Perfluorocarbon Liquid for Eye Surgery Market Overview and Analysis

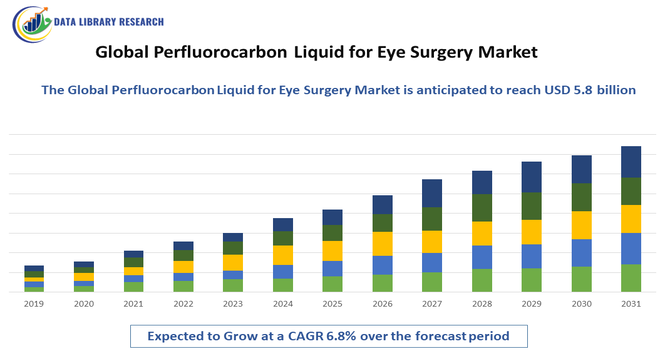

- The Global Perfluorocarbon Liquid (PFCL) for Eye Surgery market, a fast-growing segment of the Ophthalmic Tamponades market, is fueled by the rising prevalence of retinal disorders and complex vitreoretinal procedures. The broader market is projected to reach from USD 1.2 billion in 2025 to approximately USD 5.8 billion by 2033, with a forecasted Compound Annual Growth Rate (CAGR) of roughly 6.8% from 2025 to 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The rising demand for advanced vitreoretinal procedures—driven by an aging global population with increasing incidence of retinal disorders (e.g., retinal detachment, proliferative diabetic retinopathy, and complex trauma), greater access to ophthalmic care in emerging markets, and expanding surgical volumes—forms the core growth engine for the perfluorocarbon liquid (PFCL) for eye surgery market. Technological improvements in PFCL purity, safety profiles, and delivery systems, coupled with broader surgeon adoption following stronger clinical evidence and guideline acceptance, have improved outcomes and expanded indications.

Perfluorocarbon Liquid for Eye Surgery Market Latest Trends

The PFCL market is showing steady, evidence-driven adoption as surgeons increasingly use perfluorocarbon liquids not only intraoperatively but also as short-term postoperative endotamponades for complex retinal detachments, a practice supported by recent clinical studies demonstrating safety and efficacy for limited durations. Technological and quality-control improvements—including production of ultra-pure PFCLs and safer delivery systems—along with rising regulatory approvals are reducing complication concerns and encouraging wider clinical use. Convergence with trends in vitrectomy (greater uptake of 25-/27-gauge micro-incision platforms and advanced vitrectomy devices) is increasing procedure volumes and per-case PFCL consumption.

Segmentation: Global Perfluorocarbon Liquid for Eye Surgery Market is segmented By Product Type (Perfluoro-n-octane, Perfluorodecalin, Perfluorooctane–Perfluorodecalin Blends), Application (Retinal Detachment Repair, Proliferative Vitreoretinopathy, Giant Retinal Tear Surgery), End User (Hospitals, Specialized Eye Clinics, Ambulatory Surgical Centers), Distribution Channel (Direct Sales, Independent Distributors, Online Medical Supply Platforms), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Prevalence of Retinal Disorders

A growing global burden of retinal diseases—such as retinal detachment, proliferative diabetic retinopathy, giant retinal tears, and trauma-related retinal injuries—is significantly increasing the demand for vitreoretinal surgeries where PFCLs are critical tools. The rise in diabetes cases, aging populations, and improved diagnostic capabilities are collectively expanding the number of complex retinal procedures, directly driving PFCL consumption worldwide. For instance, in November 2025, the recent news published by NCBI, reported that more than 11 million Indians had been affected by retinal disorders, with over 4 million already facing advanced diabetic retinopathy, yet only around 200,000 had received treatment. This significant care gap had underscored rising unmet clinical needs, driving demand for advanced surgical solutions and expanding the global perfluorocarbon liquid market.

- Advancements in Vitreoretinal Surgical Techniques

Technological progress in micro-incision vitrectomy systems (25G/27G platforms), enhanced visualization systems, and precision surgical instruments has enabled surgeons to perform more complex retinal surgeries safely and effectively.

In April 2025, Alcon announced that it had launched the UNITY Vitreoretinal Cataract System and UNITY Cataract System, offering a versatile platform with advanced technologies such as UNITY 4D Phaco, HYPERVIT 30K, and the UNITY Intelligent Fluidics system. These innovations had been designed to improve efficiency and deliver superior outcomes in cataract and vitreoretinal surgery. Such technological progress had accelerated the evolution of vitreoretinal surgical techniques and indirectly supported growth in the global PFCL market by enhancing surgical precision and expanding procedure volumes. These innovations increase the use of perfluorocarbon liquids for intraoperative retinal manipulation, stabilization, and reattachment, thereby boosting adoption across hospitals and specialty eye centers.

