Spinal Stimulator Market Overview and Analysis

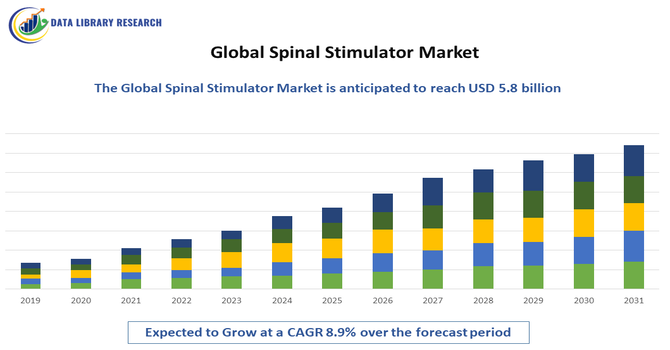

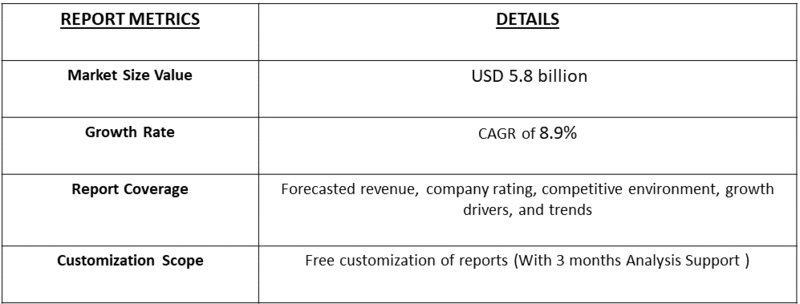

- The Global Spinal Stimulator Market size was valued at USD 2.98 billion in 2025 and is projected to grow at a CAGR of 8.9% from 2025 to 2032 reaching USD 5.8 billion in the year 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Spinal Stimulator Market encompasses implantable devices designed to deliver electrical impulses to the spinal cord, targeting chronic pain management. Key products include implantable pulse generators, leads, and neurostimulation systems, widely used in hospitals and clinics. Growth is driven by rising chronic pain prevalence, technological advancements, and preference for non-opioid therapies.

The rising adoption of minimally invasive surgical procedures, which reduce recovery time and postoperative complications, is further accelerating market expansion. Technological advancements in biomaterials, including enhanced biocompatibility, improved mechanical strength, and bioresorbable properties, are making synthetic absorbable bone cements more effective and widely preferred in clinical settings. Additionally, growing awareness among healthcare providers and patients about advanced bone repair solutions, coupled with expanding healthcare infrastructure in emerging regions, is contributing to the sustained growth of this market globally.

Spinal Stimulator Market Latest Trends

The global spinal stimulator market is experiencing significant advancements driven by technological innovations and increasing demand for non-opioid pain management solutions. Key trends include the development of closed-loop spinal cord stimulators, such as Medtronic's Inceptiv device, which automatically adjusts stimulation in real-time based on physiological feedback, enhancing patient comfort and treatment efficacy. Additionally, the integration of rechargeable systems is gaining traction, offering patients longer device longevity and reducing the frequency of surgical interventions. The market is also witnessing a surge in clinical trials exploring the efficacy of spinal stimulation in treating various conditions, including chronic pain and spinal cord injuries, further validating the therapeutic potential of these devices.

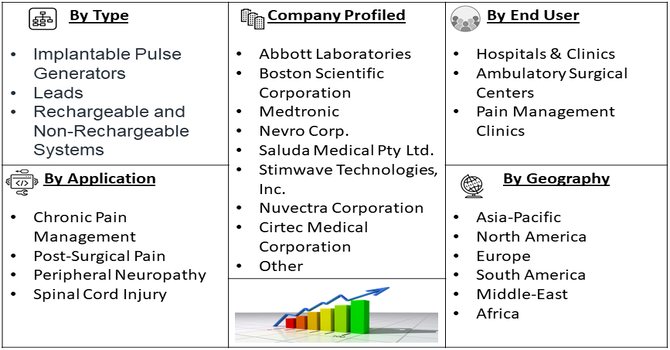

Segmentation: Global Spinal Stimulator Market is segmented By Product Type (Implantable Pulse Generators, Leads, Rechargeable and Non-Rechargeable Systems), Application (Chronic Pain Management, Post-Surgical Pain, Peripheral Neuropathy, Spinal Cord Injury), End-User (Hospitals & Clinics, Ambulatory Surgical Centers, Pain Management Clinics), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Prevalence of Chronic Pain and Neurological Disorders

