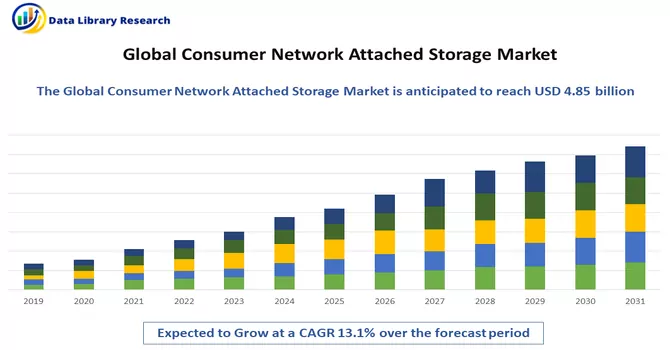

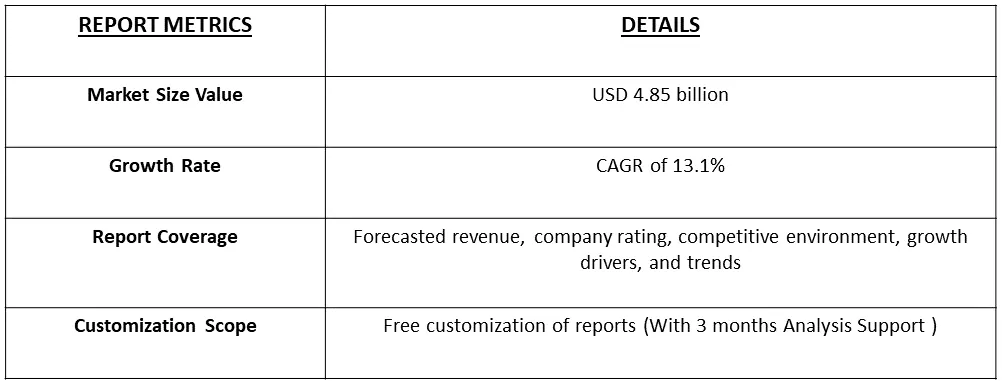

The estimated size of the global consumer network attached storage market reached USD 4.85 billion in 2022, and it is poised to exhibit a compound annual growth rate (CAGR) of 13.1% from the forecast period 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Consumer Network Attached Storage (NAS) refers to a specialized storage device designed for individual consumers, home users, and small- to medium-sized enterprises (SMEs) who require a centralized and accessible storage solution for their digital files and data. Unlike traditional external hard drives or local storage options, consumer NAS devices are equipped with network connectivity, typically through Ethernet or Wi-Fi, allowing multiple users to access, share, and store files over a local network.

The key drivers behind this growth include the rapid digital transformation witnessed among small- and medium-sized enterprises (SMEs) and the proliferation of unstructured data. A network-attached storage (NAS) device serves as a centralized storage solution, facilitating multiple users to share and store files seamlessly over a Transmission Control Protocol/Internet Protocol (TCP/IP) network using either an Ethernet cable or Wi-Fi. Specifically tailored for at-home users and SMEs in need of centralized file storage, consumer NAS devices have gained prominence due to the escalating demand driven by evolving digital trends and the increasing volume of unstructured data.

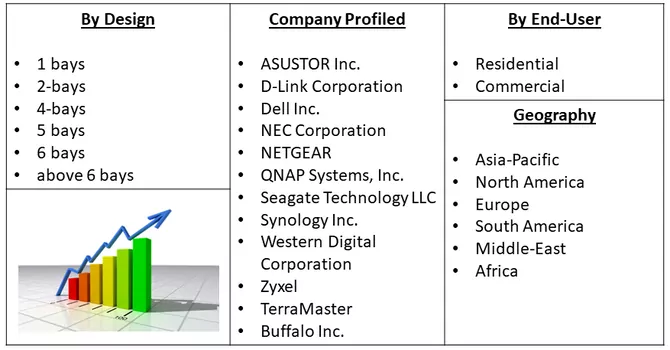

Market Segmentation: The Consumer Network Attached Storage Market is Segmented By Design (1 bays, 2-bays, 4-bays, 5 bays, 6 bays and above 6 bays), End-user (Residential and Commercial), Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa).

