Virtual Hospital Market Overview and Analysis:

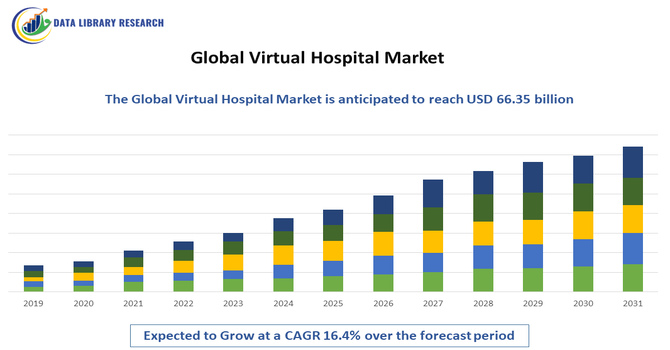

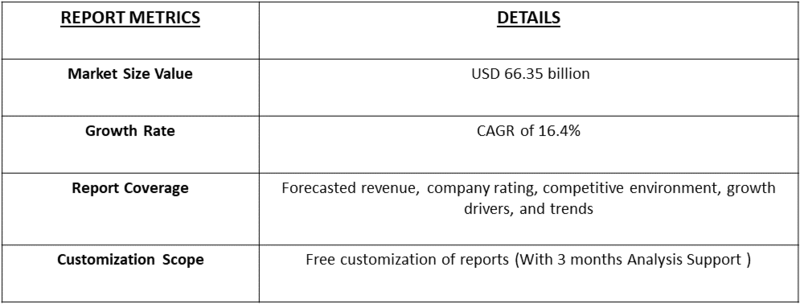

- The Global Virtual Hospital Market size is growing with CAGR of 16.4% from 2025-2032, in the prediction period & crosses USD 66.35 billion by 2032 from USD 20.34 billion in 2025.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Virtual Hospital Market is experiencing rapid expansion driven by the widespread digital transformation of healthcare systems and the growing preference for remote care delivery. Accelerated adoption of telemedicine technologies—including video consultations, cloud based platforms, and remote patient monitoring—has made virtual hospitals an essential part of modern healthcare, especially as patients increasingly seek convenient, continuous care from home. Technological advancements such as artificial intelligence (AI), Internet of Things (IoT), and advanced connectivity (e.g., 5G) are further enhancing virtual care capabilities, enabling real time diagnostics and personalized treatment, reducing dependency on physical facilities, and improving clinical outcomes.

Virtual Hospital Market Latest Trends:

The Global Virtual Hospital Market is evolving rapidly with key trends reshaping how healthcare is delivered and experienced. A major trend is the integration of advanced digital technologies such as AI, cloud based systems, and IoT enabled remote patient monitoring, which are enabling more comprehensive virtual care including diagnostics, chronic disease management, and predictive analytics that improve outcomes and efficiency. Another significant trend is the expansion of virtual care beyond basic teleconsultations to full spectrum virtual hospital services, including virtual chronic care management, home based acute care, and hybrid care models that bridge physical and digital care pathways. This shift is driven by patient preference for convenient, 24/7 access to healthcare, growth in wearable and mobile health adoption, and supportive regulatory environments that incentivize telehealth reimbursement.

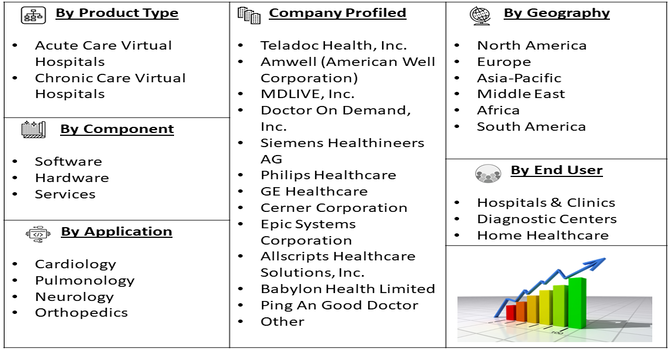

Segmentation: Global Virtual Hospital Market is segmented By Component (Software, Hardware, Services), By Type (Acute Care Virtual Hospitals, Chronic Care Virtual Hospitals), By Application (Cardiology, Pulmonology, Neurology, Orthopedics), By End User (Hospitals & Clinics, Diagnostic Centers, Home Healthcare), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Increasing Adoption of Telemedicine and Remote Patient Monitoring

