PCR Ready-to-use Master Mixes Market Overview and Analysis

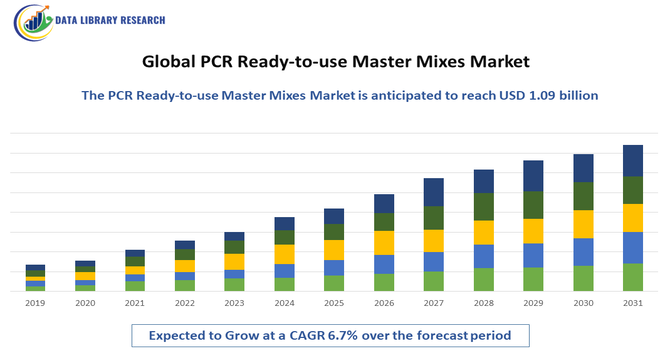

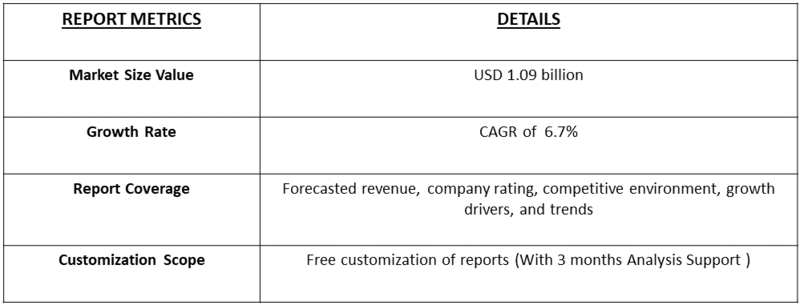

- The market is projected to grow to around USD 4.3 billion by 2032, from USD 1.09 billion in 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 6.7% over the forecast period.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global PCR Ready-to-use Master Mixes Market refers to the worldwide industry of pre-formulated reagent blends used for polymerase chain reaction (PCR) applications in research, diagnostics, and biotechnology. These master mixes include DNA polymerase, dNTPs, MgCl₂, and buffers, simplifying workflows by reducing preparation error and prep time.

Growing investments in biotechnology and life sciences research, coupled with the rising prevalence of infectious diseases and genetic disorders, are further accelerating demand for ready-to-use master mixes due to their convenience, reduced setup time, and minimized risk of contamination. Additionally, technological advancements such as hot-start PCR, multiplexing capabilities, and lyophilized formulations are enhancing assay performance and storage stability, supporting broader use in point-of-care and field-based testing.

PCR Ready-to-use Master Mixes Market Latest Trends

The Global PCR Ready-to-use Master Mixes Market is witnessing several emerging trends driven by advancements in molecular diagnostics and biotechnology research. A major trend is the growing adoption of pre-formulated, ready-to-use master mixes that simplify workflows, minimize human error, and enhance reproducibility in both research and clinical laboratories. The development of specialized formulations for real-time PCR, multiplex PCR, digital PCR, and next-generation sequencing (NGS) applications is expanding the versatility and efficiency of amplification processes. There is also a rising preference for lyophilized and room-temperature stable master mixes, enabling easier storage, transport, and use in point-of-care and field diagnostics. Increasing focus on personalized medicine and infectious disease detection, particularly post-pandemic, continues to boost demand for high-performance, contamination-resistant master mixes.

