Telehealth Franchise Market Overview and Analysis

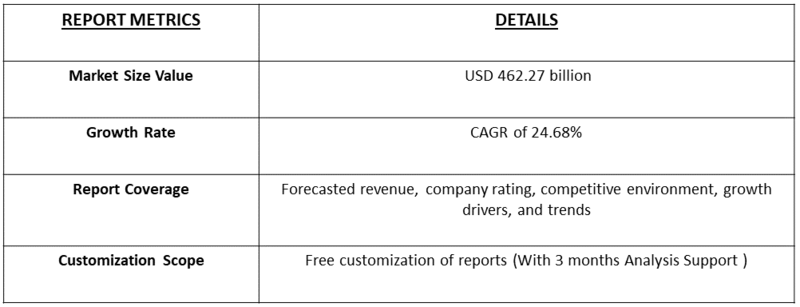

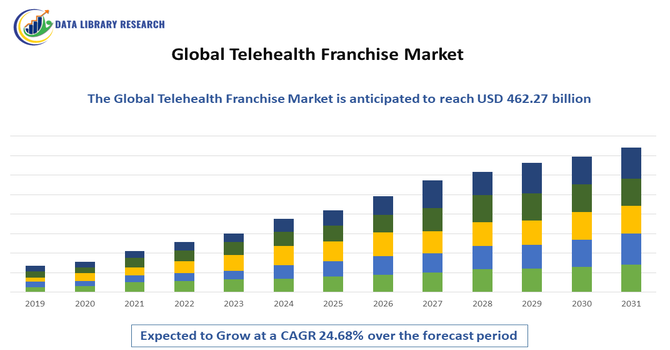

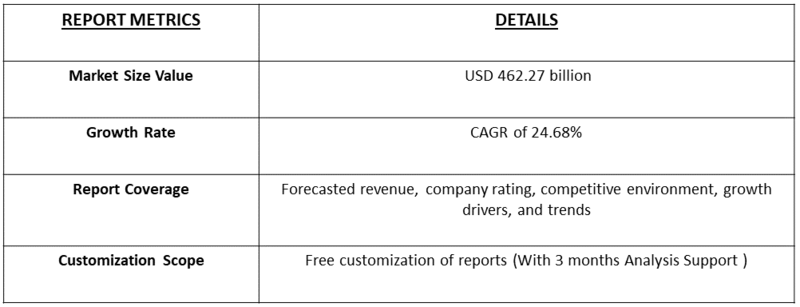

- The Global Telehealth Franchise Market size was estimated at USD 125.13 billion in 2025 and is projected to reach USD 462.27 billion by 2032, growing at a CAGR of 24.68% from 2025 to 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Telehealth Franchise Market refers to the industry segment where telehealth services—such as virtual consultations, remote patient monitoring, and digital healthcare solutions—are offered through franchised business models. Franchises enable healthcare providers, entrepreneurs, and investors to operate under an established brand, leveraging standardized technology platforms, training, and operational support. The market growth is driven by rising healthcare digitization, increasing patient demand for convenient access to medical services, and a shortage of healthcare professionals in certain regions.

Telehealth Franchise Market Latest Trends

The global telehealth franchise market is witnessing rapid growth due to increasing adoption of digital healthcare solutions and virtual consultations. Key trends include integration of AI and IoT in patient monitoring, expansion of mobile health apps, and the use of cloud-based platforms for secure data sharing. Franchises are focusing on offering specialized services such as mental health, chronic disease management, and elderly care. Rising consumer preference for convenient, accessible, and cost-effective healthcare is driving innovation and franchise expansion worldwide.

