Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Overview and Analysis

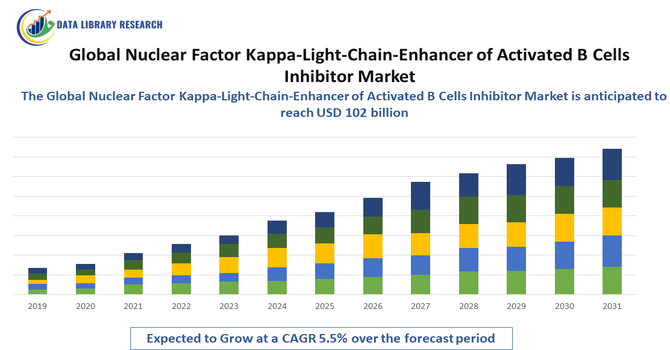

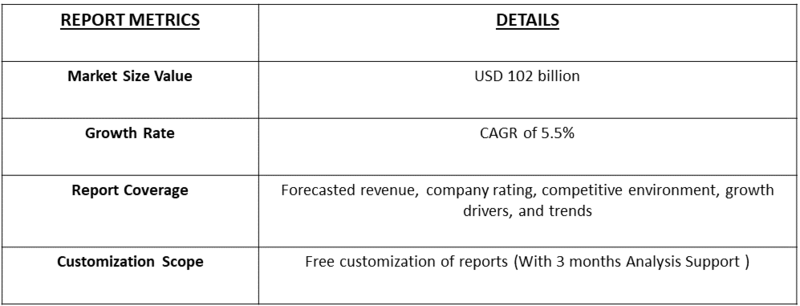

- The Global Hydropower Market was valued at approximately USD 72 billion in 2025 and is projected to reach over USD 102 billion by 2035. This market is forecasted to grow at a Compound Annual Growth Rate (CAGR) generally estimated to be 5.5% over the next decade, driven by increasing global demand for clean energy.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells (NF-κB) Inhibitor Market is experiencing significant growth, primarily driven by the rising prevalence of chronic inflammatory, autoimmune, and cancer-related diseases worldwide. The increasing focus on targeted therapies that modulate immune response and inflammatory pathways has accelerated the development and adoption of NF-κB inhibitors.

Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Latest Trends

The Global NF-κB Inhibitor Market is witnessing several notable trends shaping its growth. There is an increasing focus on targeted and selective NF-κB inhibitors that can modulate specific inflammatory and immune pathways with minimal side effects, particularly for autoimmune diseases, cancers, and chronic inflammatory disorders. Biologics and small-molecule inhibitors are gaining prominence due to their enhanced efficacy and ability to target intracellular signaling pathways. Additionally, combination therapies integrating NF-κB inhibitors with conventional chemotherapy or immunotherapy are emerging as a key trend to improve therapeutic outcomes.

Segmentation: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market is segmented By Product Type (Small-Molecule Inhibitors, Biologics / Monoclonal Antibodies, Peptide-Based Inhibitors, Natural/Plant-Derived Inhibitors), Application (Autoimmune Diseases, Cancer, Chronic Inflammatory Disorders), Route of Administration (Oral, Intravenous, Subcutaneous), End User (Hospitals & Clinics, Research Institutes & Laboratories, Pharmaceutical & Biotechnology Companies), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Prevalence of Chronic Inflammatory and Autoimmune Diseases

The increasing global incidence of chronic inflammatory and autoimmune conditions, such as rheumatoid arthritis, lupus, psoriasis, and inflammatory bowel disease, is a major driver for the NF-κB inhibitor market. For instance, in 2023, American Medical Association, reported that Inflammatory Bowel Disease (IBD) is common, with over 10 million people worldwide and about 3.1 million adults in the U.S. are suffering from this disease. NF-κB plays a central role in regulating immune responses and inflammation, and its dysregulation contributes to the progression of these diseases. As a result, healthcare providers and pharmaceutical companies are focusing on targeted therapies that inhibit NF-κB signaling to reduce inflammation, prevent tissue damage, and improve patient outcomes. The growing patient population for these disorders is significantly boosting the demand for NF-κB inhibitors worldwide.