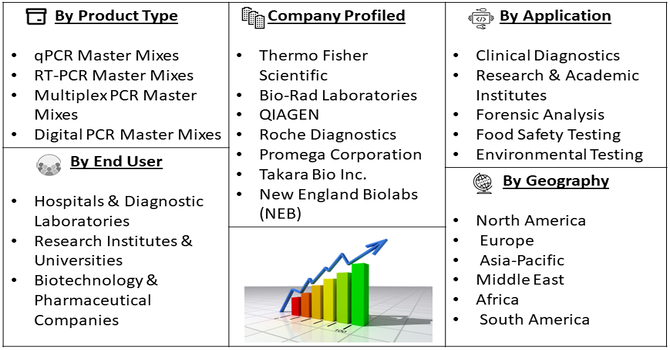

Segmentation: Global PCR Ready-to-use Master Mixes Market is segmented By Type (qPCR Master Mixes, RT-PCR Master Mixes, Multiplex PCR Master Mixes, Digital PCR Master Mixes), Application (Clinical Diagnostics, Research & Academic Institutes, Forensic Analysis, Food Safety Testing, and Environmental Testing), End User (Hospitals & Diagnostic Laboratories, Research Institutes & Universities, Biotechnology & Pharmaceutical Companies), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Demand for Rapid and Accurate Molecular Diagnostics

One of the key drivers propelling the Global PCR Ready-to-use Master Mixes Market is the increasing demand for fast, reliable, and accurate molecular diagnostic solutions. The widespread use of polymerase chain reaction (PCR) technology for detecting infectious diseases—such as COVID-19, influenza, tuberculosis, and HIV—has significantly boosted the adoption of ready-to-use master mixes. These pre-formulated reagents minimize preparation time, reduce the risk of contamination, and ensure consistent performance, making them ideal for high-throughput diagnostic laboratories and point-of-care testing. Moreover, the ongoing rise in chronic and genetic disorders has heightened the need for precise gene amplification and expression analysis, further driving the utilization of ready-to-use PCR reagents in clinical diagnostics. The shift toward personalized medicine and companion diagnostics also contributes to sustained demand for these ready-to-use formulations, enabling faster turnaround times and standardized results in critical healthcare settings.

- Technological Advancements and Product Innovation in PCR Reagents

Continuous advancements in PCR technology are another major factor driving market growth. Manufacturers are introducing highly optimized enzyme systems, buffer compositions, and stabilizing agents to improve amplification efficiency, sensitivity, and specificity across various PCR formats such as qPCR, RT-PCR, multiplex PCR, and digital PCR. Innovations like hot-start PCR, high-fidelity polymerases, and lyophilized (freeze-dried) master mixes are enhancing assay performance while offering greater stability and extended shelf life—particularly beneficial for decentralized and field-based testing. Additionally, the integration of automation-compatible master mixes supports streamlined workflows in high-throughput research and clinical laboratories. The trend toward miniaturization and microfluidic PCR platforms is further expanding the applicability of ready-to-use master mixes across diagnostic, research, and industrial sectors, thereby strengthening the overall market outlook.

Market Restraints:

- High Cost of Advanced PCR Reagents and Instruments

One major challenge is the high cost of advanced PCR reagents and instruments, which limits adoption among small laboratories and research institutions, particularly in developing regions. The initial investment required for real-time and digital PCR systems, coupled with the recurring expense of high-quality master mixes, creates financial barriers for resource-limited settings. Another key restraint is the stringent regulatory framework governing molecular diagnostic reagents. Achieving regulatory approvals such as FDA clearance or CE marking demands extensive validation, time, and cost, slowing down new product introductions. Additionally, technical limitations and sensitivity to contamination during PCR workflows can compromise accuracy, leading to false-positive or false-negative results, especially in low-template or complex samples.

Socio Economic Impact on PCR Ready-to-use Master Mixes Market

The Global PCR Ready to use Master Mixes Market has made significant socioeconomic contributions by enhancing molecular diagnostics and research capabilities worldwide. Ready to use mixes streamlined laboratory workflows, improved accuracy in disease detection, and accelerated genetic and infectious disease research, particularly in emerging economies. These tools supported public health responses, reduced diagnostic costs, and expanded access to precision medicine. By improving early diagnosis and treatment, they helped increase productivity, reduce healthcare burdens, and foster economic and technological growth globally.

Segmental Analysis:

- PCR Master Mixes segment is expected to witness the highest growth over the forecast period

The PCR Master Mixes segment is expected to dominate the market over the forecast period. This growth is primarily driven by the rising use of quantitative PCR (qPCR) in gene expression studies, clinical diagnostics, and infectious disease detection. qPCR master mixes enable real-time monitoring of amplification, offering high sensitivity, specificity, and reproducibility. Continuous advancements in probe-based chemistries, fluorescent dyes, and enzyme formulations have improved quantification accuracy and reaction efficiency, further fueling demand across research and diagnostic laboratories worldwide.

