Smart Insulin Pens (SIP) Market Overview and Analysis

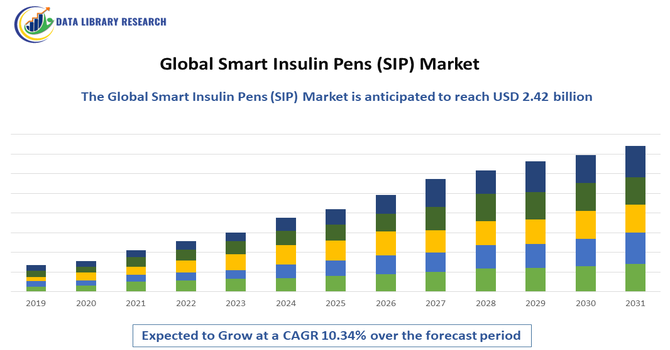

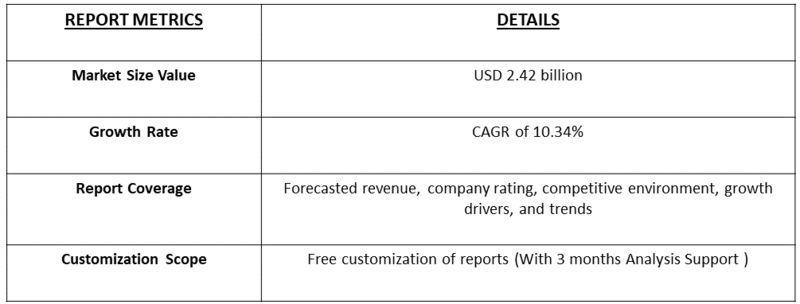

- The Global Smart Insulin Pens (SIP) Market size is expected to rise from USD 0.83 billion in 2025 to USD 2.42 billion by 2032, growing at a CAGR of 10.34% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Smart Insulin Pens (SIP) Market refers to the rapidly growing segment of diabetes management devices designed to improve insulin delivery, dosing accuracy, and patient adherence. Smart insulin pens combine traditional insulin administration with digital technology, including dose tracking, reminders, Bluetooth connectivity, and mobile app integration, enabling real-time monitoring and personalized diabetes care. Rising diabetes prevalence, increasing awareness about self-management, and demand for convenient, user-friendly solutions are driving market growth.

Smart Insulin Pens (SIP) Market Latest Trends

The Global Smart Insulin Pens market is witnessing rapid growth driven by technological innovations such as Bluetooth-enabled pens, mobile app integration, and automated dose tracking. Patients increasingly prefer devices that simplify insulin administration while improving adherence and glycemic control. Rising adoption of digital health solutions, telemedicine, and remote monitoring is further accelerating market demand. Additionally, the shift toward personalized diabetes management and continuous data sharing with healthcare providers is shaping product development.

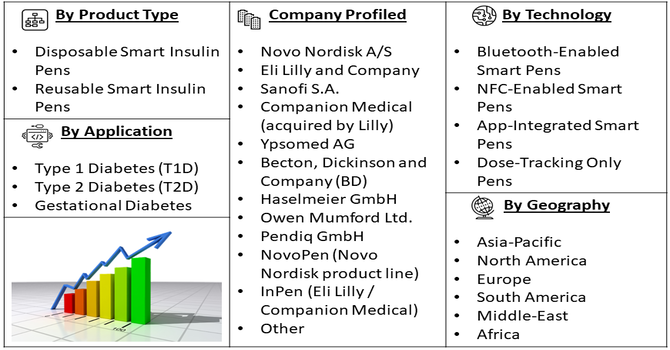

Segmentation: The Global Smart Insulin Pens market is segmented by Product Type (Disposable Smart Insulin Pens and Reusable Smart Insulin Pens), Connectivity / Technology (Bluetooth-Enabled Smart Pens, NFC-Enabled Smart Pens, App-Integrated Smart Pens, and Dose-Tracking Only Pens), Application (Type 1 Diabetes (T1D), Type 2 Diabetes (T2D) and Gestational Diabetes), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Diabetes Prevalence and Demand for Improved Management

The increasing global prevalence of diabetes, particularly Type 1 and insulin-dependent Type 2 diabetes, is driving demand for smart insulin pens. For instance, in 2025, CDC reported that Type 2 Diabetes cases are rising globally, affecting over 460 million adults, with projections reaching 853 million by 2050.

