.1 North America: Military Computers Market, by Country, 2018–2024 (USD Million) 43

- 9.2.2 North America: Military Computers Market, by Type, 2018–2024 (USD Million) 44

- 9.2.3 North America: Military Computers Market, by Platform, 2018–2024 (USD Million) 44

- 9.2.4 US 45

- 9.2.4.1 US: Military Computers Market, by Type, 2018–2024 (USD Million) 45

- 9.2.4.2 US: Military Computers Market, by Platform, 2018–2024 (USD Million) 45

- 9.2.5 Canada 46

- 9.2.5.1 Canada: Military Computers Market, 2018–2024 (USD Million) 46

- 9.2.5.2 Canada: Military Computers Market, by Commercial Platform, 2018–2024 (USD Million) 46

- 9.3.1 Europe: Military Computers Market, by Country, 2018–2024 (USD Million) 47

- 9.3.2 Europe: Military Computers Market, by Type, 2018–2024 (USD Million) 48

- 9.3.3 Europe: Military Computers Market, by Platform, 2018–2024 (USD Million 48

- 9.3.4 Germany 49

- 9.3.4.1 Germany: Military Computers Market, by Type, 2018–2024 (USD Million) 49

- 9.3.4.2 Germany: Military Computers Market, by Platform, 2018–2024 (USD Million) 49

- 9.3.5 UK 50

- 9.3.5.1 UK: Military Computers Market, by Type, 2018–2024 (USD Million) 50

- 9.3.5.2 UK: Military Computers Market, by Platform, 2018–2024 (USD Million) 50

- 9.3.6 France 51

- 9.3.6.1 France: Military Computers Market, by Type, 2018–2024 (USD Million) 51

- 9.3.6.2 France: Military Computers Market, by Platform, 2018–2024 (USD Million) 51

- 9.3.7 Russia 52

- 9.3.7.1 Russia: Military Computers Market, by Type, 2018–2024 (USD Million) 52

- 9.3.7.2 Russia: Military Computers Market, by Platform, 2018–2024 (USD Million) 52

- 9.3.8 Rest of Europe 53

- 9.3.8.1 Rest of Europe: Military Computers Market, by Type, 2018–2024 (USD Million) 53

- 9.3.8.2 Rest of Europe: Military Computers Market, by Platform, 2018–2024 (USD Million) 53

- 9.4.1 Asia-Pacific: Military Computers Market, by Country, 2018–2024 (USD Million) 54

- 9.4.2 Asia-Pacific: Military Computers Market, by Type, 2018–2024 (USD Million) 55

- 9.4.3 Asia-Pacific: Military Computers Market, by Platform, 2018–2024 (USD Million) 55

- 9.4.4 China 56

- 9.4.4.1 China: Military Computers Market, by Type, 2018–2024 (USD Million) 56

- 9.4.4.2 China: Military Computers Market, by Platform, 2018–2024 (USD Million) 56

- 9.4.5 Japan 57

- 9.4.5.1 Japan: Military Computers Market, by Type, 2018–2024 (USD Million) 57

- 9.4.5.2 Japan: Military Computers Market, by Platform, 2018–2024 (USD Million) 57

- 9.4.6 India 58

- 9.4.6.1 India: Military Computers Market, by Type, 2018–2024 (USD Million) 58

- 9.4.6.2 India: Military Computers Market, by Platform, 2018–2024 (USD Million) 58

- 9.4.7 Rest of Asia-Pacific 59

- 9.4.7.1 Rest of Asia-Pacific: Military Computers Market, by Type, 2018–2024 (USD Million) 59

- 9.4.7.2 Rest of Asia-Pacific: Military Computers Market, by Platform, 2018–2024 (USD Million) 59

- 9.5.1 Middle East: Military Computers Market, by Country, 2018–2024 (USD Million) 60

- 9.5.2 Middle East: Military Computers Market, by Type, 2018–2024 (USD Million) 61

- 9.5.3 Middle East: Military Computers Market, by Platform, 2018–2024 (USD Million) 61

- 9.5.4 UAE 62

- 9.5.4.1 UAE: Military Computers Market, by Type, 2018–2024 (USD Million) 62

- 9.5.4.2 UAE: Military Computers Market, by Platform, 2018–2024 (USD Million) 62

- 9.5.5 Saudi Arabia 63

- 9.5.5.1 Saudi Arabia: Military Computers Market, by Type, 2018–2024 (USD Million) 63

- 9.5.5.2 Saudi Arabia: Military Computers Market, by Platform, 2018–2024 (USD Million) 63

- 9.5.6 Israel 64

- 9.5.6.1 Israel: Military Computers Market, by Type, 2018–2024 (USD Million) 64

- 9.5.6.2 Israel: Military Computers Market, by Platform, 2018–2024 (USD Million) 64

- 9.5.7 Rest of the Middle East 65

- 9.5.7.1 Rest of the Middle East: Military Computers Market, by Type, 2018–2024 (USD Million) 65

