Synthetic Absorbable Bone Cement Market Overview and Analysis

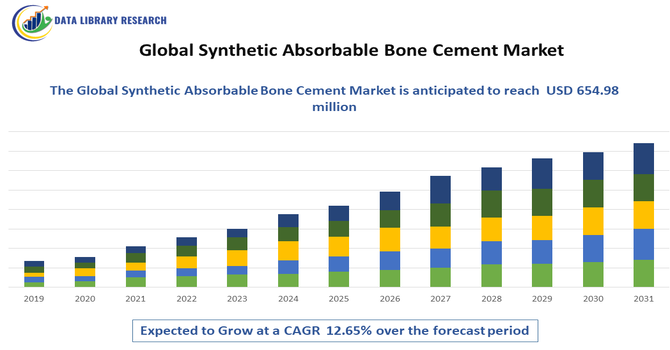

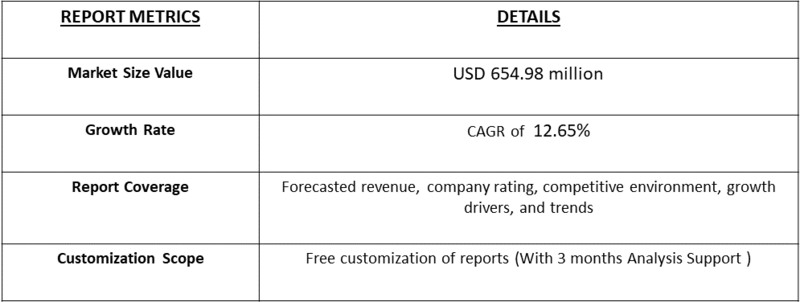

- The Global Synthetic Absorbable Bone Cement Market, anticipated to grow from USD 387.98 million in 2025 to USD 654.98 million in 2032 growing with a CAGR of 12.65% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Synthetic Absorbable Bone Cement Market encompasses biodegradable bone repair materials used in orthopedic, dental, and trauma surgeries. These cements support bone regeneration, provide structural stability, and gradually dissolve, eliminating the need for removal. Market growth is driven by rising orthopedic procedures, aging populations, and demand for minimally invasive, biocompatible solutions worldwide. @@@@ The Global Synthetic Absorbable Bone Cement Market is witnessing strong growth, driven by the rising prevalence of bone-related disorders such as osteoporosis and osteoarthritis, which are increasing the demand for orthopedic surgeries. Growing preference for minimally invasive procedures, which reduce recovery time and complications, is further propelling adoption.

Synthetic Absorbable Bone Cement Market Latest Trends

The global synthetic absorbable bone cement market is experiencing significant advancements, driven by innovations in biomaterial science and a growing preference for minimally invasive orthopedic procedures. Key trends include the development of bioresorbable scaffolds that enhance bone regeneration, the integration of drug-eluting properties to reduce infection risks, and the customization of implants using 3D printing technologies. Additionally, there is an increasing focus on patient-specific implants tailored to individual anatomical needs, improving surgical outcomes. These innovations are expanding the clinical applications of synthetic absorbable bone cements, particularly in spinal, trauma, and orthopedic surgeries. The market is also witnessing a shift towards emerging economies in Asia and Latin America, where rising healthcare infrastructure and disposable incomes are driving demand for advanced orthopedic solutions.

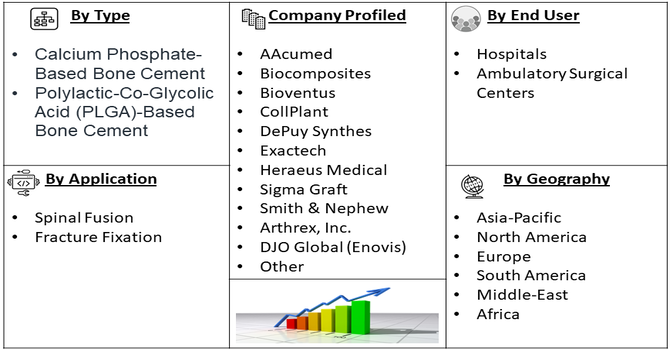

Segmentation: Global Synthetic Absorbable Bone Cement Market is segmented By Product Type (Calcium Phosphate-Based Bone Cement, Polylactic-Co-Glycolic Acid (PLGA)-Based Bone Cement), Application (Spinal Fusion, Fracture Fixation), End-User (Hospitals, Ambulatory Surgical Centers), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Increasing Prevalence of Orthopedic Disorders and Surgeries

One of the primary drivers of the global synthetic absorbable bone cement market is the rising incidence of orthopedic disorders such as osteoporosis, osteoarthritis, bone fractures, and spinal deformities. An aging global population and sedentary lifestyles have contributed to higher rates of bone-related conditions, increasing the demand for effective treatment options. Synthetic absorbable bone cements are extensively used in procedures like spinal fusion, fracture fixation, and joint reconstruction, as they provide structural support and facilitate bone regeneration. The growing number of orthopedic surgeries worldwide is directly boosting the adoption of these cements, supporting robust market growth.

