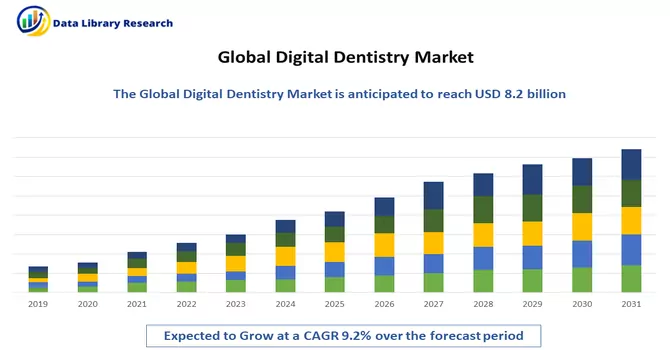

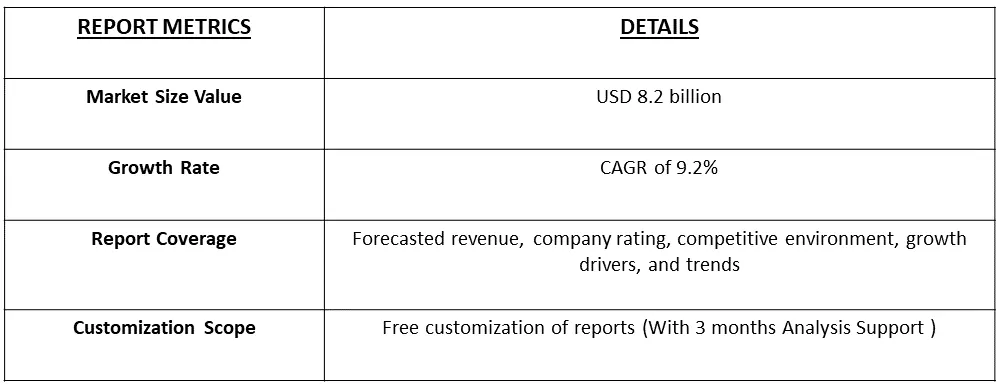

The global digital dentistry market in terms of revenue was estimated to be worth USD 8.2 billion in 2023 and is expected to register a CAGR of 9.2% over the forecast period 2023-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Digital dentistry refers to the integration of advanced digital technologies and computerized systems into various aspects of dental practice, transforming traditional methods and enhancing the delivery of oral healthcare. This innovative approach leverages digital tools to streamline processes, improve diagnostics, and elevate the overall patient experience within the field of dentistry. Digital dentistry incorporates advanced imaging technologies, such as digital radiography and intraoral scanners, allowing for precise and efficient capturing of high-resolution images of the oral cavity. This enhances diagnostic capabilities and aids in treatment planning. CAD/CAM technology enables the digital design and fabrication of dental restorations, prosthetics, and appliances. This process eliminates the need for traditional moulds, providing faster and more accurate production of crowns, bridges, and other dental devices.

The digital dentistry market is experiencing robust growth, driven by various factors that collectively contribute to the widespread adoption of advanced digital technologies in dental practices. The continuous advancements in digital technologies, including intraoral scanners, 3D printing, and artificial intelligence, propel the digital dentistry market. Dental professionals are eager to integrate the latest tools and techniques that enhance diagnostic precision and treatment outcomes. Digital dentistry provides superior diagnostic capabilities through high-resolution imaging, 3D scanning, and computer-aided analysis. Enhanced diagnostic accuracy aids in the early detection of dental issues, influencing treatment planning and patient outcomes. Thus, these market growth factors are expected to witness significant growth over the forecast period.