A major driver of the global spinal stimulator market is the increasing incidence of chronic pain conditions, including back pain, neuropathic pain, and failed back surgery syndrome. As conventional treatments like medications and physical therapy often provide limited relief, spinal stimulators offer an effective alternative for long-term pain management. Growing awareness among patients and healthcare providers about the benefits of neuromodulation therapies is further fueling adoption.

In March 2024, The Lancet Neurology published an article that reported A 2021 study found that neurological conditions affected 43% of the global population (3.4 billion people), causing 443 million disability-adjusted life years (DALYs) lost. The high global burden of neurological conditions, including chronic pain, stroke-related nerve damage, and neuropathies, has increased demand for effective pain management and neuromodulation therapies. This rising need for targeted, long-term relief is driving adoption, expanding the patient base, and fueling growth in the Global Spinal Stimulator Market, especially in regions with high neurological disease prevalence. Additionally, increasing awareness among healthcare providers and patients about advanced neuromodulation technologies supports market expansion and innovation in spinal stimulator systems.

- Preference for Minimally Invasive and Non-Opioid Pain Management Solutions

There is a significant shift toward minimally invasive procedures and non-opioid therapies due to the rising concerns over opioid addiction and associated side effects. Spinal stimulators provide a targeted, reversible, and adjustable method of pain management, reducing reliance on drugs and improving patient quality of life.

Advances in device technology, such as rechargeable systems, closed-loop stimulators, and smaller implantable devices, are enhancing clinical outcomes and driving market growth globally. For instance, in Febraury 2025, Neuvotion, Inc., an early-stage medical device company, developed AI-driven neuromodulation technologies for neurorehabilitation, brain-computer interface (BCI), and physical therapy applications. The company received FDA 510(k) clearance for NeuStim™, a non-invasive, wearable device that dynamically and precisely stimulated muscles to support hand movement recovery after stroke or spinal cord injury. Clinicians could rapidly identify stimulation targets and save individualized profiles via a touchscreen mobile interface. This innovation reinforced the preference for minimally invasive, non-opioid therapies, positively impacting the adoption of spinal stimulators in global pain management and rehabilitation markets.

Market Restraints:

- The growth of the global spinal stimulator market is restrained by several factors. High device and implantation costs limit accessibility, especially in developing regions and for patients without adequate insurance coverage. Surgical risks and potential complications, such as infection, lead migration, or device malfunction, can deter both patients and physicians. Additionally, stringent regulatory requirements for device approval and clinical validation can delay product launches and increase development costs. Limited awareness and expertise among healthcare providers in some regions, coupled with the availability of alternative pain management therapies, also pose challenges to widespread adoption of spinal stimulators.

Socio Economic Impact on Spinal Stimulator Market

The Global Spinal Stimulator Market has considerable socioeconomic impact, driven by the rising prevalence of chronic pain, spinal disorders, and an aging population. Spinal stimulators improve patients’ quality of life by reducing pain, enhancing mobility, and decreasing dependence on opioids, thereby lowering healthcare and social costs. The market’s expansion promotes technological innovation, creating opportunities in medical device manufacturing, neurosurgery, and rehabilitation sectors. Increased adoption also drives employment growth across healthcare services, R&D, and engineering fields. Moreover, improved pain management outcomes help patients return to work, boosting overall productivity and reducing disability-related economic burdens. As healthcare systems prioritize non-pharmacological pain solutions, the spinal stimulator market continues to support sustainable healthcare advancement and long-term economic resilience globally.

Segmental Analysis:

- Implantable Pulse Generators segment is expected to witness highest growth over the forecast period

Implantable Pulse Generators are the core component of spinal stimulator systems, providing adjustable electrical pulses to targeted areas of the spinal cord. Their versatility, long-term efficacy, and compatibility with both rechargeable and non-rechargeable systems make them highly preferred in pain management therapies, driving significant adoption across hospitals and clinics.

