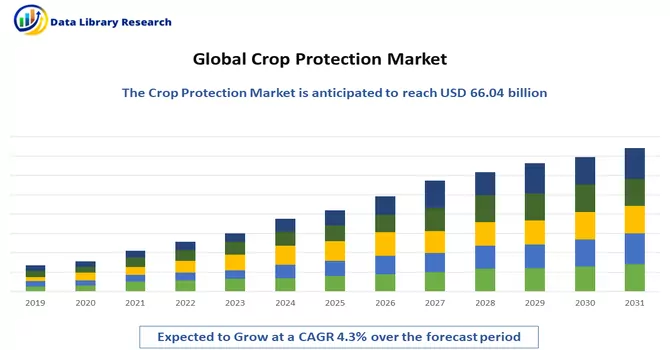

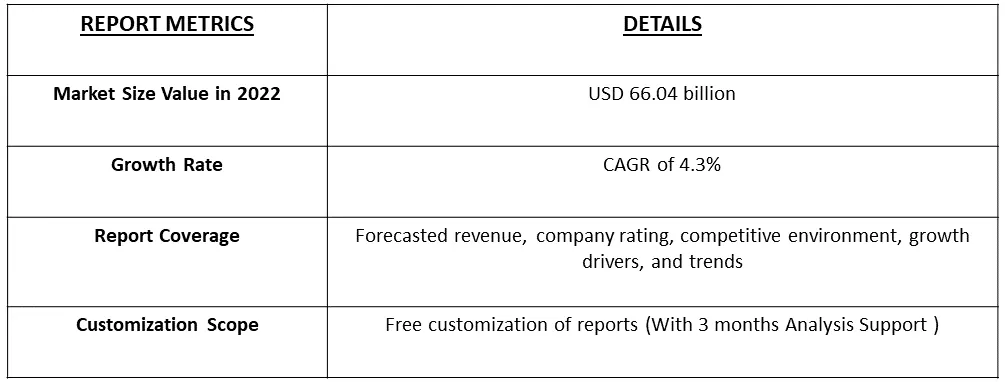

The Crop Protection Chemicals Market size is expected to grow from USD 66.04 billion in 2022, registering a CAGR of 4.3% during the forecast period (2023-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

Crop Protection Chemicals are a category of chemical substances, including pesticides and other chemicals, used in agriculture to safeguard crops from various threats that can reduce yield or quality. These chemicals are employed to control or eliminate pests, diseases, weeds, and other factors that can harm or limit the growth of crops. Crop protection chemicals encompass a wide range of products designed to prevent, mitigate, or manage the adverse impact of various biological and environmental stressors on crop plants. They play a crucial role in modern agriculture by helping farmers maximize crop productivity and protect their investments from potential threats.

The factors that are driving the growth of the studied market are the growing consumer behaviour for conscious of food safety and pesticide residues. This drives the demand for safe and responsible pesticide use. Moreover, the growing interest in organic farming and sustainable agriculture has led to the development of biopesticides and organic crop protection solutions.

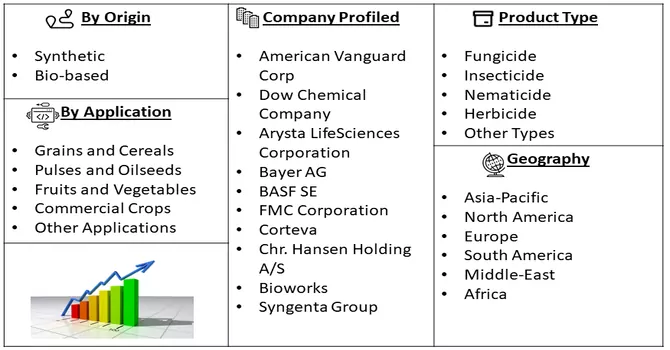

Segmentation:

The Global Crop Protection Chemicals Market is Segmented

By Origin :

Product Type :

Application :

Geography :

The report offers market size and forecasts for Crop Protection Chemicals Market in value (USD Million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The crop protection chemicals market is subject to ongoing trends that reflect the changing landscape of agriculture, environmental concerns, and consumer preferences. There is a growing demand for biological and sustainable alternatives to traditional chemical pesticides. Biopesticides, including beneficial insects, microbes, and natural compounds, are gaining popularity as eco-friendly options. The growing interest in organic and non-genetically modified organism (GMO) farming practices is driving the demand for organic crop protection solutions that meet stringent certification requirements.

Drivers:

Growing Concern for Food Safety and Pesticide Residues Consumer awareness is driving demand for crop protection chemicals that are perceived as safer and more environmentally friendly. This has led to a growing market for biopesticides, organic pesticides, and reduced-risk chemical alternatives. Consumers prefer crops treated with pesticides that have shorter residual effects, reducing the likelihood of pesticide residues in the final products. Crop protection chemical manufacturers are focusing on developing formulations with these characteristics. Thus, the market is expected to witness significant growth over the forecast period.

Advancements in Crop Protection Chemical Formulations, Precision Agriculture, and Application Technologies

The crop protection chemicals market is undergoing a transformative phase with significant advancements in formulations, precision agriculture, and application technologies. These innovations are reshaping the industry, improving efficiency, sustainability, and the overall effectiveness of crop protection solutions. Advanced formulations are being developed to improve the efficacy of crop protection chemicals. These formulations may offer better adhesion, improved coverage, and extended residual effects, reducing the need for frequent applications. Also, precision agriculture techniques, including the use of GPS technology, remote sensing, and data analytics, enable farmers to make data-driven decisions regarding the application of crop protection chemicals. This results in more efficient use of resources. Thus, the market is expected to witness significant growth over the forecast period.