Digital dentistry is evolving rapidly, driven by technological innovations, and changing patient preferences. Several market trends are shaping the landscape, influencing how dental practices leverage digital technologies to enhance patient care, streamline workflows, and stay competitive in the evolving healthcare ecosystem. CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) technology is witnessing widespread adoption. Dental practices are utilizing CAD/CAM systems for the design and production of restorations, prosthetics, and dental appliances, leading to more precise and aesthetically pleasing outcomes. Also, digital dentistry trends emphasize preventive measures, leveraging technology for early detection of oral health issues. Risk assessment tools and diagnostic aids aid in identifying potential problems before they escalate, promoting a proactive approach to dental care. Thus, these market trends are expected to witness significant growth over the forecast period.

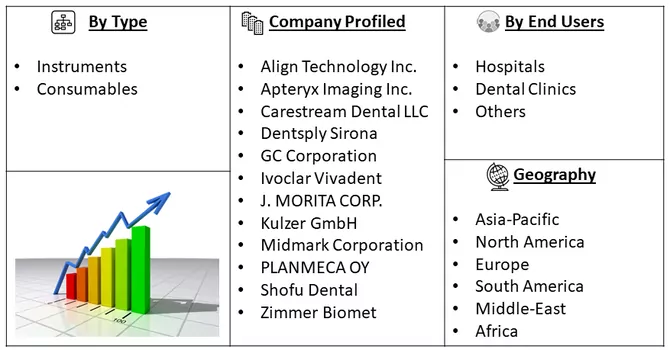

Market Segmentation: The Digital Dentistry Market is Segmented by Type (Instruments, and Consumables), End Users (Hospitals, Dental Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value (in USD million) for the above-mentioned segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Increasing Focus on Digital Dentistry

In recent years, there has been a notable surge in the emphasis on digital dentistry, marking a transformative era in oral healthcare practices. Dental professionals worldwide are increasingly recognizing the profound impact of digital technologies on diagnostics, treatment planning, and overall patient care. Digital dentistry enables unparalleled precision and accuracy in various dental procedures. Advanced imaging technologies, such as intraoral scanners and digital impressions, ensure meticulous data capture, leading to more accurate diagnoses and treatment outcomes. Moreover, the integration of digital tools streamlines dental workflows, enhancing efficiency in practices. From digital record-keeping to computer-aided design and manufacturing (CAD/CAM) for restorations, the digital approach significantly reduces turnaround times and boosts overall operational efficiency. Also, an article published by NCBI in July 2022, reported that the teenagers in US are more inclined about physical appearance and thus, 37% of the total dentistry patients consist of teenagers and millennials. Also, a 14% increase in digital dentistry services was observed in the state of Atlanta. Thus, these market factors are expected to drive the growth of the studied market over the forecast period.

Increased Adoption of CAD/CAM Technology and 3D Printing in Dentistry

CAD/CAM technology has redefined the process of designing and manufacturing dental restorations. Dentists can create highly precise digital models, leading to accurately fitting crowns, bridges, and other prosthetics. This precision minimizes the need for adjustments and enhances overall restoration quality. The integration of CAD/CAM technology streamlines dental workflows. From digital impression-taking to the design and fabrication of restorations, the digital approach significantly reduces turnaround times, allowing for quicker treatment planning and execution. Also, in March 2023, Panthera Dental, a prominent player in CAD/CAM implant solutions and the design and manufacturing of dental sleep appliances, unveiled a groundbreaking product at this year's IDS: the Magnet-X. As a part of the Integrated Bar product line, Magnet-X introduces a novel solution for all-on-X patients. Developed in collaboration with Dr. Miles Reed Cone, the Magnet-X is a removable wrap-around bar that provides permanent stable magnetic retention, ensuring the secure placement of dentures. This pioneering solution, a world first, addresses the specific needs of geriatric patients. Thus, the increased adoption of CAD/CAM technology and 3D printing underscores a paradigm shift in dental practices, fostering a digitized and patient-centred approach. As these technologies continue to evolve, they are poised to play an even more prominent role in shaping the future of dentistry, offering innovative solutions and elevating the standard of oral healthcare.