Patients and healthcare providers seek solutions that simplify insulin administration, improve adherence, and reduce dosing errors. SIPs provide real-time tracking, mobile app integration, and data-sharing capabilities, allowing better glycemic control and personalized therapy adjustments. As diabetes cases rise, especially in emerging markets, healthcare systems and patients increasingly adopt digital insulin delivery solutions, supporting SIP market growth and encouraging continuous innovation to meet patient needs for safety, convenience, and disease management.

- Technological Advancements and Integration with Digital Health

Advancements in digital health and IoT technologies are propelling the SIP market. Modern smart pens feature Bluetooth connectivity, AI-assisted dosing recommendations, and integration with continuous glucose monitoring (CGM) systems and mobile applications.

In March 2025, researchers at the National Institute of Technology (NIT) Rourkela developed an AI-driven approach for blood sugar monitoring and improved prediction. The model automatically processes glucose data and identifies critical patterns for accurate forecasting, overcoming limitations of traditional models, which often struggle with long-term trends and require manual adjustments. These innovations enable seamless data tracking, analytics, and remote monitoring by healthcare providers, improving clinical outcomes and patient engagement. The growing adoption of telemedicine and digital therapeutics further supports SIP utilization.

Market Restraints

- High Cost and Limited Reimbursement

Despite clinical benefits, the high cost of smart insulin pens compared to conventional insulin delivery methods remains a significant restraint. Limited insurance coverage and reimbursement policies in several regions hinder patient adoption, especially in low- and middle-income countries. Additionally, some patients may lack digital literacy or access to compatible smartphones, reducing usability. These economic and accessibility barriers slow market penetration, limiting the growth potential despite technological advancements. Manufacturers must address affordability and insurance coverage challenges to expand the market, while governments and healthcare providers need to implement supportive policies to facilitate wider access to SIP solutions.

Socioeconomic Impact on Smart Insulin Pens (SIP) Market

Smart insulin pens are transforming diabetes management by improving patient adherence, reducing dosing errors, and lowering long-term healthcare costs associated with complications. Enhanced monitoring and data analytics empower both patients and healthcare providers to optimize treatment plans, improving quality of life and reducing hospitalizations. Access to affordable SIP solutions supports disease management in low- and middle-income countries, mitigating the socioeconomic burden of diabetes. The devices also reduce indirect costs by minimizing productivity loss due to diabetes-related complications. Thus, the widespread adoption of SIPs contributes to better public health outcomes, economic savings, and increased awareness of proactive diabetes care globally.

Segmental Analysis:

- Disposable Smart Insulin Pens segment is expected to witness highest growth over the forecast period

The disposable smart insulin pens segment is expected to witness the highest growth over the forecast period due to increasing patient preference for convenient, single-use solutions that minimize maintenance and contamination risks. These pens offer prefilled insulin doses, enhanced portability, and reduced complexity compared to reusable systems, making them ideal for home and travel use. Growing awareness of diabetes management and rising adoption of digital health tools further drive demand. The integration of dose tracking, app connectivity, and reminders in disposable pens enhances adherence and improves glycemic control, contributing to strong market growth globally.

- Bluetooth-Enabled Smart Pens segment is expected to witness highest growth over the forecast period

Bluetooth-enabled smart insulin pens are projected to experience the highest growth owing to their ability to seamlessly connect with mobile applications, continuous glucose monitoring systems, and healthcare provider platforms. These pens allow automated dose tracking, real-time notifications, and personalized insulin recommendations, which improve patient adherence and clinical outcomes. The increasing trend of remote patient monitoring, telemedicine adoption, and digital health integration supports this growth. As patients and clinicians seek data-driven, connected solutions for diabetes management, Bluetooth-enabled smart pens are gaining traction, particularly in technologically advanced and urban markets, enhancing convenience and overall disease management.

- Type 2 Diabetes (T2D) segment is expected to witness highest growth over the forecast period

The Type 2 diabetes segment is expected to witness the highest growth due to the rising global prevalence of insulin-dependent Type 2 diabetes, particularly in aging populations and high-risk regions. Many T2D patients require insulin therapy, and smart insulin pens provide improved adherence, dose accuracy, and digital tracking, addressing common challenges in self-management. Awareness campaigns, increasing healthcare access, and the adoption of connected health technologies further fuel demand. As healthcare providers emphasize personalized and data-driven treatment strategies for T2D, the market for SIPs targeting this population continues to expand, driving innovation and adoption globally.