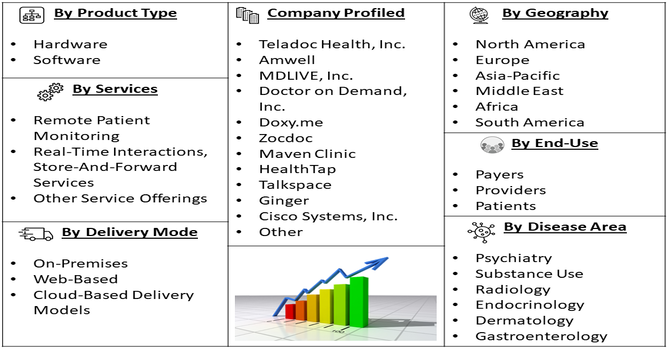

Segmentation: The Global Telehealth Franchise Market is Segmented by Product Outlook (Hardware (Monitors, Medical Peripheral Devices, Blood Pressure Meters, Blood Glucose Meters, Weighing Scales, Pulse Oximeters, Peak Flow Meters, ECG Monitors, and Other Devices), Software (Standalone Software and Integrated Software Solutions), and Services (Remote Patient Monitoring, Real-Time Interactions, Store-And-Forward Services, and Other Service Offerings), Delivery Mode (On-Premises, Web-Based, and Cloud-Based Delivery Models), Disease Area (Psychiatry, Substance Use, Radiology, Endocrinology, Dermatology, Gastroenterology, Mental Health and Counseling, Neurological Medicine, ENT, Cardiology, Oncology, Dental, Gynecology, General Medicine, and Other Disease Areas), End-Use Outlook (Payers, Providers, and Patients), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Shifting consumer demand toward immediate, on-demand medical access

The primary driver for this market is the shifting consumer demand toward immediate, on-demand medical access that eliminates the traditional barriers of travel and waiting rooms. As digital literacy increases across all age groups, patients are seeking "home-first" care models that offer the same quality of consultation as in-person visits but with significantly higher convenience. This behavioral change is supported by the rapid expansion of 5G infrastructure and high-speed internet, which ensures that high-definition video consultations are seamless. Consequently, this technological reliability builds trust between patients and providers, encouraging long-term adoption of virtual care platforms globally.

- Increasing institutional support and financial viability of the telehealth business model

Another significant driver is the increasing institutional support and financial viability of the telehealth business model for local entrepreneurs. Insurance providers are progressively expanding their reimbursement policies to cover virtual visits at the same rates as physical ones, removing the financial risk that previously hindered market growth.

In May 2024, Apollo Telehealth, in partnership with the Government of Manipur, launched a telemedicine-enabled primary health center (PHC) in Borobeka. The initiative leveraged telemedicine technology to improve primary healthcare access for the local community. For potential business owners, the franchise model provides a sophisticated "business-in-a-box" solution, offering specialized HIPAA-compliant software, established medical protocols, and recognized branding. This lowering of the entry barrier allows non-medical entrepreneurs to enter the healthcare space efficiently, fueling a surge in new telehealth clinics that can scale rapidly across different geographic regions.

Market Restraints:

The most significant restraint is the fragmented and highly complex landscape of international and regional medical regulations. Telehealth franchises must navigate a labyrinth of licensing laws, where practitioners are often required to be licensed in the exact location where the patient is physically situated during the call. These "practice of medicine" laws vary wildly between different states and countries, making it extremely difficult for a franchise to maintain a standardized operating model across borders. This regulatory friction not only increases legal and compliance costs but also slows down the speed at which a franchise can expand into new territories.

Socioeconomic Impact on Telehealth Franchise Market

Telehealth franchises are transforming healthcare accessibility, particularly in underserved or remote areas, by bridging the gap between patients and medical professionals. They reduce travel costs, save time, and enhance continuity of care. Economically, these franchises create employment opportunities, stimulate technology adoption, and support small business ownership under established brands. By lowering healthcare costs and improving efficiency, they contribute to better population health outcomes. Increased adoption also supports public health initiatives and reduces strain on traditional healthcare infrastructure.

Segmental Analysis:

- Blood Pressure Meters segment is expected to witness the highest growth over the forecast period

The blood pressure meters segment is projected to witness the highest growth over the forecast period due to increasing prevalence of hypertension and cardiovascular disorders globally. Rising awareness about early diagnosis, self-monitoring trends among patients, and the growing adoption of home healthcare devices are driving demand. Technological advancements such as wireless connectivity, integration with mobile applications, and improved accuracy further enhance the appeal of these devices. Moreover, supportive government initiatives and preventive healthcare programs aimed at monitoring blood pressure regularly are contributing to revenue growth. The segment’s expansion is expected across both developed and emerging markets.