The primary drivers of the virtual hospital market is the rapid adoption of telemedicine and remote patient monitoring technologies. Advances in digital health platforms, wearable devices, and IoT-enabled monitoring allow healthcare providers to deliver continuous care to patients outside traditional hospital settings. This is especially critical for chronic disease management, post-operative care, and follow-up consultations, reducing the need for in-person visits. Patients benefit from convenience, reduced travel time, and real-time monitoring, while hospitals can optimize resources, enhance workflow efficiency, and improve patient outcomes. The COVID-19 pandemic further accelerated the acceptance and integration of telehealth solutions, establishing virtual hospitals as a mainstream care delivery model.

- Rising Prevalence of Chronic Diseases and Aging Population

The increasing burden of chronic diseases such as cardiovascular disorders, diabetes, and respiratory illnesses, combined with a growing aging population, is fueling demand for virtual hospital services. Chronic disease patients require regular monitoring, frequent consultations, and timely interventions, which virtual hospitals can provide efficiently and cost-effectively. The aging population often faces mobility challenges and prefers care from home, which makes virtual hospital solutions particularly attractive. By enabling continuous monitoring, early detection of complications, and remote management, virtual hospitals reduce hospital readmissions, lower healthcare costs, and improve patient quality of life, thus acting as a strong growth driver for the market.

Market Restraints:

- Data Privacy and Cybersecurity Concerns

A major restraint for the virtual hospital market is the risk associated with data privacy and cybersecurity. Virtual hospitals rely heavily on digital platforms to manage sensitive patient information, including medical histories, lab results, and real-time monitoring data. The increasing prevalence of cyberattacks and data breaches in healthcare has heightened concerns among providers and patients regarding the security of personal health information. Compliance with strict data protection regulations such as HIPAA in the U.S., GDPR in Europe, and similar laws globally requires significant investment in secure infrastructure. Failure to maintain high cybersecurity standards can result in legal liabilities, loss of patient trust, and hinder the widespread adoption of virtual hospital solutions.

Socioeconomic Impact on Virtual Hospital Market

The Global Virtual Hospital Market has significantly influenced socioeconomic dynamics by improving access to healthcare, particularly in remote and underserved regions. Virtual hospitals reduce travel costs, minimize hospital congestion, and enable continuous patient monitoring, enhancing treatment efficiency and outcomes. They also lower operational expenses for healthcare providers while creating employment opportunities in telehealth, IT infrastructure, and remote patient care services. By facilitating timely medical interventions and chronic disease management, virtual hospitals improve population health and workforce productivity. Additionally, they help reduce disparities in healthcare access, contributing to more equitable health outcomes and overall societal well-being.

Segmental Analysis:

- Software segment is expected to witness highest growth over the forecast period

The software segment represents a critical portion of the virtual hospital market, as it forms the backbone of telemedicine platforms, electronic health record (EHR) systems, remote patient monitoring applications, and virtual care management tools. These software solutions enable seamless scheduling, real-time consultations, patient data analytics, and integration with wearable devices, allowing healthcare providers to deliver efficient, continuous care. The growing reliance on cloud-based and AI-enabled platforms for predictive diagnostics and personalized care is driving strong demand in this segment globally.