- North America Region is expected to witness highest growth over the forecast period

North America is anticipated to witness the highest growth in the SIP market over the forecast period due to well-established healthcare infrastructure, high adoption of digital health technologies, and widespread awareness of diabetes management. The region’s supportive reimbursement policies, increasing use of connected devices, and high smartphone penetration facilitate the adoption of smart insulin pens. For instance, The U.S. Department of Health and Human Services (HHS) launched the Healthy People 2030 initiative to lower diabetes prevalence, prevent complications, and reduce related mortality, aiming to lessen the overall diabetes burden and enhance the quality of life for affected individuals.

Additionally, the rising prevalence of diabetes, particularly among Type 2 patients, drives demand for advanced insulin delivery solutions. For instance, in 2025, CDC reported that more than 38 million Americans have diabetes (about 1 in 10), and about 90% to 95% of them have type 2 diabetes. Similarly, in 2025, Diabetes Canada reported that 90% of Canadians with diabetes are living with type 2 diabetes.

Strong presence of key market players and continuous technological innovations in Bluetooth-enabled and app-integrated pens further bolster market growth in North America, positioning it as the leading regional market. For instance, In April 2025, for the clearance of an interoperable pump, Medtronic submitted 510(k) applications to the US FDA. The clearance will lead to system integration with a continuous glucose monitoring (CGM) sensor that is based on Abbott's advanced CGM platform. Thus, together these factors are driving the growth of this region over the forecast period.

To Learn More About This Report - Request a Free Sample Copy

Smart Insulin Pens (SIP) Market Competitive Landscape

The Smart Insulin Pen market is highly competitive, with key players focusing on product innovation, strategic partnerships, and geographic expansion. Companies are investing in R&D to enhance connectivity, dose accuracy, and integration with digital health platforms. Collaborations with pharmaceutical companies and healthcare providers are driving adoption and improving patient engagement. Established medical device firms, along with emerging startups, are differentiating through features like real-time data analytics, app compatibility, and AI-driven dosing recommendations. Competitive pricing strategies and regulatory approvals in key markets, such as the U.S., Europe, and Asia-Pacific, are further intensifying market competition while expanding access to advanced diabetes management solutions.

The major players for above market are:

- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi S.A.

- Companion Medical (acquired by Lilly)

- Ypsomed AG

- Becton, Dickinson and Company (BD)

- Haselmeier GmbH

- Owen Mumford Ltd.

- Pendiq GmbH

- NovoPen (Novo Nordisk product line)

- InPen (Eli Lilly / Companion Medical)

- SmartDose (Sanofi / etectRx collaboration)

- Bigfoot Biomedical, Inc.

- Insulet Corporation (connected pen initiatives)

- Tandem Diabetes Care, Inc.

- Medtronic plc (connected insulin delivery focus)

- Roche Diabetes Care (connected pen integrations)

- Biocorp (Mallya smart cap)

- Common Sensing

- Biopen Systems, LLC

Recent Development:

- In May 2025, the smart insulin pens will be made available in the UK by Novo Nordisk, within the NHS, which will give people with diabetes access to the device for monitoring and recording their dosing information for the first time.

- In June 2023, Medtronic plc (NYSE: MDT) presented new data on its InPen™ Smart Insulin Pen at the 83rd ADA Scientific Sessions. Analysis of 5,153 Type 1 and Type 2 diabetes users showed that timely meal dosing significantly improved glycemic control, with more on-time doses correlating with higher Time in Range, highlighting InPen’s effectiveness in therapy adherence.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is growing because smart pens help patients track their doses automatically, reducing the risk of skipping or doubling a shot. As diabetes cases rise globally, people want more convenient tools than manual logging. These pens connect to apps, providing data that helps doctors and patients make better treatment decisions.

Q2. What are the main restraining factors for this market?

Growth is limited by the higher price of smart pens compared to traditional disposable ones. Many insurance plans do not yet fully cover these high-tech devices, making them expensive for out-of-pocket buyers. Additionally, some elderly patients may find it difficult to sync the devices with smartphones or navigate complex apps.

