Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Overview and Analysis

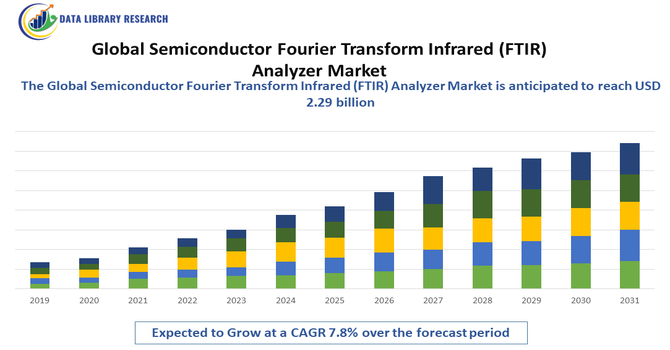

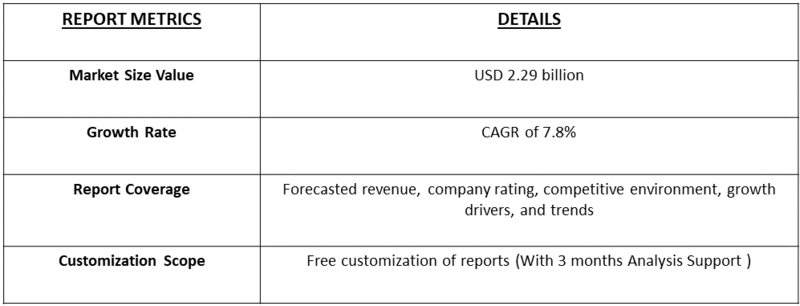

- The Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market is currently valued at USD 1.89 billion in the year 2025 and expected to reach USD 2.29 billion by 2032, growing with a CAGR of 7.8% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market refers to the industry focused on advanced spectroscopic instruments used to analyze and monitor materials during semiconductor manufacturing processes. FTIR analyzers provide precise, non-destructive chemical analysis by detecting infrared light absorption patterns, helping ensure material purity, process control, and defect detection in wafer fabrication and thin-film deposition. Driven by the increasing demand for high-performance and miniaturized chips across industries such as electronics, automotive, and telecommunications, the market is expanding rapidly.

Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Latest Trends

The market for Fourier Transform Infrared (FTIR) Spectroscopy, a key analytical technique utilized in the semiconductor industry for quality control and material characterization, is primarily driven by the ongoing trend of miniaturization and portability, with portable and handheld spectrometers exhibiting the fastest growth rate as industries demand rapid, on-site testing capabilities. Beyond semiconductors, market expansion is heavily propelled by stringent quality assurance regulations across high-growth sectors, particularly the pharmaceutical industry for drug discovery and impurity detection, as well as increasing applications in food safety, environmental monitoring, and forensic science. This growth is further supported by continuous technological advancements, including the integration of more sophisticated detectors and smart data analysis software, ensuring high precision and ease of use, with the Asia-Pacific region emerging as a critical, high-growth hub fueled by increased regional investments in R&D and advanced manufacturing.

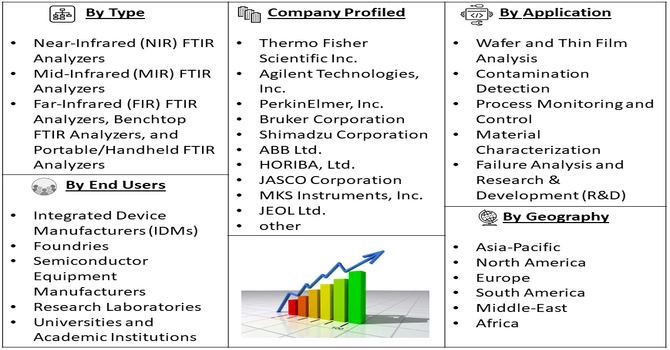

Segmentation: The Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market is segmented by Type (Near-Infrared (NIR) FTIR Analyzers, Mid-Infrared (MIR) FTIR Analyzers, Far-Infrared (FIR) FTIR Analyzers, Benchtop FTIR Analyzers, and Portable/Handheld FTIR Analyzers), Application (Wafer and Thin Film Analysis, Contamination Detection, Process Monitoring and Control, Material Characterization, Failure Analysis and Research & Development (R&D)), End User (Integrated Device Manufacturers (IDMs), Foundries, Semiconductor Equipment Manufacturers, Research Laboratories and Universities and Academic Institutions), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Growing Demand for High-Precision Semiconductor Manufacturing

As semiconductor devices become increasingly compact and complex, the need for ultra-precise material analysis tools has grown significantly. FTIR analyzers offer non-destructive testing and real-time monitoring capabilities, making them vital in ensuring the quality and consistency of semiconductor wafers, thin films, and coatings. They are especially valuable in detecting trace contaminants and verifying chemical composition during fabrication. With industries such as consumer electronics, electric vehicles, and 5G pushing the boundaries of chip performance, manufacturers are investing more in advanced process control tools like FTIR systems. This surge in demand for tighter process tolerances and improved yields is a major driver of FTIR adoption across semiconductor fabs globally.

