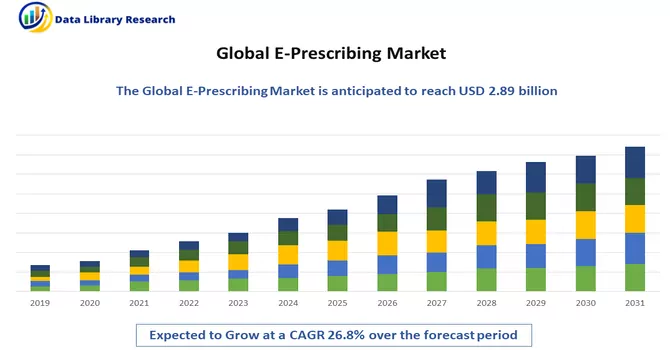

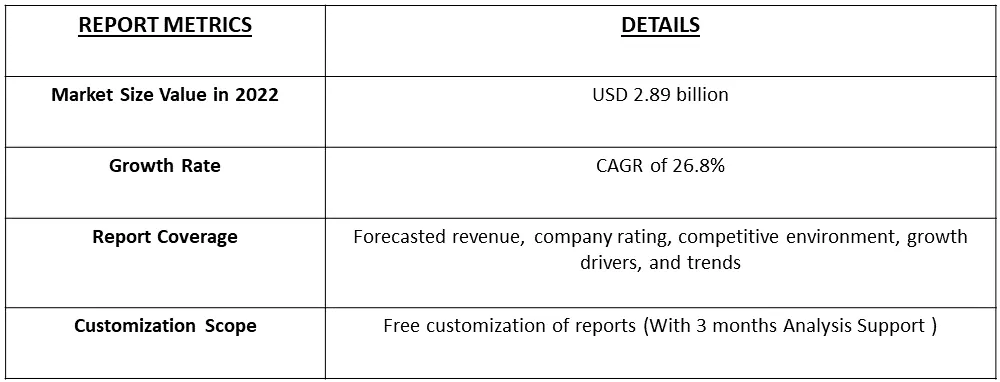

The global e-prescribing market, valued at approximately USD 2.89 billion in 2022, is projected to experience a robust compound annual growth rate (CAGR) of 26.8% throughout the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

E-prescribing, or electronic prescribing, is a technological framework designed to empower physicians and other medical practitioners by enabling them to electronically create and transmit prescriptions to a participating pharmacy, eliminating the need for handwritten, faxed notes, or phone calls for prescriptions. It operates as a web or cloud-based solution, allowing healthcare providers to generate digital prescriptions seamlessly. This computer-based process ensures the accurate creation and transmission of prescription orders to either a hospital-based or standalone pharmacy.

The market's expansion is driven by the increasing adoption of electronic prescribing for controlled substances (EPSC) and favorable government policies. Notably, at the federal level, the enactment of the SUPPORT for Patients and Communities Act (H.R. 6) mandates the use of electronic prescriptions for all controlled substances under Medicare Part D, starting from January 1, 2021. Additionally, the growing emphasis on patient safety awareness is expected to further propel market growth. The COVID-19 pandemic prompted a shift in healthcare service delivery methods, compelling facilities to adopt new approaches to minimize the spread of infection. This shift led to an increased demand for e-prescribing solutions, as they demonstrated potential in enhancing access to prescription medicines and offering convenience to patients. The market players experienced substantial growth during the pandemic, emphasizing the pivotal role of e-prescribing in the evolving landscape of healthcare services.

A growing trend is the focus on patient empowerment through improved access to prescription information. E-prescribing systems are evolving to provide patients with easy access to their medication history, dosage instructions, and potential side effects, fostering better-informed healthcare decisions. Moreover, companies in the e-prescribing market are expanding their global footprint and seeking opportunities for market penetration in diverse geographical regions. The increasing demand for digital health solutions worldwide is driving companies to explore and enter new markets.

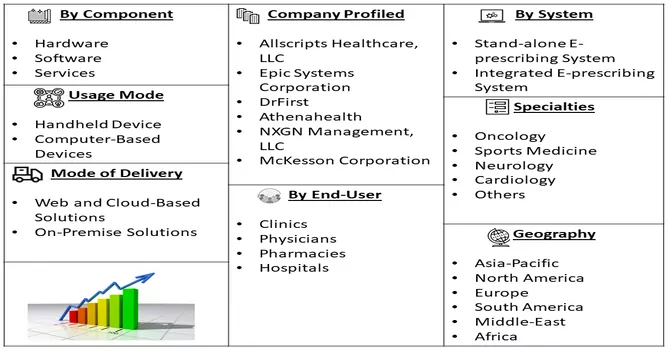

Market Segmentation: The global e-prescribing market is segmented by Component (Hardware, Software, and Services), Type of System (Stand-alone E-prescribing System and Integrated E-prescribing System), Usage Mode (Handheld Device, Computer-Based Devices), Mode of Delivery (Web and Cloud-Based Solutions, On-Premise Solutions), Specialties (Oncology, Sports Medicine, Neurology, Cardiology, Others), End-User (Clinics, Physicians, Pharmacies, Hospitals) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers

