Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Overview and Analysis

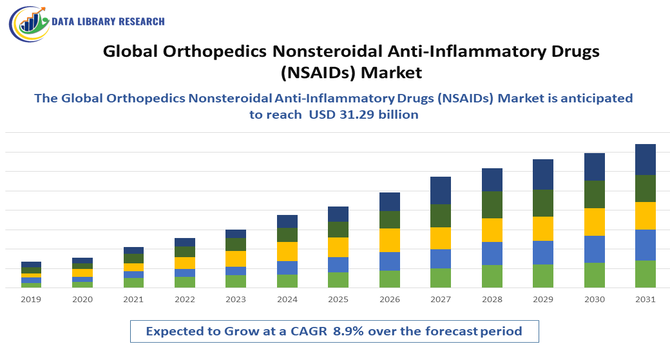

- The Global Orthopaedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market size was estimated at USD 25.58 billion in 2025 and is projected to reach USD 31.29 billion, growing with a CAGR of 8.9% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Orthopaedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market is witnessing significant growth, primarily driven by the rising prevalence of musculoskeletal disorders, including osteoarthritis, rheumatoid arthritis, and sports-related injuries. The growing aging population, coupled with increasing sedentary lifestyles and obesity rates, has led to higher incidences of joint pain and inflammation, fueling demand for effective NSAID therapies. Additionally, the preference for non-invasive pain management options over surgical interventions is boosting the adoption of NSAIDs in orthopaedic care. Advances in drug formulations, including fast-acting, extended-release, and topical NSAIDs, along with increased awareness among patients and healthcare providers regarding their efficacy and safety, are further contributing to the market’s expansion globally.

Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Latest Trends

The latest trends in the Global Orthopaedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market include the growing adoption of topical and targeted NSAID formulations, which offer localized pain relief with reduced systemic side effects. There is an increasing focus on combination therapies, where NSAIDs are used alongside other analgesics or disease-modifying agents to enhance efficacy in managing musculoskeletal conditions. The market is also witnessing a shift toward sustained-release and fast-acting oral formulations to improve patient compliance and provide rapid pain relief. Additionally, pharmaceutical companies are investing in novel delivery systems, such as transdermal patches and nanotechnology-based NSAID carriers, to enhance drug absorption and minimize gastrointestinal risks. Growing awareness of personalized treatment approaches and the integration of digital health tools for pain management are also shaping the market landscape.

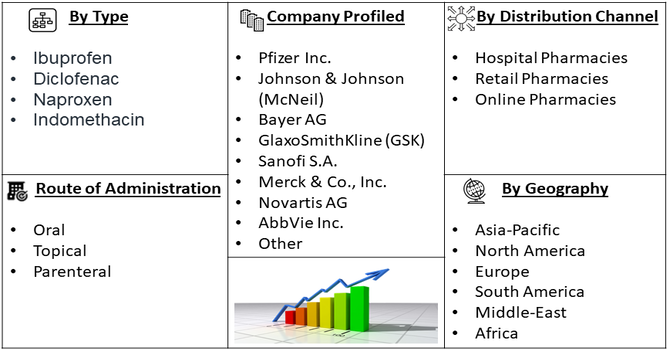

Segmentation: Global Orthopaedics Nonsteroidal Anti-Inflammatory Drugs Market is segmented By Drug Type (Ibuprofen, Diclofenac, Naproxen, Indomethacin), Formulation (Tablets & Capsules, Topical Gels & Creams, Injectables), Route of Administration (Oral, Topical, Parenteral), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Prevalence of Musculoskeletal Disorders

A major driver of the orthopaedic NSAIDs market is the increasing incidence of musculoskeletal disorders such as osteoarthritis, rheumatoid arthritis, lower back pain, and sports-related injuries. Factors like aging populations, sedentary lifestyles, and obesity contribute to joint degeneration, inflammation, and chronic pain, creating high demand for effective pain management therapies. NSAIDs are widely prescribed to alleviate pain and inflammation associated with these conditions, making them a first-line treatment option.

In October 2025, an article titled, “Global burden of six musculoskeletal disorders in women of childbearing age from 1990 to 2021”, reported that from 1990 to 2021, musculoskeletal disorders among women of childbearing age rose from 245 million to 401 million. Osteoarthritis, gout, and other MSK disorders showed the highest age-standardized prevalence increases. Forecasts projected 500 million cases by 2050, with obesity and renal dysfunction as growing contributors. The rising prevalence of MSK disorders has driven increased demand for NSAIDs for pain relief and inflammation management, boosting usage in orthopedic care, clinics, and hospitals, and expanding the global orthopedics NSAID market significantly. As awareness among patients and healthcare providers about non-invasive pain management options grows, the consumption of NSAIDs in orthopaedic care continues to expand globally.

- Preference for Non-Invasive and Fast-Acting Pain Relief Therapies

Patients and healthcare providers increasingly prefer non-invasive treatments over surgical interventions for pain management, especially for chronic and post-operative orthopaedic conditions. NSAIDs offer effective, fast-acting relief from pain and inflammation, improving patient mobility and quality of life without the need for invasive procedures.

