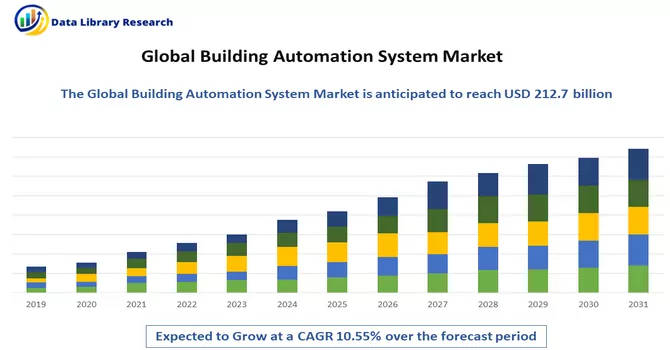

The Building Automation Systems Market size is estimated at USD 212.7 billion in 2023 and is expected to reach a CAGR of 10.55% during the forecast period (2024-2031).

Get Complete Analysis Of The Report - Download Free Sample PDF

A Building Automation and Control System (BACS), also known as a Building Management System (BMS) or Building Automation System (BAS), is a centralized control system that integrates and manages various building systems and components to enhance the efficiency, safety, and comfort of a facility. BACS is designed to automate and monitor key building functions, such as heating, ventilation, air conditioning (HVAC), lighting, security, access control, and other systems. The primary objectives of a Building Automation and Control System are to optimize energy usage, improve operational efficiency, provide a comfortable and secure environment for occupants, and facilitate effective management and maintenance of building infrastructure. BACS typically consists of sensors, controllers, communication networks, and user interfaces that work together to gather data, make informed decisions, and control the different systems within a building. Key features of a Building Automation and Control System include real-time monitoring, data analysis, remote access and control, predictive maintenance capabilities, and the ability to integrate with emerging technologies for smart and sustainable building management. The implementation of BACS results in streamlined operations, reduced energy consumption, and increased overall building performance. The growth of the Building Automation and Control System (BACS) market is propelled by various interconnected factors. Increasing emphasis on energy efficiency and sustainability, driven by environmental concerns, encourages the adoption of BACS for precise control over HVAC, lighting, and other building systems, resulting in reduced operational costs. The pursuit of cost savings and operational efficiency, coupled with advancements in technology such as IoT and data analytics, fosters the evolution of BACS, making buildings more intelligent and responsive. Government regulations and incentives further drive market growth, as do the rising demands for smart buildings and the integration of security and safety features within BACS. With a surge in construction activities and a growing awareness of occupant comfort and productivity, the BACS market continues to witness robust expansion, catering to the evolving needs of modern and sustainable building management solutions.

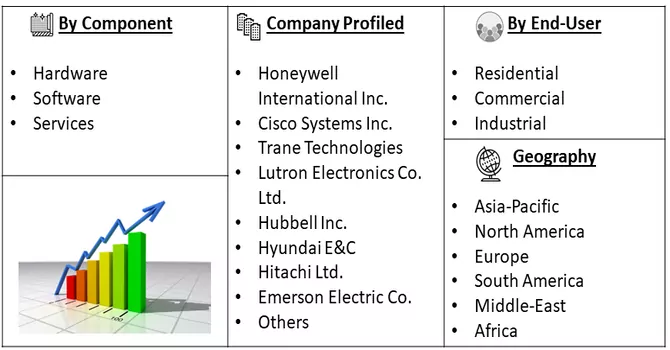

Market Segmentation: The Building Automation and Control System Market is segmented by Component (Hardware, Software, Services), End-User (Residential, Commercial, Industrial), and Geography (North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa). The market sizing and forecasts are provided in terms of value (USD billion) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The Building Automation and Control System (BACS) market is experiencing dynamic trends that redefine the landscape of intelligent building management. Notably, the integration of Artificial Intelligence (AI) and Machine Learning (ML) enhances predictive capabilities, while the adoption of edge computing enables faster real-time responses. Cybersecurity takes center stage as interconnected BACS systems leverage cloud-based platforms, emphasizing robust security measures. The industry is witnessing a shift towards open protocols, promoting interoperability and scalability. Cloud-based solutions gain traction for their accessibility and remote management capabilities. The pervasive integration of Internet of Things (IoT) devices contributes to enhanced automation and data-driven decision-making. Sustainability and wellness-focused building initiatives guide BACS trends, aligning with the broader push for green certifications and occupant-centric environments. Collectively, these trends underscore the market's evolution towards more intelligent, interconnected, and sustainable building management solutions.

