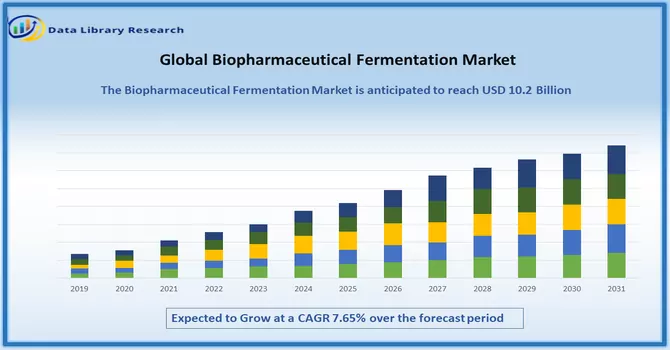

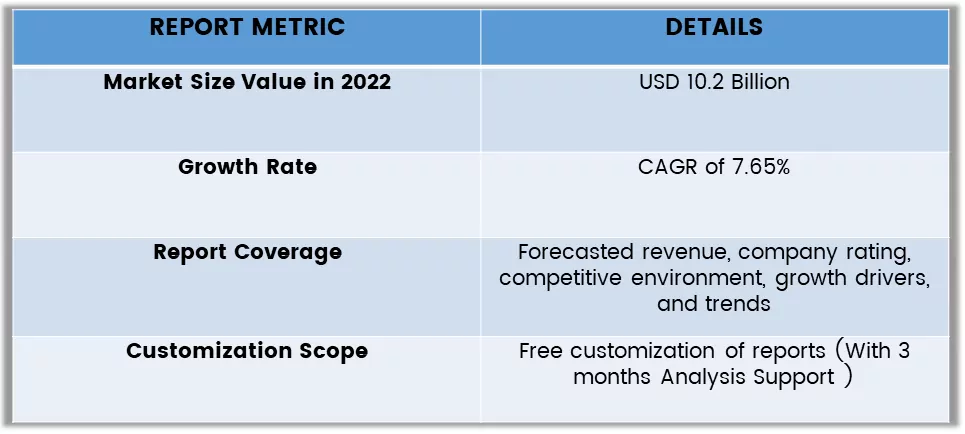

The Biopharmaceutical Fermentation Market is currently valued at USD 10.2 billion in the year 2022 registering a CAGR of 7.65% over the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

The increment within the aged population, surge within the pervasiveness of chronic illnesses over the globe, and increase in human services consumption drive interest in biopharmaceuticals. This is most likely to aim to fuel the expansion of the global Biopharmaceutical Fermentation Systems Market during the estimated period. The Global Biopharmaceutical Fermentation Systems Market report provides a holistic evaluation of the market. The report offers a comprehensive analysis of key segments, trends, drivers, restraints, competitive landscape, and factors that are playing a substantial role in the market.

Biopharmaceutical fermentation is a process used for cultivating microorganisms or other organic material into important pharmaceuticals such as antibiotics, therapeutic proteins, enzymes, and insulin. Fermentation, as a whole, includes upstream and downstream good manufacturing practice (GMP) multi-stage processes whose purpose is to yield the required biopharmaceutical therapeutic material that is pure and active, and which is released according to relevant quality standards and specifications. The process of fermentation can begin using either genetically modified or unmodified cells such as bacteria, fungi, plant, and mammalian material. Usually, large-scale fermentation processes will be performed in stainless steel or single-use bioreactors (for more information about single-use reactors, refer to single-use equipment in the biopharmaceutical industry).

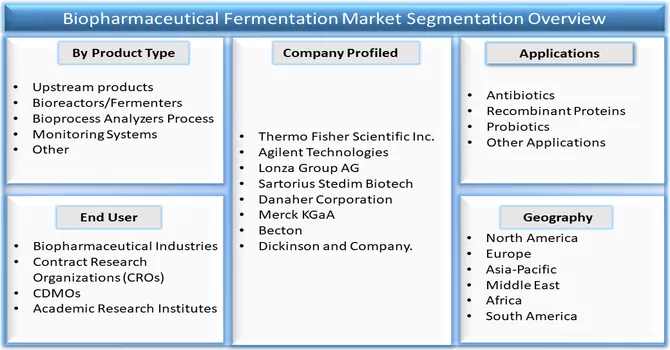

Segmentation:

The Biopharmaceutical Fermentation Market is Segmented

By Product Type

Upstream Products and Downstream Products

Applications

End User

Geography

The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The COVID-19 pandemic has had a significant impact on the growth of the biopharmaceutical fermentation market. For instance, an article published by IFPMA in June 2023, reported that 177 collaborations have been agreed for the production and commercialization of COVID-19 treatments. Since most of these COVID-19 vaccines are dependent on the fermentation plants for development, thus COVID-19 vaccines product speed up the demand for biopharmaceutical fermentation products and technologies. In the current scenario, the presence of various other harmful viruses may increase the demand for various vaccine products. For instance, in 2021 the Annual Report published by Thermo Fisher Inc. reported that 2021, the life sciences solutions business and the biosciences and bioproduction businesses of this company also expanded their capacity to meet the needs of pharma and biotech customers as they rapidly expanded their production volumes to meet global vaccine manufacturing requirements.

Furthermore, the Russian-Ukrainian conflict has adversely affected pharmaceutical supply chains, with significant effects on production, sourcing, manufacturing, processing, logistics, and significant shifts in demand between nations reliant on imports from Ukraine. Thus, such instances show the post-pandemic and the Russian War market is expanded to witness significant growth, thereby witnessing growth over the forecast period.

Drivers:

Increase in Investment in Pharmaceutical and Biotechnological R&D

There is an increasing number of health companies among the top corporate R&D investors which has been driven by the rise of the number of biotech and pharmaceutical companies. The research and development in the different types of immunotherapies (including vaccines and mRNA techniques) and the use of pathogens are evolving and developing and how the research community approaches several diseases is increasing the demand for biotechnological fermentation plants, thereby driving the growth of the studied market.

Also, the 2022 Agilent Technologies annual report, reported that in 2021, the company recorded revenue growth across the pharmaceutical sector compared to the previous year. Similarly, the news published by Fierce Biotech in March 2023, reported that the biopharma R&D has been rising at roughly 4% a year for each of the last five years. Since, microbial fermentation is the basis for the production of a wide variety of pharmaceutical drugs and biologics, from anti-cancer drugs and vaccines to hormonal disorder therapies and many others, as a result, the increase in pharmaceutical R&D is expected to increase the demand for the biopharmaceutical fermentation process, thereby driving the growth of the studied market.

Increased Demand for Biotechnological Based Drugs

Updated research published by AstraZeneca in July 2023, reported that in the current scenario, the pharmaceutical industry is focussing on the potential new therapies that are different from the traditional small molecules and current large molecules which are often aimed at targets on the cell surface or delivered without a specific molecular-targeting strategy. As a result, there is a need for advanced biotechnological-based novel molecules in tissues and cells to optimize their potential benefits for patients.

Furthermore, the launch of new biotechnological-based drugs is also expected to drive the growth of the studied market. For instance, in July 2023, Biocon Biologics launched a biosimilar version of AbbVie's blockbuster rheumatoid arthritis drug Humira in the United States. Thus, due to the above-mentioned reasons the market is expected to witness significant growth over the forecast period.

Restraints:

High Cost of Biopharmaceutical Fermentation Plant and its Installation

The report published by the Federation of American Scientists in May 2023, stated that the United States Department of Agriculture (USDA) and ARPA-H have jointly committed to an initial funding amount of USD 15 million for 10 research projects in the first year, with a total of USD 75. million over five years, in Grand Challenge funding for researchers or companies who can develop a scalable fermentation process plants for producing food-grade or pharmaceutical-grade amino acids or growth factors at a fraction of current costs. Thus, such a high cost of installation of fermentation plants is expected to slow down the growth of the studied market.

By Product Type Bioreactors/Fermenters Segment is Expected to Witness Significant Growth Over the Forecast Period

The bioreactor is a large vessel where different cells such as human or plant, or animal cells can be cultured to obtain new biological products. It provides optimum conditions like temperature, pH, substrate, oxygen, etc required for the culturing of cells producing desired products. Bioreactors are integral to the manufacture of protein-based drugs, especially monoclonal antibodies.

Furthermore, new product launches are expected to drive the growth of the studied market. For instance, in March 2021, Thermo Fisher launched a strong demand for large-scale single-use systems has bioreactors with capacities beyond the standard limits. These single-use bioreactors have become a staple in the bioprocess industry, both for clinical and commercial batches. Thus, the use of bioreactors in biotechnological drug development and new product launches is expected to drive the growth of the studied market.

By Application Types Antibiotics Segment is Expected to Witness Significant Growth Over the Forecast Period.

Antibiotics are antimicrobial drugs obtained from other organisms (such as molds, fungi, and some soil bacteria) to combat harmful microorganisms. However, they are not very useful against certain microbes such as viruses. Antibiotics are produced on a large scale by the biopharmaceutical fermentation process. A process combining hydrothermal treatment (HT), pyrolysis, and anaerobic digestion can efficiently treat antibiotic fermentation residues (AFR).