For Detailed Market Segmentation - Download Free Sample PDF

The Consumer Network Attached Storage (NAS) market is witnessing several trends that reflect the evolving needs and preferences of consumers. There is a growing trend toward the adoption of high-capacity hard drives in consumer NAS systems. As consumers accumulate larger volumes of digital content, the demand for NAS solutions with expanded storage capacities is on the rise. Consumer NAS manufacturers are focusing on providing user-friendly interfaces and mobile apps. This trend aims to make NAS setup, management, and usage more accessible to a broader audience, including individuals with limited technical expertise. Consumer NAS systems are providing more customization options, allowing users to tailor settings according to their specific preferences. This trend reflects a growing demand for personalized storage solutions that align with individual user requirements. These trends collectively depict the dynamic landscape of the Consumer NAS market, highlighting the industry's responsiveness to changing consumer behaviours, technological advancements, and emerging use cases.

Market Drivers :

Rapid Adoption of High-Capacity Drives

A noticeable shift is taking place in consumer NAS systems as there is an increasing inclination towards incorporating high-capacity hard drives. This trend is driven by the escalating accumulation of digital content by consumers, prompting a heightened demand for NAS solutions that offer extended storage capacities. The surge in data creation and consumption necessitates storage solutions capable of accommodating larger volumes of files, making the integration of high-capacity hard drives a key response to the evolving needs of users seeking comprehensive and scalable storage options.

In September 2023, QNAP Systems, Inc. unveiled the TS-AI642, an AI-powered NAS solution tailored to address the storage and backup requirements for video surveillance images within Small and Medium Enterprises (SMEs). Boasting a substantial storage capacity of up to 110 TB, this innovative solution incorporates a built-in Neural Processing Unit (NPU), enabling swift execution of high-speed AI applications. The onset of the COVID-19 pandemic triggered disruptions across supply chains, stemming from shifts in demand, labour shortages, and travel restrictions. These challenges posed a formidable threat to the industry's ability to sustain uninterrupted manufacturing and supply of products and services. Consequently, market players were compelled to institute significant operational changes in response to the dynamic conditions imposed by the pandemic.

Cloud Integration and Hybrid Solutions:

Consumer NAS devices are increasingly merging with cloud services, delivering hybrid solutions that fuse localized storage with cloud accessibility. This amalgamation presents users with a versatile approach, incorporating elements of flexibility, data redundancy, and the convenience of file access from any location. The synergy between on-premises NAS storage and cloud platforms not only enhances the overall flexibility of data management but also ensures redundancy by leveraging both local and cloud-based storage solutions. Users benefit from the convenience of accessing their files seamlessly, regardless of their physical location, thanks to the collaborative and complementary nature of this integrated approach.

Market Restraints :

Limited Integration with Smart Home Ecosystems and Perceived Complexity of Maintenance

While there is a trend towards smart home integration, not all consumer NAS devices seamlessly integrate with various smart home ecosystems. Users who seek comprehensive smart home management solutions may find limitations in integration capabilities. Some users may perceive the maintenance tasks associated with consumer NAS devices, such as firmware updates and regular backups, as cumbersome. This perception could discourage users who prefer low-maintenance storage solutions.

Segmental Analysis :

2-bays Segment is Expected to Witness Significant Growth Over the Forecast Period

The 2-bays segment is poised to exhibit the highest compound annual growth rate throughout the forecast period. This notable growth is primarily attributed to the inherent advantages of 2-bay consumer network attached storage devices, offering superior security features and enhanced storage capacity when compared to their 1-bay counterparts. Additionally, these devices come with a more economical price point compared to 4-bay consumer NAS devices, making them a preferred choice for many consumers. The popularity of 2-bay consumer NAS devices is further underscored by the ongoing innovations within the market, with numerous companies consistently introducing new and improved 2-bay devices to cater to evolving customer demands. This segment's robust growth signifies the recognition of 2-bay NAS solutions as a balanced and cost-effective choice for users seeking a balance between security, storage capacity, and affordability.

Business Segment is Expected to Witness Significant Growth Over the Forecast Period

The business segment emerged as the dominant force in the industry, commanding a market share exceeding throughout the forecast period. This sector's ascendancy is propelled by the escalating demand within businesses for reliable data management and backup solutions, particularly in response to the surging volumes of unstructured data. The growth of this segment is notably driven by the adoption of Consumer Network Attached Storage (NAS) devices, which offer businesses a convenient and accessible means to manage and safeguard their data. The increasing reliance on NAS devices in businesses is attributed to their role as centralized storage solutions. These devices enable small businesses to streamline data storage and organization by consolidating it in a singular, easily manageable location. This centralized approach not only facilitates efficient data management but also enhances data security and accessibility. Small businesses, in particular, find Consumer NAS devices to be a valuable asset in meeting their data storage needs, providing a cost-effective and scalable solution to address the challenges associated with the burgeoning volumes of data. The business segment's robust growth underscores the pivotal role played by Consumer NAS devices in empowering businesses with streamlined and secure data management capabilities. Thus, the segment is expected to witness significant growth over the forecast period.