Increased adoption of EHR solutions

The increased adoption of Electronic Health Record (EHR) solutions has become a transformative trend in the healthcare landscape. EHRs play a pivotal role in centralizing and digitizing patient health information, offering a comprehensive and accessible platform for healthcare providers. Within this digital ecosystem, the use of e-prescriptions has gained prominence as a seamless and efficient way to manage medication orders. Moreover, the increased adoption of EHR solutions is the shift toward a more integrated and patient-centric approach to healthcare. EHRs allow for the efficient sharing of patient data across different healthcare settings, ensuring continuity of care and reducing the risk of errors associated with manual record-keeping.

This interoperability extends to e-prescribing, enabling healthcare providers to electronically transmit accurate and secure prescription orders to pharmacies. For instance, in April 2020, NHS England reported that More than 85% of primary care prescriptions in England are now processed electronically, after a rise in use of the service during the coronavirus (COVID-19) pandemic. The latest data, covering April 2020, shows that 86% of prescriptions dispensed within primary care in England were processed using the Electronic Prescription Service (EPS). That is an increase of more than 10 percentage points since February, when the usage was 73%. In April 2019, usage was 68%. Thus, such instances are driving the growth of the studied market over the forecast period.

Increasing E-prescribing in hospitals

The trend of increasing E-prescribing in hospitals marks a significant shift toward a more streamlined, accurate, and efficient approach to medication management within healthcare institutions. E-prescribing, or electronic prescribing, involves the use of digital technology to generate and transmit prescription orders directly to pharmacies, replacing traditional handwritten prescriptions or faxed orders. E-prescribing facilitates quicker and more convenient access to prescribed medications for patients. The electronic transmission of prescriptions to pharmacies eliminates the need for patients to physically carry paper prescriptions. The growing emphasis on patient safety, regulatory incentives, and the overall digital transformation in healthcare are driving the trend of increasing E-prescribing in hospitals. As technology continues to play a central role in healthcare delivery, E-prescribing is expected to become an integral component of medication management strategies within hospital settings. Thus, the market is expected to witness significant growth over the forecast period.

Market Restraints

E-Prescribing Market High Cost of Employment

The growth rate of the market will face obstacles due to the elevated expenses associated with employment, security concerns, and workflow issues. Additionally, the expanding utilization of e-prescribing systems will contribute to these challenges. In developing economies, the shortage of skilled professionals and insufficient healthcare infrastructure will further impede the e-prescribing market. The costs extend beyond the initial system purchase to recurring expenditures like maintenance and support services. Thus, the growth of the market is expected to slow down over the forecast period.

While the ePrescribing market itself may not experience a direct impact from the COVID-19 pandemic, the broader influence on healthcare information technology (IT) and electronic medical records (EMR) is noteworthy. The pandemic is driving increased demand for e-prescribing tools as part of the broader digital transformation in healthcare. The surge in teleconsultations, prompted by the COVID-19 outbreak, has led to the integration of electronic health records (EHR), telemedicine, and e-prescribing functionalities. This integration forms a cohesive network that enables healthcare providers to leverage health information technology (HCIT) for patient diagnosis and prescription. Moreover, the Drug Enforcement Administration's (DEA) regulations permitting the electronic prescription of restricted substances have contributed to the growing frequency of electronic prescription transactions. Additionally, guidance from the Centers for Disease Control and Prevention (CDC) recommending the use of telemedicine services has further propelled the adoption of e-prescribing tools. As healthcare IT and EMR businesses continue to adapt to the evolving healthcare landscape during and after the pandemic, the demand for e-prescribing solutions is expected to remain on an upward trajectory.

Segmental Analysis:

Software Segment is Expected to Witness Significant Growth Over the Forecast Period

The incorporation of software into E-prescription systems is pivotal for upgrading and optimizing the medication management process. These software solutions empower healthcare providers to seamlessly generate, transmit, and oversee electronic prescriptions. With features like electronic health record (EHR) integration and decision support tools, software enhances the safety and informed nature of prescribing practices. Thus, the segment is expected to witness significant growth over the forecast period.