- Increasing Focus on Cancer Therapy and Targeted Treatments

NF-κB is also closely associated with cancer progression, tumor survival, and resistance to chemotherapy. This has led to an increased emphasis on developing NF-κB inhibitors as part of targeted cancer therapies and combination treatments to enhance the efficacy of existing chemotherapeutic or immunotherapeutic approaches. Pharmaceutical R&D investments are rapidly expanding the pipeline of small-molecule inhibitors, biologics, and natural compounds designed to modulate NF-κB activity. For instance, in Janaury 2025, Gilead Sciences and LEO Pharma formed a strategic partnership to advance STAT6 small molecule programs for inflammatory diseases. This collaboration enhances research in NF-κB inhibitors, supports targeted therapy development, and drives innovation in cancer and inflammatory treatments, strengthening the global market for precision therapies and next-generation targeted interventions. The trend toward precision medicine, where treatments are tailored to molecular pathways, is further driving adoption of NF-κB inhibitors in oncology, thereby accelerating market growth.

Market Restraints:

- High Development Costs and Complex R&D Process

Developing NF-κB inhibitors involves complex molecular research, extensive preclinical studies, and rigorous clinical trials to ensure efficacy and safety. The high costs associated with R&D, regulatory compliance, and long drug development timelines can hinder new product launches. Smaller pharmaceutical and biotech companies may struggle to invest in NF-κB inhibitor development, limiting market expansion and slowing the introduction of innovative therapies.

Socioeconomic Impact on Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market

The global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells (NF-κB) inhibitor market has significant socioeconomic impact by improving treatment options for inflammatory, autoimmune, and cancer-related diseases. Effective NF-κB inhibitors reduce disease severity, hospitalizations, and long-term healthcare costs, enhancing patient quality of life and workforce productivity. Access to innovative therapies promotes health equity and decreases the economic burden on healthcare systems, particularly in regions with high prevalence of chronic inflammatory conditions. The market also drives employment and investment in pharmaceutical research, development, and manufacturing, contributing to economic growth.

Segmental Analysis:

- Small-Molecule Inhibitors segment is expected to witness highest growth over the forecast period

Small-molecule inhibitors dominate the market due to their ability to penetrate cells and directly modulate NF-κB signaling pathways. They are widely used in research and clinical applications for treating inflammatory, autoimmune, and cancer-related conditions. Their relatively low production costs, ease of oral administration, and ability to target intracellular mechanisms make them highly attractive to pharmaceutical companies and healthcare providers.

- Autoimmune Diseases segment is expected to witness highest growth over the forecast period

Autoimmune diseases, including rheumatoid arthritis, lupus, and psoriasis, represent a major application segment. NF-κB inhibitors help regulate overactive immune responses, reduce chronic inflammation, and prevent tissue damage. With the global incidence of autoimmune disorders rising, demand for effective NF-κB-targeted therapies is growing steadily, driving market expansion.

- Oral segment is expected to witness highest growth over the forecast period

Oral administration is the preferred route for NF-κB inhibitors due to patient convenience, compliance, and ease of chronic treatment. Many small-molecule inhibitors are formulated for oral delivery, allowing for self-administration outside hospital settings. This route supports long-term therapy for chronic conditions and improves market adoption.

- Hospitals & Clinics segment is expected to witness highest growth over the forecast period

Hospitals and clinics are the primary end users as they manage patients with autoimmune, inflammatory, and cancer-related diseases requiring NF-κB inhibitors. These settings facilitate controlled administration, monitoring of patient response, and integration of inhibitors into broader treatment regimens, making them a key revenue driver.

- North America segment is expected to witness highest growth over the forecast period

North America leads the NF-κB inhibitor market due to advanced healthcare infrastructure, high R&D investment, and strong adoption of targeted therapies. Rising prevalence of autoimmune diseases, cancers, and chronic inflammatory disorders, along with government initiatives supporting drug development, further drive demand in this region. For instance, in 2022, CDC reported that Autoimmune diseases affect approximately 10% of the global population, with 4.6%–9% prevalence in countries like the U.S., disproportionately impacting women (around 63%). Rising rates, driven by genetics, environmental triggers, and lifestyle factors, have increased demand for NF-κB inhibitors, strengthening the U.S. market for chronic inflammatory and autoimmune disease therapies.

Similarly, in 2025 American Cancer Society reported that, In the U.S., the lifetime risk of developing multiple myeloma is under 1%, approximately 1 in 108 for men and 1 in 133 for women. This rising prevalence drives demand for NF-κB inhibitors, supporting therapeutic development and expanding the U.S. market for targeted myeloma treatments.