- Rise in R&D Investments and Material Innovation

The global semiconductor industry is seeing unprecedented investments in research and development to support next-generation chip technologies, including advanced packaging, EUV lithography, and new materials like compound semiconductors and 2D materials. FTIR analyzers play a critical role in this innovation ecosystem by enabling rapid and accurate chemical characterization of new materials and processes. For instance, in June 2025, Ericsson (NASDAQ: ERIC) expanded its Research and Development (R&D) team in Bengaluru, India, to strengthen its capabilities in Application-Specific Integrated Circuit (ASIC) development. This strategic move highlighted Ericsson’s commitment to positioning India at the forefront of future communication technology. Ericsson’s expansion in ASIC development reflects the broader growth and innovation in the semiconductor sector, driving increased demand for precision analytical tools like FTIR analyzers. As semiconductor design and manufacturing capabilities advance, the need for accurate material characterization and contamination detection using FTIR technology is expected to rise globally.

Their application in failure analysis and process validation also supports faster prototyping and commercialization. Additionally, the integration of FTIR tools with AI and machine learning for automated defect detection is gaining traction, further enhancing their value in R&D environments. As companies race to stay competitive, demand for high-performance analytical tools like FTIR continues to grow steadily.

Market Restraints:

- High Cost of Equipment and Skilled Labor Requirements

The primary challenges limiting the widespread adoption of FTIR analyzers in the semiconductor sector is their high initial cost and operational complexity. These instruments often require significant capital investment, which may be a barrier for small and mid-sized semiconductor manufacturers. Additionally, FTIR systems demand skilled personnel for setup, calibration, and interpretation of spectral data. The shortage of trained analysts and the learning curve associated with advanced FTIR software can delay deployment or reduce its effectiveness. Furthermore, integrating FTIR tools into existing semiconductor fabrication lines without disrupting workflow can be technically demanding and costly. These factors combined can slow down adoption, particularly in emerging markets or less automated facilities.

Socio-Economic Impact on Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market

The global market for Semiconductor Fourier Transform Infrared (FTIR) Analyzers provides substantial socio-economic impact by serving as a critical enabler for efficiency and compliance within the foundational semiconductor industry. Economically, these high-precision, non-destructive tools are essential for real-time quality control, enabling the accurate identification and quantification of critical impurities like carbon and oxygen in silicon and advanced materials, which directly leads to increased manufacturing yields, reduced material waste, and significant cost savings by optimizing material usage and minimizing production downtime. Socially, the technology plays a vital role in environmental stewardship by allowing semiconductor fabrication plants to monitor and ensure strict regulatory compliance, particularly concerning the effective destruction and removal efficiency (DRE) of complex greenhouse gas emissions, thereby mitigating pollution and supporting public health goals. This reliance on advanced, specialized metrology equipment also drives demand for innovation within the analytical instrumentation sector itself and necessitates a highly skilled workforce of engineers and technicians, contributing to high-value job creation globally.

Segmental Analysis:

- Mid-Infrared (MIR) FTIR Analysers Segment is Expected to Witness Significant Growth Over the Forecast Period

The Mid-Infrared (MIR) FTIR analysers segment is projected to see substantial growth due to their increasing application in various industries, such as pharmaceuticals, chemicals, and environmental monitoring. These analysers are highly effective for detecting specific molecular vibrations, making them ideal for precise material identification. As regulations around emissions and product quality become more stringent, industries are turning to MIR FTIR technology for its accuracy and reliability. Additionally, advancements in miniaturization and software integration are making these devices more user-friendly and accessible. The growing focus on real-time monitoring and non-destructive testing further drives the demand. Overall, technological innovation combined with increasing regulatory pressure is set to propel the MIR FTIR segment over the coming years.

- Contamination Detection Segment is Expected to Witness Significant Growth Over the Forecast Period

The contamination detection segment is expected to experience robust growth due to rising awareness and regulations concerning product safety and environmental cleanliness. Industries such as food and beverage, pharmaceuticals, and semiconductors rely heavily on accurate contamination detection to ensure quality and compliance. With stricter government regulations and consumer demand for safer products, companies are investing more in advanced detection technologies. FTIR analysers are increasingly being used in this area due to their ability to identify a wide range of organic and inorganic contaminants. Additionally, the rise in automation and smart manufacturing is pushing demand for real-time, in-line contamination monitoring solutions. This trend is likely to continue, making contamination detection a high-growth area in the coming years.

