Portable Forensic Computer Market Overview and Analysis

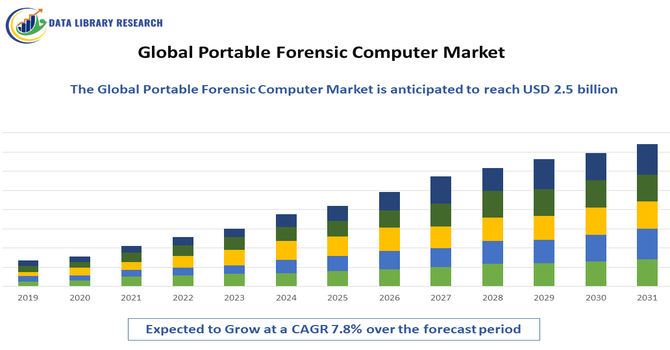

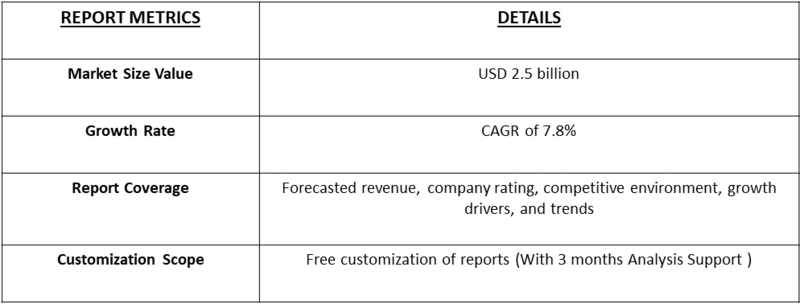

- The Portable Forensic Computer Market size is expected to reach USD 2.5 billion in 2034 registering a CAGR of 7.8%

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Portable Forensic Computer Market refers to the global industry focused on developing, manufacturing, and selling specialized portable computing devices and software designed for digital forensics. These devices allow law enforcement, cybersecurity teams, and investigative agencies to collect, analyze, and preserve digital evidence from computers, networks, and mobile devices directly at crime scenes or remote locations. Portable forensic computers are valued for their mobility, high processing power, data security, and preloaded forensic tools that ensure integrity and accuracy of evidence. Market growth is driven by rising cybercrime, increased regulatory requirements, and the need for faster, on-site forensic investigations worldwide.

Portable Forensic Computer Market Latest Trends

The Portable Forensic Computer Market is experiencing strong growth due to the increasing prevalence of cybercrime, digital fraud, and data breaches across industries. Organizations and law enforcement agencies are adopting portable forensic systems to perform on-site evidence collection, analysis, and reporting. Emerging trends include integration of AI and machine learning for faster data processing, cloud-enabled forensic solutions, and enhanced encryption for data security. Miniaturization and high-performance hardware allow forensic professionals to work efficiently in remote or field locations.

Segmentation: The Portable Forensic Computer Market is segmented by Product Type (Portable Forensic Workstations, Portable Forensic Servers and Forensic Software Solutions), Application (Law Enforcement & Criminal Investigations, Cybersecurity & Corporate Investigations and Government & Defense), Deployment Type (On-Premises and Cloud-Integrated), End User (Law Enforcement Agencies, Private Security Firms, Corporate Enterprises and Government & Defense Organizations), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Cybercrime and Digital Fraud

The increasing prevalence of cybercrime, hacking, ransomware attacks, and digital fraud is a primary driver for the portable forensic computer market. Law enforcement agencies, cybersecurity firms, and corporate security teams require on-site, high-performance portable devices to investigate breaches and collect evidence quickly. For instance, in 2025, Curbing Cyber Frauds in Digital India, Ministry of India, reported that 86% of Indian households are now online, while cybersecurity incidents surged from 10.29 lakh in 2022 to 22.68 lakh in 2024.

Portable forensic computers enable real-time data acquisition, analysis, and reporting at crime scenes, reducing delays and preserving digital evidence integrity. As organizations prioritize cybersecurity and regulatory compliance, demand for reliable, mobile forensic tools grows. This trend is further amplified by the proliferation of mobile devices, cloud storage, and IoT devices, all of which increase investigative complexity.

- Need for Rapid On-Site Investigations

Organizations and law enforcement agencies increasingly demand tools that allow forensic analysis directly at the site of a digital incident. Portable forensic computers provide the mobility, computing power, and preloaded investigative software necessary for efficient evidence collection and examination without transporting devices to a central lab.

This capability reduces operational delays, prevents data tampering, and supports faster case resolution. Growing adoption of remote and field investigations in both corporate and public sectors drives the market. Additionally, integration with AI, machine learning, and encrypted data handling enhances the efficiency and accuracy of on-site digital forensic operations.