Market Restraints:

- Risk of PFCL-Related Adverse Effects

Despite their benefits, perfluorocarbon liquids carry risks such as retinal toxicity, subretinal migration, inflammation, and visual disturbances when not used with high-purity formulations or appropriate surgical techniques. Historical incidents of PFCL-related toxicity have made surgeons more cautious, slowing adoption in some regions and pushing regulatory bodies to enforce stricter quality standards—thereby restraining market growth.

Socioeconomic Impact on Perfluorocarbon Liquid for Eye Surgery Market

The Global Perfluorocarbon Liquid (PFCL) for Eye Surgery Market has had several socioeconomic impacts. As PFCL became widely used in retinal surgeries, it helped patients recover vision more effectively, allowing many people to return to work sooner and maintain their quality of life. This supported overall productivity and reduced long-term healthcare costs linked to untreated eye disease. The growing demand for PFCL also encouraged investment in ophthalmic research and created new opportunities for medical companies and healthcare workers. In many developing regions, better access to PFCL improved outcomes for retinal detachment, helping reduce preventable blindness. However, the high cost of PFCL and specialized surgical equipment still posed challenges for lower-income populations, highlighting the need for affordable eye-care solutions.

Segmental Analysis:

- Perfluoro-n-octane segment is expected to witness the highest growth over the forecast period

Perfluoro-n-octane (PFO) holds a significant share in the market due to its excellent physical properties such as high specific gravity and low viscosity, which make it ideal for retinal flattening during vitreoretinal surgery. Its strong clinical track record, ease of intraoperative manipulation, and wide acceptance among retinal surgeons position PFO as a highly preferred PFCL product type. The segment’s growth is further supported by increasing availability of high-purity grades that enhance safety and reduce complications.

- Retinal Detachment Repair segment is expected to witness the highest growth over the forecast period

Retinal detachment repair represents the largest application segment, driven by the rising incidence of rhegmatogenous retinal detachment and complex cases requiring PFCL for intraoperative stabilization. PFCLs such as PFO and perfluorodecalin are crucial for reattaching the retina, improving surgical success rates, and reducing recovery time. With global aging populations and increasing diabetic eye conditions, the demand for retinal detachment surgery continues to rise, strengthening this segment’s dominance.

- Hospitals segment is expected to witness the highest growth over the forecast period

Hospitals remain the primary end users for PFCLs, largely due to their advanced surgical facilities, greater availability of vitreoretinal surgeons, and ability to manage complex retinal cases. Hospitals also perform a higher volume of vitreoretinal surgeries compared to smaller clinics, making them key consumers of PFCL products. Their access to specialized instrumentation and reimbursement pathways further drives steady adoption of PFCLs in surgical procedures.

- Direct Sales segment is expected to witness the highest growth over the forecast period

Direct sales account for a robust share of the market as manufacturers often supply PFCLs directly to hospitals, eye clinics, and surgical centers to ensure product quality, proper handling, and timely delivery. Direct procurement also enables healthcare institutions to negotiate better pricing and maintain reliable inventory for critical eye surgeries. This channel is particularly strong in developed regions where large healthcare networks maintain structured supplier relationships.

- North America segment is expected to witness the highest growth over the forecast period

North America leads the market owing to its advanced ophthalmic care infrastructure, high prevalence of retinal diseases, strong presence of leading PFCL manufacturers, and early adoption of innovative vitreoretinal technologies. For instance, CDC, published the recent news, that reported, by 2021, the prevalence of diabetic retinopathy in the U.S. had doubled since 2004, reaching 9.6 million patients, driven largely by rapid growth in the diabetic population. Although severe vision-threatening forms had declined due to better screening and management, aging demographics—especially Baby Boomers—had significantly increased AMD cases. IRD prevalence had also risen 1.84-fold from 2016 to 2023 as improved diagnostics expanded case identification. These trends collectively had intensified demand for advanced surgical interventions, strengthening the North American PFCL market.

The region’s high surgical volume, favorable reimbursement policies, and wide availability of trained vitreoretinal specialists contribute to sustained growth. Continued investments in research and regulatory approvals further solidify North America’s dominant position in the global market. For instance, in July 2025, Ocugen announced that it had enhanced its Retina Scientific Advisory Board and strengthened its executive leadership team to support its goal of submitting three BLAs within three years. According to CEO Dr. Shankar Musunuri, advancing gene therapy programs had made expert external guidance and high-caliber internal leadership essential for upcoming commercialization efforts. These organizational advancements had further accelerated innovation in the retinal field, indirectly supporting progress in vitreoretinal surgical techniques and reinforcing growth momentum in the North American PFCL market.