In June 2024, Sakra World Hospital, Bengaluru, completed over 425 orthopedic surgeries, including 275+ joint replacements, 70+ arthroscopies, and various trauma procedures, setting a record monthly volume under Dr. Chandrashekar P.’s leadership and becoming the first hospital in Karnataka to achieve this milestone. The growing preference for non-invasive, fast-acting pain relief therapies among orthopedic patients has increased demand for NSAIDs to manage postoperative pain and inflammation, driving higher adoption in hospitals, clinics, and rehabilitation centers and supporting global market growth. This versatility, combined with their cost-effectiveness compared to surgery or advanced biologic therapies, is a key factor driving the widespread adoption of NSAIDs in orthopaedic care.

Market Restraints:

- Adverse Side Effects and Safety Concerns

Long-term or high-dose use of NSAIDs is associated with significant side effects, including gastrointestinal bleeding, kidney dysfunction, cardiovascular risks, and liver toxicity. These safety concerns limit the prolonged use of NSAIDs, particularly among elderly patients and those with pre-existing health conditions. Healthcare providers often recommend alternative therapies or combination treatments to mitigate these risks, which can reduce overall NSAID consumption. Despite these limitations, NSAIDs remain a cornerstone in orthopedic pain management due to their rapid anti-inflammatory and analgesic effects. Continuous research and development of safer formulations, such as selective COX-2 inhibitors and combination therapies, have helped expand their clinical use, maintain patient adherence, and sustain demand in the global orthopedics NSAID market.

Socio economic Impact Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market

The Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) market has had significant socioeconomic impacts globally. Rising prevalence of chronic pain, arthritis, and inflammatory disorders has increased demand for NSAIDs, improving patient quality of life and productivity. Access to effective pain management reduces healthcare burdens, enabling individuals to remain active in the workforce and reducing indirect economic losses. The market has generated employment opportunities across pharmaceutical manufacturing, research, distribution, and retail sectors, stimulating economic activity. Additionally, technological advancements and new formulations have lowered treatment costs, increasing affordability and accessibility. Socially, widespread NSAID availability has enhanced public health outcomes and patient well-being. Overall, the NSAID market supports both economic growth and improved societal health, highlighting its critical role in healthcare systems.

Segmental Analysis:

- Diclofenac segment is expected to witness highest growth over the forecast period

Diclofenac is one of the most widely used NSAIDs in orthopaedic care due to its potent anti-inflammatory and analgesic properties. It is commonly prescribed for conditions such as osteoarthritis, rheumatoid arthritis, and post-surgical pain management. The drug’s effectiveness in reducing joint inflammation and improving mobility, along with its availability in multiple formulations (oral, topical, and injectable), makes it a preferred choice among healthcare providers, driving significant market adoption.

- Topical Gels & Creams segment is expected to witness highest growth over the forecast period

Topical NSAID formulations, such as gels and creams, are increasingly preferred for localized pain relief, particularly in joint and muscle disorders. They provide targeted therapy while minimizing systemic exposure and gastrointestinal side effects associated with oral NSAIDs. The growing demand for non-invasive, patient-friendly treatment options in orthopaedics is contributing to the rapid growth of this segment globally.

- Retail Pharmacies segment is expected to witness highest growth over the forecast period

Retail pharmacies serve as a major distribution channel for orthopaedic NSAIDs, providing easy access for outpatients and over-the-counter purchases. They play a key role in meeting the growing demand for NSAIDs among patients seeking self-managed pain relief. The expansion of pharmacy chains and the integration of e-commerce for home delivery further strengthen this channel’s contribution to market growth.

- North America region is expected to witness highest growth over the forecast period

North America dominates the global orthopaedic NSAID market, driven by the high prevalence of musculoskeletal disorders, advanced healthcare infrastructure, and strong patient awareness regarding pain management therapies.

The United States, in particular, benefits from widespread prescription practices, availability of multiple NSAID formulations, and ongoing research and development activities. These factors contribute to the region’s leading market position and continued growth. For instance, in September 2025, GSK, the British pharmaceutical company, announced a USD 30 billion investment to establish manufacturing, research, and supply chain facilities in the U.S. over five years. An initial USD 1.2 billion was allocated to construct an AI-driven biologics facility at its King of Prussia, Pennsylvania site, starting in 2026, which was expected to create hundreds of jobs and enhance production of medicines for respiratory diseases and cancers. GSK’s investment strengthened manufacturing capacity and R&D capabilities, indirectly supporting the NSAID market by improving production efficiency, innovation, and availability of orthopedic therapies, thereby boosting market growth globally.

Moreover, the growing number of accidents is also another factor that is driving the growth of this market in this region. For instance, in 2022, Canada recorded 1,931 motor vehicle fatalities (up 6% from 2021), 8,851 serious injuries (up 8.1%), and 118,853 total injuries (up 9.5%). Fatalities per 100,000 population rose to 5.0, while unbelted passenger serious injuries decreased by 19%. Thus the rise in road accidents and orthopedic injuries has increased demand for NSAIDs for pain management and inflammation control, driving higher consumption in hospitals, trauma centers, and rehabilitation settings, thereby boosting growth in the global orthopedic NSAID market.

