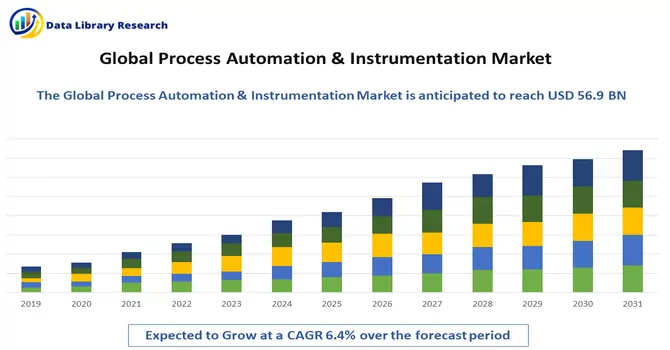

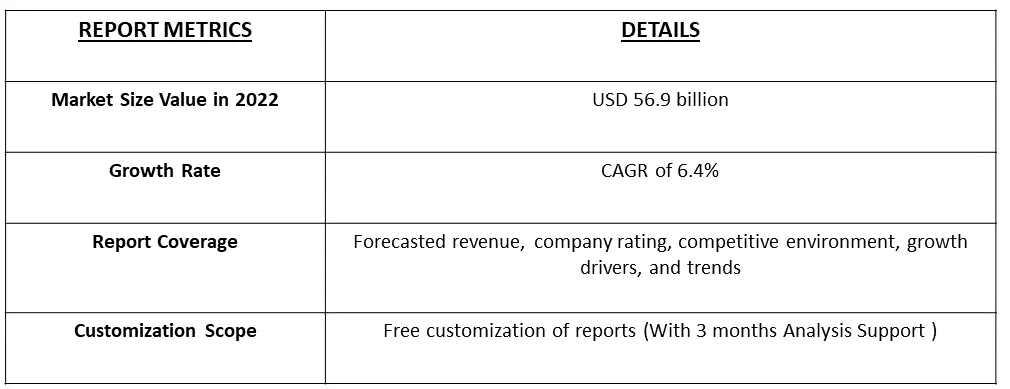

The Process Automation and Instrumentation Market is currently valued at USD 56.9 billion in the year 2022 and is expected to register a CAGR of 6.4% over the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Process automation and instrumentation processes involve careful monitoring of various business-specific production processes. This technology-enabled automation and instrumentation of complex business processes help industrial organizations streamline the business towards achieving organizational goals, achieve process efficiency, improve quality, and reduce operational costs.

The process automation and instrumentation market is expanding due to the growing adoption of digital technologies such as AI, IIoT, and machine learning. The market is also driven by the increasing emphasis on industrial automation, cost optimization, increased productivity, energy efficiency, better scalability, and reduced errors.

The automation industry has been transformed by integrating digital and physical manufacturing aspects to achieve optimal performance. Additionally, the industry’s growth is driven by the emphasis on shorter time to market and zero waste production, which has increased the demand for process automation and instrumentation in various processing sectors.

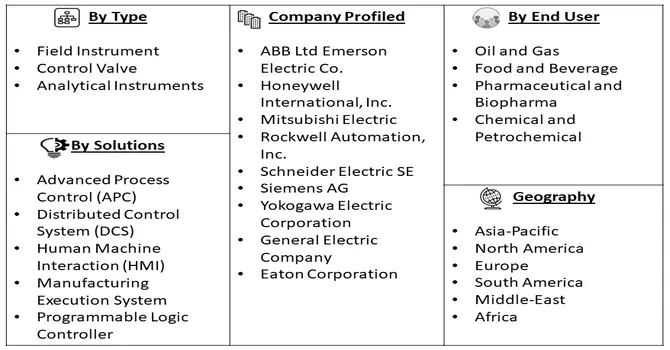

Segmentation:

The Process Automation and Instrumentation Market is segmented

By Instruments

By Solutions

End-user Industry

Geography

The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers:

Importance of Energy Efficiency and Cost Reduction

Energy efficiency and cost reduction are two of the most important factors that drive the process automation and instrumentation market. Energy efficiency is crucial for reducing energy consumption and costs, while cost reduction is essential for improving profitability and competitiveness. The adoption of digital technologies such as AI, IIoT, and machine learning has enabled companies to optimize their energy consumption and reduce costs by automating their processes. Additionally, the use of process automation and instrumentation has helped companies improve their productivity, scalability, and quality while reducing errors and waste. These benefits have made process automation and instrumentation an essential tool for companies looking to improve their energy efficiency and cost-effectiveness.

Increasing Adoption of IoT Solutions

A survey conducted by Onpassive, an AI tech company that develops fully autonomous products, revealed that a considerable number of companies are increasingly adopting intelligent automation and RPA solutions. According to the survey, approximately 58% of CEOs have initiated the automation process. Among them, 35% are experimenting, 13% are deploying, and 8% are automating at scale. These trends indicate a positive outlook for the growth of the process automation and instrumentation market.

Restraints:

High Investment for Implementation and Significant Maintenance Cost for Process Automation and Instrumentation Solutions

The implementation of process automation and instrumentation solutions often requires high initial investment and incurs significant maintenance costs. However, these investments are justified by the benefits they bring, such as improved productivity, energy efficiency, scalability, and reduced errors and waste. The adoption of digital technologies like AI, IIoT, and machine learning has further enhanced the cost-effectiveness and performance of these solutions. While the initial costs may be substantial, the long-term advantages make process automation and instrumentation a valuable investment for businesses looking to optimize their operations.