- Advancements in Biomaterial Technology and Product Innovation

Technological advancements in biomaterials are significantly propelling market growth. Modern synthetic absorbable bone cements are designed with enhanced biocompatibility, controlled degradation rates, and improved mechanical strength, making them more effective for various orthopedic applications. Innovations such as drug-eluting bone cements, bioactive scaffolds, and 3D-printed patient-specific implants are expanding clinical applications, reducing postoperative complications, and improving surgical outcomes. These technological improvements make synthetic absorbable bone cements a preferred choice for surgeons, further driving market expansion globally.

Market Restraints:

- High Costs Of Advanced Bone Cement Products and Associated Surgical Procedures

High costs of advanced bone cement products and associated surgical procedures can limit adoption, particularly in developing regions and smaller healthcare facilities. Stringent regulatory requirements for approval of new biomaterials and medical devices can delay product launches and increase compliance costs. Additionally, technical limitations and handling challenges, such as sensitivity to moisture and precise mixing requirements, may affect performance and clinician preference. Competition from traditional bone cements and alternative orthopedic fixation methods also restricts market expansion, as surgeons may continue to rely on established solutions with proven efficacy and familiarity.

Socio Economic Impact on Synthetic Absorbable Bone Cement Market

The Global Synthetic Absorbable Bone Cement Market has notable socioeconomic impacts, driven by the increasing prevalence of orthopedic conditions, aging populations, and rising demand for minimally invasive surgeries. By enabling effective bone repair and regeneration, these cements improve patient outcomes, reduce recovery times, and lower long-term healthcare costs. Hospitals and clinics benefit from enhanced surgical efficiency, while manufacturers and distributors create employment opportunities across production, sales, and technical support sectors. Growing accessibility of advanced bone repair solutions contributes to improved quality of life for patients worldwide. Additionally, ongoing research and development in biocompatible, absorbable materials foster innovation, stimulate investment in healthcare technologies, and support economic growth within the medical devices industry globally.

Segmental Analysis

- Calcium Phosphate-Based Bone Cement segment is expected to witness highest growth over the forecast period

Calcium phosphate-based bone cements dominate the market due to their excellent osteoconductive properties, which support bone regeneration and integration. These cements are widely preferred in orthopedic and spinal surgeries for their biocompatibility, ease of use, and ability to promote natural bone healing, making them a key driver of product adoption. Additionally, the rising adoption of minimally invasive surgical procedures has boosted demand for synthetic absorbable bone cements. Their injectability, controlled setting time, and predictable resorption make them ideal for complex fractures, vertebral augmentation, and dental applications. This versatility, combined with increasing awareness among surgeons, is driving widespread utilization across hospitals and specialty clinics globally.

- Spinal Fusion segment is expected to witness highest growth over the forecast period

Spinal fusion represents a significant application segment, as synthetic absorbable bone cements are extensively used to stabilize vertebrae and facilitate bone growth in patients with spinal disorders. Their bioresorbable nature allows gradual replacement by natural bone, improving long-term surgical outcomes and reducing complications. Orthopedic trauma repair is another key application segment, with synthetic absorbable bone cements widely employed to fill bone defects, support fracture fixation, and enhance healing in long bones. Their biocompatibility and resorbable properties minimize the need for secondary surgeries, improve patient recovery, and increase adoption in trauma centers and surgical hospitals globally.

- Hospitals segment is expected to witness highest growth over the forecast period

Hospitals are the largest end-users, given their capacity to perform complex orthopedic procedures requiring advanced bone cements. Hospitals adopt synthetic absorbable bone cements to provide better patient outcomes, minimize post-surgical complications, and support a wide range of orthopedic and trauma procedures. Orthopedic and dental clinics also represent a growing end-user segment, as these facilities increasingly perform specialized bone repair and reconstructive procedures. The use of synthetic absorbable bone cements in such settings enhances procedural efficiency, ensures predictable healing, and allows clinics to offer advanced, minimally invasive treatments, driving market adoption and revenue growth.

- North America region is expected to witness highest growth over the forecast period

The North America region is expected to witness the highest growth in the Synthetic Absorbable Bone Cement market over the forecast period, driven by advanced healthcare infrastructure, high adoption of innovative orthopedic technologies, and a large patient population requiring bone repair and reconstruction procedures. The region benefits from well-established hospitals and surgical centers, substantial R&D investments, and supportive regulatory frameworks that facilitate the introduction of advanced biomaterials.

Additionally, the increasing prevalence of bone-related disorders, growing preference for minimally invasive surgeries, and rising awareness of synthetic absorbable bone cement benefits among healthcare providers further accelerate market growth in North America.

To Learn More About This Report - Request a Free Sample Copy

Synthetic Absorbable Bone Cement Market Competitive Landscape

The global synthetic absorbable bone cement market is characterized by the presence of several key players actively involved in research, development, and commercialization of advanced bone cement products. These companies are focusing on product innovation, strategic partnerships, and expanding their market presence to cater to the growing demand for effective orthopedic solutions.

