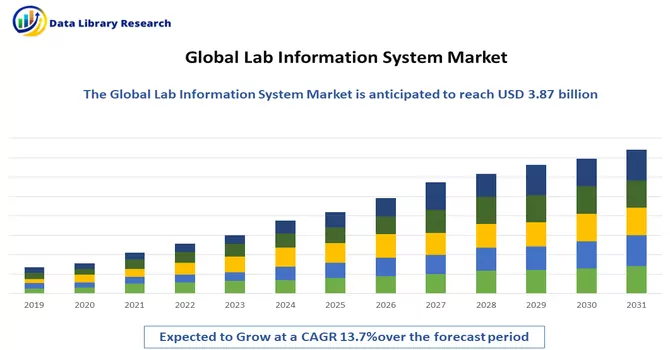

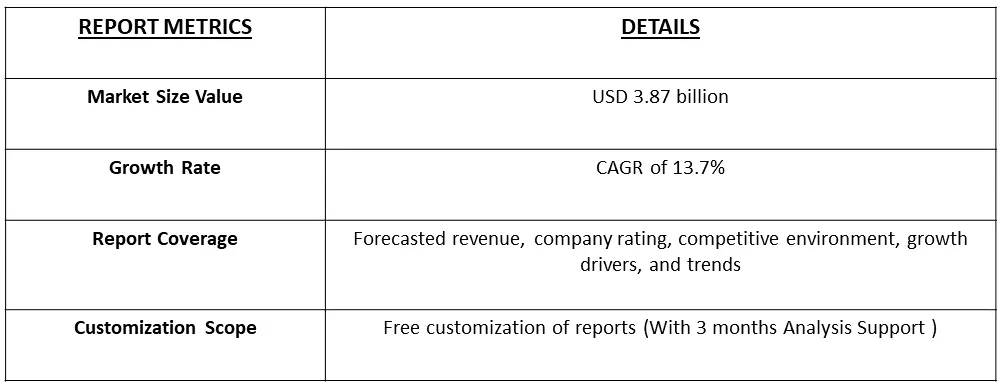

The Global Laboratory Information System Market size is estimated at USD 3.87 billion in 2023 and is expected to register a CAGR of 13.7% during the forecast period (2024-2031).

Get Complete Analysis Of The Report - Download Free Sample PDF

A Laboratory Information System (LIS) is a software solution designed to manage and streamline the workflow, data, and information within a medical or scientific laboratory. LIS facilitates the efficient tracking of samples, results, and associated information, providing a comprehensive solution for laboratory management. It includes functionalities such as sample accessioning, sample tracking, result entry, quality control, data storage, and reporting. LIS plays a crucial role in enhancing the overall efficiency, accuracy, and compliance of laboratory processes. It is commonly used in various healthcare settings, research laboratories, and industrial labs to automate and organize laboratory operations, ensuring smooth communication and data management.

The Laboratory Information System (LIS) software market experiences robust growth driven by various factors. The imperative for efficiency and workflow optimization in laboratories, coupled with the need for accurate data management, fuels the demand for LIS. Regulatory compliance requirements in the healthcare sector further contribute to its adoption. The rising workload in laboratories, integration with other healthcare systems, and ongoing technological advancements, including AI and ML integration, play pivotal roles in shaping the market. As personalized medicine gains prominence, LIS becomes instrumental in managing individual patient data. Continued investment in healthcare IT, the global embrace of digital health solutions, and the accelerated adoption during the COVID-19 pandemic collectively propel the growth of the LIS software market, highlighting its critical role in modern laboratory operations and healthcare infrastructure.