Market Restraints:

High Cost Associated with Implementation

The digital dentistry market faces potential growth impediments due to the high costs associated with implementation. The substantial financial investments required for adopting digital dentistry technologies may act as a deterrent, slowing down the market's expansion. The expenses involved in acquiring and integrating advanced digital systems, including equipment and software, could pose challenges for dental practices and institutions, potentially delaying the widespread adoption of digital dentistry solutions.

The growth of the digital dentistry market took a hit during the initial phases of the COVID-19 pandemic due to widespread cancellations of dental procedures. In Germany, for instance, many private dental practices shut down temporarily to prevent the spread of the virus, leading to a decline in the demand for digital dentistry solutions. However, as restrictions eased and dental treatment centres resumed operations, the market witnessed a notable rebound. Despite the challenges posed by the pandemic, the digital dentistry market is now showing significant growth and is expected to continue on an upward trajectory in the foreseeable future.

Segmental Analysis:

Instruments Segment is Expected to Witness Significant Growth Over the Forecast Period

Digital dentistry instruments represent a technological revolution in the field, introducing advanced tools that significantly enhance precision, efficiency, and patient outcomes. These cutting-edge instruments leverage digital technologies to streamline various dental procedures, from diagnostics to treatment planning and restoration fabrication. Intraoral scanners have replaced traditional moulds for impressions, offering a more comfortable experience for patients. These scanners utilize advanced optics and imaging technology to create highly accurate digital impressions of the teeth, improving the precision of restorations and prosthetics. Digital radiography instruments have replaced conventional X-ray films with digital sensors, allowing for instant imaging and reduced radiation exposure. These tools enhance diagnostic capabilities, offering detailed and easily shareable images for better treatment planning.

In August 2023, Cigna introduced a new digital dental screening tool, available at no cost to its members, aimed at addressing oral health concerns. Powered by SmartScan, the tool enables up to 16.5 million members to conduct self-checks for dental issues using their smartphones. The initiative targets individuals who may experience anxiety related to dental visits, providing a convenient and informative solution. Dental.com's online tool guides users to capture five images of their teeth and mouth, which SmartScan analyzes. The results, including an oral health score, personalized tips, and identified areas of concern, are reviewed by a Cigna Healthcare network dentist. The tool also facilitates connections to virtual or in-person dentists for follow-up care, promoting proactive oral health management. Additionally, SmartScan proves useful for quick self-checks between regular dental visits, especially in response to emerging tooth pain. Thus, digital dentistry instruments continue to evolve, driven by ongoing advancements in technology. Their integration into dental practices not only improves the precision and efficiency of procedures but also enhances the overall patient experience, marking a transformative era in oral healthcare.

Hospitals Segment is Expected to Witness Significant Growth Over the Forecast Period

The hospital segment is poised for substantial growth in the digital dentistry market during the forecast period. This anticipated growth is attributed to factors such as the increasing utilization of dental procedures for treating various cavities and the growing adoption of new technologies within hospital settings. Recent research studies shed light on innovative approaches to enhancing dental care in the post-pandemic era. According to an article published in the International Journal of Public Health in February 2022, approximately 80% of dentists have embraced preventive advice, tailoring it to the specific nature of each dental procedure. This shift is expected to drive the adoption of cloud-based digital dentistry services in dental facilities, facilitating the seamless uploading of cone beam computed tomography (CBCT) and intraoral scans. These digital tools are instrumental in designing plans for implant surgery and surgical guides, contributing to the growth of the hospital segment.

Moreover, increased corporate initiatives aimed at developing digital workflows and solutions are fostering the adoption of digital dentistry products within hospital environments. This trend empowers dentists to offer personalized products and services. A notable example is DENTSPLY SIRONA Inc.'s introduction of a series of innovations, the Medical-Grade 3D Printing Solution, in February 2022. This initiative, developed in collaboration with Google Cloud, aims to enhance digital workflows, providing benefits for dentists, dental labs, and patients globally. Thus, the hospital segment's growth in the digital dentistry market is propelled by the integration of advanced technologies, the adoption of preventive approaches in dental care, and the introduction of innovative solutions designed to optimize digital workflows within hospital settings.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

Anticipated significant growth is projected for the digital dentistry market in North America throughout the forecast period. This expected expansion can be attributed to various factors, including technological advancements in dental care within the region. The continuous evolution of dental technologies is contributing to the adoption of digital dentistry solutions.