- Semiconductor Equipment Manufacturers Segment is Expected to Witness Significant Growth Over the Forecast Period

The semiconductor equipment manufacturers segment is projected to see significant growth, driven by the global expansion of electronics and digital technologies. As demand for smaller, faster, and more energy-efficient devices increases, semiconductor manufacturers are under pressure to maintain the highest levels of purity and precision in production processes. For instance, in November 2024, Samsung Electronics announced that it held a tool-in ceremony for its new semiconductor research and development complex (NRD-K) at the Giheung campus, marking a major step toward the future. Samsung plans to invest approximately KRW 20 trillion by 2030 in the 109,000-square-meter complex, which will also include an R&D-dedicated production line expected to begin operation in mid-2025. Thus, such rapid expansion highlights rising demand of semiconductors as a result the segment is expected to witness high growth over the forecasted period.

FTIR analysers play a crucial role in monitoring chemical composition, contamination, and material quality in semiconductor fabrication. With the rapid development of technologies such as AI, 5G, and IoT, the need for advanced semiconductor equipment continues to rise. In addition, government initiatives to boost domestic semiconductor production in regions like North America and Asia are expected to fuel further demand for FTIR solutions in this segment.

- North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America is poised to witness substantial growth in the FTIR analyser market due to strong industrial demand, technological advancements, and supportive regulatory frameworks. The region is home to major players in pharmaceuticals, chemicals, semiconductors, and environmental monitoring—all key industries that rely on FTIR technology.

Additionally, increasing investments in research and development, along with stricter environmental regulations from agencies like the EPA, are encouraging companies to adopt advanced analytical tools like FTIR analysers. For instance, in March 2025, TSMC announced plans to increase its investment in advanced semiconductor manufacturing in the United States by an additional USD 100 billion. This builds on their existing USD 65 billion investment in Phoenix, Arizona, bringing the total U.S. investment to USD 165 billion. The expansion includes the construction of three new fabrication plants, two advanced packaging facilities, and a major R&D center. This initiative represents the largest single foreign direct investment in U.S. history and underscores TSMC’s commitment to strengthening semiconductor manufacturing capabilities in North America. The growing push toward automation and real-time monitoring also supports this trend. As fabrication and packaging facilities scale up, the need for accurate material characterization and contamination detection will grow, fueling the expansion of the FTIR analyzer market in the region. With a strong base of innovation, infrastructure, and regulatory support, North America is expected to remain a leading market for FTIR analysers over the forecast period.

To Learn More About This Report - Request a Free Sample Copy

Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Competitive Landscape

The competitive landscape in the FTIR / MIR analysis market is shaped by a blend of well established global instrument makers and more nimble specialist firms. Key players—such as Thermo Fisher Scientific, Bruker, PerkinElmer, Shimadzu, Agilent Technologies, ABB, and JASCO—dominate via broad product portfolios, strong R&D, global sales networks, and after sales support. These majors are continually pushing innovation in areas like mid infrared FTIR sensitivity, portable/benchtop designs, software for automated / real time monitoring, and contamination detection capabilities. Meanwhile, smaller or niche manufacturers compete by tailoring solutions for specific use cases (e.g. semiconductor process control, in line contamination monitoring) or by offering cost efficient and flexible offerings in emerging geographies. Price competition is strong, especially in markets with less stringent regulation, driving efficiencies in manufacturing and component use. Barriers to entry remain relatively high due to requirements for precision, certification, and strong support services. Over the forecast period, mergers, partnerships, and technology licensing are likely to be important strategies for both the incumbents and challengers as they seek to secure market share in high growth segments (e.g. MIR analysers, contamination detection, semiconductor equipment) and high opportunity regions like North America.

The 20 major players for this market are:

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- PerkinElmer, Inc.

- Bruker Corporation

- Shimadzu Corporation

- ABB Ltd.

- HORIBA, Ltd.

- JASCO Corporation

- MKS Instruments, Inc.

- JEOL Ltd.

- Foss A/S

- Spectris plc

- Hitachi High-Tech Corporation

- Metrohm AG

- Rigaku Corporation

- Endress+Hauser Group

- Emerson Electric Co.

- Yokogawa Electric Corporation

- Teledyne Technologies Incorporated

- Berthold Technologies GmbH & Co. KG

Recent Development

- In September 2025, AllegroDVT, announced a comprehensive suite of products to support the adoption of the next-generation AV2 codec from the Alliance for Open Media, set for release by the end of 2025. Their offerings include the Sirius AV2 Compliance Test Suite for robust decoder verification, the Astralis AV2 VQ Analyzer for deep bitstream analysis and optimization, and the Pulsar AV2 Decoder Semiconductor IP, designed for efficient, high-quality AV2 decoding in next-gen consumer devices. These solutions aim to accelerate development, ensure compliance, and enhance performance across AV2-enabled platforms.

