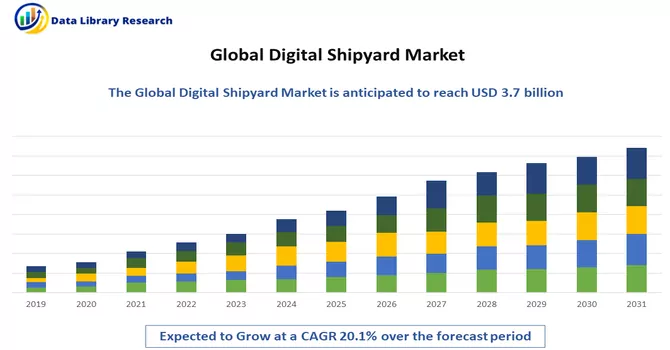

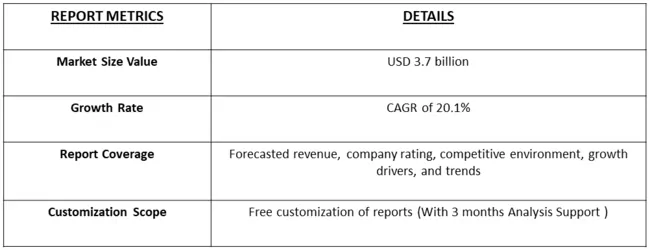

The global digital shipyard market size was estimated at USD 3.7 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 20.1% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

A digital shipyard involves the comprehensive integration of digital technologies into the shipbuilding and maritime vessel management processes. This approach encompasses the creation of a digital twin, utilizing advanced design and engineering tools, establishing integrated data systems for seamless information exchange, employing collaborative platforms to enhance communication among diverse teams, incorporating automation and robotics in manufacturing, deploying IoT sensors for real-time data collection, and leveraging augmented reality (AR) and virtual reality (VR) for training and maintenance purposes. By embracing these digital tools, a digital shipyard aims to optimize efficiency, streamline collaboration, and improve decision-making throughout the entire lifecycle of a ship, from design and construction to maintenance and operations. This approach represents a modern and technologically advanced paradigm in the maritime industry, enhancing precision, reducing costs, and ultimately ensuring the optimal performance and reliability of maritime assets.

The global digital shipyard market is experiencing robust growth driven by several key factors. First and foremost, the increasing demand for operational efficiency and cost optimization in the shipbuilding industry is propelling the adoption of digital technologies. Digital shipyards leverage advanced design and engineering tools, automation, and collaborative platforms to streamline processes, reduce manual efforts, and enhance overall productivity. The integration of digital twin technology is another significant driver, enabling real-time monitoring and simulation of vessels for proactive decision-making and predictive maintenance. The rise of IoT and sensors in maritime assets contributes to data-driven insights, optimizing performance and facilitating informed decision-making. Additionally, the globalization of the shipping industry requires efficient communication and coordination across different locations, and digital shipyards provide a platform for standardized practices on a global scale. Regulatory compliance and safety concerns are also pushing the industry towards digitalization, ensuring adherence to standards and improving documentation practices. Furthermore, the ability of digital shipyards to support customization of ship designs to meet specific client requirements is fueling demand. Technological advancements in augmented reality, virtual reality, and artificial intelligence play a pivotal role in enhancing training programs, maintenance procedures, and overall operational capabilities. The growing focus on environmental sustainability in the maritime sector drives the adoption of digital solutions to optimize fuel efficiency and reduce emissions. Lastly, the pursuit of a competitive advantage motivates companies to invest in digital shipyard technologies, contributing to innovation and market growth.