Market Segmentation: The Global Laboratory Information System Market is Segmented By Component (Software and Service), Mode of Delivery (On-premise and Cloud-Based), End User (Hospital, Clinics and Other End Users), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The market provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The global Laboratory Information System (LIS) market is witnessing several noteworthy trends. One prominent trend is the increasing adoption of cloud-based LIS solutions. Cloud-based systems offer flexibility, scalability, and cost-effectiveness, allowing healthcare organizations to streamline their operations and improve accessibility to laboratory data. Another trend is the integration of LIS with advanced technologies such as artificial intelligence (AI) and machine learning. This integration enhances data analytics, automation, and decision support capabilities, leading to more efficient laboratory processes. Additionally, there is a growing emphasis on interoperability, with LIS systems being designed to seamlessly integrate with other healthcare information systems, fostering better communication and data exchange across the healthcare ecosystem. The market also observes a rising demand for LIS solutions with user-friendly interfaces and enhanced customization options, catering to the specific needs of different laboratories. Overall, these trends indicate a dynamic landscape for LIS, driven by technological advancements and a focus on improving operational efficiency in laboratory settings.

The global Laboratory Information System (LIS) market is witnessing several noteworthy trends. One prominent trend is the increasing adoption of cloud-based LIS solutions. Cloud-based systems offer flexibility, scalability, and cost-effectiveness, allowing healthcare organizations to streamline their operations and improve accessibility to laboratory data. Another trend is the integration of LIS with advanced technologies such as artificial intelligence (AI) and machine learning. This integration enhances data analytics, automation, and decision support capabilities, leading to more efficient laboratory processes. Additionally, there is a growing emphasis on interoperability, with LIS systems being designed to seamlessly integrate with other healthcare information systems, fostering better communication and data exchange across the healthcare ecosystem. The market also observes a rising demand for LIS solutions with user-friendly interfaces and enhanced customization options, catering to the specific needs of different laboratories. Overall, these trends indicate a dynamic landscape for LIS, driven by technological advancements and a focus on improving operational efficiency in laboratory settings.

Segmental Analysis:

Software Segment to Hold a Significant Market Share Over the Forecast Period

The Laboratory Information System (LIS) software market is witnessing robust growth due to several key factors. The increasing demand for efficient data management and integration of laboratory processes is a major driver for the LIS software market. Laboratories across various industries, including healthcare, life sciences, and research, are adopting LIS software to streamline their operations, automate workflows, and enhance overall efficiency. Furthermore, advancements in technology, such as the integration of artificial intelligence and machine learning, are contributing to the evolution of LIS software. These technologies empower laboratories to analyze large datasets, improve diagnostic accuracy, and optimize decision-making processes. The rising focus on precision medicine and personalized healthcare is also fueling the demand for LIS software, as it plays a crucial role in managing patient data, test results, and facilitating collaboration among healthcare professionals. Thus, to the COVID-19 pandemic, the LIS software market experienced a surge in demand, as laboratories worldwide sought digital solutions to manage the increased volume of tests. The market is characterized by a competitive landscape, with key players investing in research and development to introduce innovative features and stay ahead in the rapidly evolving technological landscape. Overall, the LIS software market is poised for continued growth as laboratories increasingly.

Cloud-Based Segment to Hold a Significant Market Share Over the Forecast Period

The adoption of cloud-based solutions has significantly influenced the Laboratory Information System (LIS) landscape, bringing about transformative changes in how laboratories manage information. Cloud-based LIS offers several advantages, such as enhanced accessibility, scalability, and collaboration. Laboratories can store, retrieve, and analyze data securely over the cloud, reducing the need for on-premises infrastructure. One key benefit of cloud-based LIS is increased accessibility, allowing authorized users to access data from anywhere, and fostering collaboration among geographically dispersed teams. The scalability of cloud solutions enables laboratories to adjust resources based on workload fluctuations, optimizing operational efficiency. Additionally, cloud-based LIS providers often incorporate advanced security measures, ensuring data integrity and compliance with regulatory requirements. The flexibility and cost-effectiveness of cloud-based solutions make them particularly attractive for laboratories seeking streamlined data management without heavy upfront investments in hardware and maintenance. As the demand for digital transformation in laboratories continues to rise, cloud-based LIS solutions are poised to play a pivotal role in shaping the future of information management in the field of diagnostics, research, and healthcare.