Furthermore, in April 2024, Flindr Therapeutics secured EUR 20 million in Series A financing to advance its pipeline of first-in-class small molecule inhibitors for cancer treatment. This investment supports the development of NF-κB inhibitors, enhancing therapeutic innovation and strengthening the U.S. market for targeted cancer and inflammatory disease therapies.

To Learn More About This Report - Request a Free Sample Copy

Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Competitive Landscape

The NF κB inhibitor market is highly dynamic and competitive, driven by a growing pipeline of small molecules, biologics, and other novel inhibitors targeting inflammatory, autoimmune, neurodegenerative, and cancer related diseases. Major pharma and biotech players are investing heavily in R&D, forming collaborations, and acquiring smaller innovators to expand their NF κB portfolios. Differentiation is largely achieved via drug specificity (selective vs broad-spectrum NF κB inhibitors), route of administration, safety/efficacy profile, and regulatory strategy. As multiple candidate drugs progress through late-stage clinical trials, companies are also competing on speed to market, intellectual property, and the ability to integrate NF κB inhibitors into combination regimens. The increasing clinical interest and rising prevalence of chronic inflammatory and immune-mediated diseases are intensifying the competition, pushing firms toward innovation in delivery systems, dosing regimens, and therapeutic breadth.

Key Players:

- Merck & Co., Inc.

- Pfizer Inc.

- Novartis AG

- AbbVie Inc.

- Roche Holding AG

- GlaxoSmithKline plc

- Johnson & Johnson

- Amgen Inc.

- Bristol Myers Squibb Company

- Gilead Sciences, Inc.

- Takeda Pharmaceutical Company Limited

- Eli Lilly and Company

- Sanofi S.A.

- Teva Pharmaceutical Industries Ltd.

- Immix Biopharma

- Complexa

- GeneOne Life Science

- First Wave Bio

- BioVie Inc.

- AnGes

Recent News

- In October 2025, Arcus Biosciences announced promising monotherapy data for casdatifan, a HIF-2α inhibitor, in late-line metastatic clear cell renal cell carcinoma, and revealed plans to expand research into autoimmune and inflammatory diseases. These developments support the advancement of NF-κB inhibitors, driving innovation and growth in the global targeted therapy market.

- In May 2025, Ascletis Pharma received FDA clearance for a Phase I trial of ASC50, an oral small molecule IL-17 inhibitor for mild-to-moderate plaque psoriasis. This advancement supports the development of NF-κB inhibitors, enhancing global therapeutic options for autoimmune and inflammatory diseases and driving market growth.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is primarily driven by the rising global prevalence of chronic diseases like cancer, inflammatory disorders, and autoimmune conditions, where NF-κB is frequently overactive. Significant ongoing pharmaceutical research and development efforts to create novel, more targeted inhibitors for these complex diseases also boost market growth.

Q2. What are the main restraining factors for this market?

Major restraining factors include the high cost associated with the development and subsequent pricing of these specialized therapeutic agents. Furthermore, the risk of potential off-target side effects and the stringent, lengthy regulatory approval processes for new drugs pose substantial challenges to market expansion.

Q3. Which segment is expected to witness high growth?

The autoimmune diseases segment is expected to witness the highest growth due to rising prevalence of conditions like rheumatoid arthritis, lupus, and multiple sclerosis. Increasing demand for targeted therapies, advances in biologics, and growing awareness among healthcare providers and patients are driving adoption of NF-κB inhibitors in managing autoimmune disorders.

Q4. Who are the top major players for this market?

The NF-κB inhibitor market features intense competition among major multinational pharmaceutical companies. Top players include industry giants such as Pfizer Inc., Sanofi, GSK plc, Novartis AG, and AbbVie Inc., all heavily invested in the development of targeted cancer and autoimmune therapies.

Q5. Which country is the largest player?

The United States is currently the largest and most dominant country player in this market. This leadership is due to its highly advanced clinical research infrastructure, high healthcare spending, favorable reimbursement policies for innovative drugs, and the presence of numerous key pharmaceutical headquarters.

List of Figures

Figure 1: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Nuclear Factor Kappa-Light-Chain-Enhancer of Activated B Cells Inhibitor Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model