Market Drivers:

Energy Efficiency Imperatives

The increasing focus on energy efficiency and sustainable building practices acts as a significant driver for the Building Automation and Control System (BACS) market. Organizations and building owners are adopting BACS to optimize the usage of resources such as heating, ventilation, and lighting, resulting in reduced energy consumption and operational costs. The demand for solutions that contribute to green building certifications and align with environmental initiatives continues to propel the adoption of BACS.

Rising Demand for Smart Buildings

The growing trend towards smart buildings, characterized by interconnected and automated systems, drives the demand for BACS. Smart buildings leverage BACS to enhance connectivity, automate routine tasks, and provide a more intelligent and responsive infrastructure. The desire for enhanced occupant comfort, operational efficiency, and the integration of emerging technologies fuel the market's expansion.

Market Restraints:

High Initial Investment and Implementation Costs

One significant restraint for the BACS market is the high initial investment and implementation costs associated with deploying these systems. The integration of sophisticated sensors, controllers, and communication networks, along with the need for specialized software, can result in substantial upfront expenses. This cost factor may deter smaller businesses or organizations with budget constraints from adopting BACS, impacting the widespread penetration of these systems across various sectors.

The COVID-19 pandemic has brought a profound impact on the Building Automation and Control System (BACS) market, catalyzing a shift in priorities and approaches to building management. With the surge in remote work, there is an increased emphasis on BACS solutions that enable remote monitoring and control, ensuring operational continuity amid reduced on-site staffing. The pandemic has heightened concerns about indoor air quality, prompting a focus on BACS for monitoring and controlling ventilation parameters to create healthier indoor environments. Touchless solutions within BACS, driven by hygiene considerations, gained prominence, integrating voice-activated or sensor-based controls for various building systems. The incorporation of safety measures, such as security and surveillance integration to enforce social distancing, has become crucial, while delayed projects and budget constraints impact new BACS installations. Despite challenges, the pandemic underscores the resilience and adaptability of BACS, emphasizing its role in creating safer, healthier, and more responsive built environments.

Software segment is Expected to Witness Significant Growth Over the Forecast Period

In the analysis of building automation systems (BAS), the pivotal role of software cannot be overstated, as it serves as the foundational framework orchestrating and optimizing various building functions. Software plays a crucial role in seamlessly integrating components such as HVAC systems, lighting, security, and energy management, resulting in an intelligent and cohesive system. It enables real-time monitoring and control, empowering facility managers to adjust settings, monitor performance, and respond swiftly to changing conditions. Advanced software solutions contribute to enhanced energy efficiency through smart algorithms and predictive analytics, optimizing resource utilization and reducing operational costs. The adaptability and scalability of such software empower building owners to customize and upgrade their automation systems, ensuring long-term sustainability and integration of emerging technologies. An illustrative example of software advancements in building automation is Carrier's launch of the i-Vu Pro v8.5 software in October 2023. This software, designed for Carrier's building automation system, introduces enhanced security features, an efficient controller update process, and MQTT integration for streamlined communication. The inclusion of an operator information report within the software provides detailed insights for facilities staff, offering visibility into i-Vu system users, operator configuration, and security policy compliance. This release underscores Carrier's commitment as a key player in intelligent climate and energy solutions. Facility Management Systems (FMS) and Building Automation Systems (BAS) stand as indispensable components in modern building management. FMS streamlines tasks like maintenance and resource allocation, functioning as a central nervous system for facility-related functions. Concurrently, BAS integrates various building systems such as HVAC and lighting, providing real-time monitoring and control. This integration contributes to operational efficiency, cost reduction, and ensures a comfortable environment for occupants. Moreover, FMS and BAS play a pivotal role in predictive maintenance, fostering sustainability by minimizing downtime and enhancing energy efficiency. Together, these systems form a dynamic duo, addressing the evolving needs of building management and contributing to the creation of sustainable, efficient, and occupant-friendly spaces.

