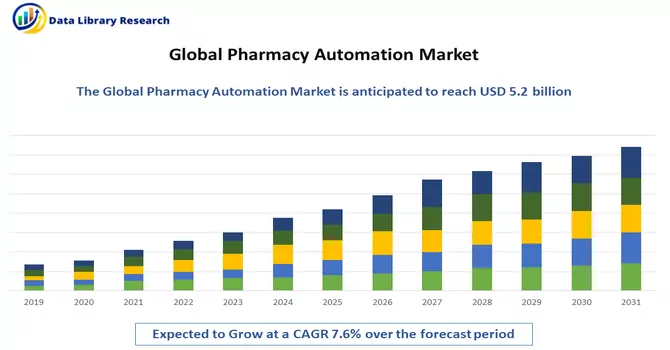

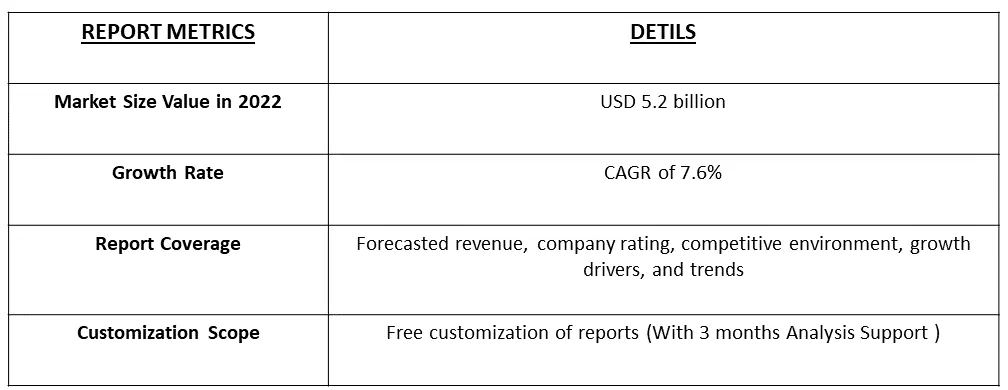

The Pharmacy Automation Market is currently valued at USD 5.2 billion in the year 2022 and is expected to register a CAGR of 7.6% over the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

The factors driving the growth of the studied market are the increasing demand for specialty drug prescription filling solutions, the rising need to minimize medication errors, and the decentralization of pharmacies. There has been a rising incidence of chronic and life-threatening diseases and an increasing dispensation of medications.

Pharmacy automation encompasses centralized or decentralized automated dispensing, packing, labeling, and other systems, which help reduce dispensing errors while improving the workflow efficiency of hospital nursing staff and pharmacies.

Intelligent automation solutions are transforming the manufacturing process within the pharma industry, providing new ways to improve quality control, reduce downtime, optimize inventory levels, and reduce costs.

Segmentation:

The pharmacy automation market is segmented

By Product

End User

Geography

The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers:

Increasing Demand for Specialty Drug Prescription Filling Solutions

The recent update published by the Assistant Secretary for Planning and Evaluation in July 2023, reported that specialty pharmacy drug spending has increased by 43% from 2016 to 2021, reaching a total of USD 301 billion. The source also reported that the number of specialty drug prescriptions being filled in a non-retail pharmacy setting has increased by 40%, illustrating the growing importance of specialty pharmacies. Thus, such factors are fueling the growth of the studied market.

Rising Need to Minimize Medication Errors and Decentralization of Pharmacies

Medication errors can have severe consequences and threaten patient safety. The patient safety-related benefits of automated dispensing cabinets (ADCs) have been reported by several previous studies, including a reduction in medication errors in intensive care units (ICUs) and emergency departments. Thus, there is a rising need to minimize medication errors. For instance, an article titled, “Reducing Medication Errors by Adopting Automatic Dispensing Cabinets in Critical Care Units” published in April 2023, reported that with the adoption of ADCs in the intensive care units, the rates of prescription and dispensing errors reduced from 3.03 to 1.75 per 100,000 prescriptions and 3.87 to 0 per 100,000 dispensations, respectively. The administrative error rate decreased from 0.046 to 0.026%. The ADCs decreased National Coordinating Council for Medication Error Reporting and Prevention category B and D errors by 75% and category C errors by 43%. Thus, such instances are fueling the growth of the studied market.

Restraints:

Reluctance to Adopt Pharmacy Automation Systems

The use of automation software is quite expensive and also requires skills for its daily usage, as a result, the implementation of this software becomes quite expensive, thereby slowing down the growth of the studied market.