- Clinical Diagnostics segment is expected to witness the highest growth over the forecast period

The Clinical Diagnostics segment holds the largest market share and is projected to witness substantial growth during the forecast period. The increasing prevalence of infectious diseases, genetic disorders, and cancer has heightened the need for molecular diagnostics based on PCR technology. Ready-to-use master mixes simplify workflow, reduce contamination risk, and ensure consistent results, making them ideal for clinical testing environments. The adoption of PCR-based diagnostic kits for pathogen detection and personalized medicine is further propelling this segment’s growth globally.

- Biotechnology & Pharmaceutical Companies segment is expected to witness the highest growth over the forecast period

The Biotechnology & Pharmaceutical Companies segment is expected to register significant growth over the forecast period. These companies extensively utilize PCR ready-to-use master mixes for drug discovery, genetic analysis, and quality control testing. The growing focus on molecular assay development, vaccine research, and biopharmaceutical production is driving the adoption of standardized PCR reagents that ensure efficiency and reproducibility. Moreover, increasing collaborations between biotech firms and diagnostic reagent manufacturers are further strengthening market penetration in this segment.

- North America region is expected to witness the highest growth over the forecast period

This growth is primarily driven by the strong presence of advanced healthcare infrastructure, well-established biotechnology and pharmaceutical industries, and increasing adoption of molecular diagnostics across clinical and research settings. The region’s high investment in genomics research, rising prevalence of infectious and genetic diseases, and growing focus on personalized medicine are further fueling demand for efficient and ready-to-use PCR reagents.

Additionally, the continuous introduction of innovative PCR technologies, automation in laboratory workflows, and favorable regulatory frameworks supporting molecular testing contribute to North America’s leading position in the market. For instance, in November 2025, The U.S. FDA approved Promega’s OncoMate MSI Dx Analysis System as a companion diagnostic to identify microsatellite stable (MSS) endometrial carcinoma patients eligible for KEYTRUDA (pembrolizumab) plus LENVIMA (lenvatinib) therapy. As Promega’s first FDA-approved companion diagnostic, the PCR-based assay assessed MSI status in tumor tissue, supporting precision oncology treatment decisions. This approval highlighted growing adoption of PCR-ready reagents, boosting demand and innovation in the global PCR Ready-to-use Master Mixes Market.

Thus, such factors are fueling the growth of the above market in this region.

To Learn More About This Report - Request a Free Sample Copy

PCR Ready-to-use Master Mixes Market Competitive Landscape

The Global PCR Ready-to-use Master Mixes Market is competitive and populated by a mix of large life-science corporations and specialized reagent companies that compete on product performance, assay consistency, stability (lyophilized/room-temperature formats), and service/support for clinical and research customers.

Key Players:

- Thermo Fisher Scientific

- Bio-Rad Laboratories

- QIAGEN

- Roche Diagnostics

- Promega Corporation

- Takara Bio Inc.

- New England Biolabs (NEB)

- Merck KGaA (MilliporeSigma)

- Abbott Laboratories

- Agilent Technologies

- PerkinElmer

- Enzo Life Sciences

- Bioneer Corporation

- Meridian Bioscience

- Kapa Biosystems (Roche)

- Eurogentec (Kaneka)

- Zymo Research

- Applied Biological Materials (ABM)

- Lucigen (LGC)

- BioBasic

Recent Development

- In January 2025, QIAGEN announced that its QIAcuity Digital PCR (dPCR) system had significantly enhanced capabilities, enabling simultaneous detection of up to 12 targets from a single biological sample—more than double the previous limit of five targets. This upgrade required no hardware changes, thanks to QIAcuity Software 3.1 and the new High Multiplex Probe PCR Kit. The improved system increased lab productivity and cost-efficiency by saving time, reducing reagent use, and conserving precious sample materials.