Stand-alone E-prescribing System Segment is Expected to Witness Significant Growth Over the Forecast Period

Stand-alone E-prescribing systems operate independently, focusing solely on electronic prescription functionalities. These systems are dedicated to streamlining the prescription process, providing healthcare providers with a specialized tool for generating and transmitting digital prescriptions. Stand-alone E-prescribing systems are versatile and can be integrated into existing healthcare IT infrastructure, offering a targeted solution for healthcare professionals.

Handheld Device Segment is Expected to Witness Significant Growth Over the Forecast Period

The utilization of handheld devices, such as smartphones and tablets, has transformed E-prescription practices. Portable devices enable healthcare providers to access E-prescribing systems, adding flexibility and mobility to the prescription process. This approach enhances efficiency and convenience, allowing healthcare professionals to manage prescriptions on-the-go.

Cloud-Based Solutions Segment is Expected to Witness Significant Growth Over the Forecast Period

Cloud-based E-prescription solutions leverage cloud computing to store and manage electronic prescriptions. Offering scalability, accessibility, and collaboration capabilities, these solutions enable secure access to patient data and prescription management from various locations. Cloud-based E-prescription systems also facilitate seamless updates and integration with other healthcare applications.

Controlled Substances Segment is Expected to Witness Significant Growth Over the Forecast Period

E-prescription systems have evolved to support the electronic prescribing of controlled substances (EPCS). This advancement enhances the security and traceability of prescriptions for medications susceptible to abuse. Compliance with regulatory requirements and the integration of biometric authentication contribute to the secure electronic transmission of prescriptions for controlled substances.

Sports Medicine Segment is Expected to Witness Significant Growth Over the Forecast Period

In the realm of sports medicine, E-prescription plays a crucial role in medication management for athletes. Healthcare providers specializing in sports medicine utilize electronic prescribing systems to efficiently prescribe medications, monitor treatment plans, and adhere to anti-doping regulations. E-prescription in sports medicine streamlines healthcare delivery for athletes.

Physicians Segment is Expected to Witness Significant Growth Over the Forecast Period

Physicians derive significant benefits from E-prescription systems, streamlining the prescription process, reducing errors, and enhancing patient safety. These platforms enable physicians to access patient information, review medication histories, and make informed prescribing decisions. The integration of E-prescription into daily workflows supports efficient and accurate medication management. Thus, the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

The North American region is experiencing a growing adoption of E-prescription systems as healthcare systems undergo digital transformations. E-prescription facilitates the shift from traditional paper-based prescribing to electronic methods, contributing to improved healthcare efficiency. Embracing E-prescription, the region's diverse healthcare landscape aims to enhance patient care, reduce medication errors, and foster a more connected and data-driven healthcare ecosystem. For instance, in July 2019, NextGen Healthcare(US) announced its partnership with Optimize Rx (US) to provide real-time access to critical financial information, allowing providers to help patients choose appropriate medication plans per their coverage and budgets. This tool has been integrated with the company’s EHR workflow. Similarly, in June 2019, Allscripts (US) acquired ZappRx (US) to help Veradigm’s e-prescribing solutions by integrating it with the automated prior authorization platform, thus adding value to its existing platform. Thus, the segment is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The market exhibits high competitiveness, marked by a concentration of a few key players holding a significant market share. As patient awareness increases and the imperative to minimize medication errors grows, coupled with the persistent demand for cost-effective and higher-quality healthcare solutions, companies are actively engaged in the development of innovative products to maintain a competitive edge. Moreover, there is a strategic focus on emerging countries poised to become pivotal markets for industry players in the foreseeable future. Among the prominent participants in the global e-prescribing market are:

Recent Development:

1. In August 2021, Meddo, an India-based health startup, acquired Doxper, an e-prescription platform, which was founded in 2015 and deals in health record management and patient engagement solutions. Moreover, the market experienced a significant increase in the demand for e-prescription apps due to the growing digitalization, which in turn is fueling the market growth.

2. In April 2020, DrFirst (US) partnered with ID.me (US) to help users of the company’s e-prescribe app to verify their identities within a few minutes. This is predictable to speed up the process for clinicians to prescribe drugs.

Q1. What was the E-Prescribing Market size in 2022?

As per Data Library Research the e-prescribing market, valued at approximately USD 2.89 billion in 2022.

Q2. What is the Growth Rate of the E-Prescribing Market?

E-Prescribing Market is projected to experience a robust compound annual growth rate (CAGR) of 26.8% over the forecast period.

Q3. What are the factors driving the E-Prescribing Market?

Key factors that are driving the growth include the Increased adoption of EHR solutions and Increasing E-prescribing in hospitals.

Q4. Which region has the largest share of the E-Prescribing Market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model