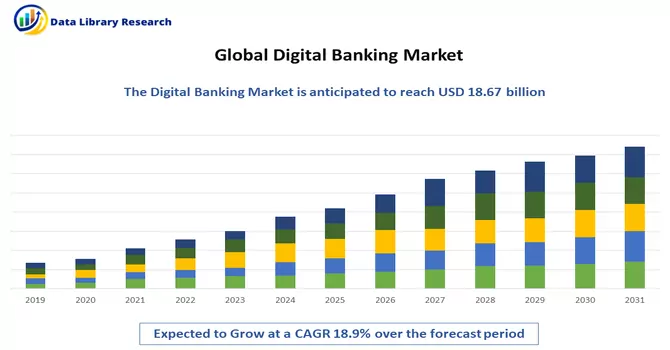

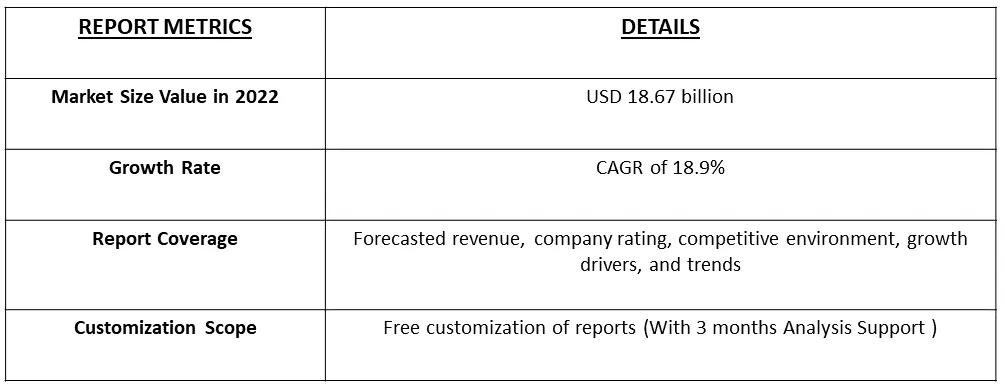

The global digital banking platform market size was valued at USD 18.67 billion in 2022 and is expected to register a CAGR of 18.9% from 2022 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

A digital banking platform is a technology-driven system that provides banking and financial services to customers through online and digital channels, rather than traditional brick-and-mortar banking locations. This platform allows customers to perform various financial transactions and activities, such as checking account balances, transferring money, paying bills, applying for loans, and managing investments, using digital devices like computers, smartphones, and tablets.

Digital banking platforms have become increasingly popular due to their convenience and accessibility. They allow customers to manage their finances from the comfort of their homes or while on the go, making banking more efficient and user-friendly in the digital age.

Banks were increasingly using AI and machine learning to enhance customer experiences, offer personalized services, and improve fraud detection and risk assessment. Digital-only banks (often referred to as neobanks) were on the rise, offering a completely branchless banking experience with a focus on user-friendly mobile apps and lower fees.

Market Segmentation:

The Digital Banking Market is Segmented

By Deployment Model :

Mode :

Services :

Type :

Geography :

The market sizes and forecasts are provided in terms of value in USD billion for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers:

Increased Penetration of Smartphones, Computers, Internet Connectivity, IoT devices, and Artificial Intelligence (AI)

The increased penetration of smartphones, computers, internet connectivity, IoT devices, and artificial intelligence (AI) has had a profound impact on the digital banking landscape. These technological advancements have not only transformed the way banks deliver their services but have also revolutionized the overall banking experience for customers. The widespread adoption of smartphones has made banking services available to a broader audience. Mobile banking apps allow customers to check their account balances, transfer funds, pay bills, and perform various financial tasks conveniently from their mobile devices.

Moreover, due to the incorporation of these technologies, digital banking has become more accessible, thereby driving the growth of the studied market. For instance, In July 2022, Revolut, a digital banking platform, declared that it would soon make its app available for easier use in Sri Lanka, Azerbaijan, Ecuador, Chile, and Oman. This would enable users to send money to more than 50 countries using more than 30 different currencies. Customers who transfer money to other Revolut users will not be charged a fee, but transferring to non-Revolut accounts will be subjected to a 1% cost. Thus, the market is expected to witness significant growth over the forecast period.

Recent Growth in Cloud Computing and Storage

The recent growth in cloud computing and storage has significantly impacted the digital banking industry, leading to numerous benefits, challenges, and innovations in the way banks operate and deliver services. Cloud services offer scalability, allowing banks to expand or reduce their computing and storage resources as needed. This flexibility is crucial in handling fluctuating workloads and adapting to changing customer demands. Thus, the market is expected to witness significant growth over the forecast period.

Restraints:

High Cost of Technologies

The high cost of technologies used in digital banking is a significant challenge that banks and financial institutions face. Moreover, setting up the necessary infrastructure, including servers, data centers, and networking equipment, can be expensive. Banks need reliable and secure hardware to support digital banking operations. This may slow down the growth of the market over the forecast period, thereby affecting the growth over the forecast period.