Market Restraints

- High Cost and Technical Complexity

The high cost of portable forensic computers and associated software solutions limits adoption, particularly among smaller law enforcement agencies and private firms. Advanced devices with rugged designs, high processing power, preloaded forensic suites, and security features require significant upfront investment. In addition, operating these systems demands specialized training and technical expertise, which can create operational and staffing challenges. Maintenance, updates, and software licensing add further costs. These financial and technical barriers can slow adoption in emerging markets and smaller organizations, restraining overall market growth despite rising demand for portable, high-performance forensic investigation solutions.

Socioeconomic Impact on Portable Forensic Computer Market

Portable forensic computers significantly support public safety, cybersecurity, and judicial efficiency. By enabling rapid, on-site digital evidence collection, they help law enforcement solve crimes faster and reduce investigative costs. Businesses benefit from improved incident response, protecting intellectual property and preventing financial losses from cyberattacks. These devices also create specialized jobs in digital forensics, software development, and cybersecurity services. Their deployment promotes trust in legal and financial systems while supporting regulatory compliance across sectors. Thus, the market contributes to safer digital ecosystems, strengthens national security, and drives economic growth through the adoption of advanced investigative technologies in both public and private sectors.

Segmental Analysis:

- Portable Forensic Servers segment is expected to witness highest growth over the forecast period

The portable forensic servers segment is expected to witness the highest growth over the forecast period. These mobile servers offer high storage capacity and processing power, allowing law enforcement and corporate investigators to analyze large volumes of digital evidence on-site. Portable servers facilitate secure data handling, rapid deployment, and efficient multi-device connectivity, making them ideal for complex cybercrime investigations and large-scale corporate audits. As organizations face growing volumes of digital data, including cloud, mobile, and IoT sources, the demand for portable servers that combine mobility, security, and high-performance computing is projected to expand rapidly worldwide.

- Law Enforcement & Criminal Investigations segment is expected to witness highest growth over the forecast period

The law enforcement and criminal investigations segment is expected to experience the highest growth. Police departments, federal agencies, and forensic labs increasingly rely on portable forensic computers to collect and analyze evidence at crime scenes, reducing delays and ensuring data integrity. The rise in cybercrime, digital fraud, and criminal use of mobile devices drives the need for on-site investigative tools. Portable forensic systems enable rapid collection, analysis, and reporting, supporting faster case resolution. Adoption of AI-enabled analysis, encryption, and cross-platform compatibility enhances investigative capabilities, positioning law enforcement as the largest and fastest-growing end-user segment in the portable forensic computer market.

- Cloud-Integrated segment is expected to witness highest growth over the forecast period

The cloud-integrated segment is projected to witness the highest growth over the forecast period. These portable forensic devices allow investigators to connect securely to cloud storage and analytics platforms while maintaining on-site operational flexibility. Cloud integration enables remote collaboration, real-time data processing, and centralized evidence management, which is particularly valuable for organizations with distributed operations or multiple investigation teams. The increasing adoption of cloud-based data storage, hybrid infrastructures, and digital evidence sharing drives the demand for portable forensic computers that support secure cloud connectivity. This segment is expected to expand rapidly as organizations prioritize efficiency, scalability, and advanced data analytics in digital forensics.

- North America Region is expected to witness highest growth over the forecast period

North America is expected to witness the highest growth in the portable forensic computer market over the forecast period. The region benefits from high cybersecurity awareness, increasing investment in law enforcement technology, and strict regulatory requirements for digital evidence handling.

In 2025, GMDSOFT received a U.S. patent (US 12387492 B2) for its next-generation video-based forensic technology. The innovation addressed challenges in reviewing large volumes of CCTV and dashcam footage, enabling faster, time-aware analysis of digital evidence and supporting investigators overwhelmed by traditional, manual review methods. The patented video-based forensic technology by GMDSOFT is expected to boost demand for high-performance portable forensic computers capable of handling large video datasets. It enhances the market by enabling faster, on-site analysis and improving efficiency for law enforcement and investigative agencies worldwide.

Growing cybercrime rates, coupled with rising demand for on-site forensic investigations, drive adoption of portable forensic servers, workstations, and cloud-enabled devices. Advanced infrastructure, skilled personnel, and technological innovation further support market expansion. Additionally, collaborations between government agencies, private security firms, and forensic technology providers are accelerating deployment of portable forensic solutions across the United States and Canada, solidifying North America as the fastest-growing regional market.

