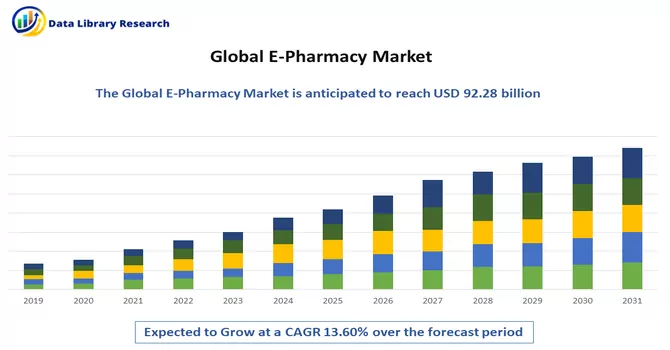

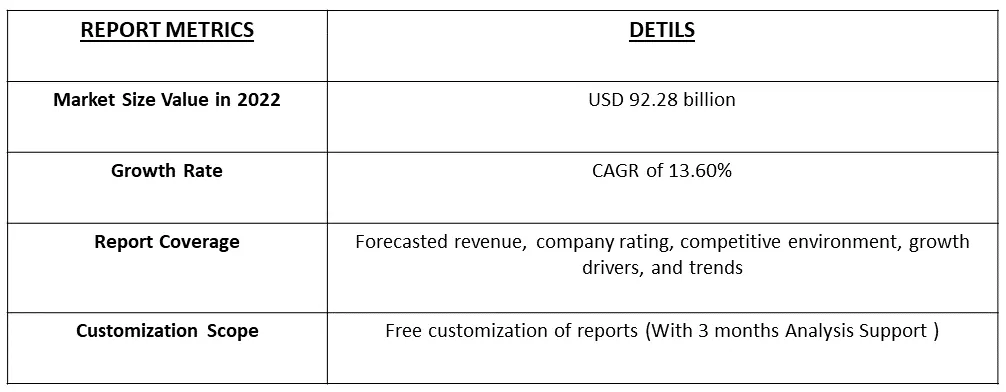

The E-pharmacy Market size is expected to grow from USD 92.28 billion in 2022 registering a CAGR of 13.60% during the forecast period 2022-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

The growth of the e-pharmacy market is attributed to a rise in internet consumers, increased access to web-based and online services, and the rising implementation of e-prescriptions in hospitals and other healthcare services.

E-pharmacy is an online pharmacy that operates over the Internet and provides medicines to consumers through mail or shipping companies.

The increasing penetration of smartphones is further aiding the market growth. As per The Mobile Economy 2020, smartphone penetration was 65.0% in 2019 and is expected to reach 80.0% by 2025. The boom in the healthcare sector coupled with high operational costs has created the need to cut operational costs with the implementation of ePharmacy solutions.

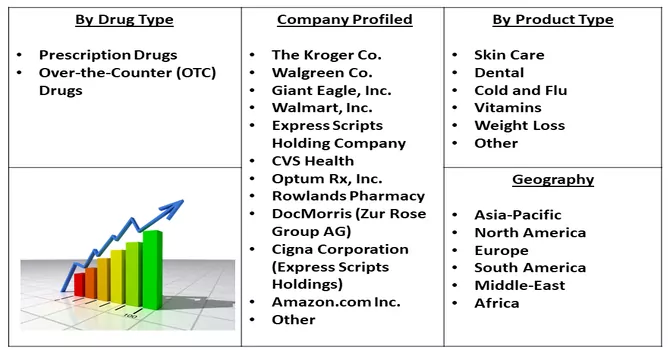

Segmentation:

The Global Online Pharmacy is Segmented

By Drug Type

By Product Type

Geography

For Detailed Market Segmentation - Download Free Sample PDF

Competitive Landscape:

The E-pharmacy market is moderately competitive, with a few players currently dominating the market. The market players are adopting various marketing strategies to gain a higher share in the e-pharmacy market and focusing on expanding their geographic presence, especially in developing regions that offer lucrative opportunities.

Some market players include

Market Drivers:

Rising Digitalization and Advantages of Using E-Pharmacy Over Traditional Pharmacy

The increasing adoption of digital technologies and e-commerce in the healthcare sector is anticipated to propel overall growth. For instance, in January 2022, Mark Cuban, the venture capitalist, launched a digital pharmacy that sells more than 100 generic pharmaceuticals at a low cost, to be radically transparent. ePharmacy offers easier access that significantly benefits chronic elderly patients from nuclear families, as well as patients who are not in a condition to go out.

Development Strategies and Rising Investments by Several Business and Government

According to the data published by the Kaiser Family Foundation in June 2021, the total enrollment in a Medicare Advantage plan is over 26 million people, accounting for 42.0% of the total Medicare population. In addition, high funding, increasing investments, and rising strategic initiatives being undertaken by several funding agencies, governments, and companies are contributing to the market growth.