- Chronic Care Virtual Hospitals segment is expected to witness the highest growth over the forecast period

The chronic care virtual hospital segment is expanding rapidly due to the rising prevalence of long-term diseases such as diabetes, cardiovascular disorders, and respiratory illnesses. These virtual hospitals offer continuous monitoring, remote consultations, and personalized treatment plans for patients managing chronic conditions, reducing hospital readmissions, and improving quality of life. The convenience of home-based care and ongoing digital engagement with healthcare providers is contributing significantly to growth in this segment.

- Cardiology segment is expected to witnessthe highest growth over the forecast period

Cardiology is a leading application area within the virtual hospital market, driven by the increasing incidence of cardiovascular diseases worldwide. Virtual hospitals enable real-time monitoring of heart rate, blood pressure, and other vital parameters using wearable devices and remote sensors. Cardiologists can provide timely interventions and manage chronic cardiac conditions efficiently, reducing the need for frequent hospital visits while enhancing patient outcomes.

- Home Healthcare segment is expected to witness the highest growth over the forecast period

The home healthcare segment is witnessing robust growth as virtual hospital platforms allow patients to receive medical care and continuous monitoring from the comfort of their homes. This is especially important for elderly patients, those with mobility issues, and individuals in rural or underserved regions. Home-based virtual care reduces the burden on hospitals and ensures personalized attention, supporting broader adoption of virtual hospital services.

- North America segment is expected to witness highest growth over the forecast period

North America dominates the global virtual hospital market, supported by advanced healthcare infrastructure, high digital literacy, widespread adoption of telemedicine, and favorable regulatory frameworks for remote healthcare delivery. The presence of leading healthcare technology providers and the growing prevalence of chronic and acute diseases further drive demand for virtual hospital solutions in the region.

Furthermore, the increasing integration of AI, IoT, and cloud-based platforms in North American virtual hospitals has enhanced patient monitoring, predictive diagnostics, and personalized care. These technological advancements improve clinical efficiency, reduce hospital readmissions, and optimize resource allocation. Additionally, growing consumer acceptance of telehealth services and rising investments in digital health innovations continue to strengthen the region’s position as the largest and most technologically advanced virtual hospital market globally.

To Learn More About This Report - Request a Free Sample Copy

Virtual Hospital Market Competitive Landscape:

The Global Virtual Hospital Market is highly competitive and rapidly evolving, driven by the growing adoption of telehealth platforms, remote monitoring solutions, and integrated digital care systems across healthcare providers worldwide. Key players differentiate themselves through technological innovation, strategic partnerships, expanded service portfolios, and scalable solutions that cater to diverse patient needs, from acute care to chronic disease management. Companies are investing heavily in AI, cloud based infrastructure, cybersecurity, and IoT connectivity to enhance virtual care delivery and patient outcomes. Continuous mergers, acquisitions, and cross-industry collaborations are further intensifying competition as providers expand their geographic reach and service offerings in this dynamic digital healthcare landscape.

Key Players:

- Teladoc Health, Inc.

- Amwell (American Well Corporation)

- MDLIVE, Inc.

- Doctor On Demand, Inc.

- Siemens Healthineers AG

- Philips Healthcare

- GE Healthcare

- Cerner Corporation

- Epic Systems Corporation

- Allscripts Healthcare Solutions, Inc.

- Babylon Health Limited

- Ping An Good Doctor

- GlobalMed

- Cisco Systems, Inc.

- Medtronic plc

- Doxy.me LLC

- HealthTap, Inc.

- eVisit, Inc.

- SOC Telemed (Patient Square Capital)

- MeMD (Walmart Health Virtual Care)

Recent Development

- In September 2025, University Hospitals implemented its Connected Care Team program at UH Lake West, becoming one of the first U.S. hospitals to fully adopt a hospital-wide virtual nursing model. Powered by Vitalchat’s AI-driven audio-video platform, the initiative followed a successful pilot across six units and five hospitals, demonstrating improved patient outcomes, enhanced caregiver support, and increased healthcare system efficiency, highlighting the growing role of virtual nursing solutions in advancing the global virtual hospital market.