The COVID-19 pandemic brought about a rapid shift towards digital banking, making online and mobile banking services more essential than ever. This transition was largely due to the need for contactless and convenient ways to manage finances during lockdowns and social distancing measures. While this transformation opened up new possibilities, it also underscored the importance of ensuring that digital banking services are accessible and user-friendly for everyone. Not everyone has the same level of digital literacy or access to digital devices and the internet. Financial institutions have a crucial role in addressing these disparities and making sure that their digital banking solutions are inclusive and equitable for all segments of the population. In essence, the pandemic compelled banks and financial institutions to adapt swiftly to evolving customer preferences and the growing demand for remote banking services. The long-term effects of these changes are expected to continue shaping the digital banking industry for years to come, emphasizing the need for innovation, accessibility, and user-friendliness as key drivers of progress in the sector.

Segmental Analysis:

Cloud-Based Segment By Deployment Model is Expected to Witness Significant Growth Over the Forecast Period

Cloud-based technology has had a transformative impact on the digital banking industry. It has enabled banks to offer more efficient, cost-effective, and innovative services while enhancing the customer experience. Cloud solutions facilitate collaboration and remote work, allowing employees to access and work on banking systems securely from anywhere. This has become increasingly important, especially during global events like the COVID-19 pandemic. Thus, owing to such advantages the segment is expected to witness significant growth over the forecast period.

Mobile Banking By Mode Type is Expected to Witness Significant Growth Over the Forecast Period

Mobile banking plays a central role in the use of digital banking, offering customers a convenient and accessible way to manage their finances. Its combination of core banking functions, security measures, and features like mobile payments and personal finance management make it an essential component of modern banking services. Mobile banking apps often integrate with digital wallets and mobile payment platforms, allowing users to make contactless payments, peer-to-peer transfers, and online purchases using their mobile devices. Thus, the segment is expected to witness significant growth over the forecast period. Professional Service is Expected to Witness Significant Growth Over the Forecast Period Professional services refer to a broad category of occupations that offer specialized expertise, knowledge, and advice to individuals, businesses, or organizations. These services encompass fields such as law, accounting, consulting, finance, and more. Digital banking has had a significant impact on the delivery of professional services, both for clients and the professionals themselves.

Digital banking offers professionals access to business loans, lines of credit, and other financing options. The application and approval processes are often faster and more accessible through online platforms. Digital banking provides professionals with easy access to financial data, which can be used to generate reports and conduct financial analysis, helping clients make informed decisions. Thus, the segment is expected to witness significant growth over the forecast period.

Investment Banking is Expected to Witness Significant Growth Over the Forecast Period

Digital banking has a significant influence on investment banking by offering more efficient, cost-effective, and accessible tools and platforms for executing financial transactions, managing investments, conducting research, and providing advisory services. Investment banks that successfully integrate digital solutions can enhance their competitiveness, streamline operations, and adapt to changing market dynamics. Digital banking has opened up opportunities for alternative financing, such as crowdfunding and peer-to-peer lending, which can be part of an investment bank's advisory services. Thus, the segment is expected to witness significant growth over the forecast period.

Asia-Pacific is Expected to Witness Significant Growth Over the Forecast Period

The Asia Pacific region held a dominant position in the market, accounting for a substantial. Furthermore, it is projected to exhibit the highest Compound Annual Growth Rate (CAGR) of 21.1% during the forecast period. The digital banking landscape in Asia is on the verge of significant expansion and transformation. The sector is witnessing a notable shift as new digital companies are making substantial changes and revolutionizing banking services for both individuals and businesses. This transformation is driven by the growing demand for mobile and online banking alternatives. As a result, there is tremendous potential for both established players and emerging entrants to participate in this evolving landscape. Regulators in the region are responding to these changes by increasing the allocation of licenses and establishing new standards for this new era of banking.

For example, Wortgage Technologies Private Limited (WeRize), a digital banking platform startup based in India, was founded in 2019. It has been offering financial products to more than 1,000 smaller cities and recently secured an impressive USD 8 million in funding through a series known as an "A funding round." This signifies the dynamic and rapidly evolving nature of the digital banking sector in the Asia Pacific region, presenting substantial opportunities for growth, innovation, and financial inclusion in the coming years.

Get Complete Analysis Of The Report - Download Free Sample PDF

The Digital Banking Market is highly fragmented due to the presence of a few global players working globally and regionally in this market segment. Some prominent players in the global digital banking platform market include:

Key Players :

Recent Developments:

1. In December 2022, Finastra partnered with Veem, an online global payments platform. This partnership enabled banks and other institutions to innovate payments and offer digital AR and AP services for their customers.

2. In November 2022, Finastra partnered with Modefin, a digital banking platform. The partnership aimed to offer fintech solutions for banks in the African and Indian markets.

Q1. What is the market size of the Digital Banking Market?

The global digital banking platform market size was valued at USD 18.67 billion in 2022 and is expected to register a CAGR of 18.9%.

Q2. At what CAGR is the Digital Banking market projected to grow within the forecast period?

Digital Banking market is expected to register a CAGR of 18.9% during the forecast period.

Q3. What are the factors on which the Digital Banking market research is based on?

By Deployment Model, By Mode, By Type, By Services and Geography are the factors on which the Digital Banking market research is based.

Q4. Which region has the largest share of the Digital Banking market? What are the largest region's market size and growth rate?

Asia-pacific region has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model