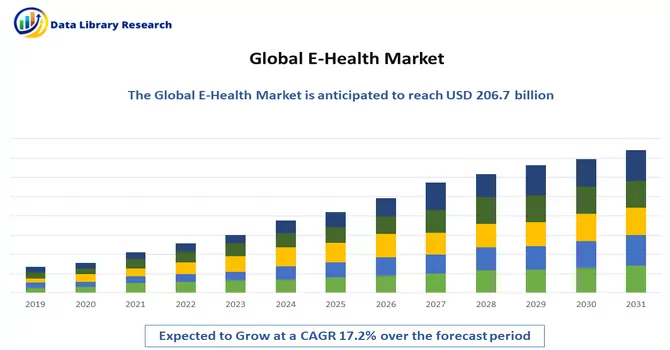

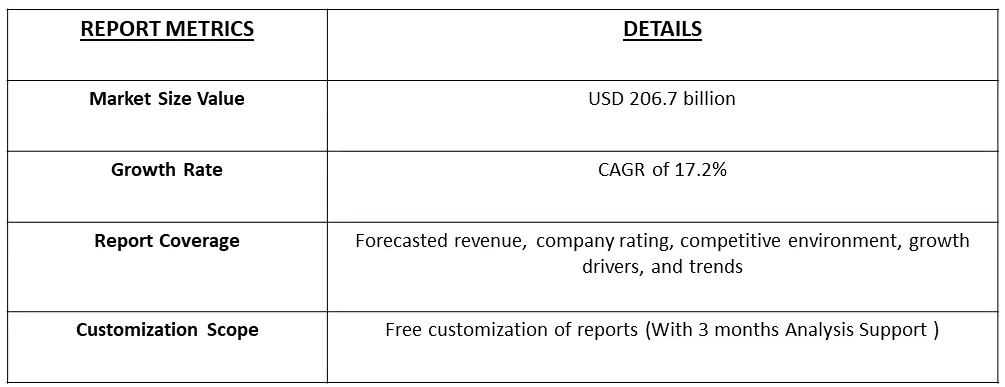

The eHealth market is currently valued at USD 206.7 billion in the year 2022 and is expected to register a CAGR of 17.2% over the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

E-health is the use of modern electronic information and communication technologies to deliver health care when healthcare providers and patients are not in direct contact, and their interaction is mediated by electronic means.

The propelling factors for the growth of the e-health market include the growth in IoT and technological innovations, rising preference toward mobile technology and the internet, and rising demand for population health management.

The tools of eHealth can lead to improving the quality and efficacy of healthcare services. Governments in developing nations are keeping eHealth in their priorities to bring improvement in quality, accessibility, and capability of the health sector.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers:

Growth in IoT and Technological Innovations and Rising Preference Toward Mobile Technology and the Internet

IoT in the E-health industry allows different parties to receive crucial information from patients and act upon that. Patients can receive information or alerts from smart medical devices on their phones that remind them to exercise, take medication, or set an appointment with the doctor when there are signs of illness. IoT healthcare devices are possible thanks to healthcare development services, and this is what makes the patients commit more to their health since they feel they are in control of the situation.

Rising Demand for Population Health Management

The strategic initiatives by market players for expansions of e-prescription solutions are expected to propel the segment’s growth. For instance, in January 2023, the Qatar-based HealthTech startup At Home Doc raised USD 1.9 million in Pre-Series A funding led by Elaj Group’s investment arm Tawasol Holdings, endorsed by Qatar Development Bank (QDB) and other angel investors. In June 2022, the Hamad Medical Corporation (HMC) and Primary Health Care Corporation (PHCC) announced adopting Cerner-managed technology to deliver better outcomes in Qatar. The funding will be utilized to enhance electronic prescription solutions in the country.

Restraints:

Concerns over Data Security and Lack of Proper Infrastructure for eHealth in Emerging Markets

Ransomware is one of the most common data security threats both in and out of the healthcare industry. Ransomware is a type of software that blocks access to a computer or collection of files until a ransom is paid. This may slow down the growth of the studied market over the forecast period.

COVID-19 has impacted the eHealth market owing to market players' increased launches of telemedicine and other eHealth solutions for COVID-19 contact tracing and consultations during the isolation period. For instance, according to an article published in the International Journal of Medical Informatics in June 2022, an online survey of Japanese healthcare providers carried out from January 25 to February 22, 2021, reported that 73.3% of care delivery institutions used electronic medical records and 57.8% of the EMRs were connected to an external network that helps in sharing the regional health information with other hospitals (22.0%), report online medical insurance claims (27.5%), and conduct intrahospital system maintenance (61.5%). Hence, the use of e-health was at its peak during the pandemic. The eHealth market is growing due to its increasing adoption because of COVID-19 and is expected to register a significant growth rate during the forecast period.