To Learn More About This Report - Request a Free Sample Copy

Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Competitive Landscape

The Global Orthopaedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market is characterized by a diverse and competitive landscape, encompassing a range of companies from established pharmaceutical giants to emerging players. These companies offer a wide array of NSAID products, catering to various musculoskeletal conditions and treatment preferences. The market is also driven by continuous research and development, leading to innovative formulations such as extended-release tablets, topical gels, and combination therapies that enhance efficacy and patient compliance. Increasing prevalence of orthopedic disorders, an aging population, and rising awareness of pain management options are further fueling demand. Additionally, strategic initiatives such as mergers, acquisitions, and partnerships among key players are expanding global reach and product portfolios. Together, these factors create a dynamic and rapidly evolving market, fostering competition, innovation, and improved accessibility of NSAID therapies for musculoskeletal health worldwide.

Key Players:

- Pfizer Inc.

- Johnson & Johnson (McNeil)

- Bayer AG

- GlaxoSmithKline (GSK)

- Sanofi S.A.

- Merck & Co., Inc.

- Novartis AG

- AbbVie Inc.

- Roche Holding AG

- Teva Pharmaceutical Industries Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Cipla Limited

- Sun Pharmaceutical Industries Ltd.

- Lupin Limited

- Aurobindo Pharma Limited

- Zydus Cadila Healthcare Limited

- Hikma Pharmaceuticals Public Limited Company

- Perrigo Company PLC

- Assertio Therapeutics Inc.

- Iroko Pharmaceuticals Inc.

Recent Development

- In January 2025, an article published, in Acta Anaesthesiologica Scandinavica, reported that The Global Orthopedics NSAIDs Market is shaped by a competitive landscape of established pharmaceutical companies and emerging players offering diverse formulations for musculoskeletal conditions. Market growth is driven by an aging population, rising prevalence of orthopedic disorders, and increasing awareness of pain management options. The PERISAFE trial, a randomized, placebo-controlled multicenter study with 2,904 patients, assessed eight-day postoperative ibuprofen use after hip and knee arthroplasties, evaluating serious adverse events, hospital-free days, opioid-related reactions, and quality of life. Its findings provided evidence of NSAID safety and efficacy, supporting wider adoption in orthopedic pain management and boosting global market growth.

- In January 2024, the PERISAFE trial, a randomized, placebo-controlled multicenter study, assessed eight-day postoperative ibuprofen use after hip and knee arthroplasties in 2,904 patients, evaluating serious adverse events, hospital-free days, opioid-related reactions, and quality of life. Around the same period, Heron Therapeutics announced FDA approval of its supplemental NDA for ZYNRELEF (bupivacaine and meloxicam) extended-release solution, expanding its indications to include soft tissue and orthopedic surgical procedures while avoiding direct exposure to articular cartilage.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary growth drivers are the rapidly expanding global geriatric population and the resultant increase in age-related musculoskeletal disorders like osteoarthritis and rheumatoid arthritis. This demographic shift significantly boosts the demand for effective non-opioid pain management options. Furthermore, rising public awareness about chronic orthopedic conditions, improved accessibility to over-the-counter (OTC) NSAID formulations, and growing public health efforts to curb opioid dependency all contribute significantly to market expansion.

Q2. What are the main restraining factors for this market?

The chief restraining factor is the well-documented risk of severe side effects associated with long-term NSAID use, specifically gastrointestinal complications (ulcers, bleeding) and potential cardiovascular risks. These safety concerns restrict prescription duration and drive demand toward alternative or non-pharmaceutical pain management therapies. Additionally, the increasing stringency of regulatory approvals for new NSAID formulations and the market pressure from generic drug competition also constrain overall market revenue growth.

Q3. Which segment is expected to witness high growth?

The Topical/Transdermal route of administration segment is expected to witness the highest growth rate. Patients and healthcare providers increasingly prefer topical NSAID gels and creams as they provide targeted pain relief directly at the site of inflammation while minimizing systemic absorption and the associated gastrointestinal or cardiovascular side effects. By application, the Osteoarthritis segment remains the largest and is projected to maintain strong growth due to its high and increasing global prevalence.

Q4. Who are the top major players for this market?

The Orthopedics NSAIDs market is dominated by global pharmaceutical and consumer health giants. Key major players include Pfizer Inc., Johnson & Johnson (McNeil), Bayer AG, GSK plc (Haleon), and Sanofi. These companies compete fiercely, leveraging their extensive distribution networks for both prescription and over-the-counter NSAID brands, and continually investing in the development of safer, more targeted, and often combined-ingredient formulations.

Q5. Which country is the largest player?

North America, particularly the United States, is the largest market player by revenue share for the Global Orthopedics NSAIDs Market. This dominance is due to the high per capita healthcare spending, the widespread prevalence of arthritis and chronic pain conditions, and the high rate of prescription and over-the-counter NSAID consumption. The region’s advanced healthcare infrastructure and strong focus on non-opioid pain management strategies further solidify its market leadership.

List of Figures

Figure 1: Global Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Orthopedics Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) Market Revenue (USD Billion) Forecast, by Country, 2018-2029