To Learn More About This Report - Request a Free Sample Copy

Portable Forensic Computer Market Competitive Landscape

The portable forensic computer market is highly competitive, with key players differentiating through technology innovation, product reliability, and integrated software solutions. Companies compete on processing power, mobility, security features, and ease of use. Leading providers focus on AI-enabled analysis, encrypted storage, and compatibility with diverse digital platforms. Strategic partnerships with law enforcement agencies, cybersecurity firms, and government bodies are common to secure contracts and expand market reach. Emerging startups are introducing lightweight, high-performance devices with specialized forensic tools, while established players leverage brand reputation and global distribution networks. Competition drives continuous product improvement, making forensic investigations faster, more secure, and more accessible worldwide.

The major players for above market are:

- Cellebrite

- MSAB

- Paraben Corporation

- AccessData Group LLC

- Magnet Forensics

- Oxygen Forensics

- Cyan Forensics

- BlackBag Technologies

- Digital Detective Group

- Digital Intelligence Inc.

- Sumuri LLC

- ADF Solutions Inc.

- Teel Technologies Inc.

- Susteen Inc.

- Passware Inc.

- Belkasoft LLC

- AVAIL Forensics LLC

- Silicon Forensics Inc.

- Regula Forensics Inc.

Recent Development

- In October 2025, Getac Technology Corporation expanded its partnership with T-Mobile, offering the broadest non-stock ruggedized device portfolio certified on the T-Mobile Network. The collaboration included T-Priority, T-Mobile’s 5G solution for first responders, enabling advanced, reliable, and secure mobile communications through Getac’s rugged computing and video solutions.

- In October 2025, T-Mobile unveiled its new Cyber Defense Center, enhancing real-time detection and response to cyber threats, and its Executive Briefing Center, allowing enterprise customers to experience T-Mobile’s technology. Together with the existing Business Operations Center, these facilities established an integrated program for cybersecurity, innovation, and operational resilience.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary driver is the global surge in cybercrime and the need for law enforcement to process digital evidence immediately at crime scenes. As mobile devices and cloud storage become central to criminal investigations, portable forensic workstations allow for rapid data imaging and triage, reducing the backlog in traditional laboratories.

Q2. What are the main restraining factors for this market?

Growth is hindered by the high cost of ruggedized, high-performance hardware and the expensive software licenses required for forensic analysis. Additionally, rapid changes in encryption and data protection technologies make it difficult for hardware to stay updated. A shortage of trained forensic experts capable of using these complex tools also limits market expansion.

Q3. Which segment is expected to witness high growth?

The Ruggedized Forensic Laptops segment is expected to see the highest growth. These units are specifically designed for field use, offering extreme durability against drops, dust, and moisture while maintaining the processing power of a desktop. Their ability to operate in harsh environments makes them essential for military and field-based investigators.

Q4. Who are the top major players for this market?

The market is led by companies specializing in high-performance computing and digital investigation tools. Key players include OpenText (Guidance Software), Magnet Forensics, MSAB, Cellebrite, and Digital Intelligence. These companies dominate by integrating powerful write-blockers and data-extraction hardware directly into portable units to ensure evidence remains legally admissible.

Q5. Which country is the largest player?

The United States is the largest player in the portable forensic computer market. This is due to its high investment in homeland security, advanced law enforcement capabilities, and the presence of leading forensic technology firms. The U.S. government’s focus on counter-terrorism and cyber defense ensures a constant demand for mobile forensic innovation.

List of Figures

Figure 1: Global Portable Forensic Computer Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Portable Forensic Computer Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Portable Forensic Computer Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Portable Forensic Computer Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Portable Forensic Computer Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Portable Forensic Computer Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Portable Forensic Computer Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Portable Forensic Computer Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Portable Forensic Computer Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Portable Forensic Computer Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Portable Forensic Computer Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Portable Forensic Computer Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Portable Forensic Computer Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Portable Forensic Computer Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Portable Forensic Computer Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Portable Forensic Computer Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Portable Forensic Computer Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Portable Forensic Computer Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Portable Forensic Computer Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Portable Forensic Computer Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Portable Forensic Computer Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Portable Forensic Computer Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Portable Forensic Computer Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Portable Forensic Computer Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Portable Forensic Computer Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Portable Forensic Computer Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Portable Forensic Computer Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Portable Forensic Computer Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Portable Forensic Computer Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Portable Forensic Computer Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Portable Forensic Computer Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Portable Forensic Computer Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Portable Forensic Computer Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Portable Forensic Computer Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Portable Forensic Computer Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Portable Forensic Computer Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Portable Forensic Computer Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Portable Forensic Computer Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Portable Forensic Computer Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Portable Forensic Computer Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Portable Forensic Computer Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Portable Forensic Computer Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Portable Forensic Computer Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Portable Forensic Computer Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Portable Forensic Computer Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Portable Forensic Computer Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Portable Forensic Computer Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Portable Forensic Computer Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Portable Forensic Computer Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Portable Forensic Computer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Portable Forensic Computer Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Portable Forensic Computer Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Portable Forensic Computer Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Portable Forensic Computer Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Portable Forensic Computer Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model