The COVID-19 pandemic has had a significant impact on the growth of the process automation and instrumentation market. The widespread lockdowns and disruptions in the supply chain and industrial sector during the initial phase of the pandemic led to a slowdown in demand for the studied market. However, the pandemic has also increased awareness about the benefits of digital technologies, which is expected to drive investments in automation and advanced instrumentation solutions. This, in turn, is creating growth opportunities in the process automation and instrumentation market.

Segmental Analysis:

Pharmaceutical and Biopharma Segment is Expected to Witness Significant Growth Over the Forecast Period

The pharmaceutical and biopharma industries have witnessed significant growth in process automation and instrumentation. The adoption of digital technologies such as AI, IIoT, and machine learning has played a crucial role in this transformation. Automation has revolutionized these industries by integrating digital and physical aspects of manufacturing to deliver optimum performance. It has enabled companies to achieve shorter time-to-market, zero waste production, improved energy efficiency, better scalability, and reduced errors. The COVID-19 pandemic has had a notable impact on the growth of these industries. While the initial phase of the pandemic disrupted the supply chain and industrial sector, it also enhanced awareness about the benefits of digital technologies. This is expected to drive investments in automation and advanced instrumentation solutions, creating growth opportunities. A survey conducted by Onpassive revealed that a significant number of companies are increasingly adopting intelligent automation and RPA solutions. High initial investment and maintenance costs are associated with process automation and instrumentation solutions. However, these investments are justified by the long-term benefits they bring, such as improved productivity, energy efficiency, scalability, and reduced errors and waste. The implementation of process automation and instrumentation solutions has been particularly beneficial for the pharmaceutical and biopharma industries. It has enabled them to streamline manufacturing operations through modern robotics.

Advanced Process Control (APC) segment is Expected to Witness Significant Growth Over the Forecast Period

Advanced Process Control (APC) is a technique used in industrial automation to optimize and improve the performance of complex processes. It involves the use of advanced control algorithms and strategies to regulate and optimize process variables such as temperature, pressure, flow rate, and composition. APC systems can help industries achieve better process stability, increased production efficiency, reduced energy consumption, and improved product quality.

The combination of APC and automation has revolutionized industries by enabling them to achieve higher levels of efficiency, accuracy, and reliability. By integrating APC techniques with automation systems, companies can optimize their processes, reduce costs, and improve overall performance. Thus, Advanced Process Control (APC) and automation are essential tools for industries looking to optimize their processes, improve efficiency, and achieve better product quality, thereby driving the growth of the studied segment.

North America is expected to hold a Significant Market Share in the Studied Market

North America is a significant global market for process automation and instrumentation. The United States is known for its innovation capabilities and is leading the way in the development of emerging technologies associated with the Fourth Industrial Revolution. The discovery of shale resources in the United States and the growing number of oil and gas projects in Canada further highlight the market’s potential.

Companies in the region are continuously expanding their presence and product portfolio in the process automation market to capitalize on the growth opportunities. For example, FANUC America, a supplier of CNCs, robotics, and ROBOMACHINEs, announced an expansion of its West Campus in August 2022. The expansion plan involves constructing a 655,000-square-foot facility in Oakland County to accommodate manufacturing, R&D, and engineering projects. This expansion will significantly increase FANUC America’s operational space to nearly two million square feet. Thus, the market is expected to witness significant growth over the forecast period in the studied region.

Get Complete Analysis Of The Report - Download Free Sample PDF

Competitive Landscape:

The market for process automation and instrumentation is moderately fragmented, with the presence of many key players operating in the segment with almost similar market presence globally. Also, the market ecosystem is subjected to high initial costs and high competition from established players, including :

Recent Developments:

1) August 2022 - Andhra Paper Limited (APL), a leading Indian integrated pulp and paper manufacturer, deployed an ABB advanced process control (APC) solution at their Rajahmundry mill’s lime kiln. To help the company reduce energy requirements, ABB integrated their OPT800 Lime APC solution into APL’s existing ABB Ability System 800xA distributed control system (DCS).

2) January 2022 - ExxonMobil selected Yokogawa Electric Corporation as the system integrator for the first-ever field trial of an Open Process Automation system designed to operate an entire production facility. According to the company, the field trial will take place at an ExxonMobil manufacturing facility located on the U.S. Gulf Coast, replacing the existing distributed control system (DCS) and programmable logic controllers (PLC) with a single, integrated system that meets the Open Process Automation Standard (O-PAS).

Q1. What is the current Process Automation & Instrumentation Market size?

The Process Automation and Instrumentation Market is currently valued at USD 56.9 billion.

Q2. What is the Growth Rate of the Process Automation & Instrumentation Market?

Process Automation & Instrumentation Market is expected to register a CAGR of 6.4% over the forecast period.

Q3. What segments are covered in the Process Automation & Instrumentation Market Report?

By Instrument, By Solution, End User & Geography these segments are covered in the Process Automation & Instrumentation Market Report.

Q4. What Impact did COVID-19 have on the Process Automation & Instrumentation Market?

The COVID-19 pandemic has had a notable impact on the growth of these industries. For detailed insights on the COVID-19 pandemics impacts and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model