Below is a list of prominent companies operating in this market:

- Acumed

- Biocomposites

- Bioventus

- CollPlant

- DePuy Synthes

- Exactech

- Heraeus Medical

- Sigma Graft

- Teknimed

- Zimmer Biomet

- Stryker Corporation

- Smith & Nephew

- Arthrex, Inc.

- DJO Global (Enovis)

- Medtronic

- Cardinal Health

- B. Braun Melsungen AG

- Paragon 28

- Globus Medical

- Orthofix Medical Inc.

Recent Development

- In October 2025, an article titled, Photon-Counting Computed Tomography of Degradable Bone Cement Loaded with Gadolinium Nanoparticles, reported that study demonstrated that incorporating gadolinium nanoparticles (GdNPs) into hydroxyapatite-based bone cement significantly enhanced radiopacity and visualization compared to conventional formulations. Photon Counting Computed Tomography (PCCT) provided superior image contrast and accurately quantified gadolinium concentrations, enabling precise implant monitoring. These findings improved diagnostic accuracy and postoperative assessment, driving innovation and technological advancement in the Global Synthetic Absorbable Bone Cement Market, fostering the development of next-generation, image-enhanced bioresorbable bone repair materials for orthopedic and spinal applications.

- In October 2025, Biomaterials Advances, reported successfully developed a high-purity silicon-doped α-tricalcium phosphate (Si-α-TCP) and CMC-enhanced calcium phosphate cement (CPC) with superior physicochemical and biological properties. The optimized formulation demonstrated excellent injectability, mechanical strength, controlled drug release, and enhanced osteogenic activity, showing strong biocompatibility and osseointegration in vivo. These advancements introduced a new generation of multifunctional bioresorbable bone cements, significantly influencing the Global Synthetic Absorbable Bone Cement Market by driving innovation in drug-loaded, ion-doped, and tissue-engineered bone repair materials for orthopedic and regenerative medicine applications.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is robustly driven by the rapid growth of the global geriatric population, who are highly susceptible to bone fractures, osteoporosis, and degenerative joint diseases, necessitating orthopedic surgeries. Key advantages of synthetic absorbable bone cements, such as eliminating the need for a second surgery for implant removal, and their enhanced biocompatibility and controlled degradation, make them preferable to traditional polymethyl methacrylate (PMMA) cements, significantly boosting adoption across various orthopedic procedures.

Q2. What are the main restraining factors for this market?

The chief restraints are the high cost associated with research, development, and manufacturing of advanced synthetic biomaterials. Furthermore, new bone cements face stringent and extensive clinical data requirements and lengthy regulatory approval timelines (especially from agencies like the FDA and EMA), which create significant market entry barriers for smaller innovative companies. Competition from well-established, lower-cost, non-absorbable PMMA cements also poses a continuous challenge.

Q3. Which segment is expected to witness high growth?

The Calcium Phosphate Cement (CPC) material segment is anticipated to witness the highest growth rate. CPCs are highly favored due to their excellent biocompatibility and their ability to be gradually absorbed and replaced by new, native bone tissue, offering a more natural healing process. By application, Kyphoplasty and Vertebroplasty procedures are also expected to show strong expansion, driven by the increasing incidence of vertebral compression fractures linked to osteoporosis.

Q4. Who are the top major players for this market?

The market is dominated by major orthopedic and medical device manufacturers who offer a broad portfolio of bone repair materials. Top major players include Stryker Corporation, Zimmer Biomet Holdings, Inc., DePuy Synthes (a subsidiary of Johnson & Johnson), Smith & Nephew, and Heraeus Medical. These companies maintain their market share by focusing on continuous innovation in bioabsorbable materials and integrating their cements into systems used for minimally invasive surgical techniques.

Q5. Which country is the largest player?

North America, with the United States as the primary contributor, holds the largest market share by revenue. This dominance is a result of the region's advanced healthcare infrastructure, high average healthcare expenditure, and a large aging population undergoing high volumes of joint replacement and trauma surgeries. Favorable reimbursement policies and the early adoption of new, premium synthetic biomaterials further solidify North America's market leadership.

List of Figures

Figure 1: Global Synthetic Absorbable Bone Cement Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Synthetic Absorbable Bone Cement Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Synthetic Absorbable Bone Cement Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Synthetic Absorbable Bone Cement Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Synthetic Absorbable Bone Cement Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Synthetic Absorbable Bone Cement Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Synthetic Absorbable Bone Cement Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Synthetic Absorbable Bone Cement Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Synthetic Absorbable Bone Cement Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Synthetic Absorbable Bone Cement Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Synthetic Absorbable Bone Cement Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Synthetic Absorbable Bone Cement Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Synthetic Absorbable Bone Cement Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Synthetic Absorbable Bone Cement Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Synthetic Absorbable Bone Cement Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Synthetic Absorbable Bone Cement Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Synthetic Absorbable Bone Cement Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Synthetic Absorbable Bone Cement Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Synthetic Absorbable Bone Cement Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Synthetic Absorbable Bone Cement Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Synthetic Absorbable Bone Cement Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Synthetic Absorbable Bone Cement Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model