North America is Expected to Witness Significant Growth Over the Forecast Period

In 2022, North America asserted its dominance in the market, commanding a substantial revenue share exceeding 34.2%, and it is poised to sustain this leadership with an anticipated Compound Annual Growth Rate (CAGR) of 11.6% throughout the forecast period. The driving force behind this regional prominence is the thriving startup ecosystem in North America, a dynamic engine propelling the market growth. Renowned as a global hub for technology startups, North America provides an environment conducive to innovation, attracting entrepreneurs, substantial venture capital investments, and cutting-edge technological advancements. The robust presence of numerous startups in North America is a significant catalyst for the demand surge in storage solutions, notably including Network Attached Storage (NAS) devices. Entrepreneurs and businesses, particularly in the technology sector, heavily rely on efficient and secure data management solutions, making NAS devices a sought-after asset in this dynamic landscape.

The region's vibrant startup ecosystem not only fuels demand but also drives continuous innovation and advancements in NAS technology to cater to the evolving needs of businesses. Furthermore, the escalating prevalence of smart homes in North America contributes positively to the demand for NAS devices. As the adoption of smart home technologies continues to rise, there is an increasing need for centralized and accessible storage solutions, that aligning perfectly with the capabilities of NAS devices. This trend further amplifies the market growth, as consumers seek reliable and scalable options to manage the data generated by their smart home devices. Thus, North America's dominance in the NAS market is propelled by its robust startup ecosystem, fostering innovation and driving demand for storage solutions. The region's continuous technological advancements and the increasing adoption of smart home technologies position it as a key player in shaping the trajectory of the NAS market.

Get Complete Analysis Of The Report - Download Free Sample PDF

The Consumer Network Attached Storage (NAS) market exhibits a moderate level of consolidation, characterized by the presence of a select few companies that specialize in providing consumer NAS devices. Within this landscape, market players are actively implementing strategic initiatives, notably expansion efforts, to secure a competitive edge in the industry. These strategic manoeuvres aim to position companies favourably within the market and capitalize on emerging opportunities. The adoption of expansion strategies underscores the competitive dynamics of the consumer NAS market, where companies are keen on extending their market presence and enhancing their offerings. By strategically expanding their reach, these market players seek to tap into new markets, cater to a broader customer base, and reinforce their position as key players in the consumer NAS device segment. Key Consumer Network Attached Storage Companies:

Recent Development:

1) In September 2023, Toshiba Corp., the renowned international electronics company headquartered in Japan, unveiled its latest technological advancement with the introduction of the MG10F model, boasting an impressive 22 Terabytes (TB) of storage capacity. This cutting-edge design incorporates Conventional Magnetic Recording (CMR) Hard Disk Drive (HDD) technology, complemented by Toshiba's well-established 10-disk helium-sealed innovation. The incorporation of these technologies signifies Toshiba's commitment to pushing the boundaries of storage capabilities, catering to the escalating demand for high-capacity storage solutions in the digital landscape.

2) In September 2023, QNAP Systems, Inc. made waves in the industry by announcing the launch of the TS-AI642, an innovative Artificial Intelligence (AI)-powered Network Attached Storage (NAS) solution. Specifically engineered to address the storage and backup requirements of Small and Medium Enterprises (SMEs) engaged in video surveillance, this groundbreaking solution boasts an expansive storage capacity of up to 110 TB. Notably, the TS-AI642 distinguishes itself by featuring a built-in Neural Processing Unit (NPU), a technological marvel that facilitates the seamless execution of high-speed AI applications. This forward-thinking NAS solution from QNAP Systems aligns with the growing needs of SMEs for advanced storage solutions that can accommodate the demands of video surveillance and harness the power of artificial intelligence.

Q1. What was the Consumer Network Attached Storage Market size in 2022?

As per Data Library Research the global consumer network attached storage market reached USD 4.85 billion in 2022.

Q2. At what CAGR is the Consumer Network Attached Storage Market projected to grow within the forecast period?

Consumer Network Attached Storage Market is poised to exhibit a compound annual growth rate (CAGR) of 13.1% over the forecast period.

Q3. What are the Growth Drivers of the Consumer Network Attached Storage Market?

Rapid Adoption of High-Capacity Drives and Cloud Integration and Hybrid Solutions Consumer Network Attached Storage Market.

Q4. Which region has the largest share of the Consumer Network Attached Storage Market? What are the largest region's market size and growth rate?

North America has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model