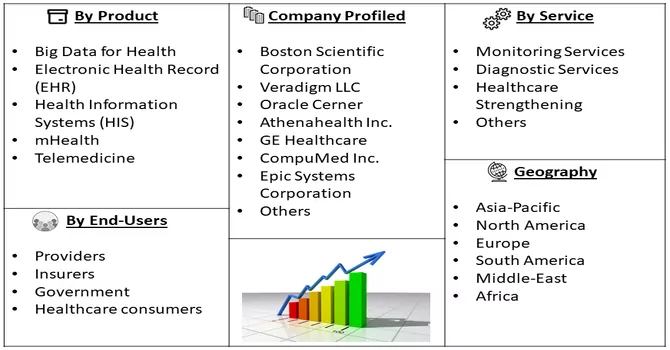

Segmental Analysis:

The Electronic Health Records Segment is Expected to Witness Significant growth Over the Forecast Period

An electronic health record is the systematized collection of patient and population electronically-stored health information in a digital format. These records can be shared across different healthcare settings.

Additionally, an increasing number of mergers and acquisitions by market players are also boosting the market growth. For instance, in January 2021, Allscripts Healthcare Solutions announced a strategic partnership with the U.S. Orthopedic Alliance (USOA). This partnership is aimed at bringing to market efficient infrastructure designed to assist orthopedic practices scale with agility, improving electronic health records implementation timelines, providing evidence-based guidelines to support evolving clinical protocols, and creating community-wide connectivity with value-based care analytics. Thus, the segment is expected to witness significant growth over the forecast period.

Insurance Companies are Expected to Witness Significant growth Over the Forecast Period

Health insurance is an agreement in which an insurance company agrees to pay for some or all of your medical expenses in exchange for a monthly premium payment. A health insurance policy is primarily designed to cover you financially in case of a medical emergency caused by illnesses, accidents, or hospitalization. It has long-term benefits that make taking a health insurance policy a definite goal in your annual financial plan. Health IT also empowers patients to take greater control over their health data by providing access via patient portals. Patient portals enable individuals to view medical test results, download their patient data, communicate with their doctor, schedule visits, and more—all via a website application or mobile app. Thus, the segment is expected to witness significant growth over the forecast period.

Monitoring Services are Expected to Witness Significant Growth Over the Forecast Period

Health monitoring is a nondestructive technique that allows the integrity of systems or structures to be actively monitored during operation and/or throughout their lives to prevent failure and reduce maintenance costs. Furthermore, technological advancements are fueling the growth of the studied market. The need for the use of health monitoring devices is rising as the number of diabetic patients rises. For instance, Abbott got FDA approval in June 2020 for the FreeStyle Libre 2 (iCGM) for adults and kids with diabetes in the United States. This device measures blood glucose levels every minute and offers a real-time alarm option that helps diabetic individuals monitor their blood glucose levels. Thus, the segment is expected to witness significant growth over the forecast period.

The North American Region Holds the Significant Market Share and is Expected to Follow the Same Trend Over the Forecast Period

The rising focus on patient care and need, supported by the well-developed and technologically advanced healthcare system, the increasing demand for more effective data management systems, and increasing partnerships, acquisitions, and product launches in the region, is expected to drive the growth of the eHealth market in the region. According to the National Center for Health Statistics 2021 estimates, 89.9% of office-based physicians in the United States used any EMR/EHR system, and 72.3% used a certified EMR/EHR system. The high adoption of EMRs in the region is projected to propel the utility of eHealth solutions during the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

Competitive Landscape:

The eHealth market is fragmented in nature due to the presence of several companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international and local companies with major or significant market shares. Some of the key market players are:

Recent Developments:

1) January 2023: India's National Health Authority launched an incentive scheme for healthcare providers and other stakeholders of the country's digital health ecosystem to promote the creation of digital health records.

2) January 2023: Health Services Management, HSM, partnered with Sound Physicians Telemedicine Services for the residents in Texas, Indiana, and Florida.

Q1. What was the E-Health Market size in 2022?

As per Data Library Research the eHealth market is currently valued at USD 206.7 billion in the year 2022.

Q2. At what CAGR is the E-Health market projected to grow within the forecast period?

E-Health market is expected to register a CAGR of 17.2% over the forecast period.

Q3. What are the factors driving the E-Health market?

Key factors that are driving the growth include the Growth in IoT and Technological Innovations and Rising Preference Toward Mobile Technology and the Internet and Rising Demand for Population Health Management

Q4. What Impact did COVID-19 have on the E-Health market?

COVID-19 has impacted the eHealth market owing to market players' increased launches of telemedicine and other eHealth solutions, for detailed insights request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model