The Commercial segment is Expected to Witness Significant Growth Over the Forecast Period

The importance of Building Automation Systems (BAS) in commercial spaces cannot be overstated, serving as a cornerstone for optimizing operational efficiency, energy management, and occupant comfort. BAS integrates diverse building components such as HVAC, lighting, security, and environmental controls into a cohesive system, enabling centralized monitoring and control. This enhances energy efficiency by optimizing resource usage, reducing operational costs, and promoting sustainability. In commercial spaces, where energy consumption is significant, BAS plays a pivotal role in minimizing waste and adhering to environmental regulations. Additionally, the system ensures occupant comfort by maintaining optimal environmental conditions and enables responsive and adaptive control based on real-time data. The centralized control and monitoring capabilities of BAS streamline facility management, providing quick diagnostics, predictive maintenance, and effective response to changing conditions. Ultimately, the implementation of BAS in commercial spaces not only improves operational efficiency but also contributes to cost savings, sustainability goals, and a conducive environment for occupants. Thus, owing to such advantages the studied segment is expected to witness growth over the forecast period.

Europe Region is Expected to Witness Significant Growth Over the Forecast Period

In the present market landscape, security systems are experiencing a surge in demand in Germany, propelled by a notable increase in thefts and burglaries. According to data from the Federal Criminal Police Office of Germany, the reported incidents of theft surpassed 1,483,000 in 2021, highlighting a significant market potential for security systems in the region that remains largely untapped. The escalating security concerns are prompting companies to introduce innovative security products for buildings, either through in-house product development or strategic acquisitions. An illustrative example is ASSA ABLOY's acquisition of Bird Home Automation GmbH in October 2022, a German manufacturer specializing in high-quality IP door intercoms for both single and multi-family buildings. This strategic move positions ASSA ABLOY for accelerated growth in the residential segment. Moreover, Europe is witnessing a remarkable uptick in demand for smart door locks among residential end-users. Established market players are capitalizing on this trend by offering advanced smart door lock solutions equipped with additional features. For instance, Ring's introduction of a wireless intercom device designed for apartment dwellers in September 2022 showcases the industry's response to evolving needs. This intercom seamlessly connects with building-wide intercom systems in apartment complexes, facilitating visitor verification and convenient access for approved guests and Amazon deliveries without the need for door codes or additional fobs. The region is also experiencing a growing emphasis on government policies and regulations promoting energy efficiency, a heightened need for security systems in response to increased theft activities, and a rising concern about losses due to fire accidents. These factors are anticipated to propel the growth of building automation systems in Europe. In response to these trends, various vendors are actively developing new products to meet evolving customer requirements, further contributing to the dynamic landscape of the building automation market in the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic maneuvers. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders. Some of the key market players working in this segment are:

Recent Development:

1) In March 2022, Trane Technologies expanded its operations in Greenville County with a substantial investment of USD 30 million. The company added approximately 300,000 square feet of manufacturing capacity, strategically designed to facilitate and support its future growth. This investment significantly contributed to the growth of building automation systems by enhancing Trane Technologies' manufacturing capabilities. The expanded capacity aligned with the increasing demand for building automation solutions, allowing the company to efficiently meet market needs and solidify its position as a key player in advancing smart and interconnected building technologies.

2) In September 2022, Honeywell International unveiled the Australian release of Fire-lite, a comprehensive suite of fire protection systems tailored to cater to the requirements of small and medium-sized businesses, as well as mid-rise residential buildings, warehouses, and retail spaces throughout Australia. The key feature of Fire-Lite lies in its customizable and intelligent addressable fire panels, strategically designed to address a spectrum of building needs. These panels offer a high degree of flexibility, ensuring adaptive solutions for diverse installations. The launch of Fire-Lite underscores Honeywell's commitment to providing advanced and tailored fire protection solutions to a broad range of commercial and residential environments in the Australian market.

Q1. What was the Building Automation System Market size in 2023?

As per Data Library Research the Building Automation Systems Market size is estimated at USD 212.7 billion in 2023.

Q2. What is the Growth Rate of the Building Automation System Market?

Building Automation System Market is expected to reach a CAGR of 10.55% during the forecast period.

Q3. What are the Growth Drivers of the Building Automation System Market?

Energy Efficiency Imperatives and Rising Demand for Smart Buildings are the Growth Drivers of the Building Automation System Market.

Q4. Which region has the largest share of the Building Automation System Market? What are the largest region's market size and growth rate?

Europe has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model