In November 2022, Imagoworks Inc. introduced a groundbreaking artificial intelligence-powered web dental CAD, known as 3Dme Crown. This innovative solution features an automatic crown design module as part of the 3Dme solutions suite, specifically designed to streamline the generation of crown prosthesis designs tailored to the unique oral environment of each patient. The incorporation of artificial intelligence in the CAD system enhances precision and efficiency, offering a sophisticated approach to crown design within the realm of digital dentistry.

Furthermore, the region is experiencing a surge in product launches within the digital dentistry sector. This increased product innovation is supported by a growing burden of dental disorders, fostering a heightened demand for advanced dental services in North America. As the prevalence of dental issues rises, there is a parallel increase in the need for cutting-edge solutions offered by digital dentistry, contributing to the overall growth of the market in the region.

The escalating prevalence of oral diseases within the population is a pivotal factor driving the demand for dental devices and services. Consequently, hospitals and dental clinics are intensifying their focus on embracing digital dentistry platforms and software. For instance, a study published in the Medicine Journal in June 2021 highlighted concerning statistics, indicating that among children, 38.0% exhibited non-cavitated lesions, 43.4% had cavitated lesions in permanent dentition, and 50.6% displayed poor oral hygiene. The findings underscore the urgent need for advanced dental solutions. Moreover, the same source identified low brushing frequency and inadequate dental hygiene as primary factors contributing to dental caries among Mexican children. This growing prevalence of oral health issues emphasizes the imperative of digital dentistry adoption to enhance diagnostic and treatment capabilities within healthcare institutions.

Thus, North America is poised to be a key growth region in the digital dentistry market, driven by technological advancements, a flurry of product launches, and the escalating demand for dental services.

Get Complete Analysis Of The Report - Download Free Sample PDF

The digital dentistry market exhibits fragmentation with the presence of numerous small and large players. These companies are actively involved in the development of technologically advanced systems. Additionally, they employ key strategies such as collaborations, partnerships, the launch of new products, and other initiatives to fortify their positions in the market. Some of the key market players working in this market segment are:

Recent Development:

1) In September 2023, Dentsply Sirona is introducing the DS Academy Campus, serving as an added platform for interaction with DS Academy's clinical, technical, and product education. The DS Campus is dedicated to delivering top-notch educational material covering cutting-edge trends and subjects in digital dentistry. With a focus on areas such as digital aligner workflows and the incorporation of artificial intelligence in dental practices, Dentsply Sirona seeks to cultivate its DS Academy community. Dental professionals from across the globe are welcome to participate, learn, and enhance both their skills and practices with assurance.

2) In June 2023: A-dec has unveiled a significant advancement in dental equipment by introducing its inaugural digitally connected delivery systems, namely the A-dec 500 Pro and A-dec 300 Pro platforms.

Q1. What was the Digital Dentistry Market size in 2023?

As per Data Library Research the global digital dentistry market in terms of revenue was estimated to be worth USD 8.2 billion in 2023.

Q2. At what CAGR is the Digital Dentistry market projected to grow within the forecast period?

Digital Dentistry Market is expected to register a CAGR of 9.2% over the forecast period.

Q3. Who are the key players in Digital Dentistry Market?

Some key players operating in the market include

Q4. What are the Growth Drivers of the Digital Dentistry Market?

Increasing Focus on Digital Dentistry and Increased Adoption of CAD/CAM Technology and 3D Printing in Dentistry are the Growth Drivers of the Digital Dentistry Market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model