- Cloud-Based Delivery Models segment is expected to witness the highest growth over the forecast period

The cloud-based delivery models segment is expected to experience the highest growth over the forecast period as healthcare organizations increasingly adopt cloud solutions for data storage, remote monitoring, and interoperability. Cloud platforms offer scalable, cost-effective, and secure solutions compared to traditional on-premises systems, enabling real-time access to patient data and analytics. The growing need for telehealth services, integration with wearable devices, and regulatory support for cloud adoption are accelerating growth. Additionally, the flexibility to update software, reduce infrastructure costs, and support large-scale remote operations makes cloud-based delivery models increasingly attractive to providers, payers, and patients worldwide.

- Mental Health and Counseling segment is expected to witness the highest growth over the forecast period

The mental health and counseling segment is expected to witness the highest growth during the forecast period, driven by rising awareness of mental health issues and increasing demand for accessible care solutions. The COVID-19 pandemic has further emphasized the importance of mental wellness, encouraging adoption of tele-counseling and remote therapy platforms. Technological advancements, including mobile-based therapy apps, AI-assisted mental health monitoring, and virtual consultations, have facilitated easier patient engagement. Additionally, government initiatives, employer-supported wellness programs, and growing insurance coverage for mental health services are boosting adoption. The increasing prevalence of psychiatric disorders and substance use disorders globally supports strong long-term revenue growth in this segment.

- Payers segment is expected to witness the highest growth over the forecast period

The payers segment is projected to witness the highest growth over the forecast period due to increasing demand for cost-effective healthcare management solutions. Payers, including insurance companies and health maintenance organizations, are adopting remote monitoring, cloud-based systems, and integrated healthcare platforms to enhance efficiency and reduce operational costs. Rising emphasis on value-based care, predictive analytics, and patient-centric models is further driving adoption. Additionally, partnerships with digital health providers and increased coverage for telehealth services are expanding opportunities in this segment. The growing need to manage chronic diseases, control healthcare expenditures, and improve patient outcomes is expected to sustain robust growth in the payers segment.

- North America Region is expected to witness the highest growth over the forecast period

North America is expected to witness the highest growth over the forecast period due to the presence of advanced healthcare infrastructure, high adoption of digital health technologies, and supportive government initiatives. The region benefits from widespread use of remote patient monitoring, telehealth services, and cloud-based platforms. For instance, in August 2023, Spark Biomedical launched telehealth services for Sparrow Ascent, enhancing access to opioid withdrawal treatment across North America. This initiative strengthened the region’s telehealth capabilities, expanded medication-assisted treatment (MAT) reach, and contributed to growth in the North American segment of the global telehealth franchise market.

Increasing prevalence of chronic diseases, rising demand for home healthcare devices, and growing awareness of preventive healthcare practices contribute to market expansion. Additionally, strong reimbursement frameworks, innovative product launches, and significant investment in research and development enhance growth prospects. North America’s favorable regulatory environment and technologically advanced medical ecosystem are key drivers of sustained revenue growth.

To Learn More About This Report - Request a Free Sample Copy

Telehealth Franchise Market Competitive Landscape

The global telehealth franchise market is highly competitive, with key players leveraging brand recognition, technology platforms, and service quality to expand their presence. Major franchises focus on strategic partnerships, acquisitions, and geographic expansion to capture market share. Differentiation is achieved through specialized telehealth services, proprietary software, and comprehensive training for franchisees. New entrants are adopting innovative models, including subscription-based services and AI-driven care solutions, intensifying competition. Consolidation and technological advancement are expected to shape the market landscape in the coming years.

The major players for above market are:

- Teladoc Health, Inc. (USA) – Virtual care and remote healthcare provider

- Amwell (American Well Corporation) (USA) – Telehealth infrastructure and services

- MDLIVE, Inc. (USA) – On-demand telehealth services

- Doctor on Demand, Inc. (USA) – Telemedicine consultations

- Doxy.me – HIPAA-compliant telehealth platform

- Zocdoc – Telehealth scheduling and provider network

- Maven Clinic – Specialized virtual care (e.g., maternal health)

- HealthTap – Telehealth platform connecting doctors and patients

- Talkspace – Digital mental health and therapy services

- Ginger – Behavioral health telecare provider

- Cisco Systems, Inc. – Enterprise telehealth technology and connectivity

- Philips Healthcare – Telehealth solutions and remote monitoring technology

- Siemens Healthineers – Telemedicine integration and remote diagnostics

- Medtronic PLC – Remote patient monitoring systems

- GE Healthcare – Telehealth-enabled healthcare devices and platforms

- GlobalMed – Telehealth hardware and software solutions

- IMediplus Inc. (China) – Telemedicine and digital health services

- VSee – Secure telehealth communication platform

- iCliniq (India) – Global online medical consultation services

- Practo (India) – Healthtech platform offering teleconsultations

Recent Development

- In December 2025, Live Forever Health launched its national franchising program, enabling entrepreneurs and physicians to implement its telemedicine-integrated clinic model across the U.S. This "full-stack" approach standardized high-quality care and expanded in-person and virtual services, significantly boosting the growth and reach of the global telehealth franchise market in specialized health and longevity.