Also, an article published by Bioresource Technology in October 2021, reported that about 0.12 million tons of antibiotics and 1.5–2 million tons of antibiotic fermentation residues (AFR) are generated in China every year. Thus, such instances show the increased production of antibiotics using the biopharmaceutical fermentation process, thereby contributing to the studied market’s growth.

By End Users, Contract Research Organizations Segment is Expected to Witness High Growth Over the Forecast Period.

A contract research organization is a company that provides clinical trial services for the pharmaceutical, biotechnology, and medical device industries. CROs range from large, international, full-service organizations to small, niche specialty groups. They can help their clients get a new drug or device from the idea stage to FDA marketing approval without the drug sponsor having to keep staff for these services.

Furthermore, novel developments are expected to drive the growth of the studied market. For instance, in February 2021, Charles River Laboratories signed a final agreement to buy Cognate BioServices Inc., a cell and gene therapy contract development and manufacturing organization (CDMO). This will increase Charles River's scientific capabilities in the fast-growing cell and gene therapy sector. Thus, such instances show the high dependence of biopharmaceutical companies on CROs for the drug development process, thereby contributing to the studied market growth.

Geography Trends North America is Expected to Dominate the Biotechnological Fermentation Market Over the Forecast Period

North America is expected to witness significant growth in the biopharmaceutical market over the forecast period owing to factors such as the increasing demand for biotech-based drugs, rising research and development activities, and growing expenditure for the development and advancements in biopharmaceutical fermentation. In addition, the rise in the frequency of chronic diseases rises the consumption of medicines which in turn helps to grow the biopharmaceutical industry and offers growth opportunities for the market players by increasing demand for biologics and biotech drugs which will ultimately propel the utility of biopharmaceutical fermentation.

The IDF in 2022, reported that 37.3 million people, or 11.3% of the U.S. population, have diabetes. An estimated 28.7 million people – or 28.5% of the population – had been diagnosed with diabetes. Approximately 8.5 million people have diabetes but have not yet been diagnosed (2022). Since the development of new diabetic drugs requires the usage of biopharmaceutical fermentation plants, as result in a rise in chronic diseases like diabetes is expected to drive the growth of the studied market.

Furthermore, the new developments by key market players are expected to drive the growth of the market over the forecast period. For instance, in January 2022, Thermo Fisher Scientific Inc. acquired PeproTech, Inc., a leading developer and manufacturer of recombinant proteins. Recombinant proteins are used in the development and manufacturing of cell and gene therapies as well as in broader cell culture applications, especially for use in cellular research models. PeproTech's recombinant proteins portfolio complements Thermo Fisher's cell culture media products and will enable Thermo Fisher to provide customers with significant benefits through an integrated offering. Thus, such developments are expected to drive the growth of the studied market over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

Competitive Landscape:

The biotechnological fermentation market is fragmented in nature due to the presence of several companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international as well as local companies that hold market shares and are well-known including

Companies :

Recent Developments:

1) In April 2023, Cytiva launched X-platform bioreactors to simplify single-use upstream bioprocessing operations. X-platform bioreactors, initially available in 50 and 200 L sizes are provided with Figurate automation solution software and can increase process efficiency through ergonomic improvements, production capability, and simplified supply chain operations. The bioreactors also work with the Cytiva Bioreactor Scaler to determine the optimal target settings for scaling without trial and error.

2) In March 2023, Plurinuva rebranded as Ever After Foods to launch its patented bioreactor platform for cultivated meat production. The new tech can increase productivity by more than 700%.

Q1. What is the Growth Rate of the Biopharmaceutical Fermentation Market ??

Biopharmaceutical Fermentation Market is currently valued at a CAGR of 7.65% over the forecast period (2023-2030)

Q2. What segments are covered in the Biopharmaceutical Fermentation Market ??

Biopharmaceutical Fermentation Market covered segmentation Like - By Product Type, Application, End User and Geography

Q3. Which Region is expected to hold the higest Market share??

North America is expected to witness significant growth in the Biopharmaceutical Fermentation Market over the forecast period.

Q4. What are the latest developments in the Biopharmaceutical Fermentation Market??

1) In March 2023, Plurinuva rebranded as Ever After Foods to launch its patented bioreactor platform for cultivated meat production.

2) In April 2023, Cytiva launched X-platform bioreactors to simplify single-use upstream bioprocessing operations.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model