- 9.5.7.2 Rest of the Middle East: Military Computers Market, by Platform, 2018–2024 (USD Million) 65

- 9.6.1 Rest of the World: Military Computers Market, by Region, 2018–2024 (USD Million) 66

- 9.6.2 Rest of the World: Military Computers Market, by Type, 2018–2024 (USD Million) 67

- 9.6.3 Rest of the World: Military Computers Market, by Platform, 2018–2024 (USD Million) 67

- 9.6.4 Latin America 68

- 9.6.4.1 Latin America: Military Computers Market, by Type, 2018–2024 (USD Million) 68

- 9.6.4.2 Latin America: Military Computers Market, by Platform, 2018–2024 (USD Million) 68

- 9.6.5 Africa 69

- 9.6.5.1 Africa: Military Computers Market, by Type, 2018–2024 (USD Million) 69

- 9.6.5.2 Africa: Military Computers Market, by Platform, 2018–2024 (USD Million) 69

10 Competitive Landscape 70

- 10.1 Competitive Overview 70

- 10.2 Competitor Dashboard 70

- 10.3 Major Growth Strategies in the Global Military Computers Market 72

- 10.4 Competitive Benchmarking 72

- 10.5 Market Share Analysis 73

- 10.6 Leading Players in Terms of Number of Developments in the Global Military Computers Market 73

- 10.7 Key Developments & Growth Strategies 74

- 10.7.1 Contracts and Agreements 74

- 10.7.2 Product Launches 74

11 Company Profiles 75

- 11.1 Cobham PLC 75

- 11.1.1 Company Overview 75

- 11.1.2 Financial Overview 76

- 11.1.3 Products/Services Offered 77

- 11.1.4 Key Developments 77

- 11.1.5 SWOT Analysis 77

- 11.1.6 Key Strategies 78

- 11.2 Curtiss-Wright Corporation 79

- 11.2.1 Company Overview 79

- 11.2.2 Financial Overview 80

- 11.2.3 Products/Services Offered 80

- 11.2.4 Key Developments 81

- 11.2.5 SWOT Analysis 81

- 11.2.6 Key Strategies 81

- 11.3 Elbit Systems Ltd 82

- 11.3.1 Company Overview 82

- 11.3.2 Financial Overview 82

- 11.3.3 Products/Services Offered 83

- 11.3.4 Key Developments 83

- 11.3.5 SWOT Analysis 83

- 11.3.6 Key Strategies 84

- 11.4 General Dynamics Corporation 85

- 11.4.1 Company Overview 85

- 11.4.2 Financial Overview 85

- 11.4.3 Products/Services Offered 86

- 11.4.4 Key Developments 86

- 11.4.5 SWOT Analysis 86

- 11.4.6 Key Strategies 87

- 11.5 Saab AB 88

- 11.5.1 Company Overview 88

- 11.5.2 Financial Overview 88

- 11.5.3 Products/Services Offered 89

- 11.5.4 Key Developments 89

- 11.5.5 SWOT Analysis 90

- 11.5.6 Key Strategies 90

12 Other Prominent Players in the Market 91

- 12.1 BAE Systems 92

- 12.2 Collins Aerospace 93

- 12.3 Getac Technology Corporation 94

- 12.4 L3 Technologies Inc. 95

- 12.5 Northrop Grumman Corporation 96

- 12.6 Panasonic Corporation 97

- 12.7 Raytheon Company 98

- 12.8 Safran Group 99

- 12.9 Thales Group 99

- 12.10 Zebra Technologies Corporation 100

13 Appendix 101

- 13.1 References 101

- 13.2 Related Reports 101

- 13.3 List of Abbreviation 101

14 Industry Insights 102

- 14.1 Military Expenditure by Country, 2017 102

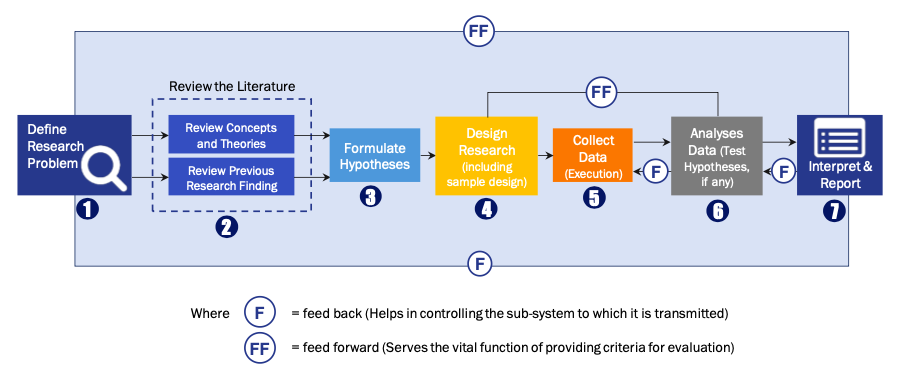

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model