Moreover, continuous advancements in miniaturization, battery technology, and wireless connectivity have further enhanced the functionality and convenience of implantable pulse generators. These innovations allow for personalized stimulation settings, remote programming, and extended device lifespan, significantly improving patient comfort and treatment outcomes. As demand for minimally invasive, long-term pain management solutions grows, implantable pulse generators continue to play a pivotal role in expanding the Global Spinal Stimulator Market and shaping the future of neuromodulation therapies.

- Chronic Pain Management segment is expected to witness highest growth over the forecast period

Chronic pain management is the primary application segment, as spinal stimulators are widely used to treat conditions like back pain, neuropathic pain, and failed back surgery syndrome. The ability to deliver precise, patient-adjustable therapy makes stimulators an effective alternative to long-term opioid use and conventional pain treatments.

- Hospitals & Clinics segment is expected to witness highest growth over the forecast period

Hospitals and clinics represent the largest end-user segment due to their capacity to perform complex implantation procedures and manage post-operative care. These institutions adopt spinal stimulators to provide advanced pain management solutions, improve patient outcomes, and offer comprehensive neuromodulation therapies.

Also, hospitals are the largest end-users of spinal stimulators, given their capacity to perform complex implant procedures and provide comprehensive pain management programs. Adoption in hospitals is driven by the need to offer advanced, minimally invasive therapies, improve patient outcomes, reduce reliance on opioids, and support multidisciplinary chronic pain management strategies.

- North America region is expected to witness highest growth over the forecast period

The North America region is expected to witness the highest growth in the Global Spinal Stimulator Market over the forecast period, driven by advanced healthcare infrastructure, high prevalence of chronic pain and spinal disorders, and widespread adoption of minimally invasive and technologically advanced neuromodulation devices. Strong reimbursement policies, increasing patient awareness about non-opioid pain management options, and early adoption of innovations such as closed-loop systems and rechargeable implantable pulse generators further support market expansion. Additionally, well-established hospitals, specialized pain management clinics, and continuous investment in research and development contribute to the robust growth of the spinal stimulator market in North America.

To Learn More About This Report - Request a Free Sample Copy

Spinal Stimulator Market Competitive Landscape

The global spinal stimulator market is characterized by the presence of several key players actively involved in research, development, and commercialization of advanced spinal cord stimulation devices. These companies are focusing on product innovation, strategic partnerships, and expanding their market presence to cater to the growing demand for effective pain management solutions.

Below is a list of prominent companies operating in this market

- Abbott Laboratories

- Boston Scientific Corporation

- Medtronic

- Nevro Corp.

- Saluda Medical Pty Ltd.

- Stimwave Technologies, Inc.

- Nuvectra Corporation

- Cirtec Medical Corporation

- Synapse Biomedical Inc.

- NeuroSigma, Inc.

- Beijing PINS Medical Co., Ltd.

- Bluewind Medical

- Spinal Modulation

- Spinal Simplicity

- Axonics Modulation Technologies, Inc.

- LivaNova PLC

- Onward Medical

- GTX Medical

- Aleva Neurotherapeutics

- NeuroPace, Inc.

Recent Development

- In April 2025, Abbott announced the launch of its next-generation neuromodulation delivery system, designed to enhance the implantation process for electrodes used in its Proclaim™ DRG neurostimulation system. The new system simplifies procedures for patients suffering from complex regional pain syndrome (CRPS) Type 1 and causalgia (CRPS Type 2) of the lower extremities—conditions known for their severe pain intensity. The dorsal root ganglion (DRG), a cluster of nerve cells along the spine that regulates pain signals from areas such as the pelvis, hip, knee, and foot, is the precise target of Abbott’s Proclaim DRG therapy, which remains the first and only FDA-approved DRG technology for treating CRPS in the lower limbs.