Q3. Which segment is expected to witness high growth?

The Integrated Apps and Software segment is expected to see the highest growth. While the pen itself is important, the software that calculates doses and tracks trends is what adds the most value. As artificial intelligence improves, these apps are becoming smarter at predicting blood sugar changes and suggesting personalized adjustments.

Q4. Who are the top major players for this market?

The market is led by global pharmaceutical leaders and medical device innovators. Key players include Novo Nordisk, Eli Lilly and Company, Sanofi, Medtronic (Companion Medical), and Bigfoot Biomedical. These companies dominate by offering "connected" ecosystems where pens, sensors, and mobile apps work together to simplify daily diabetes management.

Q5. Which country is the largest player?

The United States is the largest player in the smart insulin pens market. This is due to its advanced healthcare infrastructure and a high number of patients using insulin for Type 1 and Type 2 diabetes. Strong support for digital health tools and early adoption of new technologies keep it leading.

List of Figures

Figure 1: Global Smart Insulin Pens (SIP) Market Revenue Breakdown (USD Billion, %) by Region, 2019 & 2027

Figure 2: Global Smart Insulin Pens (SIP) Market Value Share (%), By Segment 1, 2019 & 2027

Figure 3: Global Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 4: Global Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 5: Global Smart Insulin Pens (SIP) Market Value Share (%), By Segment 2, 2019 & 2027

Figure 6: Global Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 7: Global Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 8: Global Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 9: Global Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Others, 2016-2027

Figure 10: Global Smart Insulin Pens (SIP) Market Value Share (%), By Segment 3, 2019 & 2027

Figure 11: Global Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 12: Global Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 13: Global Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 14: Global Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Others, 2016-2027

Figure 15: Global Smart Insulin Pens (SIP) Market Value (USD Billion), by Region, 2019 & 2027

Figure 16: North America Smart Insulin Pens (SIP) Market Value Share (%), By Segment 1, 2019 & 2027

Figure 17: North America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 18: North America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 19: North America Smart Insulin Pens (SIP) Market Value Share (%), By Segment 2, 2019 & 2027

Figure 20: North America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 21: North America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 22: North America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 23: North America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Others, 2016-2027

Figure 24: North America Smart Insulin Pens (SIP) Market Value Share (%), By Segment 3, 2019 & 2027

Figure 25: North America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 26: North America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 27: North America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 28: North America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Others, 2016-2027

Figure 29: North America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by U.S., 2016-2027

Figure 30: North America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Canada, 2016-2027

Figure 31: Latin America Smart Insulin Pens (SIP) Market Value Share (%), By Segment 1, 2019 & 2027

Figure 32: Latin America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 33: Latin America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 34: Latin America Smart Insulin Pens (SIP) Market Value Share (%), By Segment 2, 2019 & 2027

Figure 35: Latin America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 36: Latin America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 37: Latin America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 38: Latin America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Others, 2016-2027

Figure 39: Latin America Smart Insulin Pens (SIP) Market Value Share (%), By Segment 3, 2019 & 2027

Figure 40: Latin America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 41: Latin America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 42: Latin America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 43: Latin America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Others, 2016-2027

Figure 44: Latin America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Brazil, 2016-2027

Figure 45: Latin America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Mexico, 2016-2027

Figure 46: Latin America Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Rest of Latin America, 2016-2027

Figure 47: Europe Smart Insulin Pens (SIP) Market Value Share (%), By Segment 1, 2019 & 2027

Figure 48: Europe Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 49: Europe Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 50: Europe Smart Insulin Pens (SIP) Market Value Share (%), By Segment 2, 2019 & 2027

Figure 51: Europe Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 52: Europe Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 53: Europe Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 54: Europe Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Others, 2016-2027

Figure 55: Europe Smart Insulin Pens (SIP) Market Value Share (%), By Segment 3, 2019 & 2027

Figure 56: Europe Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 57: Europe Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 58: Europe Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 59: Europe Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Others, 2016-2027

Figure 60: Europe Smart Insulin Pens (SIP) Market Forecast (USD Billion), by U.K., 2016-2027

Figure 61: Europe Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Germany, 2016-2027

Figure 62: Europe Smart Insulin Pens (SIP) Market Forecast (USD Billion), by France, 2016-2027