To Learn More About This Report - Request a Free Sample Copy

Perfluorocarbon Liquid for Eye Surgery Market Competitive Landscape

The competitive landscape for the Global Perfluorocarbon Liquid (PFCL) for Eye Surgery market is characterized by a mix of large, diversified ophthalmic and medical-device players and smaller specialty manufacturers that focus on high-purity PFCL formulations and surgical consumables. Market competition centers on product safety and purity, regulatory approvals, surgeon training/support, and strong distribution networks—while companies differentiate through proprietary purification processes, bundled delivery systems, and regional partnerships. Mergers & acquisitions, strategic alliances with hospital groups and surgical centers, and investment in clinical evidence generation are common strategies to expand market share. Price sensitivity in emerging markets, coupled with stringent quality standards in developed markets, pushes manufacturers toward segmented product offerings (standard grade vs. ultra-pure) and targeted go-to-market approaches.

The major players for this market are:

- Alcon

- Bausch + Lomb

- Johnson & Johnson Vision

- Carl Zeiss Meditec

- Santen Pharmaceutical

- Dutch Ophthalmic Research Center (DORC)

- FCI Ophthalmics

- Fluoron GmbH

- Epsilon Medical

- MedOne Surgical

- Nidek Co., Ltd.

- Topcon Corporation

- HOYA Surgical Optics

- Rhein Medical

- SurgiTech Global Ophthalmic Supplies

- OptiMedica Corporation

- Avedro, Inc.

- Ophthalmic International

- Sterimedix

Recent Development

- In May 2025, Pykus Therapeutics, Inc. reported that strong efficacy and safety, with retinal attachment rates surpassing FDA targets, evidence of faster visual recovery, and no major safety issues. Their findings indicated that hydrogel retinal sealants had provided a promising alternative to conventional endotamponades. This progress had also suggested a potential shift in the global perfluorocarbon liquid market, as successful sealant technologies had begun to lessen clinical dependence on PFCL in retinal surgery.

- In March 2025, a study published by Department of Ophthalmology, Edward S. Harkness Eye Institute, Columbia University Irving Medical Center, US reported that retained PFCL in the anterior chamber had been capable of provoking anterior uveitis and elevated intraocular pressure, yet these complications had resolved promptly after bubble removal. This finding suggested that timely identification and extraction of retained PFCL had been essential for preventing persistent inflammation. The outcome also implied that increasing clinical awareness of such complications had supported demand for safer PFCL formulations in the global eye-surgery market.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is primarily driven by the rising global incidence of complex retinal diseases, such as severe diabetic retinopathy and age-related macular degeneration. As the worldwide elderly population grows, the number of required vitreoretinal surgeries increases. Furthermore, technological improvements lead to better PFCL formulations with enhanced safety.

Q2. What are the main restraining factors for this market?

The main restraining factors are the high cost associated with both the PFCL products and the specialized surgical procedures (vitrectomies) that use them. This cost often limits accessibility in developing regions. Additionally, the need for a second surgery to remove the PFCL post-procedure adds to the overall patient burden and cost.

Q3. Which segment is expected to witness high growth?

Within the overall ophthalmic tamponades market, the Perfluorocarbon Liquid segment itself is witnessing high growth, especially for complex vitreoretinal surgery applications like giant retinal tears and proliferative vitreoretinopathy. These complex cases require the unique heavy fluid properties of PFCLs for superior retinal stabilization during the operation.

Q4. Who are the top major players for this market?

The market features established medical device giants and specialized firms. Key major players include Alcon Inc., Bausch + Lomb Corporation, and specialized manufacturers like Fluoron GmbH and others focusing on vitreoretinal products. Competition revolves around product quality, purity, and clinical outcomes.

Q5. Which country is the largest player?

North America, especially the United States, is the largest country or regional player in terms of revenue. This is due to the advanced and accessible healthcare infrastructure, high expenditure on specialized surgical procedures, and a high prevalence of chronic diseases like diabetes leading to severe eye complications.

List of Figures

Figure 1: Global Perfluorocarbon Liquid for Eye Surgery Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Perfluorocarbon Liquid for Eye Surgery Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Perfluorocarbon Liquid for Eye Surgery Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Perfluorocarbon Liquid for Eye Surgery Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Perfluorocarbon Liquid for Eye Surgery Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Perfluorocarbon Liquid for Eye Surgery Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Perfluorocarbon Liquid for Eye Surgery Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Perfluorocarbon Liquid for Eye Surgery Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Perfluorocarbon Liquid for Eye Surgery Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Perfluorocarbon Liquid for Eye Surgery Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Perfluorocarbon Liquid for Eye Surgery Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Perfluorocarbon Liquid for Eye Surgery Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Perfluorocarbon Liquid for Eye Surgery Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Perfluorocarbon Liquid for Eye Surgery Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Perfluorocarbon Liquid for Eye Surgery Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model