- In July 2025, Siemens Digital Industries Software announced that it had collaborated with United Microelectronics Corporation (UMC), a leading global semiconductor foundry, to implement Siemens’ mPower software for electromigration (EM) and IR drop analysis. This collaboration highlights the growing demand for advanced reliability analysis tools in semiconductor manufacturing, indirectly boosting the need for high-precision analytical instruments like FTIR analyzers. As chip designs become more complex, the role of FTIR technology in contamination detection and material verification is expected to gain greater importance.

Frequently Asked Questions (FAQ) :

Q1. What the main growth driving factors for this market?

The key growth drivers for the semiconductor FTIR analyzer market include the rising demand for high-precision materials analysis in semiconductor manufacturing and increasing miniaturization of electronic components. As chips get smaller and more complex, manufacturers need accurate, non-destructive tools like FTIR analyzers to ensure material purity and process control. Additionally, the expansion of industries such as consumer electronics, automotive (EVs), and IoT is pushing the need for more semiconductors, thereby driving demand for advanced analytical equipment. Technological innovations and integration with AI and automation are also enhancing the market's appeal.

Q2. What are the main restraining factors for this market?

Despite its potential, the market faces a few key restraints. The high initial cost of FTIR analyzers, combined with the need for skilled personnel to operate and interpret the data, limits adoption—especially among smaller semiconductor manufacturers. Also, the complexity of integrating these systems into existing semiconductor fabrication workflows can slow implementation. Additionally, fluctuations in global semiconductor demand due to economic or supply chain disruptions can affect capital investments in such high-end analytical tools, hindering consistent market growth.

Q3. Which segment is expected to witness high growth?

The near-infrared (NIR) FTIR segment is expected to witness the highest growth during the forecast period. This is because NIR FTIR analyzers offer faster analysis, require minimal sample preparation, and are highly effective in non-destructive testing, which is critical in semiconductor applications. Their ability to deliver rapid, real-time data makes them ideal for in-line process monitoring in high-volume chip manufacturing environments. The increasing demand for quality control in advanced materials and thin-film analysis also supports the growth of this segment.

Q4. Who are the top major players for this market?

Some of the top players in the Global Semiconductor FTIR Analyzer Market include Thermo Fisher Scientific, Agilent Technologies, Bruker Corporation, PerkinElmer Inc., and Shimadzu Corporation. These companies have established strong reputations in precision analytical instruments and continue to innovate in FTIR technology for semiconductor applications. Other notable players include ABB, Hitachi High-Tech, and Horiba, who also provide integrated FTIR solutions tailored to semiconductor manufacturing environments. These companies compete on technological advancement, global reach, and industry-specific customization

Q5. Which country is the largest player?

The United States is currently the largest player in the global semiconductor FTIR analyzer market. This is primarily due to its strong presence in the semiconductor industry, world-leading R&D capabilities, and the headquarters of several major equipment manufacturers like Thermo Fisher and Agilent. The U.S. also benefits from strong government and private sector investment in semiconductor innovation, making it a leader not just in chip production but also in the supporting analytical technologies such as FTIR. Moreover, demand from high-tech industries further drives adoption.

List of Figures

Figure 1: Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue Breakdown (USD Billion, %) by Region, 2023 & 2029

Figure 2: Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Value Share (%), By Segment 1, 2023 & 2029

Figure 3: Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Value Share (%), By Segment 2, 2023 & 2029

Figure 6: Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Value Share (%), By Segment 3, 2023 & 2029

Figure 11: Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Value (USD Billion), by Region, 2023 & 2029

Figure 16: North America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Value Share (%), By Segment 1, 2023 & 2029

Figure 17: North America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Value Share (%), By Segment 2, 2023 & 2029

Figure 20: North America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Value Share (%), By Segment 3, 2023 & 2029

Figure 25: North America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Value Share (%), By Segment 1, 2023 & 2029

Figure 32: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Value Share (%), By Segment 2, 2023 & 2029

Figure 35: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Value Share (%), By Segment 3, 2023 & 2029

Figure 40: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Value Share (%), By Segment 1, 2023 & 2029

Figure 48: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Value Share (%), By Segment 2, 2023 & 2029

Figure 51: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Value Share (%), By Segment 3, 2023 & 2029

Figure 56: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Value Share (%), By Segment 1, 2023 & 2029

Figure 68: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Value Share (%), By Segment 2, 2023 & 2029

Figure 71: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Value Share (%), By Segment 3, 2023 & 2029

Figure 76: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Value Share (%), By Segment 1, 2023 & 2029

Figure 87: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Value Share (%), By Segment 2, 2023 & 2029

Figure 90: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Value Share (%), By Segment 3, 2023 & 2029

Figure 95: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Semiconductor Fourier Transform Infrared (FTIR) Analyzer Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model