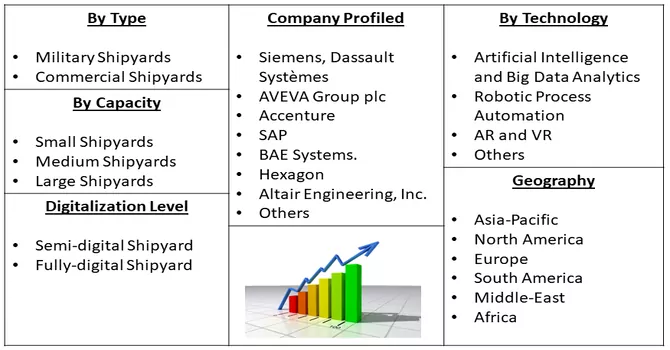

Market Segmentation: The Digital Shipyard Market Size, Share, Competitive Landscape and Trend Analysis Report by Type (Military Shipyards, Commercial Shipyards), by Technology (Artificial Intelligence and Big Data Analytics, Robotic Process Automation, AR and VR, Others), by Capacity (Small Shipyards, Medium Shipyards, Large Shipyards), by Digitalization Level (Semi-digital Shipyard, Fully-digital Shipyard) and Geography (North America, Europe, Asia-Pacific, and Rest of the World). The report offers market size and forecasts for the Robotic Lawn Market in value (USD Billion) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The digital shipyard market is experiencing notable trends driven by the increasing integration of advanced technologies in the maritime industry. One prominent trend is the growing adoption of digital twins and real-time monitoring systems, enabling shipbuilders to create virtual replicas of vessels for enhanced performance optimization and predictive maintenance. Additionally, there's a rising emphasis on data-driven decision-making facilitated by IoT sensors and connectivity solutions, providing insights into operational efficiency and safety. Collaborative platforms and cloud-based solutions are gaining traction, fostering seamless communication and collaboration among diverse stakeholders involved in the shipbuilding process. The market is witnessing a surge in demand for automation and robotics to streamline manufacturing processes and reduce labour costs. Moreover, there's a notable focus on sustainability, with digital shipyards leveraging eco-friendly technologies to minimize environmental impact and comply with stringent regulations. Overall, the digital shipyards market is evolving towards greater efficiency, transparency, and innovation, driven by the transformative power of digitalization in the maritime sector.

Market Drivers:

The adoption of digital twins and advanced simulation techniques

The adoption of digital twins and advanced simulation techniques represents a transformative shift in various industries, including shipbuilding and maritime operations. A digital twin is a virtual replica of a physical object or system, and in the context of shipbuilding, it involves creating a comprehensive digital model of a vessel. This technology allows shipbuilders and operators to monitor, analyze, and simulate the behavior of a ship in real-time. By leveraging advanced simulation techniques, stakeholders in the maritime industry gain unprecedented insights into the performance and characteristics of a ship throughout its lifecycle. Digital twins enable proactive decision-making by providing a dynamic and accurate representation of the vessel's status, allowing for the identification of potential issues before they manifest in the physical world. This adoption enhances the optimization of ship designs, streamlines construction processes, and facilitates predictive maintenance. Moreover, the integration of digital twins contributes to improved operational efficiency, reduced downtime, and enhanced safety, thereby revolutionizing traditional practices in shipbuilding and maritime operations. As the industry continues to embrace these innovative technologies, the era of digital twins and advanced simulations is proving instrumental in shaping the future of efficient, data-driven, and technologically advanced maritime practices.

The integration of Internet of Things (IoT) sensors for data-driven insights, coupled with the need for streamlined regulatory compliance and safety standards

The integration of Internet of Things (IoT) sensors in the maritime industry is playing a pivotal role in ushering in a new era of data-driven insights, particularly in the context of shipbuilding and maritime operations. IoT sensors are strategically placed on various components of a vessel to collect real-time data on crucial parameters such as engine performance, fuel consumption, environmental conditions, and equipment health. This wealth of data empowers stakeholders with comprehensive insights into the operational aspects of a ship, enabling informed decision-making and proactive maintenance strategies. Furthermore, this integration aligns with the industry's imperative for streamlined regulatory compliance and adherence to rigorous safety standards. Maritime regulations are becoming more stringent, necessitating the continuous monitoring and reporting of various operational parameters. IoT sensors provide a robust solution for automating data collection and ensuring compliance with maritime regulations. The real-time nature of the data also enables rapid response to emerging issues, contributing to enhanced safety measures. By combining IoT sensor data with advanced analytics and reporting tools, shipbuilders and operators can not only ensure compliance but also optimize operational efficiency, reduce downtime, and improve overall safety. This integration underscores the industry's commitment to leveraging digital technologies to meet regulatory requirements, enhance safety protocols, and embrace a data-driven approach for the sustainable and efficient future of maritime operations.

Market Restraints:

While the digital shipyard market is experiencing significant growth, there are several market restraints that pose challenges to its expansion. One primary restraint is the substantial initial investment required for the implementation of digital shipyard technologies. The integration of advanced software, sensors, and communication systems involves considerable upfront costs, which can be a deterrent for some shipyards, particularly smaller or financially constrained entities. Additionally, there are concerns related to cybersecurity and data privacy, as the increased digitalization exposes shipbuilding processes to potential cyber threats. Ensuring the security of sensitive data and maintaining the integrity of digital systems becomes a critical challenge. The maritime industry also faces a learning curve in adapting to and adopting these sophisticated technologies, and resistance to change within traditional shipbuilding practices can slow down the pace of digital transformation. Interoperability issues among different digital systems and standards can pose compatibility challenges, hindering seamless collaboration among various stakeholders. Moreover, the complexity of integrating digital technologies into existing workflows and the need for skilled personnel proficient in digital tools can be a constraint. Lastly, regulatory hurdles and compliance issues, particularly in ensuring that digital processes meet industry standards and regulations, can impede the widespread adoption of digital shipyard solutions. Addressing these market restraints requires strategic planning, cybersecurity measures, industry collaboration, and a gradual shift in mindset towards embracing digital transformation in the maritime sector.