- In April 2024, Medtronic plc, a global player in healthcare technology, announced that the U.S. Food and Drug Administration (FDA) approved the Inceptiv closed-loop rechargeable spinal cord stimulator (SCS) for chronic pain treatment. Inceptiv is Medtronic’s first SCS device with a closed-loop system that detects biological signals along the spinal cord and automatically adjusts stimulation in real time, ensuring consistent therapy aligned with patients’ daily movements.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The spinal stimulator market is significantly driven by the increasing global prevalence of chronic pain disorders, particularly Failed Back Surgery Syndrome (FBSS) and Complex Regional Pain Syndrome (CRPS). Furthermore, the growing opioid crisis has propelled demand for effective, non-addictive alternatives, positioning Spinal Cord Stimulation (SCS) as a crucial therapy. Continuous technological advancements, such as rechargeable, MRI-compatible, and high-frequency systems that improve patient outcomes and comfort, are also key market accelerators.

Q2. What are the main restraining factors for this market?

The primary restraining factors are the high cost associated with the devices and the implant procedure itself. The substantial initial expenditure, along with costs for pre-operative trials and long-term maintenance, creates a significant financial burden that limits access, especially in regions with inadequate reimbursement policies. Additionally, the risk of post-surgical complications and the possibility of device failure or migration, although rare, contribute to patient and provider hesitancy.

Q3. Which segment is expected to witness high growth?

The Rechargeable product segment is expected to witness the highest growth. Rechargeable spinal stimulators offer extended battery life and reduced need for surgical replacements over the patient's lifetime, making them a more cost-effective and convenient long-term solution. By application, the Failed Back Surgery Syndrome (FBSS) segment continues to dominate and is projected to maintain strong growth due to the high incidence of chronic pain following spinal surgeries.

Q4. Who are the top major players for this market?

The global spinal stimulator market is dominated by a few large, specialized medical device manufacturers. The top major players include Medtronic PLC, Abbott Laboratories, Boston Scientific Corporation, and Nevro Corp. These companies are continuously innovating by introducing new stimulation paradigms (like high-frequency and burst stimulation) and developing wireless and digital health integration features to offer personalized and superior pain relief solutions.

Q5. Which country is the largest player?

North America, specifically the United States, holds the largest market share by revenue. This leadership is attributed to the high prevalence of chronic back pain, advanced healthcare infrastructure, and the high reimbursement rates for Spinal Cord Stimulation (SCS) therapy provided by both private and public payers. A strong regulatory framework and the early adoption of technological innovations by major U.S.-based companies also solidify its dominant market position.

List of Figures

Figure 1: Global Spinal Stimulator Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Spinal Stimulator Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Spinal Stimulator Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Spinal Stimulator Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Spinal Stimulator Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Spinal Stimulator Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Spinal Stimulator Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Spinal Stimulator Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Spinal Stimulator Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Spinal Stimulator Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Spinal Stimulator Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Spinal Stimulator Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Spinal Stimulator Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Spinal Stimulator Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Spinal Stimulator Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Spinal Stimulator Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Spinal Stimulator Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Spinal Stimulator Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Spinal Stimulator Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Spinal Stimulator Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Spinal Stimulator Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Spinal Stimulator Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Spinal Stimulator Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Spinal Stimulator Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Spinal Stimulator Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Spinal Stimulator Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Spinal Stimulator Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Spinal Stimulator Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Spinal Stimulator Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Spinal Stimulator Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Spinal Stimulator Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Spinal Stimulator Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Spinal Stimulator Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Spinal Stimulator Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Spinal Stimulator Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Spinal Stimulator Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Spinal Stimulator Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Spinal Stimulator Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Spinal Stimulator Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Spinal Stimulator Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Spinal Stimulator Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Spinal Stimulator Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Spinal Stimulator Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Spinal Stimulator Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Spinal Stimulator Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Spinal Stimulator Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Spinal Stimulator Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Spinal Stimulator Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Spinal Stimulator Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Spinal Stimulator Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Spinal Stimulator Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Spinal Stimulator Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Spinal Stimulator Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Spinal Stimulator Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Spinal Stimulator Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Spinal Stimulator Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Spinal Stimulator Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Spinal Stimulator Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Spinal Stimulator Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Spinal Stimulator Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Spinal Stimulator Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Spinal Stimulator Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Spinal Stimulator Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Spinal Stimulator Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Spinal Stimulator Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Spinal Stimulator Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Spinal Stimulator Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Spinal Stimulator Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Spinal Stimulator Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Spinal Stimulator Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Spinal Stimulator Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Spinal Stimulator Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Spinal Stimulator Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Spinal Stimulator Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Spinal Stimulator Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Spinal Stimulator Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Spinal Stimulator Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Spinal Stimulator Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model