Figure 63: Europe Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Italy, 2016-2027

Figure 64: Europe Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Spain, 2016-2027

Figure 65: Europe Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Russia, 2016-2027

Figure 66: Europe Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Rest of Europe, 2016-2027

Figure 67: Asia Pacific Smart Insulin Pens (SIP) Market Value Share (%), By Segment 1, 2019 & 2027

Figure 68: Asia Pacific Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 69: Asia Pacific Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 70: Asia Pacific Smart Insulin Pens (SIP) Market Value Share (%), By Segment 2, 2019 & 2027

Figure 71: Asia Pacific Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 72: Asia Pacific Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 73: Asia Pacific Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 74: Asia Pacific Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Others, 2016-2027

Figure 75: Asia Pacific Smart Insulin Pens (SIP) Market Value Share (%), By Segment 3, 2019 & 2027

Figure 76: Asia Pacific Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 77: Asia Pacific Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 78: Asia Pacific Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 79: Asia Pacific Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Others, 2016-2027

Figure 80: Asia Pacific Smart Insulin Pens (SIP) Market Forecast (USD Billion), by China, 2016-2027

Figure 81: Asia Pacific Smart Insulin Pens (SIP) Market Forecast (USD Billion), by India, 2016-2027

Figure 82: Asia Pacific Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Japan, 2016-2027

Figure 83: Asia Pacific Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Australia, 2016-2027

Figure 84: Asia Pacific Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Southeast Asia, 2016-2027

Figure 85: Asia Pacific Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Rest of Asia Pacific, 2016-2027

Figure 86: Middle East & Africa Smart Insulin Pens (SIP) Market Value Share (%), By Segment 1, 2019 & 2027

Figure 87: Middle East & Africa Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 88: Middle East & Africa Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 89: Middle East & Africa Smart Insulin Pens (SIP) Market Value Share (%), By Segment 2, 2019 & 2027

Figure 90: Middle East & Africa Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 91: Middle East & Africa Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 92: Middle East & Africa Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 93: Middle East & Africa Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Others, 2016-2027

Figure 94: Middle East & Africa Smart Insulin Pens (SIP) Market Value Share (%), By Segment 3, 2019 & 2027

Figure 95: Middle East & Africa Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 1, 2016-2027

Figure 96: Middle East & Africa Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 2, 2016-2027

Figure 97: Middle East & Africa Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Sub-Segment 3, 2016-2027

Figure 98: Middle East & Africa Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Others, 2016-2027

Figure 99: Middle East & Africa Smart Insulin Pens (SIP) Market Forecast (USD Billion), by GCC, 2016-2027

Figure 100: Middle East & Africa Smart Insulin Pens (SIP) Market Forecast (USD Billion), by South Africa, 2016-2027

Figure 101: Middle East & Africa Smart Insulin Pens (SIP) Market Forecast (USD Billion), by Rest of Middle East & Africa, 2016-2027

List of Tables

Table 1: Global Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Segment 1, 2016-2027

Table 2: Global Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Segment 2, 2016-2027

Table 3: Global Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Segment 3, 2016-2027

Table 4: Global Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Region, 2016-2027

Table 5: North America Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Segment 1, 2016-2027

Table 6: North America Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Segment 2, 2016-2027

Table 7: North America Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Segment 3, 2016-2027

Table 8: North America Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Country, 2016-2027

Table 9: Europe Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Segment 1, 2016-2027

Table 10: Europe Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Segment 2, 2016-2027

Table 11: Europe Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Segment 3, 2016-2027

Table 12: Europe Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Country, 2016-2027

Table 13: Latin America Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Segment 1, 2016-2027

Table 14: Latin America Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Segment 2, 2016-2027

Table 15: Latin America Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Segment 3, 2016-2027

Table 16: Latin America Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Country, 2016-2027

Table 17: Asia Pacific Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Segment 1, 2016-2027

Table 18: Asia Pacific Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Segment 2, 2016-2027

Table 19: Asia Pacific Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Segment 3, 2016-2027

Table 20: Asia Pacific Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Country, 2016-2027

Table 21: Middle East & Africa Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Segment 1, 2016-2027

Table 22: Middle East & Africa Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Segment 2, 2016-2027

Table 23: Middle East & Africa Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Segment 3, 2016-2027

Table 24: Middle East & Africa Smart Insulin Pens (SIP) Market Revenue (USD Billion) Forecast, by Country, 2016-2027

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model