- In 2023, Saudi Arabia launched the Middle East’s first virtual hospital, SEHA Virtual Hospital (SVH), connecting 130 hospitals nationwide and becoming the largest globally. SVH enabled patients to access specialist consultations via live video without traveling, offered emergency and critical care across eight specialized clinics, and provided 24-hour remote monitoring through IoT devices. With the capacity to treat over 400,000 patients annually, this initiative significantly advanced virtual healthcare adoption and influenced growth in the global virtual hospital market.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary driver is the urgent need to expand healthcare access to rural and underserved areas. Rapid advancements in 5G, artificial intelligence, and the Internet of Medical Things (IoMT) allow for real-time patient monitoring. Additionally, an aging global population and the rising burden of chronic diseases are forcing hospitals to adopt remote treatment models.

Q2. What are the main restraining factors for this market?

Growth is primarily hindered by serious concerns regarding data privacy and cybersecurity, as virtual platforms handle sensitive patient information. High initial setup costs for digital infrastructure and a lack of reliable high-speed internet in developing nations also limit adoption. Furthermore, some elderly patients find it difficult to use complex digital health tools.

Q3. Which segment is expected to witness high growth?

The home healthcare segment segment is expected to see the highest growth. As healthcare shifts from reactive to proactive care, the demand for wearable devices that track vitals like heart rate and oxygen levels is surging. This allows doctors to manage chronic conditions from a distance, significantly reducing hospital readmission rates.

Q4. Who are the top major players for this market?

The market is led by innovative technology providers and established healthcare giants. Key players include Teladoc Health, Amwell, MDLIVE, and Philips Healthcare. These companies dominate by offering integrated platforms that connect patients with specialists via video, while also providing the software needed for hospitals to manage virtual "wards" and ICUs.

Q5. Which country is the largest player?

The United States is the largest player in the virtual hospital market. It leads due to its advanced digital infrastructure, high healthcare spending, and supportive government regulations. The U.S. also hosts the majority of the world’s leading telehealth companies and has a high rate of smartphone and wearable technology adoption among its citizens.

List of Figures

Figure 1: Global Virtual Hospital Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Virtual Hospital Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Virtual Hospital Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Virtual Hospital Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Virtual Hospital Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Virtual Hospital Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Virtual Hospital Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Virtual Hospital Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Virtual Hospital Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Virtual Hospital Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Virtual Hospital Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Virtual Hospital Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Virtual Hospital Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Virtual Hospital Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Virtual Hospital Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Virtual Hospital Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Virtual Hospital Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Virtual Hospital Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Virtual Hospital Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Virtual Hospital Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Virtual Hospital Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Virtual Hospital Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Virtual Hospital Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Virtual Hospital Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Virtual Hospital Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Virtual Hospital Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Virtual Hospital Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Virtual Hospital Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Virtual Hospital Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Virtual Hospital Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Virtual Hospital Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Virtual Hospital Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Virtual Hospital Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Virtual Hospital Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Virtual Hospital Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Virtual Hospital Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Virtual Hospital Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Virtual Hospital Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Virtual Hospital Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Virtual Hospital Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Virtual Hospital Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Virtual Hospital Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Virtual Hospital Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Virtual Hospital Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Virtual Hospital Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Virtual Hospital Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Virtual Hospital Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Virtual Hospital Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Virtual Hospital Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Virtual Hospital Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Virtual Hospital Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Virtual Hospital Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Virtual Hospital Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Virtual Hospital Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Virtual Hospital Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Virtual Hospital Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Virtual Hospital Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Virtual Hospital Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Virtual Hospital Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Virtual Hospital Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Virtual Hospital Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Virtual Hospital Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Virtual Hospital Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Virtual Hospital Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Virtual Hospital Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Virtual Hospital Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Virtual Hospital Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Virtual Hospital Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Virtual Hospital Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Virtual Hospital Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Virtual Hospital Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Virtual Hospital Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Virtual Hospital Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Virtual Hospital Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Virtual Hospital Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Virtual Hospital Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Virtual Hospital Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Virtual Hospital Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model