Market Restraints:

Presence of Fraudulent and Online Pharmacies that are not Approved by the USFDA and can Potentially Harm the Expansion of the Industry

Many consumers purchase their medications online these days because of the anonymity, convenience, and potential cost savings. But what many don’t realize is that most, not just some, online pharmacies are illegal and dangerous. In July 2020 National Association of Boards of Pharmacy reported that 95% of websites offering prescription drugs operate illegally. Thus, such instances may slow down the growth of the studied market.

COVID-19 is a highly infectious disease and people with underlying health conditions like cardiovascular diseases and other geriatric patients are more vulnerable that led to an increase in demand for drugs from online stores and also since the COVID-19 virus was spreading widely, the demand for various drugs through online platform increased. For instance, an article published by the National Institute of Library in October 2022, reported that a survey conducted in Canada reported the drugs ordered from online pharmacy platforms were 44.5% higher in October 2020 as compared to the previous year. Thus, such instances are expected to drive the growth of the studied market. Furthermore, post-pandemic, there will be a massive increase in the e-pharmacy business due to the exposure of people to various e-pharmacy services and the rise in the adoption of online services due to the growing penetration and adoption of online services.

Segmental Analysis:

Over-the-Counter (OTC) Drugs Segment is Expected to Witness Significant Growth Over the Forecast Period

Over-the-counter (OTC) medicines are those that can be sold directly to people without a prescription. OTC medicines treat a variety of illnesses and their symptoms including pain, coughs and colds, diarrhea, constipation, acne, and others. Furthermore, in January 2022, the Drug Technical Advisory Board of India (DTAB), as part of a new OTC drug policy, will soon permit the sale of some medications without a prescription. A list of OTC medications, including analgesics (pain relievers), cough syrups, decongestants, laxatives, antiseptics, and medicines for gum infections, has been approved by the DTAB. Such initiatives from the governments of highly populated countries are expected to drive the market significantly, driving the segment's growth.

Cold and Flu is Expected to Witness Significant Growth Over the Forecast Period

A cold and the flu are viral infections. They both affect your respiratory system. This includes your throat, nose, airway, and lungs. It is difficult to tell the two apart. The incidence of various infectious diseases in China leads to the demand for vaccinations. For instance, as per the “Notifiable Infectious Diseases Reports: Reported Cases and Deaths of National Notifiable Infectious Diseases China January 2022 report”, 627,558 cases of cold and flu were reported in China in January 2022. Thus, the high prevalence of cold and flu cases is accompanied by raising the demand for E-pharmacy products to prevent disease in China, thereby boosting the market growth.

North America is Expected to Witness Significant Growth Over the Forecast Period

North America consists of three major countries the United States, Canada, and Mexico. The growing prevalence of minor illnesses, such as flu, fever, backache, cough, and cold, increases the demand for OTC medications, and thus, the dependence on online pharmacies to obtain these drugs increases. For instance, the study published in Advances in Therapy, titled ‘Burden of Community-Acquired Pneumonia and Unmet Clinical Needs’ in February 2020, in a population over 50 years, Community-Acquired Pneumonia (CAP) incidence in Mexico and other Latin America ranged from 32.6 to 80.4 per 10,000 person-years. Such a high prevalence of infectious diseases in Mexico will lead to increased adoption of medicines in this region, which may drive the studied market growth.

Additionally, the ease of getting medicines from the comfort of home is expected to drive the e-pharmacy market in the region is contribute to studied market growth. For instance, an article published by NCBI in June 2022, reported a study conducted in UAE among 5,000 customers regarding the ease of online pharmacy products reported that 68% of the customers were more inclined towards online pharmacy, thereby contributing to the studied market growth in the region.

Furthermore, the recent development is expected to contribute to the growth of the studied market growth in the region. For instance, in September 2022, Walmart Canada and Canada Health Infoway entered a partnership. Infoway's PrescribeIT electronic prescribing service is now accessible in 14 Walmart Canada pharmacies in Ontario, Alberta, Saskatchewan, and New Brunswick, with plans to expand to additional locations by year's end.

Get Complete Analysis Of The Report - Download Free Sample PDF

Recent Developments:

1) In August 2023: In NHS England hundreds of pharmacy staff will be able to deliver more clinical services and take on more responsibility in dispensing medicines, thanks to new NHS training. The online learning modules will cover consultation skills, therapeutics, clinical decision-making, and assessment skills as well as service improvement.

2) In September 2022: Amazon stated that it was planning to sell prescription medications online in Japan. To build a platform where patients can get online instructions on taking medications, it aims to collaborate with small and medium-sized pharmacies. Without visiting a pharmacy, customers could have their drugs delivered to their homes.

Q1. What was the E-Pharmacy Market size in 2022?

As per Data Library Research the E-pharmacy Market size is expected to grow from USD 92.28 billion in 2022.

Q2. At what CAGR is the E-pharmacy market projected to grow within the forecast period?

E-pharmacy Market is registering a CAGR of 13.60% during the forecast period.

Q3. What are the factors driving the E-pharmacy market?

Key factors that are driving the growth include the Rising Digitalization and Advantages of Using E-Pharmacy Over Traditional Pharmacy and Development Strategies and Rising Investments by Several Business and Government

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model