Restraints :

Limited Access to Skilled labor and Regulator Issues

Limited access to skilled labor for the proper application of crop protection chemicals can be a challenge in some regions. Moreover, the crop protection chemicals market is heavily regulated, with stringent requirements for product registration, labeling, and safe use. Meeting these regulations can be time-consuming and costly for manufacturers. Thus, these factors may slow down the growth of the studied market over the forecast period.

The COVID-19 pandemic presented multiple challenges to the crop protection chemicals market, it also highlighted the industry's resilience and adaptability. The adoption of digital technologies, the emphasis on sustainability, and the need for a reliable and efficient supply chain have become prominent trends in the post-pandemic agriculture sector. The pandemic accelerated the adoption of digital and precision agriculture technologies, including remote monitoring, which influenced the application of crop protection chemicals. As a result, the market is expected to witness significant growth over the forecast period.

Segmental Analysis :

Bio-based Chemicals are Expected to Witness Significant Growth Over the Forecast Period

Bio-based crop protection chemicals are a promising avenue for sustainable agriculture. Their environmentally friendly nature, compatibility with integrated pest management, and potential for reduced pesticide residues in food align with the growing demand for eco-conscious farming practices. As the agricultural industry continues to embrace sustainability, bio-based solutions play a critical role in nurturing the health of crops, ecosystems, and the planet. Thus, the segment is expected to witness significant growth over the forecast period.

Fungicide Segment is Expected to Witness Significant Growth Over the Forecast Period

The fungicide market continues to evolve with advancements in formulation, precision application technologies, and growing emphasis on sustainability. Fungicides remain a critical tool in protecting crops from fungal threats, contributing to global food security and sustainable agriculture. The persistence of fungal diseases in agriculture drives the demand for effective fungicides to protect crop yields and quality. Fungicides contribute to maintaining crop health and quality, meeting consumer and market demands for visually appealing and disease-free produce. Thus, the segment is expected to witness significant growth over the forecast period.

Commercial Crop Segment is Expected to Witness Significant Growth Over the Forecast Period

The demand for crop protection chemicals for commercial crops extends worldwide, as these crops are cultivated on every continent. The relationship between commercial crops and crop protection chemicals is ever-evolving. The use of crop protection chemicals for commercial crops is subject to stringent regulatory oversight to ensure safety for consumers and the environment. As the agriculture industry places increasing emphasis on sustainability, eco-conscious practices, and food security, the market is expected to continue developing innovative solutions to protect and nurture the world's commercial crops. Thus, the segment is expected to witness significant growth over the forecast period.

Asia-Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

Asia-Pacific stands as the prominent consumer of crop protection chemicals, primarily due to its vast agricultural sector. The Asia-Pacific region is experiencing a gradual shift towards eco-friendly and natural insecticides as a response to rising awareness of the health impacts of chemical insecticides. Biopesticides have gained traction in countries like India and China, reflecting a growing preference for sustainable pest management practices. China's younger generation, in particular, has been embracing organic products, driving an increased demand for eco-friendly options.

Asia-Pacific offers a wealth of opportunities for market players involved in both conventional and biopesticides. The region's diverse agricultural landscapes, coupled with its ever-evolving consumer preferences and government initiatives, present a dynamic and thriving market for crop protection chemicals.

Get Complete Analysis Of The Report - Download Free Sample PDF

Many corporations are directing their efforts towards enhancing their footprint in emerging and promising markets like Asia Pacific and Central & South America through strategic partnerships and the establishment of new facilities. For instance, in October 2020, Nufarm Ltd merged its Australian and New Zealand operations with its Asian counterparts, forming a unified Asia Pacific business entity. This consolidation included crop protection activities in Australia, New Zealand, and South-East Asia, with the aim of enhancing supply chain efficiency, manufacturing capabilities, and growth prospects throughout the region. Several notable players in the worldwide crop protection chemicals market encompass:

Key Players :

Recent Developments

1) May 2022: Syngenta launched Victrato, a seed treatment through its seed care segment, which targets nematodes and significant soil-borne fungi, improving the quality and productivity of various crops like soybeans, corn, cereals, cotton, and rice.

2) May 2021: China's two centrally-administered, state-owned chemical manufacturers - Sinochem and ChemChina - were being restructured and merged to form a behemoth. Both companies are based in Beijing, with each holding several subsidiaries across industry segments. The new chemical giant will operate in various sectors, like life sciences, material science, basic chemicals, environmental science, rubber and tires, machinery and equipment, and industrial finance.

Q1. How big is the Crop Protection Market?

The Crop Protection Chemicals Market size is expected to grow from USD 66.04 billion in 2022, registering a CAGR of 4.3% during the forecast period.

Q2. At what CAGR is the Crop Protection Chemicals Market projected to grow within the forecast period?

Crop Protection Chemicals Market is registering a CAGR of 4.3% during the forecast period.

Q3. Which region has the largest share of the Crop Protection Chemicals Market? What are the largest region's market size and growth rate?

Asia-Pacific has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here

Q4. What segments are covered in the Crop Protection Chemicals Market Report?

By Origin, By Product Type, Application And Geography are the segments covered in the Crop Protection Chemicals Market Report.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model