The COVID-19 pandemic impacted the growth of various markets globally and so impacted the growth of global pharmacy automation. COVID-19 increased the demand for pharmacy automation, as during the pandemic, there was an increase in demand for various drug dispensing thus, the demand for automation increased. For instance, an article published by the International Conference on Communication Systems & Networks in January 2021 reported that the implementation of automated pharmacy systems in primary healthcare centers or hospitals in rural areas of middle and lower-income countries during the COVID-19 pandemic helped people access basic and advanced healthcare facilities properly, create awareness of various diseases, control the spread of pandemics and considerably bring down the mortality rates. Thus, COVID-19 boosted the growth of the studied market. In the current scenario, it is estimated that due to ease of automation such as by minimizing errors, the market is expected to witness significant growth over the forecast period.

Segmental Analysis:

The Automated Medication Dispensing Systems Segment is Expected to Witness Significant Growth Over the Forecast Period

Automatic dispensing machines (ADM) or (automated drug cabinets) are computerized drug storage and dispensing devices used in health care settings like hospitals and nursing homes and are located at the point of care (the ward, ICU, ED) rather than in the central pharmacy.

Automated dispensing systems also balance security, user-friendliness, inventory management, and control of medications, thereby driving their demand. Moreover, there is a growing demand for automated systems that help stock and inventory management. For instance, in March 2022, Capsa Healthcare expanded its suite of NexsysADC automated dispensing cabinets. Nexysys can accommodate any size of controlled and highly valued medications or supplies in two new sizes of controlled access module drawers. Similarly, in November 2021, Swisslog Healthcare and Centre Hospitalier-Le - Le Mans entered into an innovation agreement to synergize their expertise in the field of pharmacy using the automated packaging and dispensing system TheraPick. The pharmacy automation system optimizes the flow of medication handling to ensure the achievement of high patient safety standards. Thus, the segment is expected to witness significant growth over the forecast period.

Retail Pharmacies are Expected to Witness Significant Growth Over the Forecast Period

A retail pharmacy is a pharmacy acting as a retail store, selling drugs to patients. They help keep the customers informed about their healthcare while offering them seamless access to quality pharmaceutical drugs and medical products with complete security through the supply chain.

Retail pharmacy is frequently in one of three camps when it comes to pharmacy automation and dispensing technology. A retail pharmacy uses automated workflow or scan-worldwide web. However, many dispensing technologies can benefit from networking. With a networked device, the technology vendor can service and troubleshoot the device remotely, and analyze the device’s performance to help you maximize your utilization. This is especially true of a dispensing robot. Networked devices also can share data and collate orders between the units. Thus, a pharmacy using automated workflow or scanning. Thus, the segment is expected to witness significant growth over the forecast period.

North America Holds a Significant Market Share in the Pharmacy Automation Market

The North American pharmacy automation market holds a significant share due to an increase in the prevalence of various chronic disorders, the growing number of patients across the North American region, and the technological advancements due to the presence of key market players. Acquisitions and new product launches are also propelling the growth of the market in the region. For instance, in December 2022, Omnicell, Inc. completed the acquisition of ReCept Holdings, Inc. The addition of ReCept’s specialty pharmacy management services for health systems, provider groups, and federally qualified health centers (FQHCs) expanded Omnicell’s Advanced Services portfolio to address the growing and complex specialty pharmacy market. Thus, the region is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

Competitive Landscape:

The pharmacy automation market is highly fragmented and competitive. Some of the major players operating globally and regionally are:-

Recent Developments:

1) In June 2022, Becton, Dickinson and Company, and Frazier Healthcare Partners, entered into a definitive agreement for BD to acquire Parata Systems, an innovative provider of pharmacy automation solutions, for USD 1.525 billion. Parata's portfolio of innovative pharmacy automation solutions powers a growing network of pharmacies to reduce costs, enhance patient safety, and improve the patient experience.

2) In May 2022, Deenova launched its innovative Pay-Per-Dose unit dose pharmacy automation service to the UK market. This newly designed Pay-Per-Dose solution is initially offered in late 2022 for the Greater London Metropolitan Area to both NHS and private hospitals.

Q1. What is the market size of the Pharmacy Automation Market ?

The Pharmacy Automation Market is currently valued at USD 5.2 billion in the year 2022 and is expected to register a CAGR of 7.6% over the forecast period, 2023-2030.

Q2. What is the Growth Rate of the Pharmacy Automation Market ?

Pharmacy Automation Market is expected to register a CAGR of 7.6%.

Q3. Which are the major companies in the Pharmacy Automation Market ?

Arxium Inc, Becton Dickinson and Company, Capsa Solutions LLC and Cerner Corporation are some of the major companies in the Pharmacy Automation Market.

Q4. What are the factors on which the Pharmacy Automation Market research is based on ?

By Product. End User and Geography are the factors on which the Pharmacy Automation Market research is based.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model