- In June 2022, Meridian Bioscience, Inc, a global provider of diagnostic testing solutions and life science raw materials, announced the launch of two new sample-specific master mixes: Lyo-Ready Direct DNA qPCR Stool Mix and Lyo-Ready Direct RNA/DNA qPCR Stool Mix. These master mixes enhanced the molecular detection of DNA and RNA from crude fecal specimens and enabled room temperature stabilization of diagnostic assays.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary driver is the rapid and widespread adoption of PCR (Polymerase Chain Reaction) in clinical diagnostics, especially for infectious diseases (like COVID-19 and influenza) and genetic testing. Ready-to-use master mixes significantly improve workflow efficiency and reproducibility by pre-mixing essential reagents (polymerase, buffers, dNTPs) into a single solution. This simplicity reduces pipetting errors, saves preparation time in high-throughput labs, and minimizes the risk of contamination, making them essential tools for fast and reliable testing globally.

Q2. What are the main restraining factors for this market?

The primary constraint is the high initial cost of certain advanced or specialized master mixes, such as those formulated for difficult sample types or high-fidelity applications like quantitative real-time PCR (qPCR). This cost can be prohibitive for smaller research laboratories or diagnostic centers in developing regions, limiting market penetration. Additionally, the sensitivity to storage conditions (requiring strict cold chain management) and potential batch-to-batch variability in formulation can also restrain user confidence and adoption compared to customized, in-house prepared solutions.

Q3. Which segment is expected to witness high growth?

The qPCR (quantitative PCR) Ready-to-use Master Mixes Segment is projected to witness the highest growth. qPCR is the standard method for gene expression analysis, viral load quantification, and disease monitoring due to its precision and ability to quantify nucleic acids in real-time. Advances in probe-based and dye-based qPCR master mixes are continuously enhancing sensitivity and accuracy. The rising demand for rapid, precise, and high-throughput molecular diagnostics in clinical and research settings worldwide is strongly fueling the expansion of this segment.

Q4. Who are the top major players for this market?

The market is led by established life science and diagnostic companies that offer comprehensive molecular biology portfolios. Top major players include Thermo Fisher Scientific, Bio-Rad Laboratories, Merck KGaA (Sigma-Aldrich), and Promega Corporation. These companies leverage their strong global distribution networks, massive R&D capabilities, and commitment to quality control to offer a diverse range of specialized master mixes, including those optimized for hot-start, reverse transcription, and digital PCR applications, maintaining their competitive edge.

Q5. Which country is the largest player?

The United States, within the North American region, is the largest country player in the PCR Ready-to-use Master Mixes Market. This market leadership is supported by massive government and private funding for life science research, a high number of academic and biotech institutions, and a robust clinical diagnostics infrastructure with high testing volumes. Furthermore, the quick adoption of advanced molecular techniques and the strong market presence of major global suppliers headquartered in the U.S. solidify its dominance in terms of both consumption and technological innovation.

List of Figures

Figure 1: Global PCR Ready-to-use Master Mixes Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global PCR Ready-to-use Master Mixes Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global PCR Ready-to-use Master Mixes Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global PCR Ready-to-use Master Mixes Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global PCR Ready-to-use Master Mixes Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America PCR Ready-to-use Master Mixes Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America PCR Ready-to-use Master Mixes Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America PCR Ready-to-use Master Mixes Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America PCR Ready-to-use Master Mixes Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America PCR Ready-to-use Master Mixes Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America PCR Ready-to-use Master Mixes Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe PCR Ready-to-use Master Mixes Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe PCR Ready-to-use Master Mixes Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe PCR Ready-to-use Master Mixes Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific PCR Ready-to-use Master Mixes Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific PCR Ready-to-use Master Mixes Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific PCR Ready-to-use Master Mixes Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa PCR Ready-to-use Master Mixes Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa PCR Ready-to-use Master Mixes Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa PCR Ready-to-use Master Mixes Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa PCR Ready-to-use Master Mixes Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa PCR Ready-to-use Master Mixes Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model