- In April 2025 allocated funding to Medicare to reduce hospital pressure and expand community access to urgent care. The initiative introduced 1800MEDICARE, a free, nationwide health advice hotline and after-hours telehealth service, which provided Australians with round-the-clock access to general practitioners, fully supported by Medicare.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The market is growing because patients want convenient, on-demand medical care without leaving their homes. For entrepreneurs, the franchise model offers a proven business structure and brand recognition in a complex medical field. Additionally, improvements in 5G technology and the increasing acceptance of digital prescriptions by insurance companies make remote clinics more profitable.

Q2. What are the main restraining factors for this market?

Growth is limited by complex and varying medical regulations across different states and countries. Ensuring consistent quality of care across many different franchise locations can also be difficult. Furthermore, high initial franchise fees and the ongoing costs of maintaining secure, HIPAA-compliant software can be a barrier for new business owners.

Q3. Which segment is expected to witness high growth?

The Mental Health and Counseling segment is expected to see the highest growth. There is a massive global demand for therapy services that can be accessed privately and comfortably from home. Because behavioral health often requires regular talking sessions rather than physical exams, it is perfectly suited for a scalable franchise model.

Q4. Who are the top major players for this market?

The market is led by companies that combine medical expertise with scalable business platforms. Key players include Doctor on Demand, Teladoc Health, BetterHelp, and specialized franchise brands like The Joint Chiropractic (expanding into digital) or MD-Now. These organizations provide the technology and legal frameworks that individual franchisees need to operate safely.

Q5. Which country is the largest player?

The United States is the largest player in the telehealth franchise market. This is due to its large, private-sector healthcare system and a strong culture of franchising. The U.S. has a high demand for efficient healthcare alternatives and a legal environment that increasingly supports the reimbursement of virtual visits by both government and private insurance.

List of Figures

Figure 1: Global Telehealth Franchise Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Telehealth Franchise Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Telehealth Franchise Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Telehealth Franchise Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Telehealth Franchise Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Telehealth Franchise Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Telehealth Franchise Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Telehealth Franchise Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Telehealth Franchise Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Telehealth Franchise Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Telehealth Franchise Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Telehealth Franchise Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Telehealth Franchise Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Telehealth Franchise Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Telehealth Franchise Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Telehealth Franchise Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Telehealth Franchise Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Telehealth Franchise Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Telehealth Franchise Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Telehealth Franchise Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Telehealth Franchise Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Telehealth Franchise Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Telehealth Franchise Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Telehealth Franchise Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Telehealth Franchise Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Telehealth Franchise Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Telehealth Franchise Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Telehealth Franchise Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Telehealth Franchise Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Telehealth Franchise Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Telehealth Franchise Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Telehealth Franchise Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Telehealth Franchise Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Telehealth Franchise Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Telehealth Franchise Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Telehealth Franchise Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Telehealth Franchise Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Telehealth Franchise Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Telehealth Franchise Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Telehealth Franchise Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Telehealth Franchise Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Telehealth Franchise Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Telehealth Franchise Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Telehealth Franchise Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Telehealth Franchise Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Telehealth Franchise Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Telehealth Franchise Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Telehealth Franchise Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Telehealth Franchise Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Telehealth Franchise Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Telehealth Franchise Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Telehealth Franchise Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Telehealth Franchise Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Telehealth Franchise Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Telehealth Franchise Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Telehealth Franchise Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Telehealth Franchise Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Telehealth Franchise Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Telehealth Franchise Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Telehealth Franchise Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Telehealth Franchise Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Telehealth Franchise Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Telehealth Franchise Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Telehealth Franchise Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Telehealth Franchise Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Telehealth Franchise Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Telehealth Franchise Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Telehealth Franchise Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Telehealth Franchise Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Telehealth Franchise Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Telehealth Franchise Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Telehealth Franchise Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Telehealth Franchise Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Telehealth Franchise Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Telehealth Franchise Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Telehealth Franchise Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Telehealth Franchise Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Telehealth Franchise Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model