Segmental Analysis:

Military Shipyards Segment is Expected to Witness Significant Growth Over The Forecast

Military shipyards offer strategic advantages in bolstering national defence capabilities by serving as specialized facilities for the construction, repair, and maintenance of naval vessels. These shipyards, equipped with advanced infrastructure and skilled personnel, provide a tailored environment for developing technologically sophisticated warships and submarines that align with specific defence requirements. Beyond contributing to national security, military shipyards stimulate the domestic economy by generating employment opportunities and fostering technological innovation. Their role in job creation within shipbuilding communities and advancements in naval architecture also contributes to broader economic growth. Moreover, military shipyards enhance a nation's self-reliance in naval capabilities, reducing dependence on foreign suppliers and ensuring a secure and sustainable defense infrastructure. In times of conflict or emergencies, these shipyards play a pivotal role in providing rapid response capabilities for repairing and retrofitting naval assets, thereby maintaining a credible and effective naval force. Overall, military shipyards are integral components of a country's maritime defense strategy, offering a multifaceted contribution to national security, economic development, and strategic autonomy.

Robotic Process Automation Segment is Expected to Witness Significant Growth Over The Forecast

Robotic Process Automation (RPA) is becoming a transformative force in the Digital Shipyard Market, revolutionizing operational efficiency and streamlining complex processes. RPA, through its intelligent automation capabilities, is being increasingly integrated into various facets of the shipbuilding lifecycle. In the Digital Shipyard Market, RPA is automating repetitive and rule-based tasks, ranging from design and engineering processes to procurement and maintenance activities. This not only accelerates task completion but also reduces errors, enhances precision, and optimizes resource allocation. Furthermore, RPA is facilitating seamless communication and data exchange between different stages of shipbuilding, contributing to enhanced collaboration and improved decision-making. With the ability to operate 24/7 and perform tasks at scale, RPA is driving cost savings and improving overall productivity in the digital shipyard ecosystem. As the maritime industry continues its digital transformation journey, the integration of RPA in the Digital Shipyard Market is poised to play a pivotal role in achieving operational excellence, cost-effectiveness, and agility in responding to the evolving demands of the maritime landscape.

North America Region is Expected to Witness Significant Growth Over The Forecast

North America stands at the forefront of the Digital Shipyard Market, witnessing robust growth and significant technological advancements in the maritime industry. The region's shipbuilding sector is increasingly adopting digital technologies to enhance operational efficiency, reduce costs, and stay competitive in the global market. Digital Shipyards in North America leverage cutting-edge solutions such as 3D maritime design, advanced engineering tools, and collaborative platforms to streamline the entire shipbuilding lifecycle. The integration of Internet of Things (IoT) sensors and data analytics is gaining prominence, providing real-time insights for optimized decision-making and predictive maintenance. The region's emphasis on sustainability and compliance with stringent environmental regulations is driving the development of eco-friendly technologies within digital shipyards. Moreover, North America's focus on innovation and research and development is fostering the creation of next-generation ship design and information management systems. As defense remains a critical aspect, military shipyards in the region are also investing in digital technologies for the construction and maintenance of naval vessels. With a robust infrastructure, skilled workforce, and a commitment to technological advancement, North America continues to shape the Digital Shipyard Market, contributing to the evolution and digital transformation of the maritime sector.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic maneuvers. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders. Some of the key market players working in this segment are:

Recent Development:

1) In January 2024, two specialized firms focusing on 3D maritime design, engineering, and information management software announced a collaborative venture. The joint initiative aims to pioneer the development of a cutting-edge ship design and information management system, integrating a robust product lifecycle management (PLM) system. This partnership capitalizes on advanced 3D modelling techniques and incorporates the latest advancements in information management technology, marking a significant leap forward in supporting the shipbuilding process. The ultimate goal is to facilitate Hyundai Heavy Industries (HHI) in realizing its vision of a 'digital shipyard,' wherein data and digital twins play a pivotal role in optimizing the entire design process, starting from the early stages and extending through construction and production. The system is poised to provide comprehensive information throughout the ship's operational lifespan at sea, aligning with HHI's strategic objectives for enhanced efficiency and innovation in maritime endeavours.

2). In December 2023, Jiangnan Shipyard in China formalized a partnership agreement with Bureau Veritas, focusing on expediting the 3D Submission and Approval processes within shipyards and classification societies. The collaborative effort, as outlined in the Joint-Declaration on 3D Auditing and Recognition, is designed to facilitate the development of systems that streamline the utilization of a unified data source in ship design and construction endeavors in the future. This strategic alliance also encompasses plans for joint efforts in defining interoperability, establishing common standards, and devising robust data security strategies. Furthermore, the agreement emphasizes collaborative initiatives aimed at fostering the sharing of insights and co-innovation to advance the capabilities of digital twins. The overarching objective is to cultivate a more extensive 'three-dimensional community of application' within the maritime sector, promoting synergies between Jiangnan Shipyard and Bureau Veritas in shaping the future landscape of digitalized processes and standards in shipbuilding and classification.

Q1. What was the Digital Shipyard Market size in 2023 ?

As per Data Library Research the global digital shipyard market size was estimated at USD 3.7 billion in 2023.

Q2. At what CAGR is the Digital Shipyard market projected to grow within the forecast period?

Digital Shipyard Market is anticipated to grow at a compound annual growth rate (CAGR) of 20.1% over the forecast period.

Q3. What are the factors on which the Digital Shipyard market research is based on?

By Type. By Technology, By Capacity, By Digitalization Level and Geography are the factors on which the Digital Shipyard market research is based.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model