Hospitals Segment to Hold a Significant Market Share Over the Forecast Period

Hospitals are increasingly adopting Laboratory Information Systems (LIS) to enhance the efficiency, accuracy, and overall management of their laboratory operations. LIS in hospitals serves as a comprehensive solution for handling diverse laboratory data, including patient test results, specimen tracking, and workflow management. The integration of LIS with hospital information systems streamlines the communication between different departments, improving overall patient care. One key advantage of LIS in hospitals is the automation of laboratory processes, reducing manual errors and enhancing the speed of result delivery. It facilitates seamless communication between clinicians, pathologists, and laboratory staff, ensuring a more coordinated approach to patient care. LIS also aids in compliance with regulatory standards and accreditation requirements, contributing to the delivery of high-quality healthcare services. Moreover, LIS enables hospitals to manage large volumes of data efficiently, enhancing the storage, retrieval, and analysis of laboratory information. The centralized nature of LIS promotes data consistency and reduces redundancy, leading to better-informed decision-making. As hospitals continue to prioritize digitalization and data-driven healthcare practices, the integration of LIS becomes increasingly crucial in optimizing laboratory workflows and contributing to the overall effectiveness of healthcare delivery.

North America Region to Hold a Significant Market Share Over the Forecast Period

North America is poised to be a key player in the laboratory information system (LIS) market, primarily due to its well-established healthcare IT sector and government initiatives aimed at improving access to laboratory services. The United States, in particular, dominates the laboratory informatics industry, driven by the increasing adoption of digital healthcare and substantial investments by companies developing LIS software. Abbott, a U.S.-based company, invested USD 2,420 million in research and development in FY 2020, reflecting the industry's commitment to innovation. Notable LIS software manufacturers, including Orchard Software Corporation, Cerner, Epic Systems, Roper Technologies, and Comp Pro Med Inc., are headquartered in the United States, further contributing to market dominance. The implementation of new services, such as LigoLab Information System's integrated LIS support for high-volume COVID-19 testing, is expected to drive market growth. Additionally, Xybion Corporation's release of Pristima XD Digital Pathology in August 2021 aligns with the industry's digital transformation. Overall, these factors are anticipated to propel market expansion in North America throughout the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

Major market players actively pursue strategies such as expanding their production capabilities, engaging in mergers and acquisitions, and conducting research and development initiatives to maintain a competitive edge in the industry. This involves increasing their capacity for manufacturing, acquiring other companies or merging with them to strengthen their market position, and investing in innovative research and development efforts. These strategic moves are crucial for staying ahead of competitors, enhancing market share, and ensuring sustained growth in the dynamic business environment. The commitment to these initiatives underscores the players' proactive approach in adapting to market trends, meeting evolving customer demands, and securing a prominent position in the competitive landscape. The key market players in the studied market are:

Recent Developments:

1) In July 2023, RaySearch Laboratories AB entered into a strategic collaboration agreement with B dot Medical Inc., with the shared objective of advancing proton therapy. The collaboration aims to develop and validate integrations between RaySearch's treatment planning system, RayStation, and oncology information system, RayCare, with B dot Medical's ultra-compact proton therapy system. B dot Medical, a Japanese company, specializes in the development of an ultra-compact proton therapy system featuring a non-rotating gantry. The system focuses on achieving outstanding irradiation performance, incorporating advanced features such as high-speed scanning and respiratory-gated irradiation.

2) In February 2022, Biosero, Inc., a BICO company, and a developer of laboratory automation solutions to orchestrate scientific discoveries, launched several new products and features in the company's Green Button Go software suite. Together, these products deliver an array of advanced capabilities to help customers streamline, control, and generate better results from their automated lab systems.

Q1. What was the Lab Information System Market size in 2023?

As per Data Library Research the Global Laboratory Information System Market size is estimated at USD 3.87 billion in 2023.

Q2. At what CAGR is the Lab Information System market projected to grow within the forecast period?

Lab Information System Market is expected to register a CAGR of 13.7% during the forecast period.

Q3. What are the factors on which the Lab Information System market research is based on?

By Component, Mode of Delivery, End-User and Geography are the factors on which the Lab Information System market research is based.

Q4. Who are the key players in Lab Information System market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model